Exam 19: Capital Investment

Exam 1: Introduction to Cost Management157 Questions

Exam 2: Basic Cost Management Concepts201 Questions

Exam 3: Cost Behavior200 Questions

Exam 4: Activity-Based Costing201 Questions

Exam 5: Product and Service Costing: Job-Order System150 Questions

Exam 6: Process Costing188 Questions

Exam 7: Allocating Costs of Support Departments and Joint Products173 Questions

Exam 8: Budgeting for Planning and Control Key200 Questions

Exam 9: Standard Costing: a Functional-Based Control Approach123 Questions

Exam 10: Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer Pricing139 Questions

Exam 11: Strategic Cost Management151 Questions

Exam 12: Activity-Based Management146 Questions

Exam 13: The Balanced Scorecard: Strategic-Based Control124 Questions

Exam 14: Quality and Environmental Cost Management202 Questions

Exam 15: Lean Accounting and Productivity Measurement172 Questions

Exam 16: Cost-Volume-Profit Analysis138 Questions

Exam 17: Activity Resource Usage Model and Tactical Decision Making128 Questions

Exam 18: Pricing and Profitability Analysis164 Questions

Exam 19: Capital Investment126 Questions

Exam 20: Inventory Management: Economic Order Quantity, Jit, and the Theory of Constraints127 Questions

Select questions type

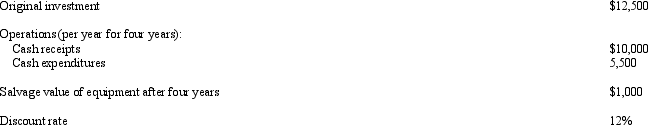

Somozas Manufacturing Company is considering the following investment proposal:  The firm uses the straight-line method of depreciation with no mid-year convention.

What is the net present value for the investment, assuming no taxes are paid?

The firm uses the straight-line method of depreciation with no mid-year convention.

What is the net present value for the investment, assuming no taxes are paid?

Free

(Multiple Choice)

4.9/5  (30)

(30)

Correct Answer:

D

Laramie Corporation is considering an investment in equipment for $20,000. Laramie uses the straight-line method of depreciation with no mid-year convention. In addition, its tax rate is 40 percent, and the life of the equipment is five years with no salvage value. The expected income before depreciation and taxes is projected to be $10,000 per year. The cost of capital is 20 percent. What is the net present value of the investment?

Free

(Multiple Choice)

4.9/5  (43)

(43)

Correct Answer:

B

Accelerated methods of __________ are preferred because of the tax benefits created.

Free

(Short Answer)

4.8/5  (38)

(38)

Correct Answer:

Depreciation

A capital investment project requires an investment of $450,000. It has an expected life of six years with an annual cash flow of $90,000 received at the end of each year. The company uses the straight-line method of depreciation with no mid-year convention. Ignore income taxes.

Required:

(Essay)

4.9/5  (26)

(26)

Ursula Company is considering the purchase of a new machine for $160,000. The machine would generate an annual cash flow before depreciation and taxes of $62,588 for four years. At the end of four years, the machine would have no salvage value. The company's cost of capital is 12 percent. The company uses straight-line depreciation with no mid-year convention and has a 40 percent tax rate. What is the internal rate of return for the machine rounded to the nearest percent?

(Multiple Choice)

4.8/5  (41)

(41)

Melancholy Company is considering the purchase of production equipment that costs $800,000. The equipment is expected to generate an annual cash flow of $250,000 and have a useful life of five years with no salvage value. The firm's cost of capital is 12 percent. The company uses the straight-line method of depreciation with no mid-year convention. There are no income taxes. The payback period in years for the project is

(Multiple Choice)

4.8/5  (31)

(31)

Which of the following is an example of an independent project?

(Multiple Choice)

4.8/5  (32)

(32)

Macadamia Company is considering an investment in equipment for $55,000. Chocolate uses the straight-line method of depreciation with no mid-year convention. In addition, its tax rate is 40 percent, and the life of the equipment is five years with no salvage value. The expected income before depreciation and taxes is projected to be $30,000 per year. What is the annual cash flow for Year 1?

(Multiple Choice)

4.8/5  (31)

(31)

MakeitRite Company is considering the purchase of a new machine for $80,000. The machine would generate an annual cash flow before depreciation and taxes of $28,778 for five years. At the end of five years, the machine would have no salvage value. The company's cost of capital is 12 percent. The company uses straight-line depreciation with no mid-year convention and has a 40 percent tax rate. What is the net present value for the machine?

(Multiple Choice)

4.9/5  (39)

(39)

Nondiscounting models for making capital investments explicitly consider the time value of money.

(True/False)

4.7/5  (26)

(26)

The required __________ is used to calculate the present value of future cash flows.

(Short Answer)

4.8/5  (43)

(43)

If the tax rate is 40 percent and a company has $800,000 of income, a depreciation deduction of $160,000 would result in a tax savings of

(Multiple Choice)

4.8/5  (22)

(22)

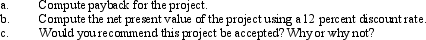

Monocle Corporation is considering an investment in equipment for $50,000. Data related to the investment is as follows:  Monocle uses the straight-line method of depreciation with no mid-year convention. In addition, its tax rate is 35 percent and the life of the equipment is four years with no salvage value. Cost of capital is 12 percent.

What is the annual cash flow for Year 1?

Monocle uses the straight-line method of depreciation with no mid-year convention. In addition, its tax rate is 35 percent and the life of the equipment is four years with no salvage value. Cost of capital is 12 percent.

What is the annual cash flow for Year 1?

(Multiple Choice)

4.8/5  (30)

(30)

Which of the following methods uses income instead of cash flows?

(Multiple Choice)

4.9/5  (30)

(30)

the two ways to compute after-tax cash flows are the income method and the composition method.

(True/False)

4.7/5  (40)

(40)

In today's markets, long-term investments in technology and pollution prevention can provide significant competitive advantages.

(True/False)

4.8/5  (33)

(33)

A corporation with taxable income of $400,000 and a 40 percent tax rate is considering the sale of an asset. The original cost of the asset is $20,000, with $12,000 of it depreciated. How much total after-tax cash will be produced from the sale of the asset for $24,000?

(Multiple Choice)

4.8/5  (27)

(27)

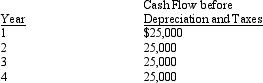

Galveston Corporation is considering an investment in equipment for $45,000. Data related to the investment are as follows:  Cost of capital is 18 percent.

Galveston uses the straight-line method of depreciation with no mid-year convention. In addition, their tax rate is 40 percent, and the life of the equipment is five years with no salvage value.

What is the net present value of the investment?

Cost of capital is 18 percent.

Galveston uses the straight-line method of depreciation with no mid-year convention. In addition, their tax rate is 40 percent, and the life of the equipment is five years with no salvage value.

What is the net present value of the investment?

(Multiple Choice)

4.8/5  (29)

(29)

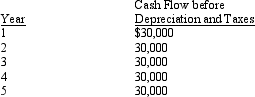

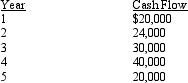

RentitAll Management Services is considering an investment of $60,000. Data related to the investment are as follows:  Cost of capital is 18 percent.

What is the payback period in years approximated to two decimal points, assuming no taxes are paid?

Cost of capital is 18 percent.

What is the payback period in years approximated to two decimal points, assuming no taxes are paid?

(Multiple Choice)

4.8/5  (39)

(39)

Showing 1 - 20 of 126

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)