Exam 12: Profit and Changes in Retained Earnings

Exam 1: Accounting: Information for Decision Making138 Questions

Exam 2: Basic Financial Statements130 Questions

Exam 3: The Accounting Cycle: Capturing Economic Events133 Questions

Exam 4: The Accounting Cycle: Accruals and Deferrals127 Questions

Exam 5: The Accounting Cycle: Reporting Financial Results109 Questions

Exam 6: Merchandising Activities117 Questions

Exam 7: Financial Assets201 Questions

Exam 8: Inventories and the Cost of Goods Sold159 Questions

Exam 9: Property, Plant, and Equipment, Intangible Assets and Natural Resources147 Questions

Exam 10: Liabilities213 Questions

Exam 12: Profit and Changes in Retained Earnings122 Questions

Exam 13: Statement of Cash Flows174 Questions

Exam 14: Financial Statement Analysis135 Questions

Exam 15: Global Business and Accounting68 Questions

Select questions type

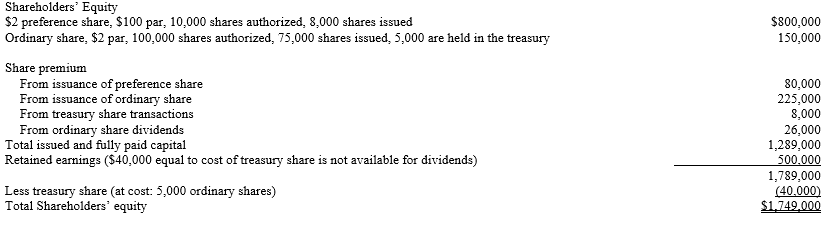

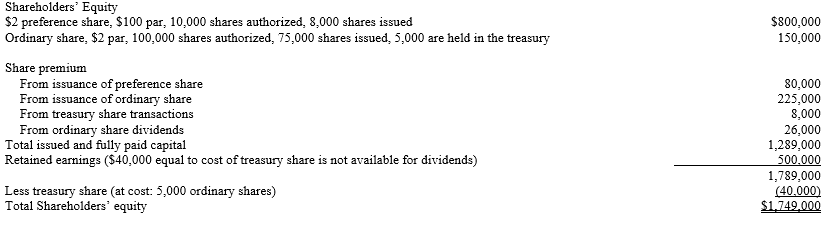

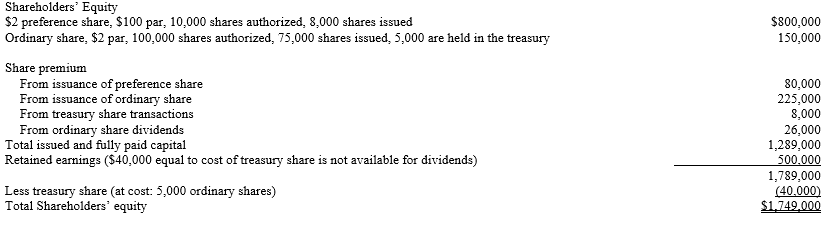

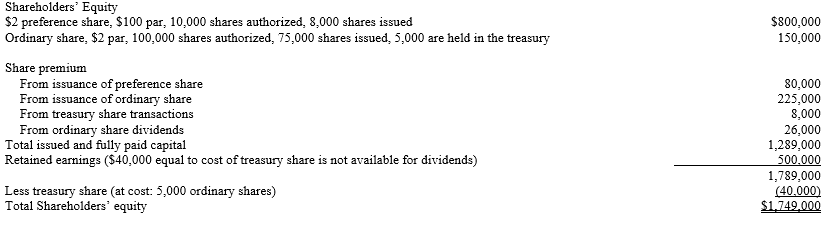

The shareholders' equity section of the balance sheet of Caesar Corporation at December 31, 2009, appears as follows: (The company engaged in no treasury share transactions prior to 2009)

-Refer to the above data. If Caesar Corporation had reacquired 7,000 shares of treasury share early in 2009, then some treasury share must have been sold during 2009 for:

-Refer to the above data. If Caesar Corporation had reacquired 7,000 shares of treasury share early in 2009, then some treasury share must have been sold during 2009 for:

(Multiple Choice)

4.7/5  (30)

(30)

General Corporation was organized on January 1 and issued 500,000 ordinary share on that date. On July 1, an additional 200,000 shares were issued for cash. Profit for the year was $5,184,000. Net earnings per share amounted to:

(Multiple Choice)

4.8/5  (28)

(28)

The shareholders' equity section of the balance sheet of Caesar Corporation at December 31, 2009, appears as follows: (The company engaged in no treasury share transactions prior to 2009)

-Refer to the above data. Assume that all remaining treasury share is reissued at a price of $14 per share in January of 2010. What amount should be credited to the account Share Premium: Treasury Share Transactions in the journal entry to record this transaction?

