Exam 3: The Adjusting Process

Exam 1: Accounting and the Business Environment246 Questions

Exam 2: Recording Business Transactions219 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Merchandising Operations277 Questions

Exam 6: Merchandise Inventory199 Questions

Exam 7: Accounting Information Systems164 Questions

Exam 8: Internal Control and Cash258 Questions

Exam 9: Receivables233 Questions

Exam 10: Plant Assets,natural Resources,and Intangibles212 Questions

Exam 11: Current Liabilities and Payroll221 Questions

Exam 12: Partnerships171 Questions

Exam 13: Corporations277 Questions

Exam 14: Long-Term Liabilities207 Questions

Exam 15: Investments193 Questions

Exam 16: The Statement of Cash Flows183 Questions

Exam 17: Financial Statement Analysis161 Questions

Exam 18: Introduction to Managerial Accounting245 Questions

Exam 19: Job Order Costing191 Questions

Exam 20: Process Costing173 Questions

Exam 21: Cost-Volume-Profit Analysis295 Questions

Exam 22: Master Budgets181 Questions

Exam 23: Flexible Budgets and Standard Cost Systems223 Questions

Exam 24: Cost Allocation and Responsibility Accounting257 Questions

Exam 25: Short-Term Business Decisions200 Questions

Exam 26: Capital Investment Decisions152 Questions

Select questions type

The major difference between a cash basis accounting system and an accrual basis accounting system is the timing of recording revenues and assets.

(True/False)

4.8/5  (36)

(36)

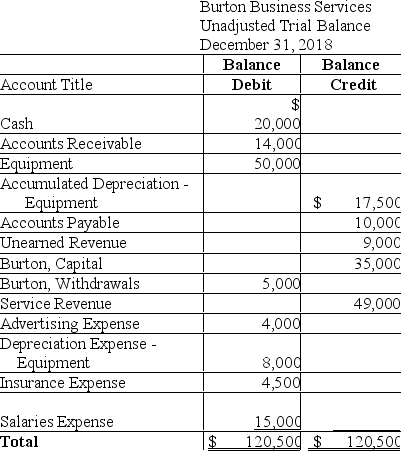

The unadjusted trial balance of Burton Business Services at December 31,2018,and the data for the adjustments follow:

Adjustment data at December 31 follows:

a.Depreciation for the equipment is $4,000.

b.As of December 31,2018,Burton had performed services for Wilson Company for $3,000.The invoice will be sent on January 5,2019 and payment is due on January 15,2019.

c.On August 31,2018,Burton agreed to provide consulting services to Allen Company for 6 months,beginning on September 1,2018,at $1,500 per month.Allen paid $9,000 on August 31,2018.Burton treats deferred revenues initially as liabilities.

Burton is preparing financial statements for the year ending December 31,2018.

Requirements

1.Journalize the adjusting entries on December 31,2018.

2.Prepare the December 31,2018 adjusted trial balance.Use a proper heading.

Adjustment data at December 31 follows:

a.Depreciation for the equipment is $4,000.

b.As of December 31,2018,Burton had performed services for Wilson Company for $3,000.The invoice will be sent on January 5,2019 and payment is due on January 15,2019.

c.On August 31,2018,Burton agreed to provide consulting services to Allen Company for 6 months,beginning on September 1,2018,at $1,500 per month.Allen paid $9,000 on August 31,2018.Burton treats deferred revenues initially as liabilities.

Burton is preparing financial statements for the year ending December 31,2018.

Requirements

1.Journalize the adjusting entries on December 31,2018.

2.Prepare the December 31,2018 adjusted trial balance.Use a proper heading.

(Essay)

4.7/5  (36)

(36)

Financial statements can be prepared from the unadjusted trial balance.

(True/False)

4.8/5  (44)

(44)

Which of the following entries would be made because of the matching principle?

(Multiple Choice)

4.9/5  (47)

(47)

A company receives payment from one of its customers on August 5 for services performed on July 21.Which of the following entries would be recorded if the company uses accrual basis accounting?

(Multiple Choice)

4.7/5  (40)

(40)

On November 27,2018,Metro Delivery Service Company signs a contract with Brooklyn Financial Services Company.Metro Delivery Service will provide 3 months of local delivery services for $5,000 per month.Brooklyn pays $15,000 cash to Metro on November 27,2018.Delivery services will begin on December 1,2018.Complete the following requirements for Metro Delivery Services.

(1)Prepare the journal entries for November 27,2018 and December 31,2018 (the end of Metro's fiscal year).Make proper journal entries (omit explanations).Deferred revenues are treated initially as liabilities.

(2)If Metro fails to record the December 31,2018 adjusting entry,what is the effect on net income,income statement account(s)and balance sheet account(s)?

(3)Why is it important for companies to record adjusting entries?

(Essay)

4.9/5  (40)

(40)

Wentfield Services Company records deferred expenses as expenses when payment is made in advance and deferred revenues as revenues when the payment is received in advance.At the end of the year,Wentfield Services Company makes the necessary adjustments based on accrual basis accounting.On July 1,it paid rent for an office in the amount of $24,000 for the period July 1 through June 30 of the following year.Prepare the year-end adjusting entry on December 31.Omit explanation.

(Essay)

4.9/5  (35)

(35)

The following Office Supplies account information is available for Nabors Company. Beginning balance \ 2,000 Office Supplies expensed 8,000 Ending balance 1,000 From the above information,calculate the amount of office supplies purchased.

(Multiple Choice)

4.7/5  (45)

(45)

A business hired a repair service to overhaul its plumbing system.The repair service began work on September 15 and completed it on October 15.The business agreed to pay the service $4,000 when the work was completed.As of September 30,the work was 50% complete,and the business made an adjusting entry to accrue repair expense as of the end of September.On October 15,the work was completed,and the repair service was paid in full.Provide the journal entry for the cash payment on October 15.(Ignore explanation).

(Essay)

4.8/5  (41)

(41)

The revenue recognition principle requires companies to record revenue when (or as)the entity satisfies each performance obligation.

(True/False)

4.9/5  (39)

(39)

The purpose of the adjusted trial balance is to ensure that no errors were made during the adjusting process.

(True/False)

4.9/5  (34)

(34)

Laramie Company signed a contract with a service provider for security services at a rate of $350 per month for the period of January through June.Laramie Company will pay the service provider the entire amount at the end of June.Laramie Company makes adjusting entries each month.During the month of June,it should record total security expense of $700.

(True/False)

4.8/5  (29)

(29)

Improvements,a home improvement magazine,collected $240,000 in subscription revenue on June 30.Each subscriber will receive an issue of the magazine in each of the next 12 months,beginning with the July issue.The company uses the accrual method of accounting.What is the amount of Subscription Revenue that has been earned by the end of December? (Round any intermediate calculations to two decimal places,and your final answer to the nearest whole number.)

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following entries would be made because of the matching principle?

(Multiple Choice)

4.8/5  (26)

(26)

The accounting period used for the annual financial statements is called the fiscal year.

(True/False)

4.9/5  (37)

(37)

Showing 21 - 40 of 225

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)