Exam 6: Variable Costing and Segment Reporting: Tools for Management

Exam 1: Managerial Accounting and Cost Concepts187 Questions

Exam 2: Job-Order Costing144 Questions

Exam 3: Activity-Based Costing208 Questions

Exam 4: Process Costing82 Questions

Exam 5: Cost-Volume-Profit Relationships121 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management187 Questions

Exam 7: Master Budgeting229 Questions

Exam 8: Flexible Budgets, Standard Costs, and Variance Analysis173 Questions

Exam 9: Performance Measurement in Decentralized Organizations423 Questions

Exam 10: Differential Analysis: the Key to Decision Making115 Questions

Exam 11: Capital Budgeting Decisions118 Questions

Exam 12: Statement of Cash Flows132 Questions

Exam 13: Financial Statement Analysis289 Questions

Exam 14: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System111 Questions

Exam 15: Journal Entries to Record Variances56 Questions

Exam 16: The Concept of Present Value13 Questions

Exam 17: The Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

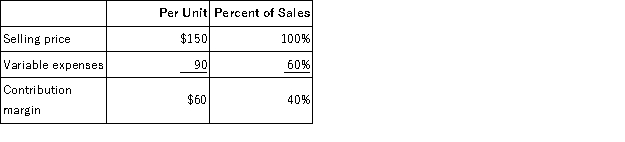

Data concerning Wythe Corporation's single product appear below:  Fixed expenses are $106,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to cut the selling price by $15 and increase the advertising budget by $5,000 per month. The marketing manager predicts that these two changes would increase monthly sales by 800 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $106,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to cut the selling price by $15 and increase the advertising budget by $5,000 per month. The marketing manager predicts that these two changes would increase monthly sales by 800 units. What should be the overall effect on the company's monthly net operating income of this change?

(Multiple Choice)

4.7/5  (33)

(33)

Alcina Corporation produces and sells a single product whose contribution margin ratio is 80%. The company's monthly fixed expense is $576,000 and the company's monthly target profit is $43,200.

Required:

Determine the dollar sales to attain the company's target profit. Show your work!

(Essay)

4.8/5  (38)

(38)

Koelsch Corporation's only product sells for $170 per unit. Its current sales are 43,600 units and its break-even sales are 39,240 units.

Required:

Compute the margin of safety in both dollars and as a percentage of sales.

(Essay)

4.8/5  (27)

(27)

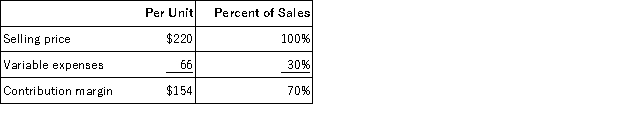

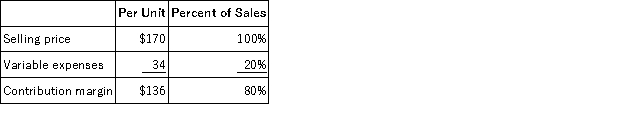

Data concerning Sumter Corporation's single product appear below:  Fixed expenses are $1,024,000 per month. The company is currently selling 8,000 units per month.

Required:

Management is considering using a new component that would increase the unit variable cost by $6. Since the new component would improve the company's product, the marketing manager predicts that monthly sales would increase by 300 units. What should be the overall effect on the company's monthly net operating income of this change if fixed expenses are unaffected? Show your work!

Fixed expenses are $1,024,000 per month. The company is currently selling 8,000 units per month.

Required:

Management is considering using a new component that would increase the unit variable cost by $6. Since the new component would improve the company's product, the marketing manager predicts that monthly sales would increase by 300 units. What should be the overall effect on the company's monthly net operating income of this change if fixed expenses are unaffected? Show your work!

(Essay)

4.9/5  (44)

(44)

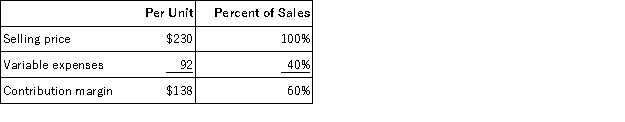

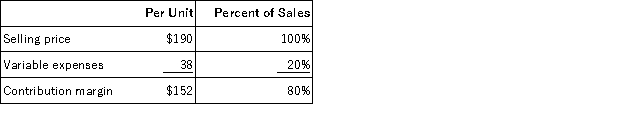

Data concerning Phung Corporation's single product appear below:  Fixed expenses are $991,000 per month. The company is currently selling 8,000 units per month.

Required:

The marketing manager believes that a $23,000 increase in the monthly advertising budget would result in a 190 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Fixed expenses are $991,000 per month. The company is currently selling 8,000 units per month.

Required:

The marketing manager believes that a $23,000 increase in the monthly advertising budget would result in a 190 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change? Show your work!

(Essay)

4.9/5  (37)

(37)

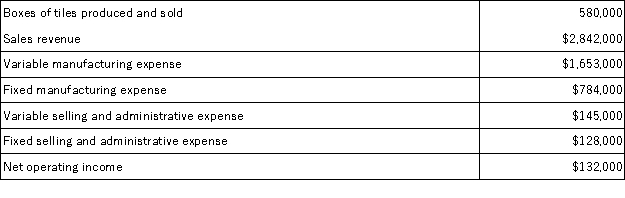

A tile manufacturer has supplied the following data:  If the company increases its unit sales volume by 5% without increasing its fixed expenses, then total net operating income should be closest to:

If the company increases its unit sales volume by 5% without increasing its fixed expenses, then total net operating income should be closest to:

(Multiple Choice)

4.8/5  (39)

(39)

At the break-even point, the total contribution margin and fixed expenses are equal.

