Exam 11: Cost Allocation and Activity-Based Costing

Exam 2: Job Order Costing177 Questions

Exam 3: Process Cost Systems180 Questions

Exam 4: Cost Behavior and Cost-Volume-Profit Analysis217 Questions

Exam 5: Variable Costing for Management Analysis154 Questions

Exam 6: Budgeting188 Questions

Exam 7: Performance Evaluation Using Variances From Standard Costs160 Questions

Exam 8: Performance Evaluation for Decentralized Operations202 Questions

Exam 9: Differential Analysis and Product Pricing163 Questions

Exam 10: Capital Investment Analysis180 Questions

Exam 11: Cost Allocation and Activity-Based Costing110 Questions

Exam 12: Cost Management for Just-In-Time Environments122 Questions

Exam 13: Statement of Cash Flows161 Questions

Exam 14: Financial Statement Analysis193 Questions

Exam 15: Managerial Accounting Concepts and Principles175 Questions

Select questions type

When a plantwide factory overhead rate is used, overhead costs are applied to all products by a single rate.

(True/False)

4.8/5  (42)

(42)

Explain why it is imperative that proper factory overhead be allocated in factories that produce multiple products.

(Essay)

4.8/5  (31)

(31)

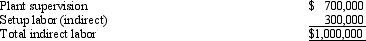

Tulip Company produces two products, T and U. The indirect labor costs include the following two items:

(Essay)

4.9/5  (42)

(42)

ABC is used to allocate selling and administrative expenses to each product based on the product's individual differences in consuming these activities.

(True/False)

4.9/5  (38)

(38)

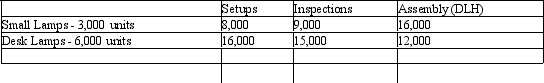

The Dawson Company manufactures small lamps and desk lamps. The following shows the activities per product and the total overhead information:

Calculate the overhead per unit to be charged to small lamps.

Calculate the overhead per unit to be charged to small lamps.

(Multiple Choice)

4.9/5  (37)

(37)

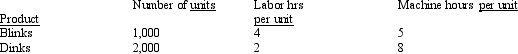

The Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

The Ramapo Company uses a single overhead rate to apply all overhead costs based on labor hours. What is the overhead cost per unit for Dinks?

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

The Ramapo Company uses a single overhead rate to apply all overhead costs based on labor hours. What is the overhead cost per unit for Dinks?

(Multiple Choice)

4.9/5  (36)

(36)

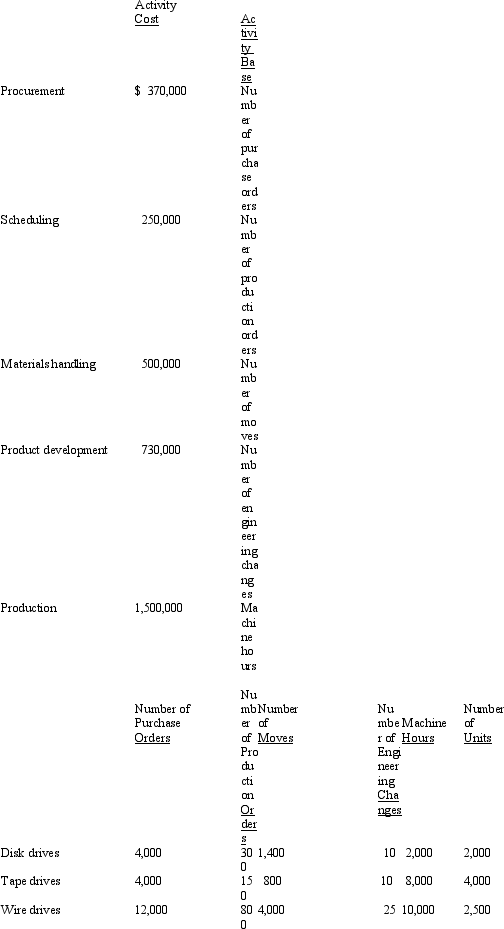

Determine the activity-based cost for each tape drive unit.

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following is a cost pool used with the activity-based costing method?

