Exam 15: International Financial Reporting Standards

Exam 1: Accounting Information and Decision Making172 Questions

Exam 2: The Accounting Information System183 Questions

Exam 3: The Financial Reporting Process183 Questions

Exam 4: Cash and Internal Controls178 Questions

Exam 5: Receivables and Sales183 Questions

Exam 6: Inventory and Cost of Goods Sold189 Questions

Exam 7: Long-Term Assets155 Questions

Exam 8: Current Liabilities142 Questions

Exam 9: Long-Term Liabilities155 Questions

Exam 10: Stockholders Equity142 Questions

Exam 11: Statement of Cash Flows150 Questions

Exam 12: Financial Statement Analysis152 Questions

Exam 13: Time Value of Money75 Questions

Exam 14: Investments52 Questions

Exam 15: International Financial Reporting Standards43 Questions

Select questions type

Which of the following statements is true regarding revaluation of property, plant, and equipment to fair value?

(Multiple Choice)

4.9/5  (44)

(44)

What does it mean to revalue a long-term asset? How do U.S. GAAP and IFRS differ regarding revaluation of long-term assets?

(Essay)

4.8/5  (36)

(36)

IFRS allows, but does not require, revaluation of property, plant and equipment to fair value.

(True/False)

4.8/5  (42)

(42)

The Norwalk Agreement formalizes the commitment between the FASB and IASB to the convergence of U.S. GAAP and IFRS.

(True/False)

4.8/5  (38)

(38)

Would a company be more likely to report a contingent liability under U.S. GAAP or IFRS?

(Multiple Choice)

4.8/5  (40)

(40)

Convergence of accounting practices is expected to increase the flow of investment across borders.

(True/False)

4.9/5  (40)

(40)

Suppose a company has research costs of $100,000 and development costs of $200,000 for the year. Under IFRS, what amount would be reported as an expense in the current year's income statement?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following is not a reason why accounting differs across countries?

(Multiple Choice)

4.8/5  (35)

(35)

In common law countries (such as the U.S., the U.K., and Canada), greater emphasis is placed on public information than in code law countries (such as France and Germany).

(True/False)

4.8/5  (35)

(35)

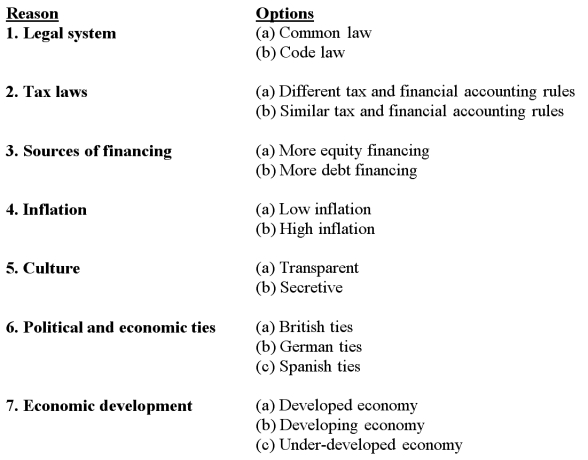

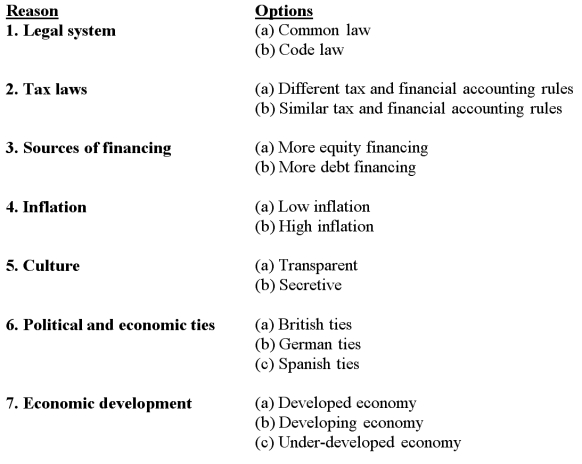

Below are seven reasons for differences in accounting practices among countries. For each reason, at least two options are provided. For each reason, select the option that best describes Germany.

(Short Answer)

4.9/5  (37)

(37)

Which inventory cost flow assumption is allowed under U.S. GAAP but not under IFRS? Explain why some U.S. companies will lobby strongly to keep this method as an allowable alternative.

(Essay)

4.7/5  (45)

(45)

Suppose a company has research costs of $100,000 and development costs of $200,000 for the year. Under U.S. GAAP, what amount would be reported as an expense in the current year's income statement?

(Multiple Choice)

4.8/5  (51)

(51)

The primary objective of the IASB is to develop accounting standards in the U.S.

(True/False)

4.9/5  (40)

(40)

Why are some U.S. companies opposed to elimination of the LIFO inventory method?

(Multiple Choice)

4.9/5  (37)

(37)

Compared to that in the U.S, the cost to companies in other countries of documenting effective internal controls is:

(Multiple Choice)

4.9/5  (40)

(40)

For countries whose tax standards are closely tied to financial reporting standards (Continental Europe and Japan), accounting earnings tend to be lower so companies can minimize tax payments.

(True/False)

4.7/5  (40)

(40)

By late 2007, over 100 jurisdictions, including China, Australia, and all of the countries in the European Union (EU), either require or permit the use of IFRS.

(True/False)

4.8/5  (41)

(41)

More economically developed economies (the U.S. and the U.K.) have a need for more complex accounting standards.

(True/False)

4.9/5  (43)

(43)

Below are seven reasons for differences in accounting practices among countries. For each reason, at least two options are provided. For each reason, select the option that best describes the United States.

(Short Answer)

4.9/5  (39)

(39)

Showing 21 - 40 of 43

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)