Exam 3: Activity-Based Costing

Exam 1: Managerial Accounting and Cost Concepts187 Questions

Exam 2: Job-Order Costing144 Questions

Exam 3: Activity-Based Costing208 Questions

Exam 4: Process Costing82 Questions

Exam 5: Cost-Volume-Profit Relationships121 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management187 Questions

Exam 7: Master Budgeting229 Questions

Exam 8: Flexible Budgets, Standard Costs, and Variance Analysis173 Questions

Exam 9: Performance Measurement in Decentralized Organizations423 Questions

Exam 10: Differential Analysis: the Key to Decision Making115 Questions

Exam 11: Capital Budgeting Decisions118 Questions

Exam 12: Statement of Cash Flows132 Questions

Exam 13: Financial Statement Analysis289 Questions

Exam 14: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System111 Questions

Exam 15: Journal Entries to Record Variances56 Questions

Exam 16: The Concept of Present Value13 Questions

Exam 17: The Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

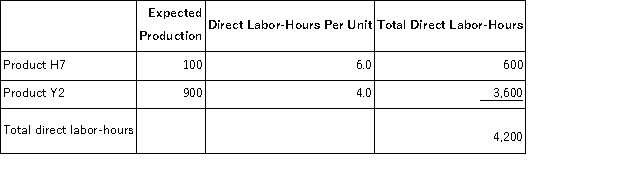

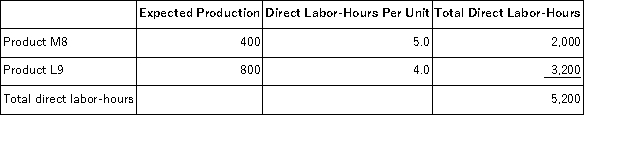

Punches, Inc., manufactures and sells two products: Product H7 and Product Y2. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $17.80 per DLH. The direct materials cost per unit for each product is given below:

The direct labor rate is $17.80 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The overhead applied to each unit of Product Y2 under activity-based costing is closest to:

The overhead applied to each unit of Product Y2 under activity-based costing is closest to:

(Multiple Choice)

4.8/5  (33)

(33)

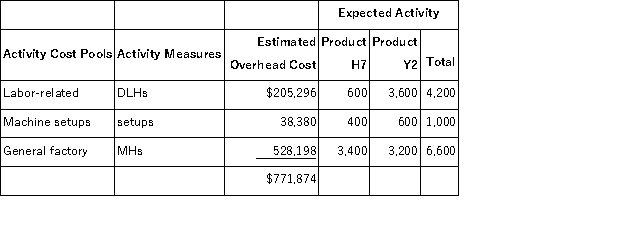

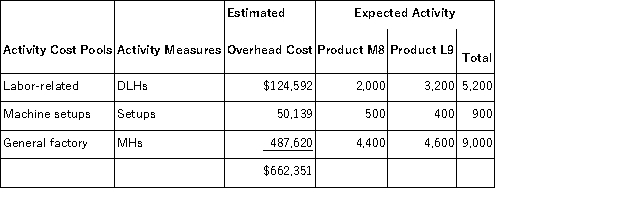

Overmeyer, Inc., manufactures and sells two products: Product M8 and Product L9. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $21.70 per DLH. The direct materials cost per unit for each product is given below:

The direct labor rate is $21.70 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a. The company currently uses a traditional costing method in which overhead is applied to products based solely on direct labor-hours. Compute the company's predetermined overhead rate under this costing method.

b. How much overhead would be applied to each product under the company's traditional costing method?

c. Determine the unit product cost of each product under the company's traditional costing method.

d. Compute the activity rates under the activity-based costing system.

e. Determine how much overhead would be assigned to each product under the activity-based costing system.

f. Determine the unit product cost of each product under the activity-based costing method.

g. What is the difference between the overhead per unit under the traditional costing method and the activity-based costing system for each of the two products?

h. What is the difference between the unit product costs under the under the traditional costing method and the activity-based costing system for each of the two products?

