Exam 7: Differential Cost Analysis for Operating Decisions

Exam 1: Fundamental Concepts114 Questions

Exam 2: Measuring Product Costs125 Questions

Exam 3: Activity-Based Management139 Questions

Exam 4: Strategic Management of Costs,quality,and Time146 Questions

Exam 5: Cost Drivers and Cost Behavior114 Questions

Exam 6: Financial Modeling for Short-Term Decision Making120 Questions

Exam 7: Differential Cost Analysis for Operating Decisions186 Questions

Exam 8: Capital Expenditure Decisions126 Questions

Exam 9: Profit Planning and Budgeting126 Questions

Exam 10: Profit and Cost Center Performance Evaluation100 Questions

Exam 11: Investment Center Performance Evaluation126 Questions

Exam 12: Incentive Issues123 Questions

Exam 13: Allocating Costs to Responsibility Centers93 Questions

Select questions type

Julianna LLC is facing a make-or-buy decision and must decide whether to meet its needs internally or to acquire goods or services from external sources.Julianna LLC adopted an activity-based costing system and found that its overhead costs were more than 50 percent of total product costs and the managers wanted to identify the activities that drove overhead costs.Based on the cost of activities,the management decided to outsource many of the activities that drove overhead costs.The expected result of this action would be that

Overhead costs cost of goods purchased from suppliers

(Multiple Choice)

4.8/5  (33)

(33)

Customer costs generally fall under several categories,including

(Multiple Choice)

4.7/5  (39)

(39)

When producing joint products,what are the relevant costs for a decision to sell or process further?

(Multiple Choice)

5.0/5  (30)

(30)

In the short run,__________ limitations require choices among alternatives.

(Multiple Choice)

4.7/5  (32)

(32)

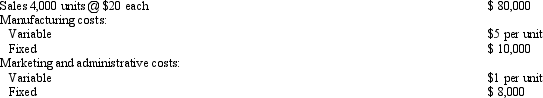

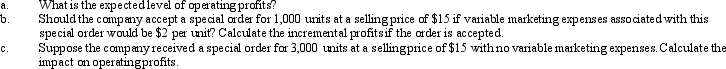

The Star Company has the capacity to produce 5,000 units per year.Its predicted operations for the year are:

REQUIRED:

REQUIRED:

(Essay)

4.9/5  (37)

(37)

Short-run decisions include pricing for which of the following?

(Multiple Choice)

4.8/5  (42)

(42)

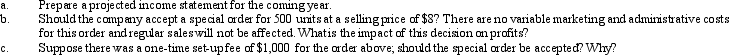

M Corporation makes automobile engines.The company's records show the following costs to

Manufacture part #308FD:

Another manufacturer has offered to supply M Corporation with part #308FD for a cost of $50 per unit.M Corporation uses 1,000 units annually.If M Corporation accepts the offer,what will be the short-run impact on operating income?

Another manufacturer has offered to supply M Corporation with part #308FD for a cost of $50 per unit.M Corporation uses 1,000 units annually.If M Corporation accepts the offer,what will be the short-run impact on operating income?

(Multiple Choice)

4.8/5  (42)

(42)

In estimating order costs and carrying costs,only __________ costs matter.

(Multiple Choice)

4.9/5  (31)

(31)

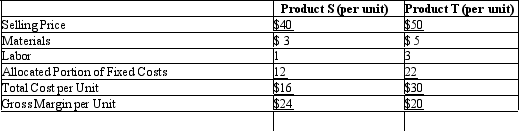

Product mix decision.The Gulf Shores Company has one machine on which it can produce either of two products,S or T.Sales demand for both products is such that the machine could operate at full capacity on either of the products,and Gulf Shores can sell all output at current prices.Product S requires one hour of machine time per unit of output and Product T requires two hours of machine time per unit of output.The following information summarizes the per-unit cash inflows and costs of Products S and T.

Selling costs are the same whether Gulf Shores produces Product S or T,or both;you may ignore them.

Required:

Should Gulf Shores Company plan to produce Product S,Product T,or some mixture of both? Why?

(Gulf Shores Company;product mix decision. )

Selling costs are the same whether Gulf Shores produces Product S or T,or both;you may ignore them.

Required:

Should Gulf Shores Company plan to produce Product S,Product T,or some mixture of both? Why?

(Gulf Shores Company;product mix decision. )

(Essay)

4.9/5  (39)

(39)

Which of the following represent the three major influences on pricing decisions?

(Multiple Choice)

4.8/5  (35)

(35)

External financial reporting requires which costing method?

(Multiple Choice)

4.8/5  (44)

(44)

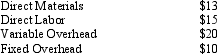

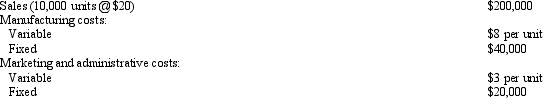

Grizzly Company

Grizzly Company manufactures footballs.The forecasted income statement for the year before any special orders is as follows:

Refer to Grizzly Company.By what amount would operating income of Grizzly be increased or decreased as a result of accepting the special order?

Refer to Grizzly Company.By what amount would operating income of Grizzly be increased or decreased as a result of accepting the special order?

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following describes just-in-time inventory methods?

(Multiple Choice)

4.7/5  (45)

(45)

Which statement is true with regards to differential pricing?

(Multiple Choice)

4.9/5  (47)

(47)

Which of the following cost allocation methods would be used to determine the lowest price that could be quoted for a special order that would utilize idle capacity within a production area?

(Multiple Choice)

4.9/5  (41)

(41)

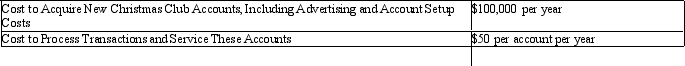

Customer profitability analysis.TMBank's management is evaluating the profitability of providing special Christmas Club accounts.The company's financial analysts have developed the following cost information:

On average,each account generates $75 per year in fees and interest.After inquiring whether the costs above are all differential,you learn that the $100,000 per year cost to acquire accounts includes $10,000 of advertising that TMBank would have done with or without the new accounts.The remainder of the $100,000 costs are differential.Further,you learn that $5 of the $50 to process and service accounts are general office costs allocated to these accounts,which are incurred whether or not the bank has the new accounts.The bank has an average of 3,500 new Christmas Club accounts each year.

Required:

Should TMBank continue to offer these promotional accounts?

On average,each account generates $75 per year in fees and interest.After inquiring whether the costs above are all differential,you learn that the $100,000 per year cost to acquire accounts includes $10,000 of advertising that TMBank would have done with or without the new accounts.The remainder of the $100,000 costs are differential.Further,you learn that $5 of the $50 to process and service accounts are general office costs allocated to these accounts,which are incurred whether or not the bank has the new accounts.The bank has an average of 3,500 new Christmas Club accounts each year.

Required:

Should TMBank continue to offer these promotional accounts?

(Essay)

4.8/5  (32)

(32)

Which of the following represents the performance measures used in a just-in-time system?

(Multiple Choice)

4.8/5  (33)

(33)

What costs can be justified when a firm enters into agreements for the development and production of customized products with the Federal government?

(Multiple Choice)

4.9/5  (43)

(43)

Genia Enterprises,Inc.has the capacity to produce 12,000 units per year.Expected operations for the year are

REQUIRED:

REQUIRED:

(Essay)

4.8/5  (35)

(35)

Which of the following is the term that represents the costs of processing each purchase order?

(Multiple Choice)

4.8/5  (34)

(34)

Showing 101 - 120 of 186

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)