Exam 4: Cost Accumulation,tracing,and Allocation

Exam 1: Management Accounting and Corporate Governance148 Questions

Exam 2: Cost Behavior, operating Leverage, and Profitability Analysis153 Questions

Exam 3: Analysis of Cost, volume, and Pricing to Increase Profitability149 Questions

Exam 4: Cost Accumulation,tracing,and Allocation159 Questions

Exam 5: Cost Management in an Automated Business Environment: ABC, ABM, and TQM154 Questions

Exam 6: Relevant Information for Special Decisions153 Questions

Exam 7: Planning for Profit and Cost Control152 Questions

Exam 8: Performance Evaluation156 Questions

Exam 9: Responsibility Accounting146 Questions

Exam 10: Planning for Capital Investments156 Questions

Exam 11: Product Costing in Service and Manufacturing Entities149 Questions

Exam 12: Job-Order, process, and Hybrid Costing Systems148 Questions

Exam 13: Financial Statement Analysis155 Questions

Exam 14: Statement of Cash Flows149 Questions

Select questions type

Humphries Construction Company builds warehouses that range in size from 12,000 to 100,000 square feet.Which of the following would not be a rational base for allocating overhead costs to the warehouses?

(Multiple Choice)

4.8/5  (29)

(29)

A predetermined overhead rate is calculated using estimated or predicted cost and volume data.

(True/False)

4.9/5  (40)

(40)

Danforth Manufacturing Company uses a cost-plus pricing strategy.At the beginning of the year,Danforth estimated that total annual fixed overhead costs would amount to $60,000.Further,Danforth estimated that the annual volume of production would be 1,000 units of product.Based on these estimates,Danforth computed a predetermined overhead rate that was used to allocate overhead cost to the products made throughout the year.As predicted,the actual volume of production amounted to 1,000 units of product.However,actual fixed overhead costs amounted to $56,000.Based on this information alone:

(Multiple Choice)

4.7/5  (39)

(39)

Services performed by service departments for the benefit of an operating department are called interdepartmental services.

(True/False)

4.8/5  (35)

(35)

Preston Company has three divisions.The company should consider a cost to be a direct cost of a division if:

(Multiple Choice)

4.8/5  (38)

(38)

Indirect costs should not be pooled unless they share a common cost driver.

(True/False)

4.7/5  (33)

(33)

The direct method of allocating service department costs does not take into account the fact that service departments often provide assistance to other service departments.

(True/False)

4.9/5  (42)

(42)

At the beginning of the year,Rangle Company expected to incur $54,000 of overhead costs in producing 6,000 units of product.The direct material cost is $20 per unit of product.Direct labor cost is $30 per unit.During January,600 units were produced.The total cost of the units made in January was:

(Multiple Choice)

4.7/5  (41)

(41)

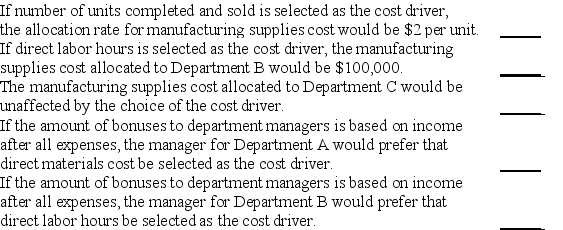

The following information was gathered for Company J,a manufacturing company with three departments,A,B,and C:

Manufacturing supplies cost is expected to be $300,000.Possible cost drivers are direct labor hours,direct materials cost,and number of units completed and sold.The three departments have varying amounts for these items.

Departrnent A Department B Departrnent C Direct labor hours 15,000 40,000 45,000 Direct materials cost \ 500,000 \ 2,500,000 \ 2,000,000 \# of units expected to be completed and sold 80,000 30,000 40,000 Based on this information,indicate whether each of the following statements is true or false.

(Essay)

4.9/5  (38)

(38)

Which of the following best describes the term used to assign indirect costs to a cost object?

(Multiple Choice)

4.9/5  (39)

(39)

Each indirect cost should be allocated to products individually to provide the most useful cost information.

(True/False)

4.9/5  (40)

(40)

All of the following are examples of indirect costs that can be classified as being variable costs except:

(Multiple Choice)

4.8/5  (41)

(41)

Southeast Manufacturing Company has identified the following cost objects: Cost Object 1: The cost of operating the finishing department

Cost Object 2: The cost of a particular product made in June

Cost Object 3: The cost of operating the factory

With respect to these cost objects,the cost of the salary of the supervisor of the finishing department is directly traceable to cost objects:

(Multiple Choice)

4.8/5  (39)

(39)

Which of the followings statements is correct regarding direct and indirect costs?

(Multiple Choice)

4.8/5  (40)

(40)

Sheddon Industries produces two products.The products' identified costs are as follows: Product A Product B Direct materials \2 0,000 \1 5,000 Direct labor 12,000 24,000

The company's overhead costs of $108,000 are allocated based on labor cost.Assume 4,000 units of product A and 5,000 units of Product B are produced.What amount of production costs would be assigned to Product A? (Do not round intermediate calculations.)

(Multiple Choice)

4.8/5  (46)

(46)

Indicate whether each of the following statements is true or false.

When a company can identify more than one cost driver for a particular cost, it should use the cost driver with the strongest cause-and-effect relationship to the cost.

Availability and cost of information are likely to influence a company's choice of cost drivers.

A company should never use a cost driver unless there is a strong causal relationship between the cost and the cost driver.

Different cost drivers almost always give about the same results when a cost is allocated to cost objects.

In allocating costs among departments, a company must consider how department managers are likely to respond.

(Essay)

4.8/5  (38)

(38)

Showing 141 - 159 of 159

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)