Exam 2: Basic Accounting Concepts

Exam 1: The Role of Accounting in Business96 Questions

Exam 2: Basic Accounting Concepts89 Questions

Exam 3: Accrual Accounting Concepts111 Questions

Exam 4: Accounting for Merchandising Businesses138 Questions

Exam 5: Sarbanes-Oxley, Internal Control, and Cash110 Questions

Exam 6: Receivables and Inventories102 Questions

Exam 7: Fixed Assets and Intangible Assets86 Questions

Exam 8: Liabilities and Stockholders Equity131 Questions

Exam 9: Financial Statement Analysis83 Questions

Exam 10: Accounting Systems for Manufacturing Businesses120 Questions

Exam 11: Cost Behavior and Cost-Volume-Profit Analysis140 Questions

Exam 12: Differential Analysis and Product Pricing99 Questions

Exam 13: Budgeting and Standard Cost Systems168 Questions

Exam 14: Performance Evaluation for Decentralized Operations137 Questions

Exam 15: Capital Investment Analysis103 Questions

Select questions type

The accounting equation is expressed as follows: Assets = Liabilities + Stockholders' Equity.

(True/False)

4.9/5  (37)

(37)

A business receives $10,000 cash for a sale of merchandise and records this receipt of cash as an increase in accounts receivable by mistake. The accounting equation is still in balance.

(True/False)

4.8/5  (41)

(41)

Which of the following situations increase stockholders' equity?

(Multiple Choice)

4.8/5  (34)

(34)

Equality of the accounting equation means that no errors have occurred.

(True/False)

4.8/5  (28)

(28)

The accounting equation "Assets = Liabilities + Stockholders' Equity" is affected by transactions. Is it possible to have a transaction that only impacts one financial element of the equation? Can a transaction impact two elements of the equation? Give examples.

(Essay)

4.8/5  (38)

(38)

The statement of cash flows is integrated with the balance sheet because:

(Multiple Choice)

4.8/5  (33)

(33)

For EFG Co., the transaction "purchase of store equipment with a note payable" would:

(Multiple Choice)

4.8/5  (42)

(42)

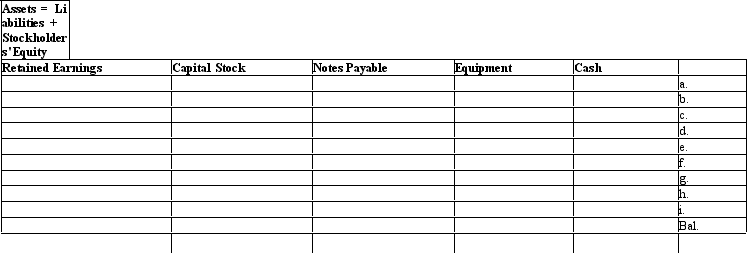

Part A

Indicate the effect of each transaction during the month of October 2013 and the balances for the accounting equation after all transactions have been recorded. No beginning balances exist in the accounts. An accounting equation has been provided.

a.Opened a business bank account for Jones, Inc., with an initial deposit of in exchange for capital stock.

b. Paid rent on the office building for the month .

c.Received cash for fees earned of .

d.Purchased equipment, .

e.Borrowed by issuing \& note payable.

f.Paid salaries for the monith, .

g.Received cash for fees earned of .

h. Paid dividends, .

