Exam 9: Inventories: Additional Issues

Exam 1: Environment and Theoretical Structure of Financial Accounting144 Questions

Exam 2: Review of the Accounting Process124 Questions

Exam 3: The Balance Sheet and Financial Disclosures111 Questions

Exam 4: The Income Statement, comprehensive Income, and the Statement of Cash Flows103 Questions

Exam 5: Income Measurement347 Questions

Exam 6: Time Value of Money Concepts109 Questions

Exam 7: Cash and Receivables160 Questions

Exam 8: Inventories: Measurement129 Questions

Exam 9: Inventories: Additional Issues124 Questions

Exam 10: Property, plant, and Equipment and Intangible Assets: Acquisition and Disposition120 Questions

Exam 11: Property, plant, and Equipment and Intangible Assets: Utilization and Impairment133 Questions

Exam 12: Investments179 Questions

Exam 13: Current Liabilities and Contingencies116 Questions

Exam 14: Bonds and Long-Term Notes147 Questions

Exam 15: Leases143 Questions

Exam 16: Accounting for Income Taxes155 Questions

Exam 17: Pensions and Other Postretirement Benefits196 Questions

Exam 20: Accounting Changes125 Questions

Exam 21: The Statement of Cash Flows155 Questions

Select questions type

For a purchase commitment extending beyond the current fiscal year,if the market price on the purchase date declines from the previous year-end price,the purchase is recorded at the market price.

(True/False)

4.8/5  (39)

(39)

Hawkeye Auto Parts uses the average cost retail method to estimate inventories.Data for the first six months of 2016 include: beginning inventory at cost and retail were $55,000 and $100,000,net purchases at cost and retail were $785,000 and $1,300,000,and sales during the first six months totaled $800,000.The estimated inventory at June 30,2016,would be:

(Multiple Choice)

4.9/5  (36)

(36)

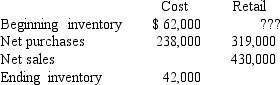

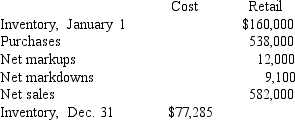

Trask Inc.uses the average cost retail method to estimate its ending inventory.Partial information at June 30,2016,is as follows:

Required:

Assuming Trask's cost-to-retail = 60%,compute Trask's beginning inventory at retail.

Required:

Assuming Trask's cost-to-retail = 60%,compute Trask's beginning inventory at retail.

(Essay)

4.7/5  (38)

(38)

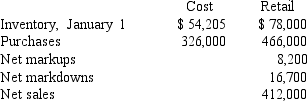

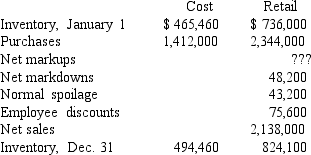

Manila Bread Company uses the average cost retail method to estimate its ending inventories.The following data has been summarized for the year 2016:

Required:

Estimate the ending inventory as of December 31,2016.

Required:

Estimate the ending inventory as of December 31,2016.

(Essay)

4.8/5  (35)

(35)

To the nearest thousand,the estimated ending inventory at cost is (round cost-to-retail ratio to whole percentage):

(Multiple Choice)

4.8/5  (37)

(37)

Under the dollar-value LIFO retail method,to determine if the increase in the value of inventory was due to an increase in quantities:

(Multiple Choice)

4.8/5  (36)

(36)

Under the retail method,the denominator in the cost-to-retail percentage does not include:

(Multiple Choice)

4.9/5  (46)

(46)

Coastal Shores Inc.(CSI)was destroyed by Hurricane Fred on August 5,2016.At January 1,CSI reported an inventory of $170,000.Sales from January 1,2016,to August 5,2016,totaled $480,000 and purchases totaled $195,000 during that time.CSI consistently marks up its products 60% over cost to arrive at a selling price.The estimated inventory loss due to Hurricane Fred would be:

(Multiple Choice)

4.8/5  (38)

(38)

Net realizable value is selling price less costs of completion,disposal,and transportation.

(True/False)

4.8/5  (30)

(30)

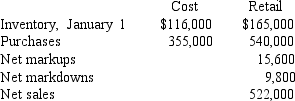

Murdock Industries uses a periodic inventory system and the LIFO retail method to estimate its ending inventories.The following data has been summarized for December 31,2016:

Required:

Estimate the LIFO cost of ending inventory.Assume stable retail prices during the period.

Required:

Estimate the LIFO cost of ending inventory.Assume stable retail prices during the period.

(Essay)

4.9/5  (47)

(47)

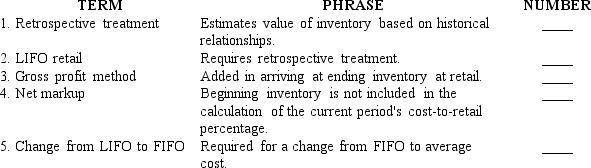

Listed below are five terms followed by a list of phrases that describe or characterize each of the terms.Match each phrase with the number for the correct term.

(Essay)

5.0/5  (38)

(38)

Ramsgate Company has used the FIFO method for inventory valuation since it began business in 2012,but has elected to change to the average cost method starting in 2015.Year-end inventory valuations under each method are shown below:  Required:

How,and when,would Ramsgate reflect the change in accounting principle in its financial statements (ignore income taxes)?

Required:

How,and when,would Ramsgate reflect the change in accounting principle in its financial statements (ignore income taxes)?

(Essay)

4.8/5  (40)

(40)

Cindy Lou Linens uses the conventional retail method to estimate its ending inventories.The company records sales net of employee discounts.The following partial data has been summarized for the year ended December 31,2016:

Required:

Compute the net markups for Cindy Lou Linens during 2016.

Required:

Compute the net markups for Cindy Lou Linens during 2016.

(Essay)

4.9/5  (41)

(41)

The numerator for the current period's cost-to-retail percentage is:

(Multiple Choice)

4.9/5  (38)

(38)

An inventory written down due to the lower of cost and net realizable value may be written back up if market value increases.

(True/False)

4.8/5  (40)

(40)

New York Sales Inc.uses the conventional retail method to estimate its ending inventories.The following data has been summarized for December 31,2016:

Required:

Compute the cost-to-retail percentage used by New York Sales Inc.

Required:

Compute the cost-to-retail percentage used by New York Sales Inc.

(Essay)

4.8/5  (32)

(32)

When changing from the average cost method to FIFO,the current year's income includes the cumulative after-tax difference that would have resulted if the company had used FIFO in all prior years.

(True/False)

4.8/5  (39)

(39)

In applying the lower of cost and net realizable value rule,the inventory of apparel would be valued at:

(Multiple Choice)

4.9/5  (35)

(35)

Showing 21 - 40 of 124

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)