Exam 1: Introduction to Accounting and Business

Exam 1: Introduction to Accounting and Business188 Questions

Exam 2: Analyzing Transactions216 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle198 Questions

Exam 5: Accounting for Merchandising Businesses220 Questions

Exam 6: Inventories170 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash178 Questions

Exam 8: Receivables148 Questions

Exam 9: Fixed Assets and Intangible Assets177 Questions

Exam 10: Current Liabilities and Payroll174 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends172 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes186 Questions

Exam 13: Investments and Fair Value Accounting133 Questions

Exam 14: Statement of Cash Flows161 Questions

Exam 15: Financial Statement Analysis184 Questions

Exam 16: Managerial Accounting Concepts and Principles175 Questions

Exam 17: Job Order Costing176 Questions

Exam 18: Process Cost Systems177 Questions

Exam 19: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 20: Variable Costing for Management Analysis154 Questions

Exam 21: Budgeting185 Questions

Exam 22: Performance Evaluation Using Variances From Standard Costs160 Questions

Exam 23: Performance Evaluation for Decentralized Operations198 Questions

Exam 24: Differential Analysis and Product Pricing161 Questions

Exam 25: Capital Investment Analysis179 Questions

Exam 26: Cost Allocation and Activity-Based Costing111 Questions

Exam 27: Cost Management for Just-In-Time Environments122 Questions

Select questions type

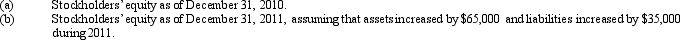

At the end of its accounting period, December 31, 2010, Miller's Arcade has assets of $450,000 and liabilities of $125,000. Using the accounting equation, determine the following amounts:

(Essay)

4.7/5  (33)

(33)

If total assets decreased by $88,000 during a period of time and stockholders' equity increased by $71,000 during the same period, then the amount and direction (increase or decrease) of the period's change in total liabilities is

(Multiple Choice)

4.8/5  (42)

(42)

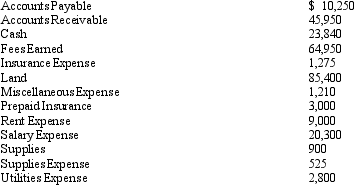

On March 1, 2014, Cook's Catering Company Capital Stock balance was $30,000 and the balance of Retained Earnings was $120,000. During March, dividends of $31,000 were declared and paid by the business. Assets, liabilities, revenues, and expenses at March 31, 2014, were as follows:

Present, in good form, (a) an income statement for March, (b) a retained earnings statement for March, and (c) a balance sheet as of March 31.

Present, in good form, (a) an income statement for March, (b) a retained earnings statement for March, and (c) a balance sheet as of March 31.

(Essay)

4.9/5  (42)

(42)

Simpson Designers began operations on April 1, 2011. The financial statements for Simpson Designers are shown below for the month ended April 30, 2011 (the first month of operations). Determine the missing amounts for letters (a) through (o).

(Essay)

4.8/5  (42)

(42)

Countries outside the United States use financial accounting standards issued by the

(Multiple Choice)

4.9/5  (45)

(45)

Given the following data: Dec. 31,2014 Dec. 31,2013 Total liabilities \ 128,250 \ 120,000 Total stockholders' equity 95,000 80,000 Compute the ratio of liabilities to stockholders' equity for each year. Round to two decimal places.

(Multiple Choice)

4.9/5  (30)

(30)

The cost concept is the basis for entering the exchange price into the accounting records.

(True/False)

4.9/5  (38)

(38)

How does the purchase of equipment by signing a note affect the accounting equation?

(Multiple Choice)

4.9/5  (34)

(34)

Bob Johnson is the sole stockholder of Johnson's Carpet Cleaning Service. Bob purchased a personal automobile for $10,000 cash plus he took loan for $20,000 in his name. Describe how this transaction is related to the business entity concept.

(Essay)

4.7/5  (38)

(38)

A business paid $7,000 to a creditor in payment of an amount owed. The effect of the transaction on the accounting equation was to

(Multiple Choice)

4.7/5  (30)

(30)

Given the following: Beginning retained earnings $ 58,000

Ending retained earnings $ 30,000

Dividends declared and paid $ 25,000

Calculate net income or net loss.

(Essay)

4.7/5  (41)

(41)

If total assets decreased by $30,000 during a specific period and stockholder's equity decreased by $35,000 during the same period, the period's change in total liabilities was an $65,000 increase.

(True/False)

4.9/5  (41)

(41)

There are four transactions that affect stockholders' equity.

(a) What are the two types of transactions that increase stockholders' equity?

(b) What are the two types of transactions that decrease stockholders' equity?

(Essay)

4.9/5  (39)

(39)

Which type of accountant typically practices as an individual or as a member of a public accounting firm?

(Multiple Choice)

4.8/5  (39)

(39)

On April 25, Gregg Repair Service extended an offer of $115,000 for land that had been priced for sale at $140,000. On May 3, Gregg Repair Service accepted the seller's counteroffer of $125,000. On June 20, the land was assessed at a value of $95,000 for property tax purposes. On August 4, Gregg Repair Service was offered $150,000 for the land by a national retail chain. At what value should the land be recorded in Gregg Repair Service's records?

(Multiple Choice)

4.8/5  (38)

(38)

Showing 81 - 100 of 188

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)