Exam 22: The Budgeting Process

Exam 1: Accounting Principles and the Financial Statements170 Questions

Exam 2: Analyzing and Recording Business Transactions137 Questions

Exam 3: Adjusting the Accounts169 Questions

Exam 4: Completing the Accounting Cycle179 Questions

Exam 5: Foundations of Financial Reporting and the Classified Balance Sheet133 Questions

Exam 6: Accounting for Merchandising Operations177 Questions

Exam 7: Inventories162 Questions

Exam 8: Cash and Internal Control142 Questions

Exam 9: Receivables112 Questions

Exam 10: Long -Term Assets227 Questions

Exam 11: Current Liabilities and Fair Value Accounting180 Questions

Exam 12: Accounting for Partnerships153 Questions

Exam 13: Accounting for Corporations198 Questions

Exam 14: Long Term Liabilities206 Questions

Exam 15: The Statement of Cash Flows148 Questions

Exam 16: Financial Statement Analysis169 Questions

Exam 17: Managerial Accounting and Cost Concepts200 Questions

Exam 18: Costing Systems: Job Order Costing122 Questions

Exam 19: Costing Systems Process Costing139 Questions

Exam 20: Value-Based Systems: Activity-Based Costing and Lean Accounting146 Questions

Exam 21: Cost-Volume-Profit Analysis163 Questions

Exam 22: The Budgeting Process113 Questions

Exam 23: Flexible Budgets and Performance Analysis116 Questions

Exam 24: Standard Costing and Variance Analysis120 Questions

Exam 25: Short-Run Decision Analysis and Capital Budgeting185 Questions

Select questions type

Which of the following is prepared directly after the cash budget?

Free

(Multiple Choice)

4.9/5  (33)

(33)

Correct Answer:

C

Assume that the forecasted cost of goods sold is $800,000,budgeted selling and administrative expenses are $320,000,planned capital expenditures are $320,000,and the tax rate is 40 percent.What is the forecasted net income if 15,000 units are expected to be sold at $150 per unit?

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

A

Budgets assign resources and the responsibility to use them wisely to managers who are held accountable for their results.

Free

(True/False)

4.8/5  (35)

(35)

Correct Answer:

True

Responsibility accounting authorizes managers to take control of and be held accountable for the revenues and expenses in their budgets.

(True/False)

4.8/5  (29)

(29)

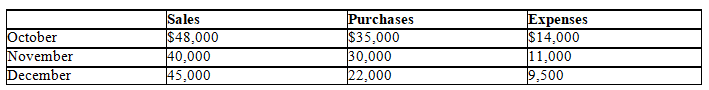

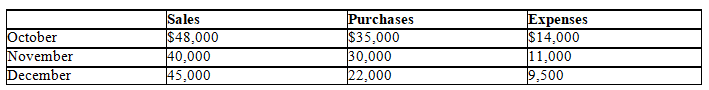

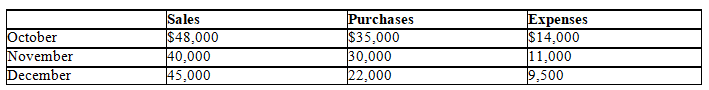

Great Lake Corporation wishes to prepare a cash budget for November 2014.Sales,purchases,and expenses for October (actual)and November and December (estimated)are as follows:  Sales: All sales are on credit,and the company's experience shows that,on an average,80 percent of sales are collected in the month of sale and the balance in the following month.A 2 percent discount is allowed on all collections in the month of sale.

Purchases: The company pays 60 percent of purchases in the month of purchase and the balance in the following month.The company is allowed an average discount of 1 percent on payments made in the month of purchase.

Expenses: The monthly expenses for November include charges for depreciation amounting to $1,000 and $100 of prepaid expenses,which will expire.All other expenses are paid as incurred.

Other: On September 1,2014,a new machine was purchased for $5,000.A down payment of $500 was made,and it was agreed that the balance would be paid in equal installments in the following three months.

-The cash receipts in November for November sales of Great Lake are expected to be

Sales: All sales are on credit,and the company's experience shows that,on an average,80 percent of sales are collected in the month of sale and the balance in the following month.A 2 percent discount is allowed on all collections in the month of sale.

Purchases: The company pays 60 percent of purchases in the month of purchase and the balance in the following month.The company is allowed an average discount of 1 percent on payments made in the month of purchase.

Expenses: The monthly expenses for November include charges for depreciation amounting to $1,000 and $100 of prepaid expenses,which will expire.All other expenses are paid as incurred.

Other: On September 1,2014,a new machine was purchased for $5,000.A down payment of $500 was made,and it was agreed that the balance would be paid in equal installments in the following three months.

