Exam 10: Cost Recovery on Property: Depreciation, Depletion, and Amortization

Exam 1: Federal Income Taxation-An Overview150 Questions

Exam 2: Income Tax Concepts151 Questions

Exam 3: Income Sources146 Questions

Exam 4: Income Exclusions160 Questions

Exam 5: Introduction to Business Expenses167 Questions

Exam 6: Business Expenses146 Questions

Exam 7: Losses-Deductions and Limitations129 Questions

Exam 8: Taxation of Individuals163 Questions

Exam 9: Acquisitions of Property106 Questions

Exam 10: Cost Recovery on Property: Depreciation, Depletion, and Amortization110 Questions

Exam 11: Property Dispositions139 Questions

Exam 12: Non-Recognition Transactions117 Questions

Exam 13: Choice of Business Entity-General Tax and Nontax Factorsformation99 Questions

Exam 14: Choice of Business Entity-Operations and Distributions93 Questions

Exam 15: Choice of Business Entity-Other Considerations103 Questions

Exam 16: Tax Research92 Questions

Select questions type

Determine the MACRS cost recovery deductions for 2018 and 2019 on the following assets that were purchased for use in a farming business on July 15, 2018. The taxpayer does not wish to use the Section 179 election and elects out of bonus depreciation.

?

Assets Cost Breeding hogs \ 20,000 Dairy cattle 20,000 Tractor 20,000

a.Breeding hogs depreciation:?Total 2018 Breeding hogs Cost Recovery Deduction (show your calculations)Total 2019 Breeding hogs Cost Recovery Deduction (show your calculations)

b.Dairy cattle depreciation:?Total 2018 Dairy Cattle Cost Recovery Deduction (show your calculations)Total 2019 Dairy Cattle Cost Recovery Deduction (show your calculations)

c.Tractor depreciation:?Total 2018 Tractor Cost Recovery Deduction (show your calculations)Total 2019 Tractor Cost Recovery Deduction (show your calculations)? d. Assume the B reeding hogs are sold for on February 1, 2020. Determine the adjusted basis of the hogs as of the sale date and the realized gain (loss) on the sale. Show your calculations.

Adjusted basis

Realized gain (loss)

(Essay)

4.8/5  (34)

(34)

Which income tax concepts/constructs might taxpayers who take depletion deductions be violating?

I.Accounting method construct.

II.All-inclusive income concept.

III.Capital recovery concept.

(Multiple Choice)

4.8/5  (38)

(38)

To compute cost depletion, you must know the basis subject to depletion, the recoverable quantity of the natural resource, and the quantity of the natural resource sold during the year.

(True/False)

4.8/5  (41)

(41)

During 2018, Witt Processing Corporation places $210,000 of Section 179 property in service for use in its business. What is the amount of Witt Processing's maximum Section 179 deduction for 2018?

(Multiple Choice)

4.8/5  (33)

(33)

On July 17, 2018, Elise purchases office furniture (7-year property) costing $50,000 for use in her business. She wishes to use the Section 179 election but does not elect to use bonus depreciation. Her taxable income before the Section 179 depreciation deduction is $25,000. What is the maximum total cost recovery deduction Elise can take for the current year?

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following is not part of the modified accelerated cost recovery system (MACRS)?

(Multiple Choice)

4.8/5  (37)

(37)

Cruz Copy Shop purchases a new copy machine in July 2018 for $30,000. No other depreciable assets are placed in service in 2018. Since Cruz Copy Shop expects to be in a much higher tax bracket in future years, it desires to minimize its current cost recovery amount to the fullest extent possible. What is the amount of Cruz Copy Shop's MACRS straight-line depreciation for 2018?

(Multiple Choice)

4.8/5  (39)

(39)

Contrast the facts and circumstances depreciation approach commonly used before 1981 with Modified Accelerated Cost Recovery (MACRS).

(Essay)

4.8/5  (34)

(34)

Nonresidential commercial realty placed in service on March 2, 2018, is depreciated over

(Multiple Choice)

4.8/5  (38)

(38)

Cost recoverable intangible properties include

I.Uranium ore.

II.Patents.

III.Agreements not to compete.

IV.Copyrights.

(Multiple Choice)

4.8/5  (36)

(36)

Delta Freight Company purchases 10 delivery vans on April 4, 2018, at a total cost of $366,000. In prior years, Delta used the regular MACRS system on all of its delivery vans (the delivery vans are 5-year MACRS property and are not limited by listed property rules). Delta's annual income is $15,000 before the depreciation deduction. What is Delta's maximum cost recovery deduction on the vans in 2018?

(Multiple Choice)

5.0/5  (32)

(32)

Match each statement with the correct term below.

-Section 179

(Multiple Choice)

4.8/5  (35)

(35)

Match each statement with the correct term below.

-Depreciation

(Multiple Choice)

4.8/5  (39)

(39)

Brent purchases a new warehouse building on May 16, 2017, for $6,000,000 (exclusive of the cost of the land). What is Brent's 2018 depreciation deduction?

(Multiple Choice)

4.7/5  (46)

(46)

Match each statement with the correct term below.

-Capital recovery

(Multiple Choice)

4.8/5  (31)

(31)

Which of the following statements related to the Section 179 election to expense is (are) true?

I.A Section 179 deduction can be claimed on tangible personal property

II.A Section 179 deduction can be claimed on property held for the production of income.

III.A Section 179 deduction can be claimed on real property.

IV.A Section 179 deduction is allowed only for assets used in trade or business.

(Multiple Choice)

4.9/5  (37)

(37)

Match each statement with the correct term below.

-Adjusted basis

(Multiple Choice)

4.8/5  (27)

(27)

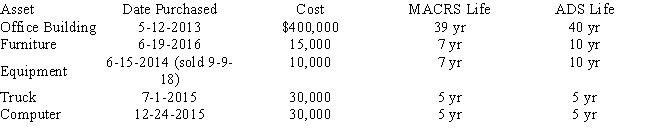

Kuo Corporation uses the following assets in its business in 2018:

?

Assume Kuo Corporation does not utilize Sec 179 expense, has not disposed of any asset since 2003, and has never expensed an asset previously. Kuo, when applicable, elected not to use bonus depreciation in past years. The equipment was sold on 9-9-18 for $4,000.

What is Kuo's 2018 depreciation expense using MACRS and for ADS?

?

2018 MACRS 2018 ADS Building Furniture Equipment Truck Computer

Assume Kuo Corporation does not utilize Sec 179 expense, has not disposed of any asset since 2003, and has never expensed an asset previously. Kuo, when applicable, elected not to use bonus depreciation in past years. The equipment was sold on 9-9-18 for $4,000.

What is Kuo's 2018 depreciation expense using MACRS and for ADS?

?

2018 MACRS 2018 ADS Building Furniture Equipment Truck Computer

(Essay)

4.9/5  (35)

(35)

MACRS eliminates several sources of potential conflict between the IRS and taxpayers concerning an asset's useful life and the calculation of the depreciation deduction.

(True/False)

4.7/5  (35)

(35)

During 2018, Duncan purchases and places in service office equipment with a cost of $40,000. The equipment is 7-year MACRS property with an ADS recovery period of 10 years. Duncan desires to avoid the AMT. What is his minimum 2018 depreciation deduction?

(Multiple Choice)

4.8/5  (37)

(37)

Showing 21 - 40 of 110

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)