Exam 16: Cost Allocation: Joint Products and Byproducts

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis209 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets,direct-Cost Variances,and Management Control181 Questions

Exam 8: Flexible Budgets, overhead Cost Variances, and Management Control171 Questions

Exam 9: Inventory Costing and Capacity Analysis207 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy,balanced Scorecard,and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management209 Questions

Exam 14: Cost Allocation, customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts150 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, just-In-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, transfer Pricing, and Multinational Considerations150 Questions

Exam 23: Performance Measurement, compensation, and Multinational Considerations150 Questions

Select questions type

Which of the following statements best define split off point in joint costing?

(Multiple Choice)

4.8/5  (34)

(34)

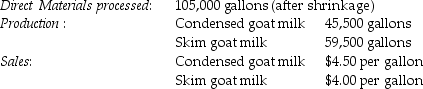

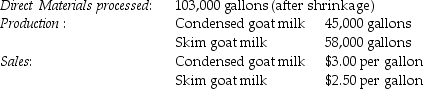

The Green Company processes unprocessed goat milk up to the split-off point where two products,condensed goat milk and skim goat milk result.The following information was collected for the month of October:

The costs of purchasing the of unprocessed goat milk and processing it up to the split-off point to yield a total of 105,000 gallons of saleable product was $191,480.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 45,000 gallons (the remainder is shrinkage)of a medicinal milk product,Xyla,for an additional processing cost of $5 per usable gallon.Xyla can be sold for $20 per gallon.

Skim goat milk can be processed further to yield 58,200 gallons of skim goat ice cream,for an additional processing cost per usable gallon of $5.The product can be sold for $12 per gallon.

There are no beginning and ending inventory balances.

Using the sales value at split-off method,what is the gross-margin percentage for skim goat milk at the split-off point? (Round intermediary percentages to the nearest hundredth. )

The costs of purchasing the of unprocessed goat milk and processing it up to the split-off point to yield a total of 105,000 gallons of saleable product was $191,480.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 45,000 gallons (the remainder is shrinkage)of a medicinal milk product,Xyla,for an additional processing cost of $5 per usable gallon.Xyla can be sold for $20 per gallon.

Skim goat milk can be processed further to yield 58,200 gallons of skim goat ice cream,for an additional processing cost per usable gallon of $5.The product can be sold for $12 per gallon.

There are no beginning and ending inventory balances.

Using the sales value at split-off method,what is the gross-margin percentage for skim goat milk at the split-off point? (Round intermediary percentages to the nearest hundredth. )

(Multiple Choice)

4.7/5  (35)

(35)

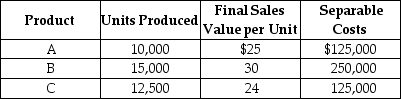

Calamata Corporation processes a single material into three separate products A,B,and C.During September,the joint costs of processing were $300,000.Production and sales value information for the month were as follows:

Required:

Determine the amount of joint cost allocated to each product if the constant gross-margin percentage NRV method is used.

Required:

Determine the amount of joint cost allocated to each product if the constant gross-margin percentage NRV method is used.

(Essay)

4.8/5  (32)

(32)

Which of the following statements is true of main products and byproducts?

(Multiple Choice)

4.8/5  (33)

(33)

All products yielded from joint product processing have some positive value to the firm.

(True/False)

4.9/5  (42)

(42)

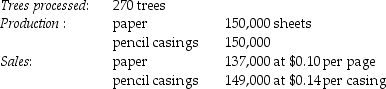

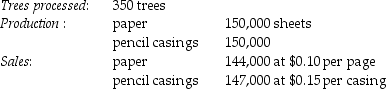

Bismite Corporation purchases trees from Cheney lumber and processes them up to the split-off point where two products (paper and pencil casings)emerge from the process.The products are then sold to an independent company that markets and distributes them to retail outlets.The following information was collected for the month of October:

The cost of purchasing 270 trees and processing them up to the split-off point to yield 150,000 sheets of paper and 150,000 pencil casings is $14,500.

Bismite's accounting department reported no beginning inventory.

What is the total sales value at the split-off point of the pencil casings?

The cost of purchasing 270 trees and processing them up to the split-off point to yield 150,000 sheets of paper and 150,000 pencil casings is $14,500.

Bismite's accounting department reported no beginning inventory.

What is the total sales value at the split-off point of the pencil casings?

(Multiple Choice)

4.7/5  (31)

(31)

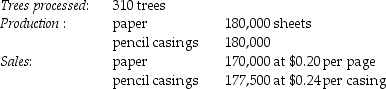

Bismite Corporation purchases trees from Cheney lumber and processes them up to the split-off point where two products (paper and pencil casings)are obtained.The products are then sold to an independent company that markets and distributes them to retail outlets.The following information was collected for the month of October:

The cost of purchasing 310 trees and processing them up to the split-off point to yield 180,000 sheets of paper and 180,000 pencil casings is $12,500.

