Exam 8: Performance Evaluation

Exam 1: Management Accounting and Corporate Governance148 Questions

Exam 2: Cost Behavior, operating Leverage, and Profitability Analysis153 Questions

Exam 3: Analysis of Cost, volume, and Pricing to Increase Profitability149 Questions

Exam 4: Cost Accumulation,tracing,and Allocation159 Questions

Exam 5: Cost Management in an Automated Business Environment: ABC, ABM, and TQM154 Questions

Exam 6: Relevant Information for Special Decisions153 Questions

Exam 7: Planning for Profit and Cost Control152 Questions

Exam 8: Performance Evaluation156 Questions

Exam 9: Responsibility Accounting146 Questions

Exam 10: Planning for Capital Investments156 Questions

Exam 11: Product Costing in Service and Manufacturing Entities149 Questions

Exam 12: Job-Order, process, and Hybrid Costing Systems148 Questions

Exam 13: Financial Statement Analysis155 Questions

Exam 14: Statement of Cash Flows149 Questions

Select questions type

Which of the following income statement formats is most commonly used with flexible budgeting?

(Multiple Choice)

4.8/5  (43)

(43)

Sometimes the sales staff will deliberately underestimate the amount of expected sales.This practice is known as:

(Multiple Choice)

4.8/5  (39)

(39)

In general,budget variances should not be used to single out managers for praise or punishment.

(True/False)

4.9/5  (38)

(38)

Sales volume variances are attributable to differences between planned and actual activity volumes,as well as differences in selling price.

(True/False)

4.9/5  (42)

(42)

Standard cost systems facilitate the management practice known as:

(Multiple Choice)

4.7/5  (41)

(41)

What is the result when the actual rate paid for labor is less than the standard rate?

(Multiple Choice)

4.9/5  (38)

(38)

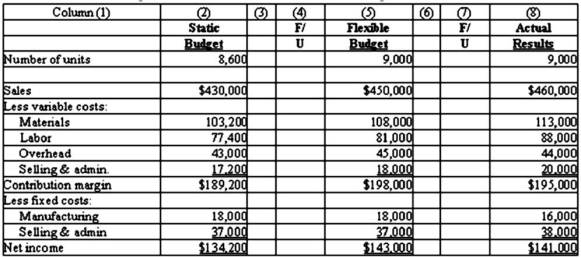

The Broaddus Company has requested a performance report that reports both sales activity variances and flexible budget variances.The following table of information is provided:

Required:

(1)Compute and enter the variances and label the variances as favorable (F)or unfavorable (U).

(2)Which variances are sales volume variance and which variances are flexible budget variances?

(3)Comment on this company's performance.

Required:

(1)Compute and enter the variances and label the variances as favorable (F)or unfavorable (U).

(2)Which variances are sales volume variance and which variances are flexible budget variances?

(3)Comment on this company's performance.

(Essay)

4.8/5  (39)

(39)

Which of the following is an incorrect statement regarding variances?

(Multiple Choice)

4.9/5  (46)

(46)

Which of the following equations can be used to compute the total materials variance? (A = Actual; S = Standard; Q = Quantity; P = Price)

(Multiple Choice)

4.8/5  (50)

(50)

Heartwood Company reported a $4,000 favorable direct labor price variance and a $1,500 unfavorable direct labor usage variance.Select the correct statement from the following.

(Multiple Choice)

4.7/5  (45)

(45)

Jared expects to charge $60 per hour for his industrial maintenance business during the following year.He expects to reach 50,000 hours at that price.Jared's partner disagrees with the estimate and expects closer to 40,000 hours. What should Jared do when preparing the budget for the year?

(Multiple Choice)

4.7/5  (33)

(33)

Marks Company makes one product,for which it has established the following standards for materials:

Average quantity of material per unit of product: 4.5 pounds

Price per pound of materials: $16

During March,Marks made 10,000 units of the product,using 50,000 pounds at a total purchase price of $825,000.