-The cash receipts in November for November sales of Great Lake are expected to be

(Multiple Choice)

4.8/5  (38)

(38)

Lee Carter Inc.forecast of sales is as follows: July,$50,000;August,$80,000;September,$150,000.Sales are normally 75 percent cash and 25 percent credit.Credit sales are collected in full in the following month.Merchandise cost averages 70 percent of sales price.The company desires an inventory as of September 30 of $50,000.The inventory as of June 30 was $30,000.The accounts receivable had zero balance on June 30.

-Total purchases that must be made in order to meet sales and inventory requirements of Lee Carter for the quarter amount to

(Multiple Choice)

4.8/5  (42)

(42)

Which of the following budgets must managers prepare before they can prepare a direct materials purchases budget?

(Multiple Choice)

4.9/5  (39)

(39)

The selling and administrative expense budget is typically separated into variable and fixed cost components.

(True/False)

4.9/5  (38)

(38)

A company pays for 25 percent of its purchases by credit terms n/60,40 percent of its purchases by credit terms n/30,and the remaining 35 percent by a two-month advance payment.The sources for June's cash payments schedule for direct materials would not include which of the following?

(Multiple Choice)

4.8/5  (32)

(32)

Only the lowest levels of management can be evaluated using budgets.

(True/False)

4.8/5  (28)

(28)

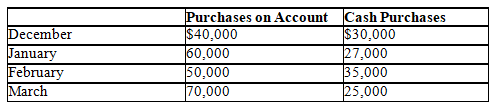

The projections of direct materials purchases that follow are for the Sombo Corporation.  The company pays for 60 percent of purchases on account in the month of purchase and 40 percent in the month following the purchase.

-What is the expected cash payment for direct materials for the month of February of Sombo?

The company pays for 60 percent of purchases on account in the month of purchase and 40 percent in the month following the purchase.

-What is the expected cash payment for direct materials for the month of February of Sombo?

(Multiple Choice)

4.8/5  (33)

(33)

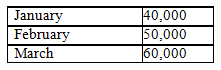

Fantastic Futons manufactures futons.The estimated number of futon sales for the first three months of 2014 are as follows:  Finished goods inventory at the end of 2013 was 10,000 units.On average,25 percent of the futons to be sold in the next month are produced and kept as ending balance in finished goods inventory.The planned selling price is $150 per unit.

-How many futons are budgeted to be produced in February by Fantastic Futons?

Finished goods inventory at the end of 2013 was 10,000 units.On average,25 percent of the futons to be sold in the next month are produced and kept as ending balance in finished goods inventory.The planned selling price is $150 per unit.

-How many futons are budgeted to be produced in February by Fantastic Futons?

(Multiple Choice)

4.9/5  (30)

(30)

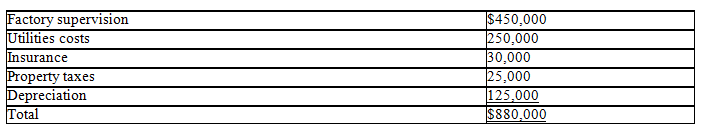

Emerald Corporation's overhead budget for 2013 was as follows:  750,000 units were produced in 2013.

Direct labor cost is $42,000,000.

For both 2013 and 2014,each unit required 4 direct labor hours at $14 per hour.

In 2014,property taxes,insurance,and depreciation are expected to stay at 2013 levels.

Utilities costs vary proportionally with units produced.

Factory supervision increases by increments of $45,000 for every 300,000 increase in direct labor hours.

The 2014 expected production is 1,200,000 units.

-What will be the value for utilities of Emerald in the 2014 overhead budget?

750,000 units were produced in 2013.

Direct labor cost is $42,000,000.

For both 2013 and 2014,each unit required 4 direct labor hours at $14 per hour.

In 2014,property taxes,insurance,and depreciation are expected to stay at 2013 levels.

Utilities costs vary proportionally with units produced.

Factory supervision increases by increments of $45,000 for every 300,000 increase in direct labor hours.

The 2014 expected production is 1,200,000 units.

-What will be the value for utilities of Emerald in the 2014 overhead budget?

(Multiple Choice)

4.9/5  (32)

(32)

Which of the following is not true of the direct materials purchases budget?

(Multiple Choice)

4.8/5  (38)

(38)

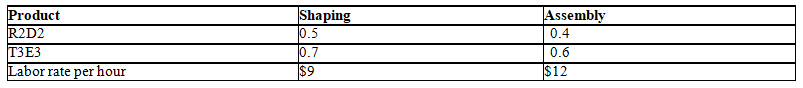

Sarusse Inc.produces two products in a single plant utilizing two departments: Shaping and Assembly.Direct labor hour and dollar requirements for 2014 are being projected using 2013 unit standard labor information.Departmental data and routing sequence information are shown below.

Management has forecasted that 20,000 units of product R2D2 and 70,000 units of product T3E3 must be produced during 2014.

