Exam 6: Intercompany Inventory Transactions

Exam 1: Intercorporate Acquisitions and Investments in Other Entities46 Questions

Exam 2: Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries With No Differential39 Questions

Exam 3: The Reporting Entity and Consolidation of Less-Than-Wholly-Owned Subsidiaries With No Differential39 Questions

Exam 4: Consolidation of Wholly Owned Subsidiaries Acquired at More Than Book Value47 Questions

Exam 5: Consolidation of Less-Than-Wholly-Owned Subsidiaries Acquired at More Than Book Value41 Questions

Exam 6: Intercompany Inventory Transactions49 Questions

Exam 7: Intercompany Transfers of Services and Noncurrent Assets46 Questions

Exam 8: Intercompany Indebtedness40 Questions

Exam 9: Consolidation Ownership Issues54 Questions

Exam 10: Additional Consolidation Reporting Issues47 Questions

Exam 11: Multinational Accounting: Foreign Currency Transactions and Financial Instruments66 Questions

Exam 12: Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity Statements60 Questions

Exam 13: Segment and Interim Reporting52 Questions

Exam 14: Sec Reporting50 Questions

Exam 15: Partnerships: Formation, operation, and Changes in Membership56 Questions

Exam 16: Partnerships: Liquidation49 Questions

Exam 17: Governmental Entities: Introduction and General Fund Accounting69 Questions

Exam 18: Governmental Entities: Special Funds and Government-Wide Financial Statements66 Questions

Exam 19: Not-For-Profit Entities112 Questions

Exam 20: Corporations in Financial Difficulty41 Questions

Select questions type

Parent Corporation owns 90 percent of Subsidiary 1 Company's stock and 75 percent of Subsidiary 2 Company's stock.During 20X8,Parent sold inventory purchased in 20X7 for $48,000 to Subsidiary 1 for $60,000.Subsidiary 1 then sold the inventory at its cost of $60,000 to Subsidiary 2.Prior to December 31,20X8,Subsidiary 2 sold $45,000 of inventory to a nonaffiliate for $67,000 and held $15,000 in inventory at December 31,20X8.

-Based on the information given above,what amount should be reported in the 20X8 consolidated income statement as cost of goods sold?

(Multiple Choice)

4.8/5  (37)

(37)

Consolidated net income for a parent and its 80 percent owned subsidiary should be computed by eliminating:

(Multiple Choice)

4.7/5  (26)

(26)

Push Company owns 60% of Shove Company's outstanding common stock.

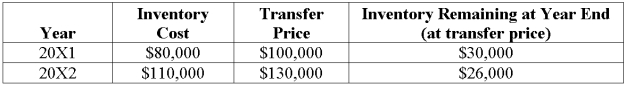

Intra-entity sales are as follows:

-Assume Push sold the inventory to Shove.

Using the fully adjusted equity method,what journal entry would be recorded by Push to defer the unrealized gross profit on inventory sales to Shove in 20X1?

-Assume Push sold the inventory to Shove.

Using the fully adjusted equity method,what journal entry would be recorded by Push to defer the unrealized gross profit on inventory sales to Shove in 20X1?

(Multiple Choice)

4.9/5  (43)

(43)

Pilfer Company acquired 90 percent ownership of Scrooge Corporation in 20X7,at underlying book value.On that date,the fair value of noncontrolling interest was equal to 10 percent of the book value of Scrooge Corporation.Pilfer purchased inventory from Scrooge for $90,000 on August 20,20X8,and resold 70 percent of the inventory to unaffiliated companies on December 1,20X8,for $100,000.Scrooge produced the inventory sold to Pilfer for $67,000.The companies had no other transactions during 20X8.

-Based on the information given above,what amount of consolidated net income will be assigned to the controlling interest for 20X8?

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following are examples of intercompany balances and transactions that must be eliminated in preparing consolidated financial statements?

