Exam 10: Current Liabilities and Payroll

Exam 1: Introduction to Accounting and Business194 Questions

Exam 2: Analyzing Transactions222 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle196 Questions

Exam 5: Accounting for Merchandising Businesses221 Questions

Exam 6: Inventories167 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash174 Questions

Exam 8: Receivables147 Questions

Exam 9: Fixed Assets and Intangible Assets175 Questions

Exam 10: Current Liabilities and Payroll172 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends168 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 13: Investments and Fair Value Accounting137 Questions

Exam 14: Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis184 Questions

Select questions type

For paying their payroll, most employers use payroll checks drawn on a special bank account.

Free

(True/False)

4.7/5  (38)

(38)

Correct Answer:

True

The accounting for defined benefit plans is usually very easy and straight forward.

Free

(True/False)

4.8/5  (24)

(24)

Correct Answer:

False

Which of the following would be used to compute the federal income taxes to be withheld from an employee's earnings?

(Multiple Choice)

5.0/5  (45)

(45)

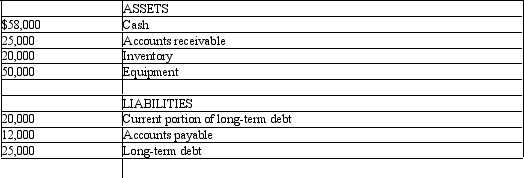

The Core Company had the following assets and liabilities as of December 31, 2012:

Calculate: Current Ratio, Working Capital and Quick Ratio

Calculate: Current Ratio, Working Capital and Quick Ratio

(Essay)

4.9/5  (32)

(32)

An employee receives an hourly rate of $15, with time and a half for all hours worked in excess of 40 during the week. Payroll data for the current week are as follows: hours worked, 46; federal income tax withheld, $120; cumulative earnings for the year prior to this week, $5,500; Social security tax rate, 6% on maximum of $100,000; and Medicare tax rate, 1.5% on all earnings; state unemployment compensation tax, 3.4% on the first $7,000; federal unemployment compensation tax, .8% on the first $7,000. Prepare the journal entries to record the salaries expense and the employer payroll tax expense.

(Essay)

4.8/5  (35)

(35)

Aqua Construction installs swimming pools. They calculate that warranty obligations are 5% of gross sales. For the year just ending Aqua's gross sales were $1,500,000. Due to previous quarter recognitions, the Warranty Liability account has a credit balance of $48,700. Determine the year's total warranty liability and journalize any necessary value to establish the year's liability at December 31st.

(Essay)

5.0/5  (42)

(42)

Elgin Company sells merchandise with a one year warranty. Sales consisted of 2,500 units in 2012 and 2,000 units in 2013. It is estimated that warranty repairs will average $10 per unit sold, and 30% of the repairs will be made in 2012 and 70% in 2013 for the 2012 sales. Similarly, 30% of repairs will be made in 2013 and 70% in 2014 for the 2013 sales. In the 2013 income statement, how much of the warranty expense shown will be due to 2012 sales?

(Multiple Choice)

4.8/5  (37)

(37)

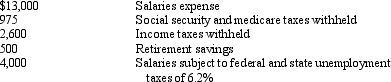

The following totals for the month of February were taken from the payroll register of Arcon Company:

How much is the total payroll expense for Arcon Company for this payroll?

Assume that the monthly salaries expense remains the same for the entire year and no employees are hired or fired during that time. Based on what you learned in Chapter 11 about payroll taxes, do you expect the total payroll expense to stay the same every month? Explain.

How much is the total payroll expense for Arcon Company for this payroll?

Assume that the monthly salaries expense remains the same for the entire year and no employees are hired or fired during that time. Based on what you learned in Chapter 11 about payroll taxes, do you expect the total payroll expense to stay the same every month? Explain.

(Essay)

4.8/5  (35)

(35)

Prior to the last weekly payroll period of the calendar year, the cumulative earnings of employees A and B are $99,350 and $91,000 respectively. Their earnings for the last completed payroll period of the year are $850 each. The amount of earnings subject to social security tax at 6% is $100,000. All earnings are subject to Medicare tax of 1.5%. Assuming that the payroll will be paid on December 29, what will be the employer's total FICA tax for this payroll period on the two salary amounts of $850 each?

(Multiple Choice)

5.0/5  (29)

(29)

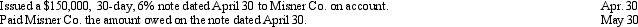

Journalize the following, assuming a 360-day year is used for interest calculations:

(Essay)

4.8/5  (42)

(42)

On July 8, Alton Co. issued an $80,000, 6%, 120-day note payable to Seller Co. Assume that the fiscal year of Alton Co. ends July 31. Using the 360-day year in your calculations, what is the amount of interest expense recognized by Alton in the current fiscal year?

(Multiple Choice)

4.9/5  (35)

(35)

Federal unemployment compensation tax becomes an employer's liability at the time the employee is paid.

(True/False)

4.9/5  (32)

(32)

Zennia Company provides its employees with varying amount of vacation per year, depending on the length of employment. The estimated amount of the current year's vacation cost is $165,000. The journal entry to record the adjusting entry required on December 31, the end of the current year, to record the current month's accrued vacation pay is

(Multiple Choice)

4.8/5  (46)

(46)

Martin Services Company provides their employees vacation benefits and a defined contribution pension plan. Employees earned vacation pay of $43,000 for the period. The pension plan requires a contribution to the plan administrator equal to 9% of employee salaries. Salaries were $600,000 during the period. Provide the journal entry for (a.) the vacation pay and (b.) the pension benefit.

(Essay)

4.8/5  (38)

(38)

Interest expense is reported in the operating expense section of the income statement.

(True/False)

4.8/5  (37)

(37)

Payroll taxes levied against employers become an employer liability at the time the employee wages are incurred.

(True/False)

4.8/5  (27)

(27)

On June 8, Alton Co. issued an $80,000, 6%, 120-day note payable to Seller Co. Assume that the fiscal year of Seller Co. ends June 30. Using the 360-day year in your calculations, what is the amount of interest revenue recognized by Seller in the following year?

(Multiple Choice)

4.9/5  (36)

(36)

Showing 1 - 20 of 172

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)