Exam 12: Pricing Products and Services

Exam 1: Managerial Accounting and Cost Concepts186 Questions

Exam 2: Cost-Volume-Profit Relationships187 Questions

Exam 3: Job-Order Costing100 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management224 Questions

Exam 5: Activity-Based-Costing: a Tool to Aid Decision Making145 Questions

Exam 6: Differential Analysis: the Key to Decision Making174 Questions

Exam 7: Capital Budgeting Decisions167 Questions

Exam 8: Profit Planning172 Questions

Exam 9: Flexible Budgets and Performance Analysis306 Questions

Exam 10: Standard Costs and Variances187 Questions

Exam 11: Performance Measurement in Decentralized Organizations115 Questions

Exam 12: Pricing Products and Services82 Questions

Exam 13: Profitability Analysis76 Questions

Exam 14: Least Squares Regression Computations21 Questions

Exam 15: Activity-Based Absorption Costing12 Questions

Exam 16: the Predetermined Overhead Rate and Capacity28 Questions

Exam 17: Super-Variable Costing49 Questions

Exam 18: Abc Action Analysis16 Questions

Exam 19: the Concept of Present Value13 Questions

Exam 20: Income Taxes and the Net Present Value Method147 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System111 Questions

Exam 22: Transfer Pricing25 Questions

Exam 23: Service Department Charges51 Questions

Select questions type

The price elasticity of demand is NOT used to determine the markup over cost when computing the profit-maximizing price.

(True/False)

4.9/5  (33)

(33)

Magner, Inc. , uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products.Based on budgeted sales of 34, 000 units next year, the unit product cost of a particular product is $61.80.The company's selling and administrative expenses for this product are budgeted to be $809, 200 in total for the year.The company has invested $400, 000 in this product and expects a return on investment of 9%. The selling price for this product based on the absorption costing approach would be closest to:

(Multiple Choice)

4.8/5  (29)

(29)

Target costing is the process of determining the maximum allowable cost for a new product and then developing a prototype that can be profitably made for that maximum cost figure.

(True/False)

4.8/5  (38)

(38)

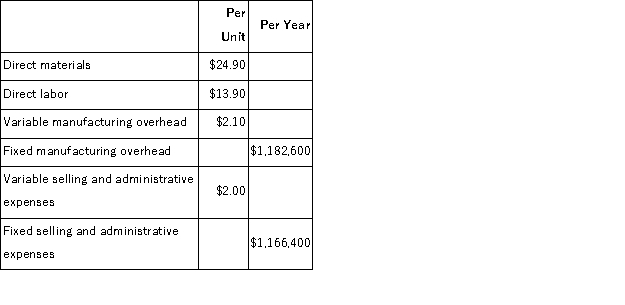

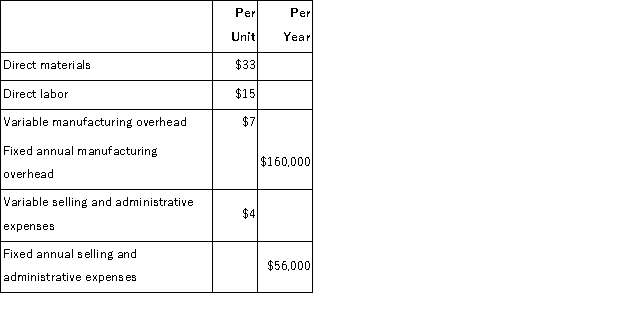

Kircher, Inc. , manufactures a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 81, 000 units per year. The company has invested $220, 000 in this product and expects a return on investment of 15%.

The selling price based on the absorption costing approach would be closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 81, 000 units per year. The company has invested $220, 000 in this product and expects a return on investment of 15%.

The selling price based on the absorption costing approach would be closest to:

(Multiple Choice)

4.9/5  (35)

(35)

Pricing decisions are most difficult in those situations in which a company makes a product that is in competition with other, identical products for which a market already exists.

(True/False)

4.9/5  (41)

(41)

Nguyen Corporation's marketing manager believes that every 8% increase in the selling price of one of the company's products would lead to a 15% decrease in the product's total unit sales.The product's absorption costing unit product cost is $19.40.The variable production cost is $5.40 per unit and the variable selling and administrative cost is $2.20.