I.Security holdings

II.Interest and dividends

III.Sales and purchases

(Multiple Choice)

4.7/5  (26)

(26)

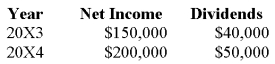

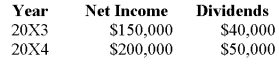

Pisa Company acquired 75 percent of Siena Company on January 1,20X3 for $712,500.The fair value of the noncontrolling interest was equal to 25 percent of book value.On the date of acquisition,Siena had common stock outstanding of $300,000 and a balance in retained earnings of $650,000.During 20X3,Siena purchased inventory for $35,000 and sold it to Pisa for $50,000.Of this amount,Pisa reported $20,000 in ending inventory in 20X3 and later sold it in 20X4.In 20X4,Pisa sold inventory it had purchased for $40,000 to Siena for $60,000.Siena sold $45,000 of this inventory in 20X4.

Income and dividend information for Siena for 20X3 and 20X4 are as follows:

Pisa Company uses the modified equity method.

Required:

a.Present the worksheet elimination entries necessary to prepare consolidated financial statements for 20X3.

b.Present the worksheet elimination entries necessary to prepare consolidated financial statements for 20X4.

(Essay)

5.0/5  (44)

(44)

Pisa Company acquired 75 percent of Siena Company on January 1,20X3 for $712,500.The fair value of the noncontrolling interest was equal to 25 percent of book value.On the date of acquisition,Siena had common stock outstanding of $300,000 and a balance in retained earnings of $650,000.During 20X3,Siena purchased inventory for $35,000 and sold it to Pisa for $50,000.Of this amount,Pisa reported $20,000 in ending inventory in 20X3 and later sold it in 20X4.In 20X4,Pisa sold inventory it had purchased for $40,000 to Siena for $60,000.Siena sold $45,000 of this inventory in 20X4.

Income and dividend information for Siena for 20X3 and 20X4 are as follows:

Pisa Company uses the fully adjusted equity method.

Required:

a.Present the worksheet elimination entries necessary to prepare consolidated financial statements for 20X3.

b.Present the worksheet elimination entries necessary to prepare consolidated financial statements for 20X4.

(Essay)

4.9/5  (29)

(29)

ABC Corporation owns 75 percent of XYZ Company's voting shares.During 20X8,ABC produced 50,000 chairs at a cost of $79 each and sold 35,000 chairs to XYZ for $90 each.XYZ sold 18,000 of the chairs to unaffiliated companies for $117 each prior to December 31,20X8,and sold the remainder in early 20X9 for $130 each.Both companies use perpetual inventory systems.

-Based on the information given above,what amount of cost of goods sold did XYZ record in 20X8?

(Multiple Choice)

4.9/5  (40)

(40)

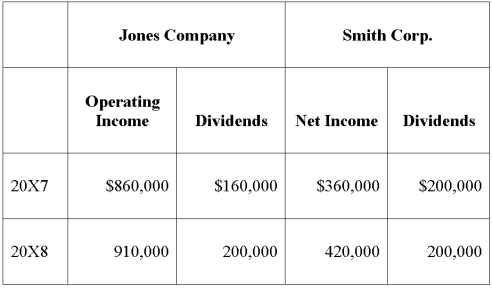

On January 1,20X7,Jones Company acquired 90 percent of the outstanding common stock of Smith Corporation for $1,242,000.On that date,the fair value of noncontrolling interest was equal to $138,000.The entire differential was related to land held by Smith.At the date of acquisition,Smith had common stock outstanding of $520,000,additional paid-in capital of $200,000,and retained earnings of $540,000.During 20X7,Smith sold inventory to Jones for $440,000.The inventory originally cost Smith $360,000.By year-end,30 percent was still in Jones' ending inventory.During 20X8,the remaining inventory was resold to an unrelated customer.Both Jones and Smith use perpetual inventory systems.

Income and dividend information for both Jones and Smith for 20X7 and 20X8 are as follows:

Assume Jones uses the fully adjusted equity method to account for its investment in Smith.

Required:

a.Present the worksheet elimination entries necessary to prepare consolidated financial statements for 20X7.

b.Present the worksheet elimination entries necessary to prepare consolidated financial statements for 20X8.

(Essay)

4.9/5  (45)

(45)

Showing 41 - 49 of 49

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)