(Multiple Choice)

4.8/5  (36)

(36)

Pinacle Corp. budgeted $350,000 of overhead cost for 2012. Actual overhead costs for the year were $325,000. Pinacle's plantwide allocation base, machine hours, was budgeted at 50,000 hours. Actual machine hours were 40,000. A total of 100,000 units was budgeted to be produced and 98,000 units were actually produced. Pinacle's plantwide factory overhead rate for 2012 is:

(Multiple Choice)

4.9/5  (33)

(33)

When production departments differ significantly in their manufacturing process, it is recommended that the single plantwide factory overhead rate be used for allocating factory overhead.

(True/False)

4.9/5  (48)

(48)

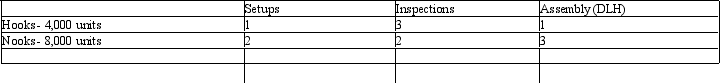

The Skagit Company manufactures Hooks and Nooks. The following shows the activities per product and total activity information:

Calculate the total factory overhead to be charged to Nooks.

Calculate the total factory overhead to be charged to Nooks.

(Multiple Choice)

4.7/5  (28)

(28)

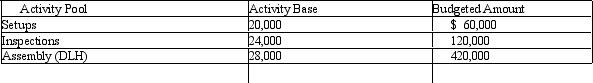

The Pikes Peak Leather Company manufactures leather handbags (H) and moccasins (M). The company has been using the factory overhead rate method but has decided to evaluate the activity based costing to allocate factory overhead. The factory overhead estimated per unit together with direct materials and direct labor will help determine selling prices.

(Essay)

4.8/5  (40)

(40)

Use of a plantwide factory overhead rate assumes that the activities causing overhead costs are different across different departments and products.

(True/False)

4.8/5  (38)

(38)

The total factory overhead for Big Light Company is budgeted for the year at $403,750. Big Light manufactures two different products - night lights and desk lamps. Night lights is budgeted for 30,000 units. Each night light requires 1/2 hour of direct labor. Desk lamps is budgeted for 40,000 units. Each desk lamp requires 2 hours of direct labor. Determine (a) the total number of budgeted direct labor hours for year, (b) the single plantwide factory overhead rate using direct labor hours as the allocation base, and (c) the factory overhead allocated per unit for each product using the single plantwide factory overhead rate calculated in (b).

(Essay)

4.8/5  (38)

(38)

The Sawtooth Leather Company manufactures leather handbags and moccasins. For simplicity reasons, they have decided to use the single plantwide factory overhead rate method to allocate factory overhead. Calculate the amount of factory overhead to be allocated to each unit using direct labor hours.

Handbags = 60,000 units, 2 hours of direct labor

Moccasins= 40,000 units, 3 hours of direct labor

Total Budgeted factory overhead cost = $360,000

(Essay)

4.9/5  (34)

(34)

Which of the following is not a factory overhead allocation method?

(Multiple Choice)

4.9/5  (39)

(39)

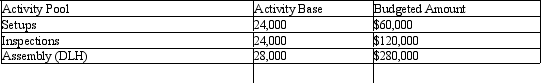

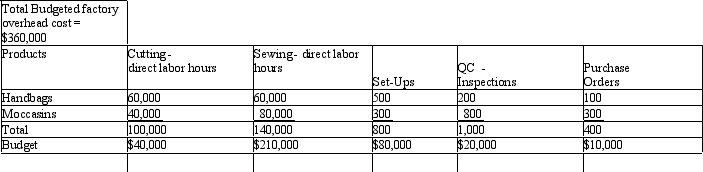

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below.  Determine the activity-based cost for each disk drive unit.

Determine the activity-based cost for each disk drive unit.

(Multiple Choice)

4.8/5  (41)

(41)

Product costing consists of only direct materials and direct labor.

(True/False)

4.8/5  (32)

(32)

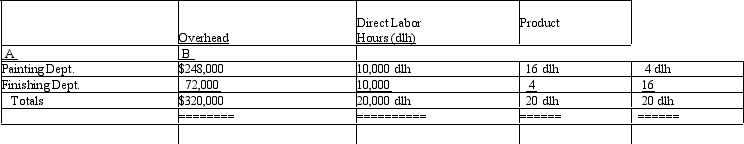

Blue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours.  Using a single plantwide rate, determine the overhead rate per unit for Product B:

Using a single plantwide rate, determine the overhead rate per unit for Product B:

(Multiple Choice)

4.8/5  (42)

(42)

Multiple production department factory overhead rates are less accurate and less costly than are plantwide factory overhead rates.

(True/False)

4.7/5  (36)

(36)

Showing 61 - 80 of 110

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)