Exam 20: Variable Costing for Management Analysis

Exam 1: Introduction to Accounting and Business188 Questions

Exam 2: Analyzing Transactions216 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle198 Questions

Exam 5: Accounting for Merchandising Businesses220 Questions

Exam 6: Inventories170 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash178 Questions

Exam 8: Receivables148 Questions

Exam 9: Fixed Assets and Intangible Assets177 Questions

Exam 10: Current Liabilities and Payroll174 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends172 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes186 Questions

Exam 13: Investments and Fair Value Accounting133 Questions

Exam 14: Statement of Cash Flows161 Questions

Exam 15: Financial Statement Analysis184 Questions

Exam 16: Managerial Accounting Concepts and Principles175 Questions

Exam 17: Job Order Costing176 Questions

Exam 18: Process Cost Systems177 Questions

Exam 19: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 20: Variable Costing for Management Analysis154 Questions

Exam 21: Budgeting185 Questions

Exam 22: Performance Evaluation Using Variances From Standard Costs160 Questions

Exam 23: Performance Evaluation for Decentralized Operations198 Questions

Exam 24: Differential Analysis and Product Pricing161 Questions

Exam 25: Capital Investment Analysis179 Questions

Exam 26: Cost Allocation and Activity-Based Costing111 Questions

Exam 27: Cost Management for Just-In-Time Environments122 Questions

Select questions type

The factory superintendent's salary would be included as part of the cost of products manufactured under the variable costing concept.

(True/False)

4.7/5  (38)

(38)

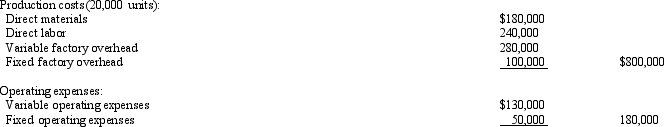

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,500 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

If 1,500 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

(Multiple Choice)

4.8/5  (34)

(34)

If variable cost of goods sold totaled $80,000 for the year (16,000 units at $5.00 each) and the planned variable cost of goods sold totaled $86,250 (15,000 units at $5.75 each), the effect of the unit cost factor on the change in variable cost of goods sold is:

(Multiple Choice)

4.9/5  (34)

(34)

In contribution margin analysis, the quantity factor is computed as the difference between actual quantity sold and the planned quantity sold, multiplied by the planned unit sales price or unit cost.

(True/False)

4.8/5  (31)

(31)

If sales totaled $800,000 for the year (80,000 units at $10.00 each) and the planned sales totaled $799,500 (78,000 units at $10.25 each), the effect of the unit price factor on the change in sales is:

(Multiple Choice)

4.8/5  (45)

(45)

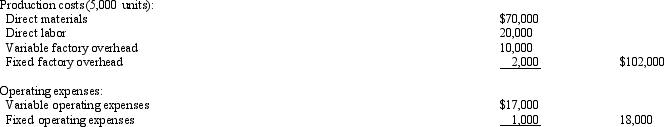

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,000 units remain unsold at the end of the month and sales total $150,000 for the month, what would be the amount of income from operations reported on the absorption costing income statement?

If 1,000 units remain unsold at the end of the month and sales total $150,000 for the month, what would be the amount of income from operations reported on the absorption costing income statement?

(Multiple Choice)

4.9/5  (39)

(39)

For a period during which the quantity of product manufactured equals the quantity sold, income from operations reported under absorption costing will equal the income from operations reported under variable costing.

(True/False)

4.8/5  (42)

(42)

Electricity purchased to operate factory machinery would be included as part of the cost of products manufactured under the absorption costing concept.

(True/False)

4.9/5  (32)

(32)

Management may use both absorption and variable costing methods for analyzing a particular product.

(True/False)

4.8/5  (33)

(33)

On the variable costing income statement, variable costs are deducted from contribution margin to yield manufacturing margin.

(True/False)

4.8/5  (37)

(37)

In the absorption costing income statement, deduction of the cost of goods sold from sales yields gross profit.

(True/False)

4.8/5  (34)

(34)

The beginning inventory is 10,000 units. All of the units manufactured during the period and 8,000 units of the beginning inventory were sold. The beginning inventory fixed costs are $50 per unit, and variable costs are $300 per unit. Determine (a) whether variable costing income from operations is less than or greater than absorption costing income from operations, and (b) the difference in variable costing and absorption income from operations.

(Essay)

4.8/5  (36)

(36)

In evaluating the performance of salespersons, the salesperson with the highest level of sales should be evaluated as the best performer.

(True/False)

4.9/5  (39)

(39)

In contribution margin analysis, the unit price or unit cost factor is computed as:

(Multiple Choice)

4.9/5  (31)

(31)

Accountants prefer the variable costing method over absorption costing method for evaluating the performance of a company because

(Multiple Choice)

5.0/5  (32)

(32)

For a period during which the quantity of inventory at the end equals the inventory at the beginning, income from operations reported under variable costing will equal income from operations reported under absorption costing.

(True/False)

4.8/5  (33)

(33)

For a period during which the quantity of product manufactured was less than the quantity sold, income from operations reported under absorption costing will be smaller than income from operations reported under variable costing.

(True/False)

5.0/5  (34)

(34)

Direct labor cost is an example of a controllable cost for the supervisor of a manufacturing department.

(True/False)

4.8/5  (41)

(41)

Under absorption costing, the cost of finished goods includes only direct materials, direct labor, and variable factory overhead.

(True/False)

5.0/5  (30)

(30)

Under which inventory costing method could increases or decreases in income from operations be misinterpreted to be the result of operating efficiencies or inefficiencies?

(Multiple Choice)

4.9/5  (42)

(42)

Showing 21 - 40 of 154

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)