Bismite's accounting department reported no beginning inventory.

What is the total sales value at the split-off point for paper?

The cost of purchasing 310 trees and processing them up to the split-off point to yield 180,000 sheets of paper and 180,000 pencil casings is $12,500.

Bismite's accounting department reported no beginning inventory.

What is the total sales value at the split-off point for paper?

(Multiple Choice)

4.8/5  (26)

(26)

When a joint production process yields one product with a high total sales value compared to the total sales value of the other products of the process,that product is called a joint product.

(True/False)

4.7/5  (33)

(33)

List the reasons that the sales value at split-off method of joint cost allocation should be used.

(Essay)

4.9/5  (37)

(37)

Joint costing allocates the joint costs to the individual products that are eventually sold.

(True/False)

4.9/5  (32)

(32)

Which of the following statements is true of joint production process and its components?

(Multiple Choice)

4.8/5  (32)

(32)

Bismite Corporation purchases trees from Cheney lumber and processes them up to the split-off point where two products (paper and pencil casings)emerge.The products are then sold to an independent company that markets and distributes them to retail outlets.The following information was collected for the month of October:

The cost of purchasing 350 trees and processing them up to the split-off point to yield 150,000 sheets of paper and 150,000 pencil casings is $15,500.

Bismite's accounting department reported no beginning inventory.

If the sales value at split-off method is used,what is the approximate production cost for each paper sheet? (Round intermediary percentages to the nearest hundredth. )

The cost of purchasing 350 trees and processing them up to the split-off point to yield 150,000 sheets of paper and 150,000 pencil casings is $15,500.

Bismite's accounting department reported no beginning inventory.

If the sales value at split-off method is used,what is the approximate production cost for each paper sheet? (Round intermediary percentages to the nearest hundredth. )

(Multiple Choice)

4.9/5  (32)

(32)

What revenue or expense amounts are necessary to make a sell-or-process-further decision and why? What items are irrelevant to the decision and why?

(Essay)

4.7/5  (39)

(39)

Which of the following statements best define joint products?

(Multiple Choice)

4.8/5  (41)

(41)

In joint costing,which of the following changes may lead to a change in product classification?

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following is a is a market-based approach to allocating joint costs?

(Multiple Choice)

4.9/5  (31)

(31)

The constant gross-margin percentage NRV method is the only method whereby products can receive negative allocations.

(True/False)

4.8/5  (37)

(37)

The Green Company processes unprocessed goat milk up to the split-off point where two products,condensed goat milk and skim goat milk result.The following information was collected for the month of October:

The costs of purchasing the of unprocessed goat milk and processing it up to the split-off point to yield a total of 103,000 gallons of saleable product was $186,480.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 44,500 gallons (the remainder is shrinkage)of a medicinal milk product,Xyla,for an additional processing cost of $7 per usable gallon.Xyla can be sold for $25 per gallon.

Skim goat milk can be processed further to yield 56,700 gallons of skim goat ice cream,for an additional processing cost per usable gallon of $7.The product can be sold for $12 per gallon.

There are no beginning and ending inventory balances.

How much (if any)extra income would Green earn if it produced and sold skim milk ice cream from goats rather than goat skim milk? Allocate joint processing costs based upon the relative sales value at the split-off point.(Round intermediary percentages to the nearest hundredth. )

The costs of purchasing the of unprocessed goat milk and processing it up to the split-off point to yield a total of 103,000 gallons of saleable product was $186,480.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 44,500 gallons (the remainder is shrinkage)of a medicinal milk product,Xyla,for an additional processing cost of $7 per usable gallon.Xyla can be sold for $25 per gallon.

Skim goat milk can be processed further to yield 56,700 gallons of skim goat ice cream,for an additional processing cost per usable gallon of $7.The product can be sold for $12 per gallon.

There are no beginning and ending inventory balances.

How much (if any)extra income would Green earn if it produced and sold skim milk ice cream from goats rather than goat skim milk? Allocate joint processing costs based upon the relative sales value at the split-off point.(Round intermediary percentages to the nearest hundredth. )

(Multiple Choice)

4.9/5  (34)

(34)

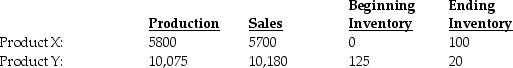

Torid Company processes 18,025 gallons of direct materials to produce two products,Product X and Product Y.Product X sells for $5 per gallon and Product Y,the main product,sells for $170 per gallon.The following information is for December:

The manufacturing costs totalled $26,000.

Under production method,Product X NRV would be offset against the costs of Product Y by how much?

The manufacturing costs totalled $26,000.

Under production method,Product X NRV would be offset against the costs of Product Y by how much?

(Multiple Choice)

4.9/5  (29)

(29)

Showing 101 - 120 of 150

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)