Exam 4: Completing the Accounting Cycle

Exam 1: Introduction to Accounting and Business191 Questions

Exam 2: Analyzing Transactions226 Questions

Exam 3: The Adjusting Process180 Questions

Exam 4: Completing the Accounting Cycle195 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses218 Questions

Exam 7: Inventories169 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash177 Questions

Exam 9: Receivables151 Questions

Exam 10: Fixed Assets and Intangible Assets172 Questions

Exam 11: Current Liabilities and Payroll171 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies192 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends171 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes188 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows165 Questions

Exam 17: Financial Statement Analysis186 Questions

Select questions type

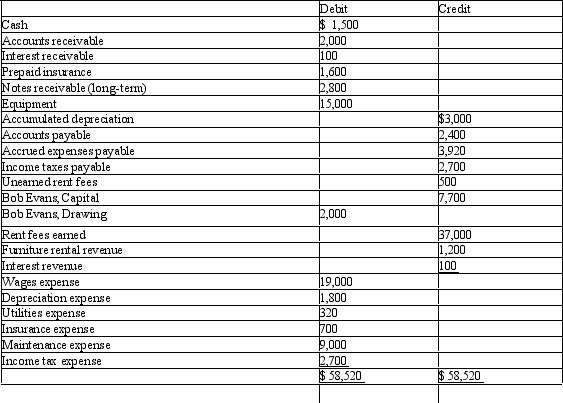

Bob Evans owns a business, Beachside Realty, that rents condominiums and furnishings. Below is the adjusted trial balance at December 31, 2010.

Prepare the entry required to close the expense accounts at the end of the period.

Prepare the entry required to close the expense accounts at the end of the period.

(Essay)

4.8/5  (42)

(42)

The income statement columns in the worksheet show that debits are equal to $55,800 and credits are $67,520. What does this information mean to the accountant?

(Multiple Choice)

4.7/5  (40)

(40)

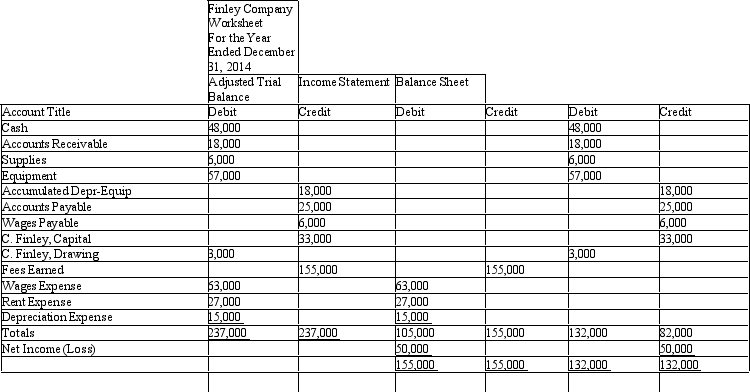

Use the following worksheet to answer the following questions.  Based on the preceding trial balance, the ending balance in C. Finley, Capital is:

Based on the preceding trial balance, the ending balance in C. Finley, Capital is:

(Multiple Choice)

4.9/5  (32)

(32)

After analyzing transactions, the next step would be to post the transactions in the ledger.

(True/False)

4.9/5  (41)

(41)

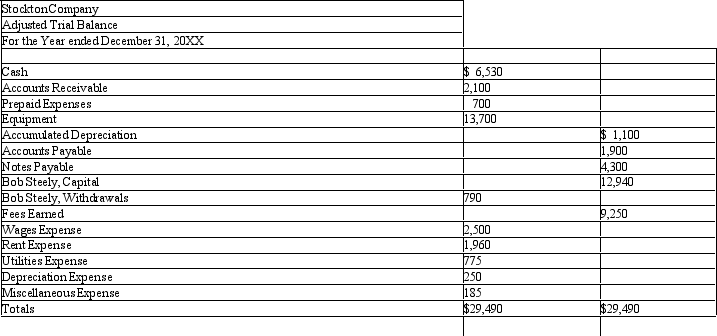

Use the following information in the adjusted trial balance for Stockton Company to answer the following questions.  Determine the total liabilities for the period.

Determine the total liabilities for the period.

(Multiple Choice)

4.9/5  (35)

(35)

Since the adjustments are entered on the work sheet, it is necessary to record them in the journal or post them to the ledger.

(True/False)

4.7/5  (43)

(43)

Which of the following accounts ordinarily appears in the post-closing trial balance?

(Multiple Choice)

4.7/5  (38)

(38)

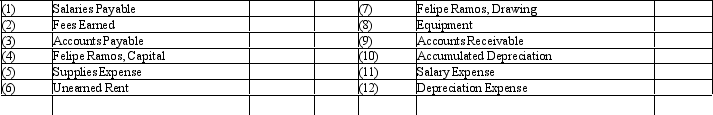

The balances for the accounts listed below appeared in the Adjusted Trial Balance columns of the work sheet. Indicate whether each balance should be extended to (a) the Income Statement columns or (b) the Balance Sheet columns.

(Essay)

4.7/5  (33)

(33)

The income statement is prepared from the adjusted trial balance or the income statement columns on the work sheet.

(True/False)

4.7/5  (35)

(35)

After all of the account balances have been extended to the Income Statement columns of the work sheet, the totals of the debit and credit columns are $77,500 and $83,900, respectively. What is the amount of the net income or net loss for the period?

(Multiple Choice)

4.8/5  (45)

(45)

The post-closing trial balance differs from the adjusted trial balance in that it

(Multiple Choice)

5.0/5  (34)

(34)

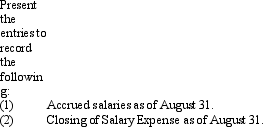

Prior to adjustment at August 31, 2014, Salary Expense has a debit balance of $298,500. Salaries owed but not paid as of the same date total $7,200.

(Essay)

4.7/5  (35)

(35)

Net income is shown on the work sheet in the Income Statement debit column and the Balance Sheet credit column.

(True/False)

4.8/5  (35)

(35)

Showing 181 - 195 of 195

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)