Required:

In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a. The company currently uses a traditional costing method in which overhead is applied to products based solely on direct labor-hours. Compute the company's predetermined overhead rate under this costing method.

b. How much overhead would be applied to each product under the company's traditional costing method?

c. Determine the unit product cost of each product under the company's traditional costing method.

d. Compute the activity rates under the activity-based costing system.

e. Determine how much overhead would be assigned to each product under the activity-based costing system.

f. Determine the unit product cost of each product under the activity-based costing method.

g. What is the difference between the overhead per unit under the traditional costing method and the activity-based costing system for each of the two products?

h. What is the difference between the unit product costs under the under the traditional costing method and the activity-based costing system for each of the two products?

(Essay)

4.9/5  (40)

(40)

Managing and sustaining product diversity requires many more overhead resources such as production schedulers and product design engineers. The costs of these resources have no obvious connection with direct labor.

(True/False)

4.8/5  (38)

(38)

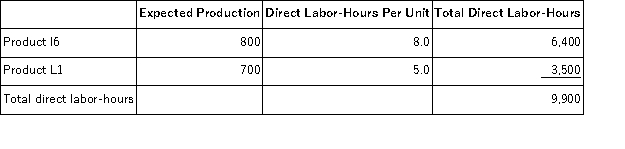

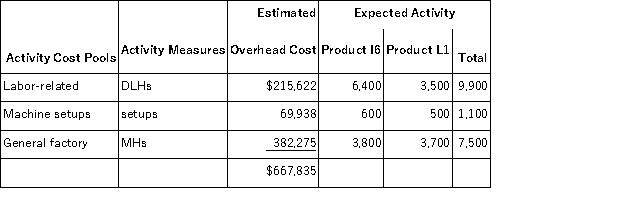

Mcleese, Inc., manufactures and sells two products: Product I6 and Product L1. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $26.60 per DLH. The direct materials cost per unit for each product is given below:

The direct labor rate is $26.60 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product L1 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product L1 would be closest to:

(Multiple Choice)

4.9/5  (38)

(38)

A plantwide predetermined overhead rate based on direct labor-hours results in high overhead costs for products with a high direct labor-hour content and low overhead costs for products with a low direct labor-hour content.

(True/False)

4.8/5  (43)

(43)

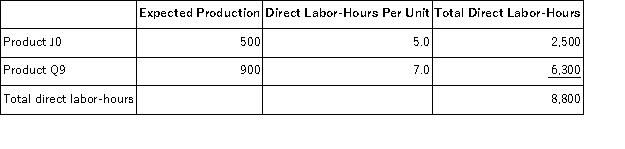

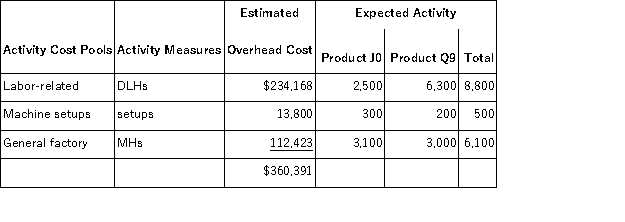

Wlodarczyk, Inc., manufactures and sells two products: Product J0 and Product Q9. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The overhead applied to each unit of Product J0 under activity-based costing is closest to:

The overhead applied to each unit of Product J0 under activity-based costing is closest to:

(Multiple Choice)

4.8/5  (31)

(31)

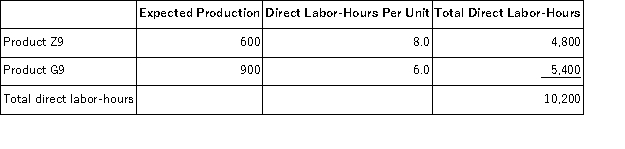

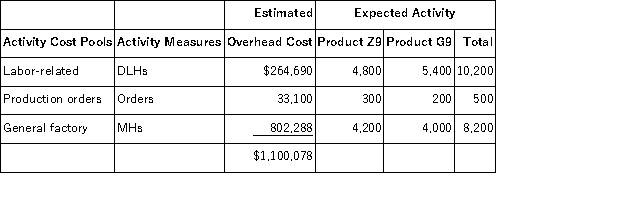

Yarn, Inc., manufactures and sells two products: Product Z9 and Product G9. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $19.40 per DLH. The direct materials cost per unit is $268.80 for Product Z9 and $250.00 for Product G9.

