Exam 7: Capital Gains and Other Sales of Property Schedule D and Form 4797

Exam 1: Introduction to Taxation, the Income Tax Formula, and Form 1040ez139 Questions

Exam 2: Expanded Tax Formula, forms 1040a and 1040, and Basic Concepts125 Questions

Exam 3: Gross Income: Inclusions and Exclusions125 Questions

Exam 4: Adjustments for Adjusted Gross Income116 Questions

Exam 5: Itemized Deductions119 Questions

Exam 6: Self-Employed Business Income Line 12 of Form 1040 and Schedule C76 Questions

Exam 7: Capital Gains and Other Sales of Property Schedule D and Form 4797118 Questions

Exam 8: Rental Property, royalties, and Income From Flow-Through Entities Line 17, form 1040, and Schedule E119 Questions

Exam 9: Tax Credits Form 1040, lines 46 Through 54 and Lines 66a Through 73141 Questions

Exam 10: Payroll Taxes121 Questions

Exam 11: Retirement and Other Tax-Deferred Plans and Annuities124 Questions

Exam 12: Special Property Transactions75 Questions

Exam 13: At-Riskpassive Activity Loss Rules and the Individual Alternative Minimum Tax73 Questions

Exam 14: Partnership Taxation74 Questions

Exam 15: Corporate Taxation127 Questions

Select questions type

Jake purchased a $300,000 earthmover for his business.He sold the earthmover for $245,000 after taking $210,000 of depreciation.What is the nature and amount of the gain or loss on the sale?

(Multiple Choice)

5.0/5  (31)

(31)

Sammy sells a piece of specialized equipment with a high resale value)used in his business for $41,650 on September 10,2016.The equipment was purchased on May 20,2013 for $32,000.Sammy has taken $9,200 of depreciation on the equipment.What are the amount and classification of the gain on the sale by Sammy?

(Multiple Choice)

4.9/5  (34)

(34)

Unused capital losses in any one year carry forward indefinitely to offset any future short-term or long-term gains.

(True/False)

4.8/5  (31)

(31)

The basis of inherited property to the beneficiary is the FMV at the date of death or alternate valuation date.

(True/False)

4.8/5  (40)

(40)

The holding period of an asset starts on the date acquired and ends on the day the asset is sold.

(True/False)

4.9/5  (35)

(35)

If Section 1231 losses exceed Section 1231 gains,the excess is treated as an ordinary loss.

(True/False)

4.7/5  (38)

(38)

Anike received property as part of an inheritance from her father who passed away on March 10,2016.Her father purchased the property on July 3,2015,for $156,000.Anike sold the property on June 30,2016,for $168,000.At the date of his death the property had a FMV of $154,000.What gain,if any,will Anike pick up on her return for 2016?

(Multiple Choice)

4.9/5  (37)

(37)

Yolanda,a single taxpayer,has W-2 income of $87,500.She also has a short-term capital loss of $7,000,a short-term capital gain of $1,000,and a long-term capital gain of $2,000.What is Yolanda's AGI for 2016?

(Multiple Choice)

4.8/5  (41)

(41)

Juanita is a sole proprietor who has some outstanding receivables she wishes to sell.The receivables have a $16,000 FMV and a basis of $10,000.Juanita sells the receivables for $12,500.What gain or loss does Juanita recognize on the sale?

(Multiple Choice)

4.8/5  (35)

(35)

Joe received a parcel of land as a gift from his sister,Lisa,in 2011.At the time of the gift,the land had a FMV of $20,000.Lisa purchased the land in 2007 for $23,000.If Joe sells the land in 2016 for $32,450,he will report a

(Multiple Choice)

4.9/5  (44)

(44)

The basis of property transferred to a taxpayer from a spouse or former spouse incident to a divorce is the FMV of the property at the date the divorce was final.

(True/False)

4.9/5  (35)

(35)

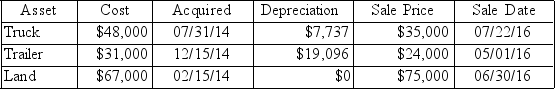

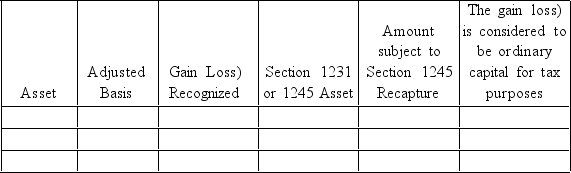

Jim,the owner of a sole proprietorship,sold the following assets in 2016:

Complete the following table: and the character of the realized and recognized gain or loss from the sale of each asset.Assume the land was held for investment and had a FMV of $73,000.

Complete the following table: and the character of the realized and recognized gain or loss from the sale of each asset.Assume the land was held for investment and had a FMV of $73,000.

(Essay)

4.8/5  (39)

(39)

The holding period for property acquired by inheritance begins on the date of the decedent's death.

(True/False)

4.8/5  (41)

(41)

Wyatt sold 300 shares of Clothes and More Inc.,in 2016 for $30,000.Wyatt's investment portfolio includes the following purchases of Clothes and More Inc.,stock: 2008 100 shares @ 80 per share

2009 75 shares @ 75 per share

2010 125 shares @ 67 per share

2011 100 shares @ 85 per share

Assuming Wyatt does not identify which shares he sold,he will recognize aan)

(Multiple Choice)

4.9/5  (40)

(40)

If a taxpayer has a net Section 1231 loss for the year,all Section 1231 gains and losses are treated as being capital gains and losses.

(True/False)

4.9/5  (36)

(36)

What is the basis of artistic works that have been gifted to another by the creator?

(Multiple Choice)

4.7/5  (29)

(29)

If the property's fair market value at the date of the gift is lower than the adjusted basis,then the property's basis for determining loss is its fair market value on that date.

(True/False)

4.8/5  (46)

(46)

Showing 101 - 118 of 118

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)