Exam 6: Risk, Return, and the Capital Asset Pricing Model

Exam 1: An Overview of Financial Management and the Financial Environment41 Questions

Exam 3: Analysis of Financial Statements104 Questions

Exam 4: Time Value of Money168 Questions

Exam 5: Bonds, Bond Valuation, and Interest Rates101 Questions

Exam 6: Risk, Return, and the Capital Asset Pricing Model146 Questions

Exam 7: Stocks, Stock Valuation, and Stock Market Equilibrium91 Questions

Exam 8: Financial Options and Applications in Corporate Finance28 Questions

Exam 9: The Cost of Capital92 Questions

Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows108 Questions

Exam 11: Cash Flow Estimation and Risk Analysis78 Questions

Exam 12: Financial Planning and Forecasting Financial Statements46 Questions

Exam 13: Corporate Valuation, Value-Based Management and Corporate Governance6 Questions

Exam 15: Capital Structure Decisions87 Questions

Exam 16: Working Capital Management138 Questions

Exam 17: Multinational Financial Management49 Questions

Select questions type

If markets are in equilibrium, which of the following conditions will exist?

(Multiple Choice)

4.8/5  (33)

(33)

Porter Plumbing's stock had a required return of 11.75% last year, when the risk-free rate was 5.50% and the market risk premium was 4.75%. Then an increase in investor risk aversion caused the market risk premium to rise by 2%. The risk-free rate and the firm's beta remain unchanged. What is the company's new required rate of return? (Hint: First calculate the beta, then find the required return.)

(Multiple Choice)

4.7/5  (42)

(42)

Sherrie Hymes holds a $200,000 portfolio consisting of the following stocks. The portfolio's beta is 0.875. If Sherrie replaces Stock A with another stock, E, which has a beta of 1.50, what will the portfolio's new beta be?

(Multiple Choice)

4.9/5  (37)

(37)

Assume that investors have recently become more risk averse, so the market risk premium has increased. Also, assume that the risk-free rate and expected inflation have not changed. Which of the following is most likely to occur?

(Multiple Choice)

4.9/5  (48)

(48)

Nystrand Corporation's stock has an expected return of 12.25%, a beta of 1.25, and is in equilibrium. If the risk-free rate is 5.00%, what is the market risk premium?

(Multiple Choice)

4.7/5  (44)

(44)

Dixon Food's stock has a beta of 1.4, while Clark Café's stock has a beta of 0.7. Assume that the risk-free rate, rRF, is 5.5% and the market risk premium, (rM − rRF), equals 4%. Which of the following statements is CORRECT?

(Multiple Choice)

4.8/5  (37)

(37)

For a stock to be in equilibrium, that is, for there to be no long-term pressure for its price to depart from its current level, then

(Multiple Choice)

4.7/5  (35)

(35)

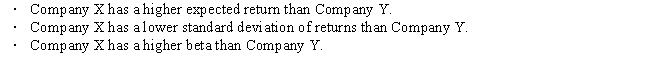

You observe the following information regarding Companies X and Y: Given this information, which of the following statements is CORRECT?

(Multiple Choice)

4.8/5  (33)

(33)

Stocks A, B, and C are similar in some respects: Each has an expected return of 10% and a standard deviation of 25%. Stocks A and B have returns that are independent of one another; i.e., their correlation coefficient, r, equals zero. Stocks A and C have returns that are negatively correlated with one another; i.e., r is less than 0. Portfolio AB is a portfolio with half of its money invested in Stock A and half in Stock B. Portfolio AC is a portfolio with half of its money invested in Stock A and half invested in Stock C. Which of the following statements is CORRECT?

(Multiple Choice)

4.8/5  (39)

(39)

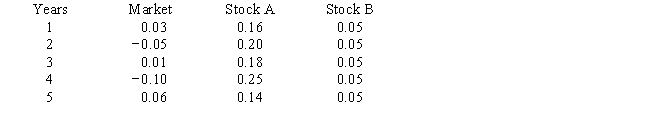

Consider the following average annual returns for Stocks A and B and the Market. Which of the possible answers best describes the historical betas for A and B?

(Multiple Choice)

4.9/5  (35)

(35)

Suppose that during the coming year, the risk free rate, rRF, is expected to remain the same, while the market risk premium (rM − rRF), is expected to fall. Given this forecast, which of the following statements is CORRECT?

(Multiple Choice)

4.7/5  (40)

(40)

An individual stock's diversifiable risk, which is measured by its beta, can be lowered by adding more stocks to the portfolio in which the stock is held.

(True/False)

4.8/5  (34)

(34)

Ann has a portfolio of 20 average stocks, and Tom has a portfolio of 2 average stocks. Assuming the market is in equilibrium, which of the following statements is CORRECT?

(Multiple Choice)

4.9/5  (42)

(42)

Bad managerial judgments or unforeseen negative events that happen to a firm are defined as "company-specific," or "unsystematic," events, and their effects on investment risk can in theory be diversified away.

(True/False)

4.8/5  (41)

(41)

Company A has a beta of 0.70, while Company B's beta is 1.20. The required return on the stock market is 11.00%, and the risk-free rate is 4.25%. What is the difference between A's and B's required rates of return? (Hint: First find the market risk premium, then find the required returns on the stocks.)

(Multiple Choice)

4.8/5  (28)

(28)

Joel Foster is the portfolio manager of the SF Fund, a $3 million hedge fund that contains the following stocks. The required rate of return on the market is 11.00% and the risk-free rate is 5.00%. What rate of return should investors expect (and require) on this fund?

(Multiple Choice)

4.9/5  (39)

(39)

Showing 61 - 80 of 146

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)