Required:

a.Compute the product's price elasticity of demand as defined in the text to two decimal places.

b.Compute the product's profit-maximizing price according to the formula in the text.

(Essay)

4.9/5  (28)

(28)

Warvel Corporation's management has found that every 5% increase in the selling price of one of the company's products leads to an 8% decrease in the product's total unit sales.The variable production cost of the product is $18.00 per unit and the variable selling and administrative cost is $12.00 per unit. According to the formula in the text, the product's profit-maximizing price is closest to:

(Multiple Choice)

4.7/5  (45)

(45)

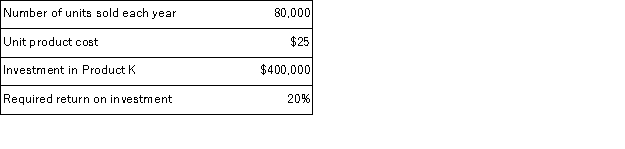

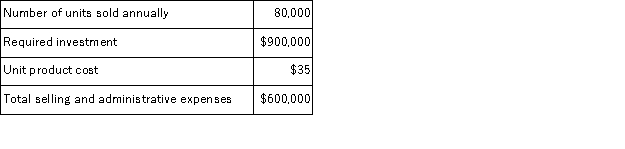

Surent Corporation has the following information available on Product K:  The company uses the absorption costing approach to cost-plus pricing described in the text and a 50% markup.Based on these data, the company's total selling and administrative expenses associated with Product K each year are:

The company uses the absorption costing approach to cost-plus pricing described in the text and a 50% markup.Based on these data, the company's total selling and administrative expenses associated with Product K each year are:

(Multiple Choice)

4.8/5  (33)

(33)

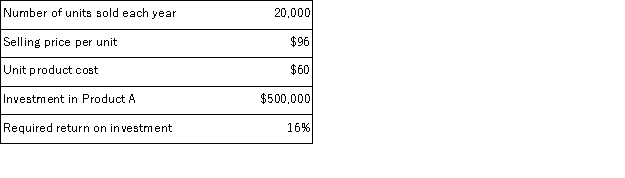

The following information is available on Browning Inc.'s Product A:  The company uses the absorption costing approach to cost-plus pricing described in the text.Based on these data, the total selling and administrative expenses each year are:

The company uses the absorption costing approach to cost-plus pricing described in the text.Based on these data, the total selling and administrative expenses each year are:

(Multiple Choice)

4.8/5  (30)

(30)

The Sloan Corporation must invest $120, 000 to produce and market 16, 000 units of Product X each year.The company uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products.Other cost information regarding Product X is as follows:  If Sloan Corporation requires a 15% return on investment, then the markup percentage on absorption cost for Product X (rounded to the nearest percent)would be:

If Sloan Corporation requires a 15% return on investment, then the markup percentage on absorption cost for Product X (rounded to the nearest percent)would be:

(Multiple Choice)

4.8/5  (47)

(47)

The price elasticity of demand is NOT used in the absorption costing approach to cost-plus pricing to determine the markup over cost.

(True/False)

4.9/5  (35)

(35)

Sawit Corporation, a manufacturer of woodworking tools, wants to introduce a new power screwdriver.To compete effectively, the screwdriver cannot be priced at more than $14.The company requires a 15% rate of return on investment on all new products.In order to produce and sell 80, 000 screwdrivers each year, the company will need to make an investment of $800, 000.The target cost per screwdriver would be:

(Multiple Choice)

4.9/5  (36)

(36)

The management of Kizer Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing.The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 8, 000 units of the new product annually.The new product would require an investment of $1, 580, 000 and has a required return on investment of 10%. The markup percentage on absorption cost is closest to:

Management plans to produce and sell 8, 000 units of the new product annually.The new product would require an investment of $1, 580, 000 and has a required return on investment of 10%. The markup percentage on absorption cost is closest to:

(Multiple Choice)

4.9/5  (43)

(43)

Simmons Corporation estimated that the following costs and activity would be associated with Product T:  If the company uses the absorption costing approach to cost-plus pricing described in the text and desires a 20% ROI, the selling price for Product T would be:

If the company uses the absorption costing approach to cost-plus pricing described in the text and desires a 20% ROI, the selling price for Product T would be:

(Multiple Choice)

4.8/5  (35)

(35)

Management of Daubert Corporation is considering a new product, an outdoor speaker that would have a selling price of $43 per unit and projected sales of 60, 000 units.Launching the new product would require an investment of $300, 000.The desired return on investment is 13%.

