Exam 17: Accounting for State and Local Governments,part II

Exam 1: The Equity Method of Accounting for Investments118 Questions

Exam 2: Consolidation of Financial Information123 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition122 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership51 Questions

Exam 5: Consolidated Financial Statements - Intercompany Asset Transactions114 Questions

Exam 6: Variable Interest Entities, intercompany Debt, consolidated Statement of Cash Flows, and Other Issues115 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes115 Questions

Exam 8: Segment and Interim Reporting114 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk90 Questions

Exam 10: Translation of Foreign Currency Financial Statements94 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards58 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission74 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations82 Questions

Exam 14: Partnerships: Formation and Operation79 Questions

Exam 15: Partnerships: Termination and Liquidation73 Questions

Exam 16: Accounting for State and Local Governments, Part I72 Questions

Exam 17: Accounting for State and Local Governments,part II53 Questions

Exam 18: Accounting for Not-For-Profit Organizations58 Questions

Exam 19: Accounting for Estates and Trusts74 Questions

Select questions type

Which item is not included on the government-wide Statement of Activities?

(Multiple Choice)

4.8/5  (38)

(38)

What information is required in the introductory section of a state or local government's CAFR?

(Essay)

4.7/5  (30)

(30)

For the purpose of government-wide financial statements,the cost of cleaning up a government-owned landfill and closing the landfill

(Multiple Choice)

4.9/5  (35)

(35)

GASB No.34 makes which of the following statements regarding Management's Discussion and Analysis?

(Multiple Choice)

4.7/5  (41)

(41)

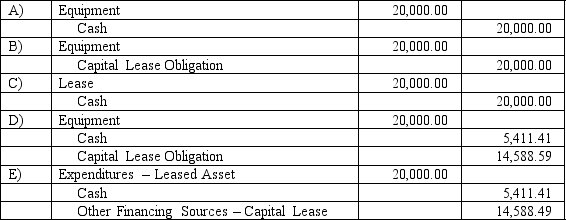

A five-year lease is signed by the City of Wachovia for equipment with a seven-year life.The asset will be returned to the lessor at the end of the lease.The present value of the lease is $20,000,and annual payments of $5,411.41 are payable beginning on the date the lease is signed.The interest portion of the second payment is $1,604.75.The equipment is to be used in City Hall and was purchased from appropriated funds of the General Fund.

What entry should be made for the government-wide financial statements on the date the lease is signed?

(Multiple Choice)

4.8/5  (33)

(33)

Which statement is false regarding the government-wide Statement of Net Assets?

(Multiple Choice)

4.8/5  (39)

(39)

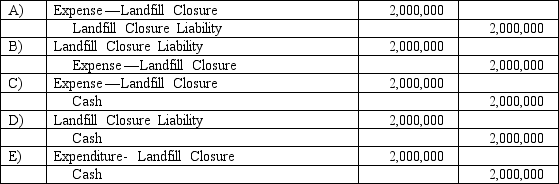

The town of Conway opened a solid waste landfill in 1998 that is now filled to capacity.The city initially anticipated closure costs of $2 million.These costs were not expected to be incurred until the landfill is closed.What is the final journal entry to record these costs assuming the estimated $2 million closure costs were properly recorded and the landfill is accounted for in an enterprise fund?

(Multiple Choice)

4.8/5  (40)

(40)

A method of depreciation for infrastructure assets that allows the expensing of all maintenance costs each year instead of computing depreciation is called

(Multiple Choice)

4.9/5  (43)

(43)

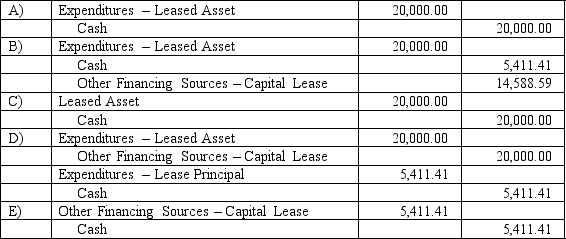

A five-year lease is signed by the City of Wachovia for equipment with a seven-year life.The asset will be returned to the lessor at the end of the lease.The present value of the lease is $20,000,and annual payments of $5,411.41 are payable beginning on the date the lease is signed.The interest portion of the second payment is $1,604.75.The equipment is to be used in City Hall and was purchased from appropriated funds of the General Fund.

What should be recorded in the General Fund on the date the lease is signed?

(Multiple Choice)

4.8/5  (35)

(35)

What are the three broad sections of a state or local government's CAFR?

(Essay)

4.8/5  (32)

(32)

.The City of Wetteville has a fiscal year ending June 30.Examine the following transactions for Wetteville:

(A. )On 6/1/08,Wetteville enters into a 5-year lease on a copying machine.The lease meets the criteria of a capital lease and carries an implied interest rate of 10%.The copier has a present value of $2,300.Wetteville has to put a $300 down payment on the lease at the beginning of the lease with monthly payments thereafter of $42.49.

(B. )On 6/5/08,Wetteville opens a new landfill.The engineers estimate that at the end of 10 years the landfill will be full.Estimated costs to close the landfill are currently at $3,500,000.

(C. )On 6/15/08,the end of the two-week pay period,Wetteville has $20,000 in accrued vacation pay related to the payroll for the period.The city estimates that $5,000 of this pay will be taken by the end of this summer and the rest will be used next summer.

(D. )On 6/18/08,Wetteville receives a donation of a vintage railroad steam engine.The engine will be put on display at the local town park.A fee will be charged to actually climb up into the engine.The engine has been valued at $500,000.

(E. )On 6/30/08,Wetteville makes its first payment on the leased copier.The $42.49 payment includes $16.68 interest.

(F. )On 6/30/08,Wetteville estimates that the landfill is 2% filled.

Required:

Prepare the journal entries for the above transactions,on the dates mentioned for each lettered item,for the purposes of preparing the government-wide financial statements.

(Essay)

4.8/5  (42)

(42)

What three criteria must be met before a governmental unit can elect to not capitalize and therefore report a work of art or historical treasure as an asset?

(Essay)

4.8/5  (38)

(38)

Showing 41 - 53 of 53

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)