Exam 11: Current Liabilities

Exam 10: Property,plant and Equipment,and Intangibles205 Questions

Exam 11: Current Liabilities99 Questions

Exam 12: Partnerships84 Questions

Exam 13: Organization and Operation of Corporations109 Questions

Exam 15: Bonds and Long-Term Notes Payable156 Questions

Exam 17: Reporting and Analyzing Cash Flows138 Questions

Exam 18: Analyzing Financial Statements332 Questions

Select questions type

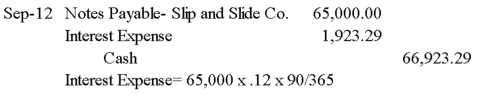

On June 14,Cool Sports gave a 90-day note payable to Slip and Slide Co.,instead of cash payment of an overdue account.The amount of the note was $65,000 at an interest rate of 12%.

Prepare the journal entry and determine the maturity date for Cool Sports to record payment of the note.

Free

(Essay)

4.8/5  (40)

(40)

Correct Answer:

The employer should record payroll deductions as:

Free

(Multiple Choice)

4.9/5  (29)

(29)

Correct Answer:

B

West Coast Outdoor Co.signed a $8,000,90-day,4% interest-bearing note payable at the bank in exchange for cash.Which of the following journal entries should West Coast Outdoor Co.use to record the note?

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

B

A short-term note payable is a written promise to pay a specified amount on a specified future date within one year or the payee's operating cycle,whichever is shorter.

(True/False)

4.8/5  (33)

(33)

Contingent liabilities are disclosed when the liability is not _______________ or it cannot be _______________.

(Short Answer)

4.8/5  (32)

(32)

A combined GST and PST rate of 12% applied to taxable supplies is called:

(Multiple Choice)

4.9/5  (35)

(35)

The difference between the amount received from a note payable and the amount repaid is:

(Multiple Choice)

4.9/5  (41)

(41)

A company's obligations not expected to be paid within the longer of one year of the balance sheet date or the next operating cycle are reported as current liabilities.

(True/False)

4.9/5  (27)

(27)

A refund of GST would be received if the balance in the GST ________________ account exceeded the balance in the GST __________________ account.

(Short Answer)

4.7/5  (36)

(36)

_____________ is to compensate the owner of note payable for its use by a borrower until payment is made.

(Short Answer)

4.9/5  (39)

(39)

Trade accounts payable are amounts owed to suppliers for products or services purchased on credit.

(True/False)

5.0/5  (30)

(30)

On November 15,Lohr Co.borrowed $20,000 from Convenient Bank.The loan had an interest rate of 12% and was due in 120 days.

Prepare the journal entry to record the payment of the note on Lohr's books,assuming an adjusting entry was made at December 31st ,Lohr Co.'s year end.

(Essay)

4.8/5  (29)

(29)

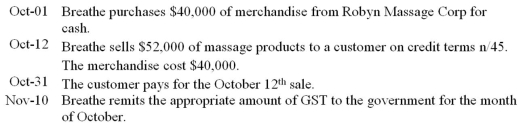

Breathe Therapeutic Company is located in Medicine Hat,Alberta and is a retailer of massage supplies.Beginning inventory is $70,000,and Breathe uses the perpetual inventory system.Complete the journal entries on the following dates,including 5% GST as applicable.

(Essay)

4.7/5  (29)

(29)

Taxable goods or services on which GST is calculated and that include everything except zero-rated and exempt supplies are called ________________.

(Short Answer)

4.8/5  (35)

(35)

Showing 1 - 20 of 99

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)