Exam 6: Time Value of Money Concepts

Exam 1: Environment and Theoretical Structure of Financial Accounting144 Questions

Exam 2: Review of the Accounting Process124 Questions

Exam 3: The Balance Sheet and Financial Disclosures111 Questions

Exam 4: The Income Statement, comprehensive Income, and the Statement of Cash Flows103 Questions

Exam 5: Income Measurement347 Questions

Exam 6: Time Value of Money Concepts109 Questions

Exam 7: Cash and Receivables160 Questions

Exam 8: Inventories: Measurement129 Questions

Exam 9: Inventories: Additional Issues124 Questions

Exam 10: Property, plant, and Equipment and Intangible Assets: Acquisition and Disposition120 Questions

Exam 11: Property, plant, and Equipment and Intangible Assets: Utilization and Impairment133 Questions

Exam 12: Investments179 Questions

Exam 13: Current Liabilities and Contingencies116 Questions

Exam 14: Bonds and Long-Term Notes147 Questions

Exam 15: Leases143 Questions

Exam 16: Accounting for Income Taxes155 Questions

Exam 17: Pensions and Other Postretirement Benefits196 Questions

Exam 20: Accounting Changes125 Questions

Exam 21: The Statement of Cash Flows155 Questions

Select questions type

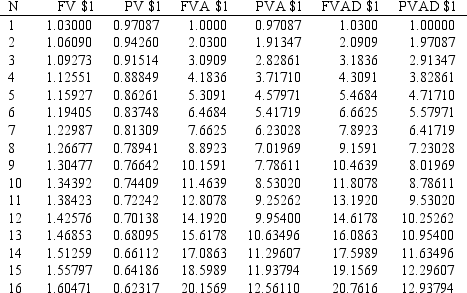

DEF Company will issue $2,000,000 in 10%,10-year bonds when the market rate of interest is 12%.Interest is paid semiannually.

Required: Determine how much cash DEF Company should realize from the bond issue.

(Essay)

4.7/5  (43)

(43)

Use the following to answer questions

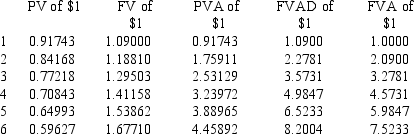

Present and future value tables of 1 at 9% are presented below.

-How much must be deposited at the beginning of each year to accumulate to $10,000 in four years if interest is at 9%?

-How much must be deposited at the beginning of each year to accumulate to $10,000 in four years if interest is at 9%?

(Multiple Choice)

4.9/5  (27)

(27)

Spielberg Inc.signed a $200,000 noninterest-bearing note due in five years from a production company eager to do business.Comparable borrowings have carried an 11% interest rate.What is the value of this debt at its inception?

(Multiple Choice)

4.9/5  (44)

(44)

Use the following to answer questions

Present and future value tables of $1 at 3% are presented below:

-On January 1,2016,you are considering making an investment that will pay three annual payments of $10,000.The first payment is not expected until December 31,2018.You are eager to earn 3%.What is the present value of the investment on January 1,2016?

-On January 1,2016,you are considering making an investment that will pay three annual payments of $10,000.The first payment is not expected until December 31,2018.You are eager to earn 3%.What is the present value of the investment on January 1,2016?

(Multiple Choice)

4.8/5  (38)

(38)

Loan A has the same original principal,interest rate,and payment amount as Loan B.However,Loan A is structured as an annuity due,while Loan B is structured as an ordinary annuity.The maturity date of Loan A will be:

(Multiple Choice)

4.8/5  (39)

(39)

George Jones is planning on a cruise for his 70th birthday party.He wants to know how much he should set aside at the beginning of each month at 6% interest to accumulate the sum of $4,800 in five years.He should use a table for the:

(Multiple Choice)

4.8/5  (32)

(32)

Use the following to answer questions

Present and future value tables of $1 at 3% are presented below:

-Micro Brewery borrows $300,000 to be paid off in three years.The loan payments are semiannual with the first payment due in six months,and interest is at 6%.What is the amount of each payment?

-Micro Brewery borrows $300,000 to be paid off in three years.The loan payments are semiannual with the first payment due in six months,and interest is at 6%.What is the amount of each payment?

