Exam 1: An Introduction to Accounting

Exam 1: An Introduction to Accounting94 Questions

Exam 2: Accounting for Accruals and Deferrals92 Questions

Exam 3: The Double-Entry Accounting System106 Questions

Exam 4: Accounting for Merchandising Businesses114 Questions

Exam 5: Accounting for Inventories86 Questions

Exam 6: Internal Control and Accounting for Cash82 Questions

Exam 7: Accounting for Receivables83 Questions

Exam 8: Accounting for Long-Term Operational Assets110 Questions

Exam 9: Accounting for Current Liabilities and Payroll86 Questions

Exam 10: Accounting for Long-Term Debt105 Questions

Exam 11: Proprietorships,partnerships,and Corporations92 Questions

Exam 12: Statement of Cash Flows88 Questions

Exam 13: Financial Statement Analysis108 Questions

Select questions type

The following information applies to the questions displayed below.

Yowell Company began operations on January 1, Year 1. During Year 1, the company engaged in the following cash transactions:

1) issued stock for $40,000

2) borrowed $25,000 from its bank

3) provided consulting services for $39,000

4) paid back $15,000 of the bank loan

5) paid rent expense for $9,000

6) purchased equipment costing $12,000

7) paid $3,000 dividends to stockholders

8) paid employees' salaries, $21,000

-What is Yowell's ending notes payable balance?

(Multiple Choice)

4.9/5  (39)

(39)

An asset source transaction increases a business's assets and the claims to assets.

(True/False)

4.8/5  (42)

(42)

Li Company paid cash to purchase land.What happened as a result of this business event?

(Multiple Choice)

4.9/5  (34)

(34)

The following information applies to the questions displayed below.

Yowell Company began operations on January 1, Year 1. During Year 1, the company engaged in the following cash transactions:

1) issued stock for $40,000

2) borrowed $25,000 from its bank

3) provided consulting services for $39,000

4) paid back $15,000 of the bank loan

5) paid rent expense for $9,000

6) purchased equipment costing $12,000

7) paid $3,000 dividends to stockholders

8) paid employees' salaries, $21,000

-What is Yowell's net income?

(Multiple Choice)

4.8/5  (37)

(37)

Liabilities are obligations of a business to relinquish assets,provide services,or accept other obligations.

(True/False)

4.8/5  (38)

(38)

At the end of Year 2,retained earnings for the Baker Company was $3,500.Revenue earned by the company in Year 2 was $1,500,expenses paid during the period were $800,and dividends paid during the period were $500.Based on this information alone,what was the amount of retained earnings at the beginning of Year 2?

(Multiple Choice)

4.8/5  (37)

(37)

Santa Fe Company was started on January 1,Year 1,when it acquired $9,000 cash by issuing common stock.During Year 1,the company earned cash revenues of $4,500,paid cash expenses of $3,750,and paid a cash dividend of $250.Which of the following is true based on this information?

(Multiple Choice)

4.7/5  (44)

(44)

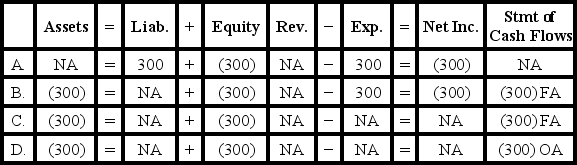

Perez Company paid a $300 cash dividend.Which of the following accurately reflects how this event affects the company's financial statements?

(Multiple Choice)

4.8/5  (28)

(28)

When a business provides services for cash,which elements of the accounting equation are affected?

(Multiple Choice)

4.9/5  (41)

(41)

Hazeltine Company issued common stock for $200,000 cash.What happened as a result of this event?

(Multiple Choice)

4.9/5  (35)

(35)

Algonquin Company reported assets of $50,000,liabilities of $22,000 and common stock of $15,000.Based on this information only,what is the amount of the company's retained earnings?

(Multiple Choice)

4.8/5  (35)

(35)

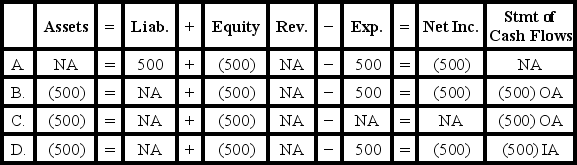

Jackson Company paid $500 cash for salary expenses.Which of the following accurately reflects how this event affects the company's financial statements?

(Multiple Choice)

4.8/5  (33)

(33)

Mayberry Company paid $30,000 cash to purchase land.What happened as a result of this business event?

(Multiple Choice)

4.9/5  (34)

(34)

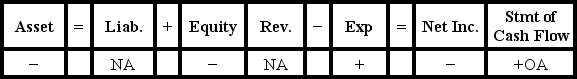

Delta Company experienced an accounting event that affected its financial statements as indicated below:

Which of the following accounting events could have caused these effects on the elements of Delta's statements?

Which of the following accounting events could have caused these effects on the elements of Delta's statements?

(Multiple Choice)

4.9/5  (28)

(28)

Which financial statement matches asset increases from operating a business with asset decreases from operating the business?

(Multiple Choice)

4.8/5  (33)

(33)

Turner Company reported assets of $20,000 (including cash of $9,000),liabilities of $8,000,common stock of $7,000,and retained earnings of $5,000.Based on this information,what can be concluded?

(Multiple Choice)

4.8/5  (47)

(47)

Which of the following financial statements provides information about a company as of a specific point in time?

(Multiple Choice)

4.7/5  (38)

(38)

Showing 21 - 40 of 94

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)