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The direct labor rate is $19.40 per DLH. The direct materials cost per unit is $268.80 for Product Z9 and $250.00 for Product G9.

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Determine the unit product cost of each product under the activity-based costing method.

Required:

Determine the unit product cost of each product under the activity-based costing method.

(Essay)

4.7/5  (32)

(32)

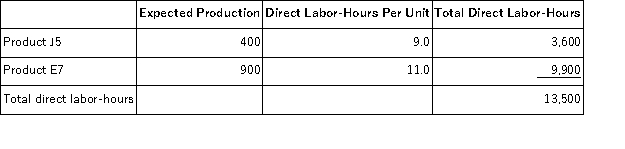

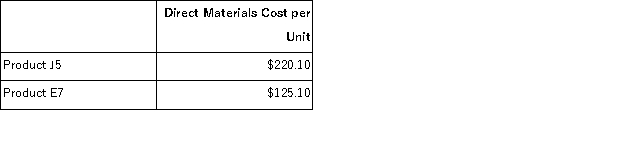

Dameron, Inc., manufactures and sells two products: Product J5 and Product E7. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $15.90 per DLH. The direct materials cost per unit for each product is given below:

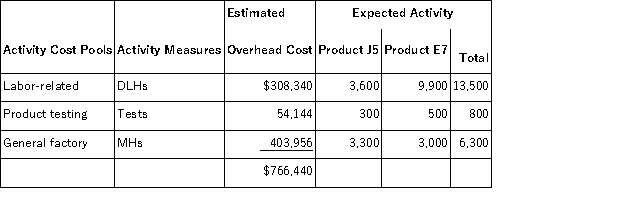

The direct labor rate is $15.90 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a. Compute the activity rates under the activity-based costing system.

b. Determine how much overhead would be assigned to each product under the activity-based costing system.

c. Determine the unit product cost of each product under the activity-based costing method.

Required:

In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a. Compute the activity rates under the activity-based costing system.

b. Determine how much overhead would be assigned to each product under the activity-based costing system.

c. Determine the unit product cost of each product under the activity-based costing method.

(Essay)

4.9/5  (39)

(39)

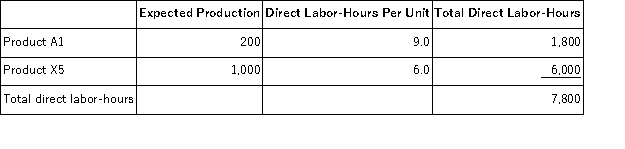

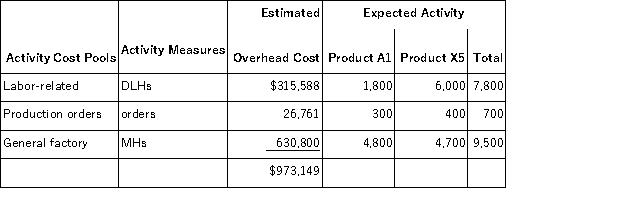

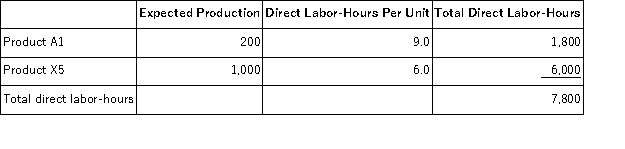

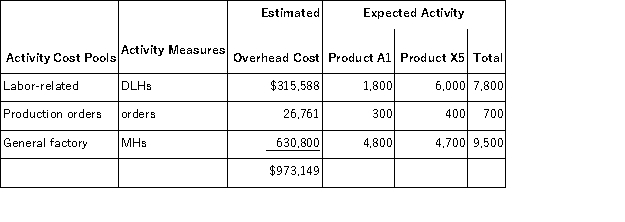

Bohringer, Inc., manufactures and sells two products: Product A1 and Product X5. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $28.20 per DLH. The direct materials cost per unit is $256.50 for Product A1 and $165.20 for Product X5. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The direct labor rate is $28.20 per DLH. The direct materials cost per unit is $256.50 for Product A1 and $165.20 for Product X5. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The total overhead applied to Product A1 under activity-based costing is closest to:

The total overhead applied to Product A1 under activity-based costing is closest to:

(Multiple Choice)

4.7/5  (35)

(35)

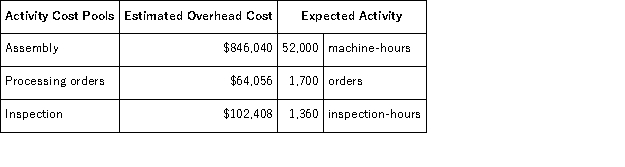

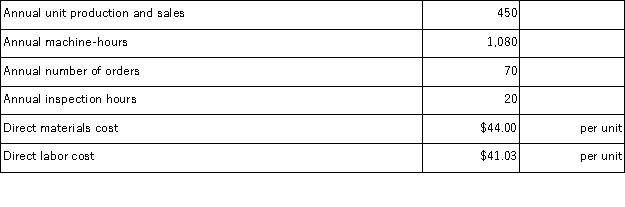

Paparo Corporation has provided the following data from its activity-based costing system:  Data concerning the company's product Q79Y appear below:

Data concerning the company's product Q79Y appear below:  According to the activity-based costing system, the unit product cost of product Q79Y is closest to:

According to the activity-based costing system, the unit product cost of product Q79Y is closest to:

(Multiple Choice)

4.9/5  (36)

(36)

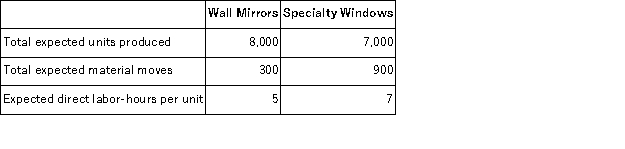

The controller of Hartis Company estimates the amount of materials handling overhead cost that should be allocated to the company's two products using the data that are given below:  The total materials handling cost for the year is expected to be $38,448.00. If the materials handling cost is allocated on the basis of direct labor-hours, the total materials handling cost allocated to the wall mirrors is closest to:

The total materials handling cost for the year is expected to be $38,448.00. If the materials handling cost is allocated on the basis of direct labor-hours, the total materials handling cost allocated to the wall mirrors is closest to:

(Multiple Choice)

4.8/5  (30)

(30)

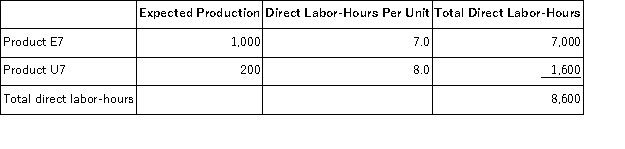

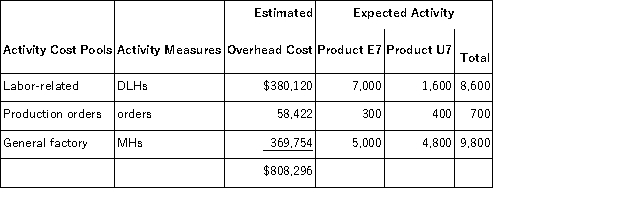

Hewett, Inc., manufactures and sells two products: Product E7 and Product U7. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $29.50 per DLH. The direct materials cost per unit is $164.10 for Product E7 and $289.50 for Product U7. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The direct labor rate is $29.50 per DLH. The direct materials cost per unit is $164.10 for Product E7 and $289.50 for Product U7. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the predetermined overhead rate would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the predetermined overhead rate would be closest to:

(Multiple Choice)

4.9/5  (31)

(31)