-Refer to the above data. Assume that all remaining treasury share is reissued at a price of $14 per share in January of 2010. What amount should be credited to the account Share Premium: Treasury Share Transactions in the journal entry to record this transaction?

(Multiple Choice)

4.9/5  (39)

(39)

A stock dividend provides a shareholder with more shares of stock but his or her percentage of ownership in the company, is no larger than before.

(True/False)

4.8/5  (30)

(30)

A company had 125,000 shares of ordinary share outstanding on January 1 and then sold 35,000 additional shares on March 30. Profit for the year was $594,750. What are earnings per share?

(Multiple Choice)

4.8/5  (32)

(32)

Comprehensive income may be presented in a separate statement of comprehensive income, or as part of an income statement.

(True/False)

4.9/5  (41)

(41)

The shareholders' equity section of the balance sheet of Caesar Corporation at December 31, 2009, appears as follows: (The company engaged in no treasury share transactions prior to 2009)

-Refer to the above data. What was the average issue price per share of preference share?

-Refer to the above data. What was the average issue price per share of preference share?

(Multiple Choice)

4.8/5  (32)

(32)

Accounting terminology

Listed below are nine technical accounting terms introduced in this chapter:

Cash dividend Price-earnings ratio Stock dividend Profit from continuing operation Share split Statement of changes in equity Earnings per share Retrospective restatement Extraordinary item

Each of the following statements may (or may not) describe one of these technical terms. In the space provided below each statement, indicate the accounting term described, or answer "None" if the statement does not correctly describe any of the terms.

(a) A financial statement showing the revenue, expenses, and net earnings of a corporation during the current accounting period.

(b) A distribution of cash to shareholders.

(c) A distribution to shareholders of additional shares, accompanied by a proportionate reduction in the par value per share.

(d) The market price of a share of preference share, divided by the profit of the corporation.

(e) A correction in the amount of profit reported in an earlier accounting period.

(f) Item no allowed to be presented under IFRS.

(g) A subtotal sometimes included in an income statement to assist investors in forecasting the profit of future accounting periods.

(Essay)

4.9/5  (35)

(35)

In order for a loss on the disposal of a discontinued operation to be classified on the income statement as a discontinued operation, it must be unusual in nature.

(True/False)

4.7/5  (42)

(42)

Retrospective restatements appear in the statement of changes in equity and in the income statement for the current year.

(True/False)

4.7/5  (34)

(34)

MRB Company purchased 1000 shares of its own outstanding $12 par value ordinary share for $16 per share and then sold 400 shares six months later for $19 a share. Prepare the journal entries for the purchase of the shares and for the sale.

(Essay)

4.8/5  (33)

(33)

A share split changes the par value of a share whereas a stock dividend does not.

(True/False)

4.8/5  (30)

(30)

The shareholders' equity section of the balance sheet of Caesar Corporation at December 31, 2009, appears as follows: (The company engaged in no treasury share transactions prior to 2009)

-Refer to the above data. A small stock dividend of 1,000 shares was declared and distributed during 2009. What was the market price per share on the date of declaration?

-Refer to the above data. A small stock dividend of 1,000 shares was declared and distributed during 2009. What was the market price per share on the date of declaration?

(Multiple Choice)

4.7/5  (40)

(40)

On January 1, 2010, Edward Corporation had 10,000 shares of $6 par value ordinary share and 10,000 shares of 8%, $100 par value convertible preference share outstanding. The preference shares carried a 3 for 1 conversion privilege. On October 1, 2010, all of the preference shares were converted to ordinary. What number of shares must Edward use in computing basic earnings per share at December 31, 2010?

(Multiple Choice)

4.8/5  (35)

(35)

Showing 41 - 60 of 122

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)