Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes

Exam 1: The Equity Method of Accounting for Investments119 Questions

Exam 2: Consolidation of Financial Information118 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition121 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership116 Questions

Exam 5: Consolidated Financial Statements - Intercompany Asset Transactions127 Questions

Exam 6: Intercompany Debt, Consolidated Statement of Cash Flows, and Other Issues114 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes117 Questions

Exam 8: Segment and Interim Reporting113 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk93 Questions

Exam 10: Translation of Foreign Currency Financial Statements97 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards60 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations83 Questions

Exam 14: Partnerships: Formation and Operation88 Questions

Exam 15: Partnerships: Termination and Liquidation70 Questions

Exam 16: Accounting for State and Local Governments78 Questions

Exam 17: Accounting for State and Local Governments51 Questions

Exam 18: Accounting for Not-For-Profit Organizations64 Questions

Exam 19: Accounting for Estates and Trusts80 Questions

Select questions type

What configuration of corporate ownership is described as a father-son-grandson relationship?

(Essay)

4.8/5  (31)

(31)

Woods Company has one depreciable asset valued at $800,000. Because of recent losses, the company has a net operating loss carry-forward of $150,000. The tax rate is 30%. The company was acquired for $1,000,000. It is likely the benefit will be realized. Compute the goodwill realized in consolidation.

(Multiple Choice)

4.8/5  (32)

(32)

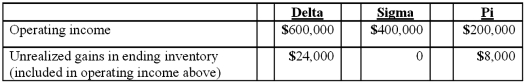

Delta Corporation owns 90 percent of Sigma Company, and Sigma owns 90 percent of Pi, Inc., all of which are domestic corporations. Information for the three companies for the year ending December 31, 2011 follows:  What is Delta's accrual-based income for 2011?

What is Delta's accrual-based income for 2011?

(Multiple Choice)

4.9/5  (41)

(41)

Which of the following statements is false concerning a father-son-grandson configuration?

(Multiple Choice)

4.8/5  (38)

(38)

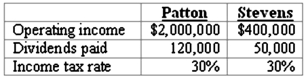

Patton's operating income excludes income from the investment in Stevens, but includes $150,000 of unrealized gains on intra-entity transfers of inventory. Patton uses the initial value method to account for the investment in Stevens.

Assume Patton owns 90 percent of the voting stock of Stevens and they each file separate income tax returns. What amount of total income tax would be paid?

Patton's operating income excludes income from the investment in Stevens, but includes $150,000 of unrealized gains on intra-entity transfers of inventory. Patton uses the initial value method to account for the investment in Stevens.

Assume Patton owns 90 percent of the voting stock of Stevens and they each file separate income tax returns. What amount of total income tax would be paid?

(Essay)

4.9/5  (34)

(34)

Britain Corporation acquires all of English, Inc. for $800,000 cash. On that date, English has net assets with fair value of $750,000 but a book value and tax basis of $500,000. The tax rate is 35 percent. Prior to this date, neither Britain nor English has reported any deferred income tax assets or liabilities. What amount of goodwill should be recognized on the date of the acquisition?

(Multiple Choice)

4.9/5  (41)

(41)

Wilkins Inc. owned 60% of Motumbo Co. During the current year, Motumbo reported net income of $280,000 but paid a total cash dividend of only $56,000.

Required:

Assuming an income tax rate of 30%, what amount of Deferred Income Tax Liability arising this year must be recognized in the consolidated balance sheet?

(Essay)

4.8/5  (35)

(35)

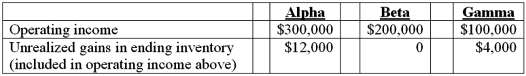

Alpha Corporation owns 100 percent of Beta Company, and Beta owns 80 percent of Gamma, Inc., all of which are domestic corporations. Information for the three companies for the year ending December 31, 2011 follows:  What is the total non-controlling interest in the subsidiaries' income for 2011?

What is the total non-controlling interest in the subsidiaries' income for 2011?

(Multiple Choice)

4.8/5  (34)

(34)

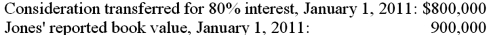

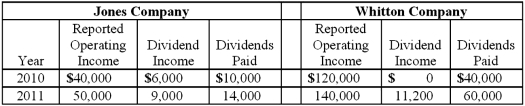

On January 1, 2010, Jones Company bought 15% of Whitton Company. Jones paid $150,000 for these shares, an amount that exactly equaled the proportionate book value of Whitton. On January 1, 2011, Whitton acquired 80% ownership of Jones. The following data are available concerning Whitton's acquisition of Jones:  Excess fair value over book value (assigned to trademarks) is amortized over 20 years. The initial value method is used by both companies.

The following information is available regarding Jones and Whitton:

Excess fair value over book value (assigned to trademarks) is amortized over 20 years. The initial value method is used by both companies.

The following information is available regarding Jones and Whitton:  Compute the non-controlling interest in net income for 2011.

Compute the non-controlling interest in net income for 2011.

(Multiple Choice)

4.8/5  (47)

(47)

In a father-son-grandson combination, which of the following statements is true?

(Multiple Choice)

4.8/5  (42)

(42)

T Corp. owns several subsidiaries that are eligible for inclusion on a consolidated income tax return, but T Corp. decided that each company in the group will file a separate return. Under what conditions would there be minimal advantage in filing a consolidated income tax return?

(Essay)

4.8/5  (30)

(30)

Jull Corp. owned 80% of Solaver Co. Solaver paid $250,000 for 10% of Jull's common stock. In 2011, Jull and Solaver reported operating income (not including income from the investment) of $300,000 and $80,000, respectively. Jull and Solaver paid dividends of $120,000 and $50,000, respectively.

Required:

Under the treasury stock approach, what is Jull's controlling interest in Solaver Co.'s net income?

(Essay)

4.7/5  (32)

(32)

When indirect control is present, which of the following statements is true?

(Multiple Choice)

4.9/5  (26)

(26)

Dog Corporation acquires all of Cat, Inc. for $400,000 cash. On that date, Cat has net assets with fair value of $350,000 but a book value and tax basis of $325,000. The tax rate is 30 percent. Prior to this date, neither Dog nor Cat has reported any deferred income tax assets or liabilities. What amount of goodwill should be recognized on the date of the acquisition?

(Multiple Choice)

4.8/5  (34)

(34)

Gamma Co. owns 80% of Delta Corp., and Delta Corp. owns 15% of Gamma Co. The two companies use the treasury stock approach to account for mutual ownership. How should Delta Corp.'s ownership interest in Gamma Co. be accounted for in the consolidation?

(Essay)

4.9/5  (42)

(42)

Which of the following statements is true regarding mutual ownership between a parent and its subsidiary?

(Multiple Choice)

4.7/5  (35)

(35)

Reggie, Inc. owns 70 percent of Nancy Corporation. During the current year, Nancy reported earnings before tax of $100,000 and paid a dividend of $30,000. The income tax rate for both companies is 30 percent. What deferred income tax liability arising in the current year must be recognized in the consolidated balance sheet?

(Multiple Choice)

4.9/5  (26)

(26)

Showing 21 - 40 of 117

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)