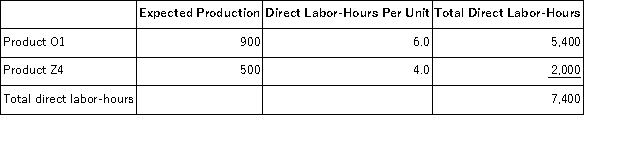

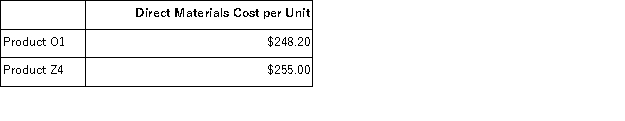

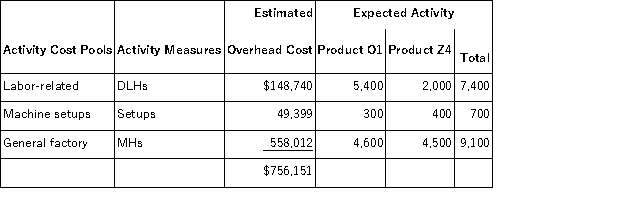

Gribbins, Inc., manufactures and sells two products: Product O1 and Product Z4. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $23.00 per DLH. The direct materials cost per unit for each product is given below:

The direct labor rate is $23.00 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

What is the difference between the unit product costs under the under the traditional costing method and the activity-based costing system for each of the two products?

Required:

What is the difference between the unit product costs under the under the traditional costing method and the activity-based costing system for each of the two products?

(Essay)

4.9/5  (33)

(33)

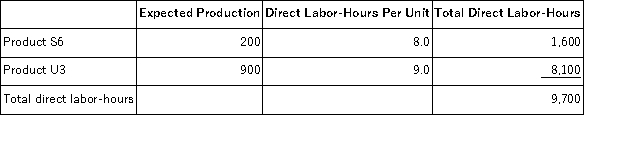

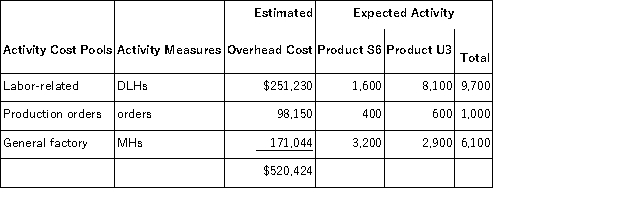

Sampaga, Inc., manufactures and sells two products: Product S6 and Product U3. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $20.90 per DLH. The direct materials cost per unit is $145.30 for Product S6 and $221.50 for Product U3. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The direct labor rate is $20.90 per DLH. The direct materials cost per unit is $145.30 for Product S6 and $221.50 for Product U3. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The overhead applied to each unit of Product U3 under activity-based costing is closest to:

The overhead applied to each unit of Product U3 under activity-based costing is closest to:

(Multiple Choice)

4.8/5  (33)

(33)

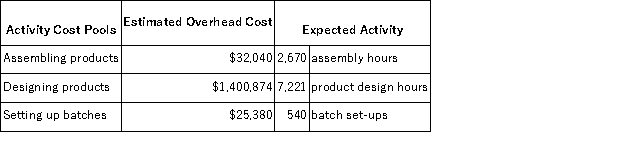

Data concerning three of Falkenstein Corporation's activity cost pools appear below:  Required:

Compute the activity rates for each of the three cost pools. Show your work!

Required:

Compute the activity rates for each of the three cost pools. Show your work!

(Essay)

4.9/5  (32)

(32)

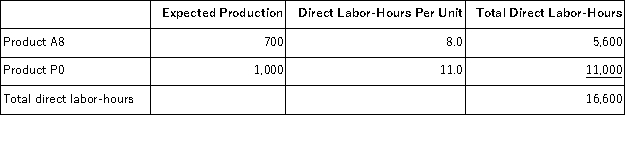

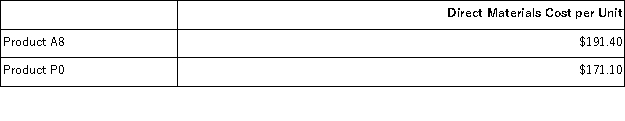

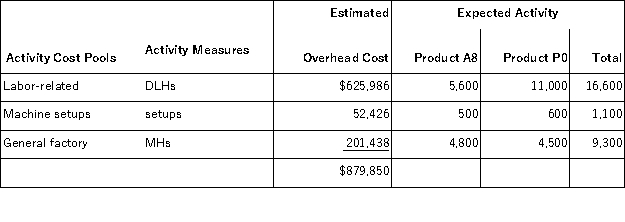

Molette, Inc., manufactures and sells two products: Product A8 and Product P0. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $28.80 per DLH. The direct materials cost per unit for each product is given below:

The direct labor rate is $28.80 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Which of the following statements concerning the unit product cost of Product A8 is true?

