Exam 4: Consolidation of Wholly Owned Subsidiaries Acquired at More Than Book Value

Exam 1: Intercorporate Acquisitions and Investments in Other Entities46 Questions

Exam 2: Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries With No Differential39 Questions

Exam 3: The Reporting Entity and Consolidation of Less-Than-Wholly-Owned Subsidiaries With No Differential39 Questions

Exam 4: Consolidation of Wholly Owned Subsidiaries Acquired at More Than Book Value47 Questions

Exam 5: Consolidation of Less-Than-Wholly-Owned Subsidiaries Acquired at More Than Book Value41 Questions

Exam 6: Intercompany Inventory Transactions49 Questions

Exam 7: Intercompany Transfers of Services and Noncurrent Assets46 Questions

Exam 8: Intercompany Indebtedness40 Questions

Exam 9: Consolidation Ownership Issues54 Questions

Exam 10: Additional Consolidation Reporting Issues47 Questions

Exam 11: Multinational Accounting: Foreign Currency Transactions and Financial Instruments66 Questions

Exam 12: Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity Statements60 Questions

Exam 13: Segment and Interim Reporting52 Questions

Exam 14: Sec Reporting50 Questions

Exam 15: Partnerships: Formation, operation, and Changes in Membership56 Questions

Exam 16: Partnerships: Liquidation49 Questions

Exam 17: Governmental Entities: Introduction and General Fund Accounting69 Questions

Exam 18: Governmental Entities: Special Funds and Government-Wide Financial Statements66 Questions

Exam 19: Not-For-Profit Entities112 Questions

Exam 20: Corporations in Financial Difficulty41 Questions

Select questions type

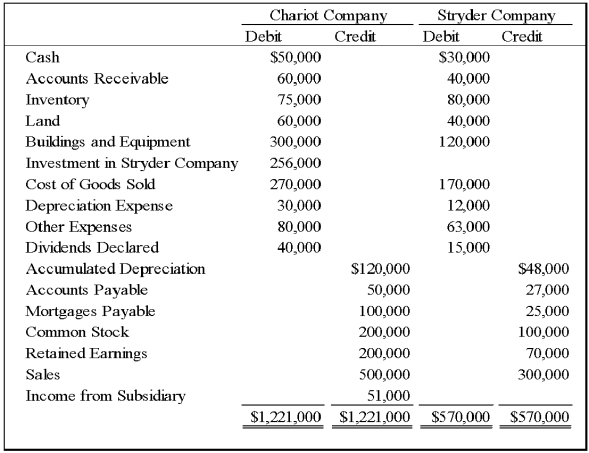

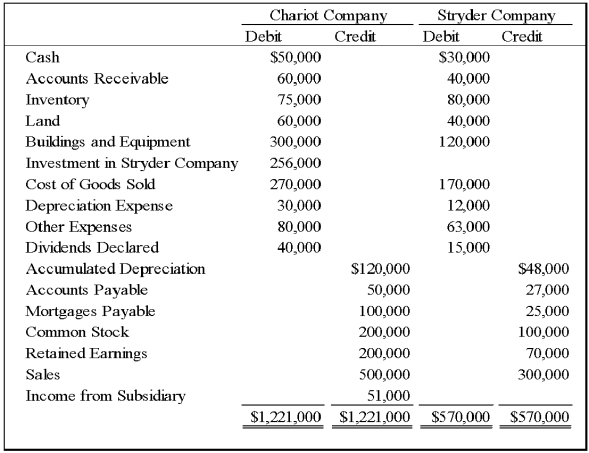

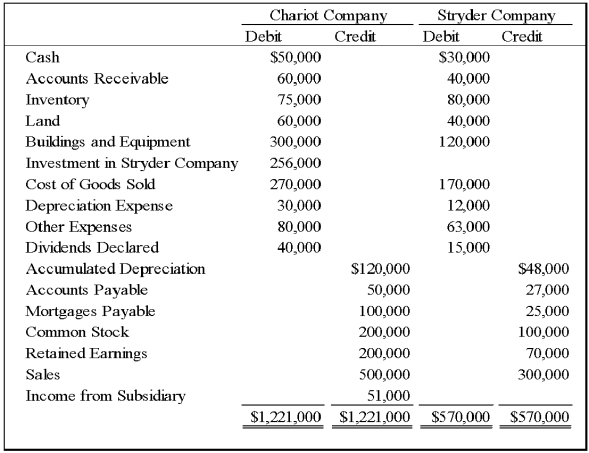

On January 1,20X8,Chariot Company acquired 100 percent of Stryder Company for $220,000 cash.The trial balances for the two companies on December 31,20X8,included the following amounts:

On the acquisition date,Stryder reported net assets with a book value of $170,000.A total of $10,000 of the acquisition price is applied to goodwill,which was not impaired in 20X8.Stryder's depreciable assets had an estimated economic life of 10 years on the date of combination.The difference between fair value and book value of tangible assets is related entirely to buildings and equipment.Chariot used the equity method in accounting for its investment in Stryder.Analysis of receivables and payables revealed that Stryder owed Chariot $10,000 on December 31,20X8.