Prepare a direct labor budget for 2014 that shows the budgeted direct labor cost for each department and the company as a whole.

Management has forecasted that 20,000 units of product R2D2 and 70,000 units of product T3E3 must be produced during 2014.

Prepare a direct labor budget for 2014 that shows the budgeted direct labor cost for each department and the company as a whole.

(Essay)

4.8/5  (44)

(44)

Great Lake Corporation wishes to prepare a cash budget for November 2014.Sales,purchases,and expenses for October (actual)and November and December (estimated)are as follows:  Sales: All sales are on credit,and the company's experience shows that,on an average,80 percent of sales are collected in the month of sale and the balance in the following month.A 2 percent discount is allowed on all collections in the month of sale.

Purchases: The company pays 60 percent of purchases in the month of purchase and the balance in the following month.The company is allowed an average discount of 1 percent on payments made in the month of purchase.

Expenses: The monthly expenses for November include charges for depreciation amounting to $1,000 and $100 of prepaid expenses,which will expire.All other expenses are paid as incurred.

Other: On September 1,2014,a new machine was purchased for $5,000.A down payment of $500 was made,and it was agreed that the balance would be paid in equal installments in the following three months.

-The cash receipts in November for October sales of Great Lake are expected to be

Sales: All sales are on credit,and the company's experience shows that,on an average,80 percent of sales are collected in the month of sale and the balance in the following month.A 2 percent discount is allowed on all collections in the month of sale.

Purchases: The company pays 60 percent of purchases in the month of purchase and the balance in the following month.The company is allowed an average discount of 1 percent on payments made in the month of purchase.

Expenses: The monthly expenses for November include charges for depreciation amounting to $1,000 and $100 of prepaid expenses,which will expire.All other expenses are paid as incurred.

Other: On September 1,2014,a new machine was purchased for $5,000.A down payment of $500 was made,and it was agreed that the balance would be paid in equal installments in the following three months.

-The cash receipts in November for October sales of Great Lake are expected to be

(Multiple Choice)

5.0/5  (38)

(38)

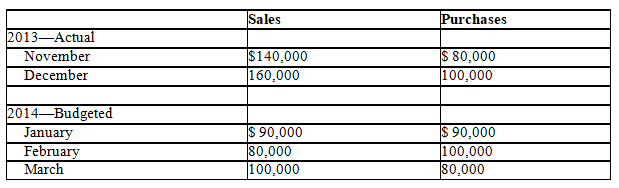

Allan International is in the construction business.In 2014,it is expected that 30 percent of a month's sales will be received in cash,with the balance being received the following month.Of the purchases,60 percent are paid the following month,30 percent are paid in two months,and the remaining 10 percent are paid during the month of purchase.

The sales force receives $2,000 a month base pay plus a 4 percent commission.Labor expenses are expected to be $6,000 a month.Other operating expenses are expected to run about $5,000 a month,including $1,000 for depreciation.

The ending cash balance for 2013 was $28,000.

Prepare a cash budget and determine the projected ending cash balances for the first three months of 2014.

Prepare a cash budget and determine the projected ending cash balances for the first three months of 2014.

(Essay)

4.8/5  (31)

(31)

Great Lake Corporation wishes to prepare a cash budget for November 2014.Sales,purchases,and expenses for October (actual)and November and December (estimated)are as follows:  Sales: All sales are on credit,and the company's experience shows that,on an average,80 percent of sales are collected in the month of sale and the balance in the following month.A 2 percent discount is allowed on all collections in the month of sale.

Purchases: The company pays 60 percent of purchases in the month of purchase and the balance in the following month.The company is allowed an average discount of 1 percent on payments made in the month of purchase.

Expenses: The monthly expenses for November include charges for depreciation amounting to $1,000 and $100 of prepaid expenses,which will expire.All other expenses are paid as incurred.

Other: On September 1,2014,a new machine was purchased for $5,000.A down payment of $500 was made,and it was agreed that the balance would be paid in equal installments in the following three months.

-The cash payments in November for purchases of Great Lake are expected to be

Sales: All sales are on credit,and the company's experience shows that,on an average,80 percent of sales are collected in the month of sale and the balance in the following month.A 2 percent discount is allowed on all collections in the month of sale.

Purchases: The company pays 60 percent of purchases in the month of purchase and the balance in the following month.The company is allowed an average discount of 1 percent on payments made in the month of purchase.

Expenses: The monthly expenses for November include charges for depreciation amounting to $1,000 and $100 of prepaid expenses,which will expire.All other expenses are paid as incurred.

Other: On September 1,2014,a new machine was purchased for $5,000.A down payment of $500 was made,and it was agreed that the balance would be paid in equal installments in the following three months.

-The cash payments in November for purchases of Great Lake are expected to be

(Multiple Choice)

4.8/5  (25)

(25)

Showing 1 - 20 of 113

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)