Required:

(a)Determine the total flexible budget materials variance and indicate whether it is favorable or unfavorable.

(b)Calculate the materials price variance and indicate whether it is favorable or unfavorable.

(c)Determine the materials usage variance and indicate whether it is favorable or unfavorable.

(Essay)

4.7/5  (45)

(45)

The sales volume variance is favorable if actual sales volume is higher than the budgeted volume.

(True/False)

4.8/5  (33)

(33)

The following static budget is provided: Per Unit Total Sales \ 60 \ 900,000 Less variable costs: Manufacturing costs 30 450,000 Selling and administrative costs Contribution margin \ 300,000 Less fixed costs: Manufacturing costs 75,000 Selling and administrative costs Total fixed costs Net income

What will be the overall volume variance if 12,000 units are produced and sold?

(Multiple Choice)

4.9/5  (40)

(40)

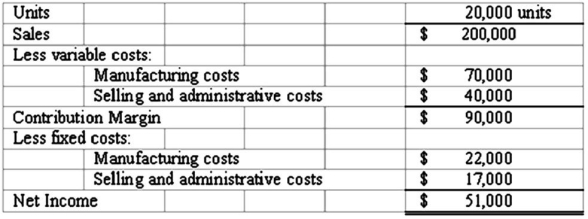

The following static budget is provided:  What will budgeted net income equal if 21,000 units are produced and sold? (Do not round intermediate calculations.)

What will budgeted net income equal if 21,000 units are produced and sold? (Do not round intermediate calculations.)

(Multiple Choice)

4.8/5  (36)

(36)

Canton Company estimates sales of 12,000 units for the upcoming period.At this sales volume its budgeted income is as follows:

Per Unit 12.000 Units Sales \ 30 \ 360,000 Less variable costs: Manufacturing costs 16 192,000 Selling and administrative costs Contribution margin \ 6 \ 72,000 Less fixed costs: Manufacturing costs 20,000 Selling and administrative costs Net income During the period the company actually produced and sold 14,000 units.

Required:

1)The manager now wants to evaluate the company's performance by comparing actual costs and revenues to those shown above,but you have advised against it.Explain your reasoning.

2)Prepare a flexible budget based on 14,000 units.

3)If management compares actual revenues and costs to the appropriate flexible budget,will they be able to fully understand what went right and what went wrong with the operation during the period? Why or why not?

(Essay)

4.8/5  (43)

(43)

A budget prepared at a single volume of activity is referred to as a:

(Multiple Choice)

4.8/5  (49)

(49)

Pfeiffer Company produces a number of products,including a small American flag.The firm,which began operations at the beginning of the current year,uses a standard cost system.The standard costs for one American Flag are provided below:

Direct material (0.5 yd @ \1 .00) \ .50 Direct labor (1@\ 10.00) 10.00 Variable overhed (1@\ 1.00) 1.00 Fixed overhead (1@\ 0.50) The $0.50 fixed overhead rate is based on total budgeted fixed overhead costs of $17,000.There were no changes in any inventory accounts during the period.The company produced and sold 35,000 units at the following costs:

Direct materials (18,000 yds.) \ 17,280 Direct labor (36,000 hrs.) 374,400 Variable factory overhead 34,500 Fixed factory overhead Required:

1)Compute and label as Favorable (F)or Unfavorable (U)the following flexible budget variances:

a) Direct materials price variance

b) Direct materials usape variance

c) Direct labor price variance

d) Direct labor usage variance

e) Total variable overhead variance

f) Fixed overhead spending variance

e) Fixed overhead volume variance

2)Comment on the firm's performance.

(Essay)

4.8/5  (37)

(37)

When a comparison of static and flexible budgets shows an unfavorable sales volume variance,the variable cost volume variances will also be unfavorable.

(True/False)

4.8/5  (40)

(40)

Showing 21 - 40 of 156

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)