(Multiple Choice)

4.8/5  (36)

(36)

Simpson Mining is obligated to restore leased land to its original condition after its excavation activities are over in three years.The cash flow possibilities and probabilities for the restoration costs in three years are as follows:  The company's credit-adjusted risk-free interest rate is 5%.The liability that Simpson must record at the beginning of the project for the restoration costs is:

The company's credit-adjusted risk-free interest rate is 5%.The liability that Simpson must record at the beginning of the project for the restoration costs is:

(Multiple Choice)

4.8/5  (36)

(36)

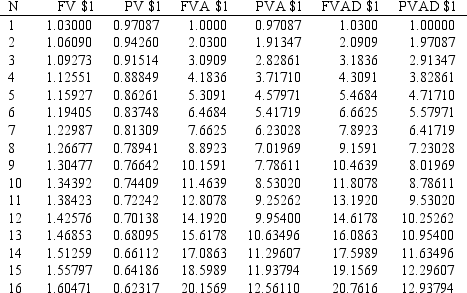

Baird Bros.Construction is considering the purchase of a machine at a cost of $125,000.The machine is expected to generate cash flows of $20,000 per year for 10 years and can be sold at the end of 10 years for $10,000.Interest is at 10%.Assume the machine purchase would be paid for on the first day of year one,but that all other cash flows occur at the end of the year.Ignore income tax considerations.

Required: Determine if Baird should purchase the machine.

(Essay)

4.8/5  (39)

(39)

Titanic Corporation leased executive limos under terms of $20,000 down and four equal annual payments of $30,000 on the anniversary date of the lease.The interest rate implicit in the lease is 11%.The first year's interest expense would be:

(Multiple Choice)

4.9/5  (32)

(32)

Use the following to answer questions

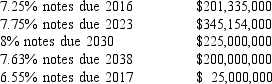

The note about debt included in the financial statements of Healdsburg Company for the year ended December 31,2015 disclosed the following:

Debt.The following table summarizes the long-term debt of the Company at December 31,2015.All of the notes were issued at their face (maturity)value.

Required: Assuming that the notes pay interest annually and mature on December 31 of the respective years,compute the following:

-Suppose that Healdsburg wants to buy back the 7.75% notes on December 31,2016, (i.e. ,five years early)when the going interest rate is 6%,thereby retiring the $345,154,000 in debt.How much would Healdsburg have to pay for the notes (principal only)?

Required: Assuming that the notes pay interest annually and mature on December 31 of the respective years,compute the following:

-Suppose that Healdsburg wants to buy back the 7.75% notes on December 31,2016, (i.e. ,five years early)when the going interest rate is 6%,thereby retiring the $345,154,000 in debt.How much would Healdsburg have to pay for the notes (principal only)?

(Essay)

4.9/5  (35)

(35)

Zulu Corporation hires a new chief executive officer and promises to pay her a signing bonus of $2 million per year for 10 years,starting five years after she joins the company.The liability for this bonus when the CEO is hired:

(Multiple Choice)

4.7/5  (50)

(50)

Price Mart is considering outsourcing its billing operations.A consultant estimates that outsourcing should result in after-tax cash savings of $9,000 the first year,$15,000 for the next two years,and $18,000 for the next two years.Interest is at 12%.Assume cash flows occur at the end of the year.

Required: Calculate the total present value of the cash flows.

(Essay)

4.8/5  (37)

(37)

Touche Manufacturing is considering a rearrangement of its manufacturing operations.A consultant estimates that the rearrangement should result in after-tax cash savings of $6,000 the first year,$10,000 for the next two years,and $12,000 for the next two years.Interest is at 12%.Assume cash flows occur at the end of the year.

Required: Calculate the total present value of the cash flows.

(Essay)

4.7/5  (46)

(46)

Other things being equal,the present value of an annuity due will be less than the present value of an ordinary annuity.

(True/False)

4.7/5  (43)

(43)

Chancellor Ltd.sells an asset with a $1 million fair value to Sophie Inc.Sophie agrees to make six equal payments,one year apart,commencing on the date of sale.The payments include principal and 6% annual interest.Compute the annual payments.

(Multiple Choice)

4.8/5  (37)

(37)

The calculation of present value eliminates interest from future cash flows.

(True/False)

4.8/5  (35)

(35)

On October 1,2016,Justine Company purchased equipment from Napa Inc.in exchange for a noninterest-bearing note payable in five equal annual payments of $500,000,beginning Oct 1,2017.Similar borrowings have carried an 11% interest rate.The equipment would be recorded at:

(Multiple Choice)

4.8/5  (39)

(39)

Showing 41 - 60 of 109

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)