i. Paid interest on the note, .  Part B

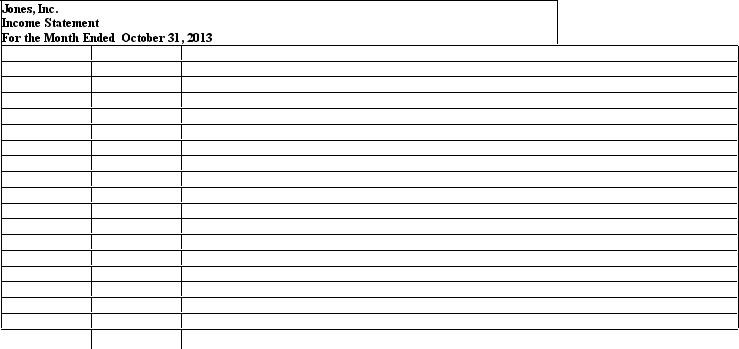

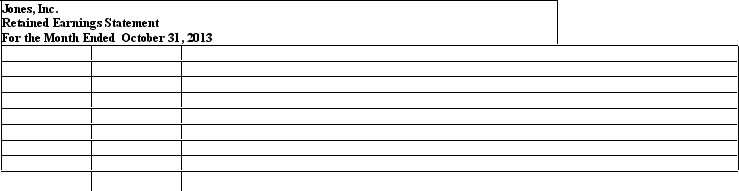

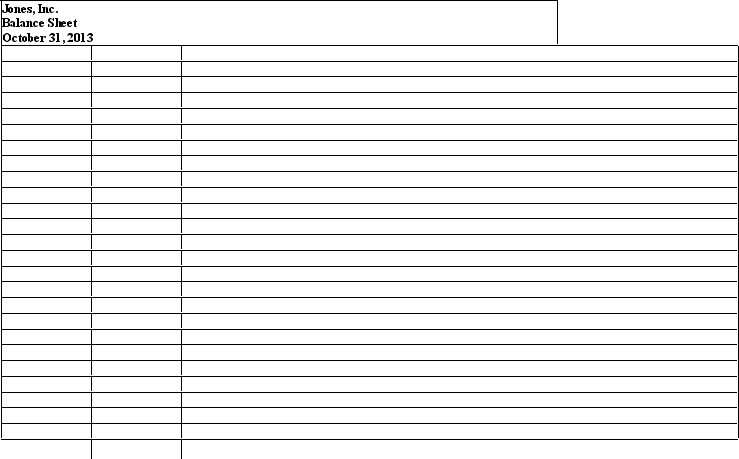

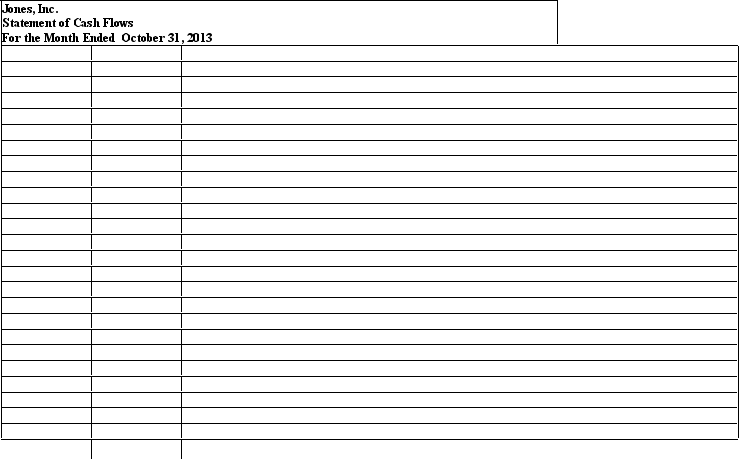

Using the information from Part A, prepare (1) an income statement, (2) a statement of retained earnings, (3) a balance sheet, and (4) a statement of cash flows for the month of October.

Part B

Using the information from Part A, prepare (1) an income statement, (2) a statement of retained earnings, (3) a balance sheet, and (4) a statement of cash flows for the month of October.

(Essay)

4.8/5  (40)

(40)

BNC Company earns revenues and as a result collects cash. Which of the following financial statement elements increased?

(Multiple Choice)

4.9/5  (39)

(39)

Exhibit 2-1 Total Liabilities Total Assets \ 60,000 \ 100,000 Beginning of the year \ 325,000 \ 500,000 End of the year

Refer to Exhibit 2-1. What is net income, assuming $50,000 of stock was issued and no dividends were paid?

(Multiple Choice)

4.9/5  (34)

(34)

It is possible for a transaction to change the makeup of assets, but to not affect assets in total.

(True/False)

4.8/5  (39)

(39)

When capital stock is issued by a corporation for cash, both the income statement and the balance sheet are affected.

(True/False)

4.9/5  (35)

(35)

Stockholders' Equity will be reduced by all of the following accounts except:

(Multiple Choice)

4.9/5  (28)

(28)

For EFG Co., the transaction "payment of interest expense" would:

(Multiple Choice)

4.9/5  (37)

(37)

Flow, Inc. received cash from fees earned. How does this transaction affect the Statement of Cash Flows?

(Multiple Choice)

4.8/5  (41)

(41)

A _____ is an economic event that under generally accepted accounting principles affects an element of the financial statements and must be recorded.

(Multiple Choice)

4.8/5  (43)

(43)

When a notes payable account is paid in cash, the stockholders' equity in the business increases.

(True/False)

4.7/5  (36)

(36)

Exhibit 2-1 Total Liabilities Total Assets \ 60,000 \ 100,000 Beginning of the year \ 325,000 \ 500,000 End of the year

Refer to Exhibit 2-1. What is net income, assuming no stock was issued and no dividends were paid?

(Multiple Choice)

4.8/5  (35)

(35)

Showing 41 - 60 of 89

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)