-Based on the information provided,the differential associated with this acquisition is:

-Based on the information provided,the differential associated with this acquisition is:

(Multiple Choice)

4.7/5  (39)

(39)

On December 31,20X8,Mercury Corporation acquired 100 percent ownership of Saturn Corporation.On that date,Saturn reported assets and liabilities with book values of $300,000 and $100,000,respectively,common stock outstanding of $50,000,and retained earnings of $150,000.The book values and fair values of Saturn's assets and liabilities were identical except for land which had increased in value by $10,000 and inventories which had decreased by $5,000.

-Based on the preceding information,what amount of differential will appear in the eliminating entries required to prepare a consolidated balance sheet immediately after the business combination,if the acquisition price was $240,000?

(Multiple Choice)

4.8/5  (32)

(32)

West,Inc.holds 100 percent of the common stock of Coast Company,an investment acquired for $680,000.Immediately following the combination,West's net assets have a book value of $1,150,000 and a fair value of $1,390,000.The book value and the fair value of Coast's net assets on the date of combination are $400,000 and $550,000,respectively.Immediately following the combination,a consolidated balance sheet is prepared.

-Based on the information given above,what will be the amount of net assets reported in the consolidated balance sheet,prepared immediately following the combination?

(Multiple Choice)

4.8/5  (44)

(44)

On January 1,20X8,Chariot Company acquired 100 percent of Stryder Company for $220,000 cash.The trial balances for the two companies on December 31,20X8,included the following amounts:

On the acquisition date,Stryder reported net assets with a book value of $170,000.A total of $10,000 of the acquisition price is applied to goodwill,which was not impaired in 20X8.Stryder's depreciable assets had an estimated economic life of 10 years on the date of combination.The difference between fair value and book value of tangible assets is related entirely to buildings and equipment.Chariot used the equity method in accounting for its investment in Stryder.Analysis of receivables and payables revealed that Stryder owed Chariot $10,000 on December 31,20X8.

-Based on the information provided,what amount of retained earnings will be reported in the consolidated financial statements for the year?

-Based on the information provided,what amount of retained earnings will be reported in the consolidated financial statements for the year?

(Multiple Choice)

4.8/5  (37)

(37)

On January 1,20X8,Chariot Company acquired 100 percent of Stryder Company for $220,000 cash.The trial balances for the two companies on December 31,20X8,included the following amounts:

On the acquisition date,Stryder reported net assets with a book value of $170,000.A total of $10,000 of the acquisition price is applied to goodwill,which was not impaired in 20X8.Stryder's depreciable assets had an estimated economic life of 10 years on the date of combination.The difference between fair value and book value of tangible assets is related entirely to buildings and equipment.Chariot used the equity method in accounting for its investment in Stryder.Analysis of receivables and payables revealed that Stryder owed Chariot $10,000 on December 31,20X8.

-Based on the information provided,what amount of net income will be reported in the consolidated financial statements for the year?

-Based on the information provided,what amount of net income will be reported in the consolidated financial statements for the year?

(Multiple Choice)

4.9/5  (35)

(35)

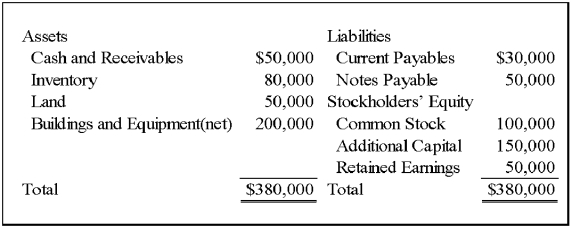

On January 1,20X9,Wilton Company acquired all of Sirius Company's common shares,for $365,000 cash.On that date,Sirius's balance sheet appeared as follows:

The fair values of all of Sirius's assets and liabilities were equal to their book values except for inventory that had a fair value of $85,000,land that had a fair value of $60,000,and buildings and equipment that had a fair value of $250,000.Buildings and equipment have a remaining useful life of 10 years with zero salvage value.Wilton Company decided to employ push-down accounting for the acquisition.Subsequent to the combination,Sirius continued to operate as a separate company.

-Based on the preceding information,what amount of differential will arise in the consolidation process?

-Based on the preceding information,what amount of differential will arise in the consolidation process?

(Multiple Choice)

4.8/5  (42)

(42)

On December 31,20X8,Mercury Corporation acquired 100 percent ownership of Saturn Corporation.On that date,Saturn reported assets and liabilities with book values of $300,000 and $100,000,respectively,common stock outstanding of $50,000,and retained earnings of $150,000.The book values and fair values of Saturn's assets and liabilities were identical except for land which had increased in value by $10,000 and inventories which had decreased by $5,000.

-Based on the preceding information,what amount of goodwill will be reported if the acquisition price was $195,000?

(Multiple Choice)

4.9/5  (33)

(33)

Showing 41 - 47 of 47

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)