Exam 3: Operating Decisions and the Accounting System

Exam 1: Financial Statements and Business Decisions119 Questions

Exam 2: Investing and Financing Decisions and the Accounting System100 Questions

Exam 3: Operating Decisions and the Accounting System110 Questions

Exam 4: Adjustments,financial Statements,and the Quality of Earnings127 Questions

Exam 5: Communicating and Interpreting Accounting Information108 Questions

Exam 6: Reporting and Interpreting Sales Revenue, receivables, and Cash135 Questions

Exam 7: Reporting and Interpreting Cost of Goods Sold and Inventory161 Questions

Exam 8: Reporting and Interpreting Property, plant, and Equipment; Intangibles; and Natural Resources142 Questions

Exam 9: Reporting and Interpreting Liabilities152 Questions

Exam 10: Reporting and Interpreting Bond Securities111 Questions

Exam 11: Reporting and Interpreting Stockholders Equity161 Questions

Exam 12: Statement of Cash Flows136 Questions

Exam 13: Analyzing Financial Statements124 Questions

Select questions type

A high total asset turnover signifies efficient management of assets; a low asset turnover ratio signifies less efficient management.

Free

(True/False)

4.8/5  (39)

(39)

Correct Answer:

True

For a merchandising company,the largest operating cash outflow would result from which of the following?

Free

(Multiple Choice)

4.9/5  (39)

(39)

Correct Answer:

A

Profit differs from cash flow from operations because the revenue recognition and matching processes result in the recognition of revenues and related expenses that are independent of the timing of cash receipts and payments.

Free

(True/False)

4.8/5  (25)

(25)

Correct Answer:

True

At the end of December,the owner of an apartment complex realized that the December rent had not been collected from one of the tenants.December 31 was the end of the accounting year; therefore,the owner made the appropriate adjusting entry at that time.When the December rent was collected in January of the following year,the entry made by the apartment owner should include which of the following?

(Multiple Choice)

5.0/5  (34)

(34)

An increase in expenses represents an increase in shareholders' equity.

(True/False)

4.9/5  (34)

(34)

Which of the following expenses is usually listed last on the income statement?

(Multiple Choice)

4.7/5  (41)

(41)

Losses are decreases in assets or increases in liabilities from peripheral activities.

(True/False)

4.9/5  (39)

(39)

The operating cycle is the time it takes for a company to purchase goods,pay for the goods,sell them to customers,and collect the cash from the customers.

(True/False)

4.9/5  (43)

(43)

Which of the following is not normally a condition that must be met for revenue to be recognized (recorded)under the revenue principle?

(Multiple Choice)

4.9/5  (30)

(30)

A Taco Bell restaurant would most likely have a longer operating cycle than Walmart.

(True/False)

4.9/5  (36)

(36)

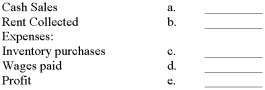

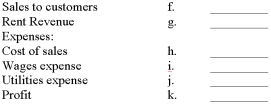

The Upton Country Store had the following transactions in April:

a.Sold $25,000 of goods to customers and received $22,000 in cash and the rest are on account

b.The cost of the inventory sold was $13,000

c.The store purchased $8,000 of inventory and paid for $4,000 in cash and the rest were bought on account

d.They paid $7,000 in wages for the month

e.Received a $600 bill for utilities for the month that will not be paid until May

f.Received rent for the adjacent store front for the months of April and May in the amount of $3,000

Complete the following statements:

Cash Basis

Income Statement

Revenues:

Accrual Basis

Income Statement

Revenues:

(Essay)

4.8/5  (38)

(38)

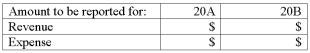

Small Company rendered services to customers amounting to $6,000 during 20A; the related cash was collected as follows: $4,000 in 20A; $2,000 in 20B.During 20A,$3,000 was incurred for wages expense; the related cash payments were made as follows: $1,200 in 20A; in 20B,$1,800.Based only on these data,provide the following amounts:

(Essay)

4.9/5  (31)

(31)

A gain causes an increase in income as a result of normal operating activities.

(True/False)

4.8/5  (27)

(27)

Shareholders' equity is increased by investments of the owners and is decreased by profit.

(True/False)

4.7/5  (34)

(34)

Which group of accounts contains only those that normally have a debit balance?

(Multiple Choice)

4.9/5  (51)

(51)

A company that ships product to its customers in January 20B but records them as revenue in December 20A has not violated the revenue principle because they were manufactured and ready for sale before the accounting year end.

(True/False)

4.9/5  (40)

(40)

If Pizza Pizza reports an asset turnover ratio of 2.34 for 2011 and their competitor Pizza Hut reports 3.79 for their 2011 ratio,it means which of the following?

(Multiple Choice)

4.9/5  (37)

(37)

Golden Company had these transactions during the accounting period: Sold merchandise for $600; its cost was $400.

Collected $400 from a trade receivable.The account was established in the previous year.

Used office supplies of $50.

Golden's profit for the period would be which of the following?

(Multiple Choice)

4.9/5  (35)

(35)

Revenues are decreases in assets or settlements of liabilities from ongoing operations.

(True/False)

4.9/5  (30)

(30)

Showing 1 - 20 of 110

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)