Which of the following statements concerning the unit product cost of Product A8 is true?

(Multiple Choice)

4.8/5  (29)

(29)

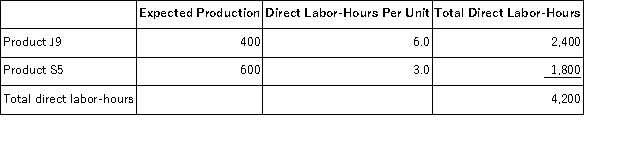

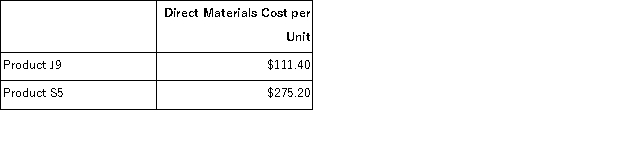

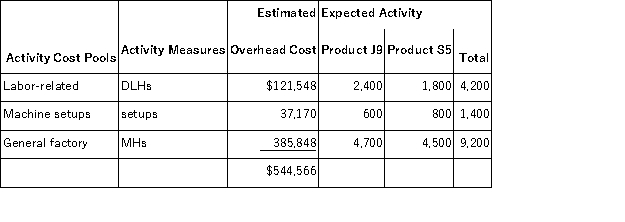

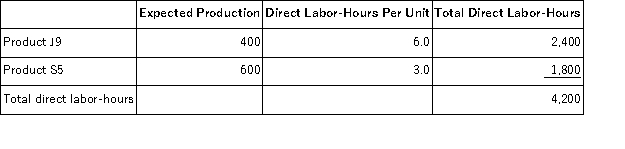

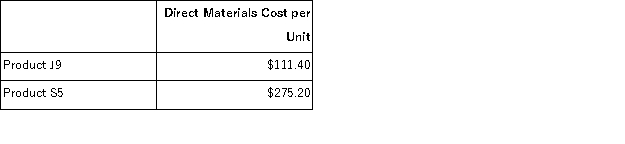

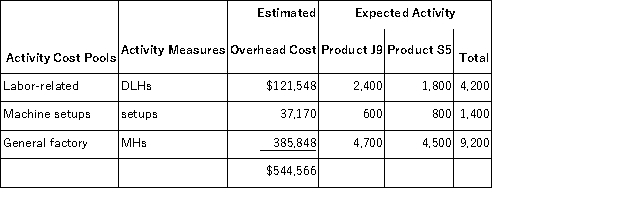

Accurso, Inc., manufactures and sells two products: Product J9 and Product S5. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $22.50 per DLH. The direct materials cost per unit for each product is given below:

The direct labor rate is $22.50 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Which of the following statements concerning the unit product cost of Product S5 is true?

Which of the following statements concerning the unit product cost of Product S5 is true?

(Multiple Choice)

5.0/5  (38)

(38)

Facility-level activities are activities that are carried out regardless of which products are produced, how many batches are run, or how many units are made.

(True/False)

4.7/5  (37)

(37)

Bohringer, Inc., manufactures and sells two products: Product A1 and Product X5. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $28.20 per DLH. The direct materials cost per unit is $256.50 for Product A1 and $165.20 for Product X5. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The direct labor rate is $28.20 per DLH. The direct materials cost per unit is $256.50 for Product A1 and $165.20 for Product X5. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The total overhead applied to Product X5 under activity-based costing is closest to:

The total overhead applied to Product X5 under activity-based costing is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

Accurso, Inc., manufactures and sells two products: Product J9 and Product S5. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $22.50 per DLH. The direct materials cost per unit for each product is given below:

The direct labor rate is $22.50 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The activity rate for the Machine Setups activity cost pool under activity-based costing is closest to:

The activity rate for the Machine Setups activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.9/5  (33)

(33)

Showing 21 - 40 of 208

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)