(True/False)

5.0/5  (40)

(40)

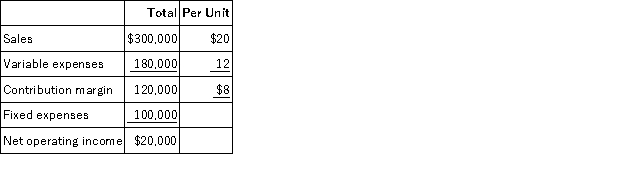

Spartan Systems reported total sales of $300,000, at a price of $20 and per unit variable expenses of $12, for the sales of their single product.  What is the amount of contribution margin if sales volume increases by 30%?

What is the amount of contribution margin if sales volume increases by 30%?

(Multiple Choice)

4.9/5  (40)

(40)

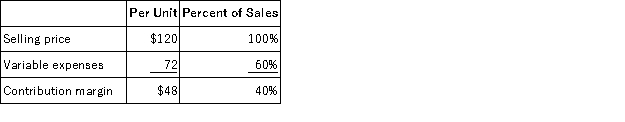

Chibu Corporation is a single product firm with the following cost formula for all of its costs for next year, where X is the number of units sold and Y is total cost: Y = $225,000 + $30X

Chibu sells its product for $120 per unit. What would Chibu's total sales dollars have to be next year in order to generate $270,000 of net operating income?

(Multiple Choice)

4.9/5  (35)

(35)

Data concerning Marchman Corporation's single product appear below:  The company is currently selling 4,000 units per month. Fixed expenses are $166,000 per month. Consider each of the following questions independently. This question is to be considered independently of all other questions relating to Marchman Corporation. Refer to the original data when answering this question.

The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $8 per unit. In exchange, the sales staff would accept a decrease in their salaries of $27,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

The company is currently selling 4,000 units per month. Fixed expenses are $166,000 per month. Consider each of the following questions independently. This question is to be considered independently of all other questions relating to Marchman Corporation. Refer to the original data when answering this question.

The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $8 per unit. In exchange, the sales staff would accept a decrease in their salaries of $27,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

(Multiple Choice)

4.8/5  (32)

(32)

Brees Inc., a company that produces and sells a single product, has provided its contribution format income statement for April.  If the company sells 5,800 units, its total contribution margin should be closest to:

If the company sells 5,800 units, its total contribution margin should be closest to:

(Multiple Choice)

4.8/5  (38)

(38)

Renfrew Corporation has provided the following data concerning its only product:  The margin of safety as a percentage of sales is closest to:

The margin of safety as a percentage of sales is closest to:

(Multiple Choice)

4.9/5  (35)

(35)

Data concerning Kuralt Corporation's single product appear below:  The break-even in monthly unit sales is closest to:

The break-even in monthly unit sales is closest to:

(Multiple Choice)

4.7/5  (37)

(37)

Arthur Corporation has a margin of safety percentage of 25% based on its actual sales. The break-even point is $300,000 and the variable expenses are 45% of sales. Given this information, the actual profit is:

(Multiple Choice)

4.9/5  (36)

(36)

Data concerning Bunck Corporation's single product appear below:  Fixed expenses are $202,000 per month. The company is currently selling 2,000 units per month. Management is considering using a new component that would increase the unit variable cost by $18. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $202,000 per month. The company is currently selling 2,000 units per month. Management is considering using a new component that would increase the unit variable cost by $18. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

(Multiple Choice)

4.9/5  (33)

(33)

Data concerning Kuralt Corporation's single product appear below:  The break-even in monthly dollar sales is closest to:

The break-even in monthly dollar sales is closest to:

(Multiple Choice)

4.9/5  (40)

(40)

If Q equals the level of output, P is the selling price per unit, V is the variable expense per unit, and F is the fixed expense, then the degree of operating leverage is equal to:

(Multiple Choice)

4.9/5  (36)

(36)

At a break-even point of 800 units sold, White Corporation's variable expenses are $8,000 and its fixed expenses are $4,000. What will the Corporation's net operating income be at a volume of 801 units?

(Multiple Choice)

5.0/5  (35)

(35)

Torbert, Inc., produces and sells a single product. The product sells for $190.00 per unit and its variable expense is $72.20 per unit. The company's monthly fixed expense is $353,400.

Required:

Determine the monthly break-even in unit sales. Show your work!

(Essay)

4.9/5  (34)

(34)

Larita Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $243,000 per month. The company is currently selling 2,000 units per month.

Required:

The marketing manager believes that a $28,000 increase in the monthly advertising budget would result in a 180 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Fixed expenses are $243,000 per month. The company is currently selling 2,000 units per month.

Required:

The marketing manager believes that a $28,000 increase in the monthly advertising budget would result in a 180 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change? Show your work!

(Essay)

4.8/5  (40)

(40)

Showing 41 - 60 of 187

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)