Required:

Determine the target cost per unit for the outdoor speaker.

(Essay)

4.8/5  (34)

(34)

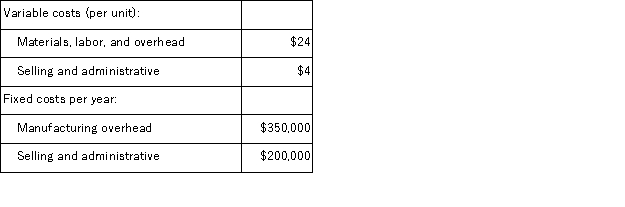

Merced Corporation estimates that an investment of $600, 000 would be necessary to produce and sell 50, 000 units of a new product each year.Other costs associated with the new product would be:  The company requires a 15% return on the investment in all products.The company uses the absorption costing approach costing to pricing as described in the text. The markup percentage on the new product would be closest to:

The company requires a 15% return on the investment in all products.The company uses the absorption costing approach costing to pricing as described in the text. The markup percentage on the new product would be closest to:

(Multiple Choice)

4.8/5  (43)

(43)

Samples Corporation would like to use target costing for a new product it is considering introducing.At a selling price of $21 per unit, management projects sales of 20, 000 units.The new product would require an investment of $400, 000.The desired return on investment is 12%. The target cost per unit is closest to:

(Multiple Choice)

4.8/5  (33)

(33)

Loyola International, Inc.is considering adding a portable CD player to its product line.Management believes that in order to be competitive, the CD player cannot be priced above $79.The company requires a minimum return of 20% on its investments.Launching the new product would require an investment of $20, 000, 000.Sales are expected to be 250, 000 units of the CD player per year.

Required:

Compute the target cost of a CD player.

(Essay)

4.8/5  (43)

(43)

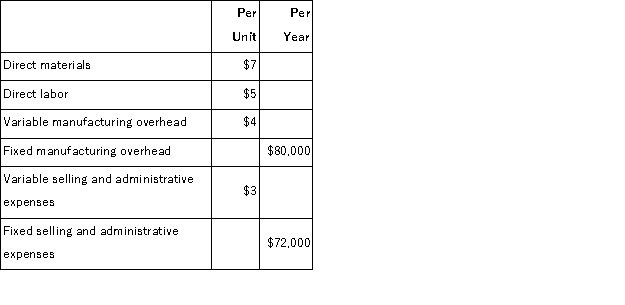

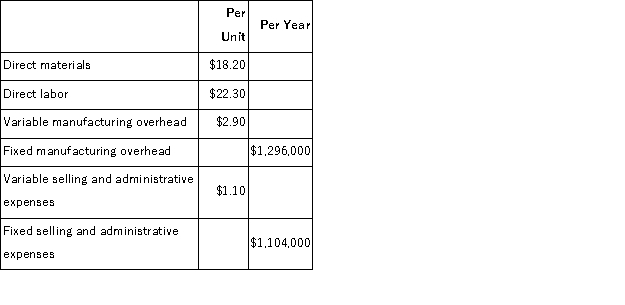

Dickson Corporation makes a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 60, 000 units per year. The company has invested $320, 000 in this product and expects a return on investment of 15%.

Direct labor is a variable cost in this company.

The markup on absorption cost is closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 60, 000 units per year. The company has invested $320, 000 in this product and expects a return on investment of 15%.

Direct labor is a variable cost in this company.

The markup on absorption cost is closest to:

(Multiple Choice)

4.9/5  (41)

(41)

Showing 61 - 80 of 82

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)