Exam 3: The Adjusting Process

Exam 1: Introduction to Accounting and Business185 Questions

Exam 2: Analyzing Transactions212 Questions

Exam 3: The Adjusting Process169 Questions

Exam 4: Completing the Accounting Cycle193 Questions

Exam 5: Accounting for Merchandising Businesses219 Questions

Exam 6: Inventories163 Questions

Exam 7: Sarbanes-Oxley, internal Control, and Cash175 Questions

Exam 8: Receivables145 Questions

Exam 9: Fixed Assets and Intangible Assets174 Questions

Exam 10: Current Liabilities and Payroll171 Questions

Exam 11: Corporations: Organization, stock Transactions, and Dividends169 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes183 Questions

Exam 13: Investments and Fair Value Accounting127 Questions

Exam 14: Statement of Cash Flows160 Questions

Exam 15: Financial Statement Analysis183 Questions

Select questions type

Under accrual accounting,revenues and expenses should be recorded in the same period to which they relate.

(True/False)

4.8/5  (35)

(35)

A company pays $360 for a yearly trade magazine on August 1.The adjusting entry on December 31 is debit Unearned Subscription Revenue,$150 and credit Subscription Revenue,$150.

(True/False)

4.8/5  (31)

(31)

A company realizes that the last two day's revenue for the month was billed but not recorded.The adjusting entry on December 31 is debit Accounts Receivable and credit Fees Earned.

(True/False)

4.8/5  (26)

(26)

The supplies account has a balance of $2,100 at the beginning of the year and was debited during the year for $2,300,representing the total of supplies purchased during the year.If $400 of supplies are on hand at the end of the year,the supplies expense to be reported on the income statement for the year is

(Multiple Choice)

4.7/5  (33)

(33)

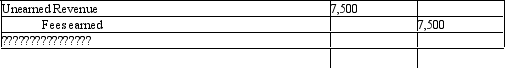

The following adjusting journal entry does not include an explanation.Select the best explanation for the entry.

(Multiple Choice)

4.8/5  (48)

(48)

Prepaid advertising,representing payment for the next quarter,would be reported on the balance sheet as a(n)

(Multiple Choice)

4.8/5  (45)

(45)

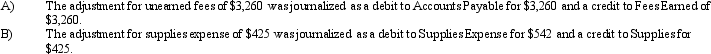

For each of the following errors,considered individually,indicate whether the error would cause the adjusted trial balance totals to be unequal.If the error would cause the adjusted trial balance totals to be unequal,indicate whether the debit or credit total is higher and by how much.

(Essay)

4.8/5  (34)

(34)

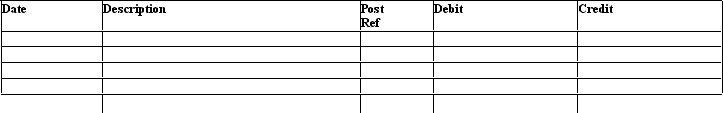

Requirement: Make the journal entries for both of the following:

(a)On December 1,$18,000 was received for a service contract to be performed from December 1 through until April 30.

(b)If the service work for this contract is performed evenly and on a regular basis throughout this period,prepare the adjusting journal entry as of year-end,December 31.

(Essay)

4.8/5  (33)

(33)

If the debit portion of an adjusting entry is to an asset account,then the credit portion must be to a liability account.

(True/False)

4.8/5  (40)

(40)

The cash basis of accounting records revenues and expenses when the cash is exchanged while the accrual basis of accounting

(Multiple Choice)

4.8/5  (31)

(31)

The type of account and normal balance of Accumulated Depreciation is

(Multiple Choice)

4.9/5  (40)

(40)

Generally accepted accounting principles require the accrual basis of accounting.

(True/False)

4.9/5  (27)

(27)

On January 1st,Power House Co.prepays the year's rent,$10,140 to its landlord.Prepare the journal entry by recording the prepayment to an asset account.

(Essay)

4.9/5  (38)

(38)

The general term employed to indicate an expense that has not been paid and has not yet been recognized in the accounts by a routine entry is

(Multiple Choice)

4.8/5  (35)

(35)

The net income reported on the income statement is $58,000.However,adjusting entries have not been made at the end of the period for supplies expense of $2,200 and accrued salaries of $1,300.Net income,as corrected,is

(Multiple Choice)

4.8/5  (40)

(40)

The difference between deferred revenue and accrued revenue is that accrued revenue has been recorded and needs adjusting and deferred revenue has never been recorded.

(True/False)

4.9/5  (36)

(36)

A business pays bi-weekly salaries of $20,000 every other Friday for a ten-day period ending on that day.The last pay day of December is Friday,December 27.Assuming the next pay period begins on Monday,December 30,journalize the adjusting entry necessary at the end of the fiscal period (December 31).

(Essay)

4.7/5  (38)

(38)

Showing 81 - 100 of 169

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)