Exam 3: Process Cost Systems

Exam 2: Job Order Costing177 Questions

Exam 3: Process Cost Systems180 Questions

Exam 4: Cost Behavior and Cost-Volume-Profit Analysis217 Questions

Exam 5: Variable Costing for Management Analysis154 Questions

Exam 6: Budgeting188 Questions

Exam 7: Performance Evaluation Using Variances From Standard Costs160 Questions

Exam 8: Performance Evaluation for Decentralized Operations202 Questions

Exam 9: Differential Analysis and Product Pricing163 Questions

Exam 10: Capital Investment Analysis180 Questions

Exam 11: Cost Allocation and Activity-Based Costing110 Questions

Exam 12: Cost Management for Just-In-Time Environments122 Questions

Exam 13: Statement of Cash Flows161 Questions

Exam 14: Financial Statement Analysis193 Questions

Exam 15: Managerial Accounting Concepts and Principles175 Questions

Select questions type

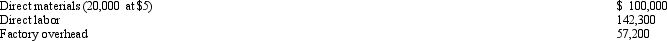

Department J had no work in process at the beginning of the period, 18,000 units were completed during the period, 2,000 units were 30% completed at the end of the period, and the following manufacturing costs were debited to the departmental work in process account during the period (Assuming the company uses FIFO and rounds average cost per unit to two decimal places):  Assuming that all direct materials are placed in process at the beginning of production, what is the total cost of the 18,000 units completed during the period?

Assuming that all direct materials are placed in process at the beginning of production, what is the total cost of the 18,000 units completed during the period?

(Multiple Choice)

4.9/5  (39)

(39)

If the costs for direct materials, direct labor, and factory overhead were $277,300, $52,600, and $61,000, respectively, for 14,000 equivalent units of production, the total conversion cost was $390,900.

(True/False)

4.7/5  (46)

(46)

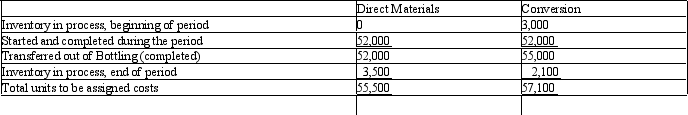

The cost per equivalent units of direct materials and conversion in the Bottling Department of Beverages on Jolt Company is $.47 and $.15, respectively. The equivalent units to be assigned costs are as follows.

(Essay)

4.8/5  (32)

(32)

One of the differences in accounting for a process costing system compared to a job order system is that the amounts used to transfer goods from one department to the next comes from the cost of production report instead of job cost cards.

(True/False)

4.7/5  (37)

(37)

All costs of the processes in a process costing system ultimately pass through the Cost of Goods Sold account.

(True/False)

4.7/5  (36)

(36)

Process manufacturing usually reflects a manufacturer that produces small quantities of unique items.

(True/False)

4.7/5  (36)

(36)

Mocha Company manufactures a single product by a continuous process, involving three production departments. The records indicate that direct materials, direct labor, and applied factory overhead for Department 1 were $100,000, $125,000, and $150,000, respectively. The records further indicate that direct materials, direct labor, and applied factory overhead for Department 2 were $55,000, $65,000, and $80,000, respectively. In addition, work in process at the beginning of the period for Department 1 totaled $75,000, and work in process at the end of the period totaled $60,000. The journal entry to record the flow of costs into Department 2 during the period for applied overhead is:

(Multiple Choice)

4.9/5  (44)

(44)

Costs are transferred, along with the units, from one work in process inventory account to the next in a process costing system.

(True/False)

4.9/5  (33)

(33)

Equivalent units of production are always the same as the total number of physical units finished during the period.

(True/False)

4.8/5  (38)

(38)

The entry to transfer goods in process from Department X to Department Y includes a debit to Work in Process-Department X.

(True/False)

4.7/5  (37)

(37)

If Department H had 600 units, 60% completed, in process at the beginning of the period, 6,000 units were completed during the period, and 700 units were 30% completed at the end of the period, what was the number of equivalent units of production for conversion costs for the period, if the first-in, first-out method is used to cost inventories?

(Multiple Choice)

4.7/5  (34)

(34)

The FIFO method separates work done on beginning inventory in the previous period from work done on it in the current period.

(True/False)

4.8/5  (40)

(40)

The cost of production report reports the cost of the goods sold.

(True/False)

4.7/5  (36)

(36)

The cost of direct materials transferred into the Bottling Department of the Mountain Springs Water Company is $28,072. The conversion cost for the period in the Bottling Department is $10,275. The total equivalent units for direct materials and conversion are 63,800 and 68,500 respectively. Determine the direct materials and conversion cost per equivalent unit.

(Essay)

4.8/5  (45)

(45)

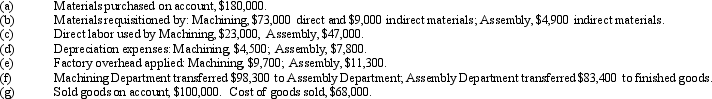

Zang Co. manufacturers its products in a continuous process involving two departments, Machining and Assembly. Present entries to record the following selected transactions related to production during June:

(Essay)

4.7/5  (31)

(31)

Which of the following is NOT a way in which process and job order cost systems are similar?

(Multiple Choice)

4.8/5  (40)

(40)

Department E had 4,000 units in Work in Process that were 40% completed at the beginning of the period at a cost of $12,500. Of the $12,500, $8,000 was for material and $4,500 was for conversion costs. 14,000 units of direct materials were added during the period at a cost of $28,700. 15,000 units were completed during the period, and 3,000 units were 75% completed at the end of the period. All materials are added at the beginning of the process. Direct labor was $32,450 and factory overhead was $18,710. If the average cost method is used the material cost per unit (to the nearest cent) would be:

(Multiple Choice)

4.7/5  (33)

(33)

In a process costing system, the cost per equivalent unit is computed before computing equivalent units.

(True/False)

4.9/5  (32)

(32)

Which of the following industries would normally use job order costing systems and which would normally use process costing systems?

(Essay)

4.9/5  (38)

(38)

In a process costing system, indirect materials are charged to Work in Process.

(True/False)

4.8/5  (30)

(30)

Showing 161 - 180 of 180

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)