Exam 13: Differential Analysis: The Key to Decision Making

Exam 1: Managerial Accounting and Cost Concepts186 Questions

Exam 2: Job-Order Costing: Calculating Unit Production Costs138 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting199 Questions

Exam 4: Process Costing121 Questions

Exam 5: Supplement: Process Costing Using the Fifo Method81 Questions

Exam 6: Cost-Volume-Profit Relationships187 Questions

Exam 7: Variable Costing and Segment Reporting: Tools for Management223 Questions

Exam 8: Activity-Based Costing: a Tool to Aid Decision Making172 Questions

Exam 9: Master Budgeting421 Questions

Exam 10: Flexible Budgets and Performance Analysis115 Questions

Exam 11: Differential Analysis: The Key to Decision Making114 Questions

Exam 12: Performance Measurement in Decentralized Organizations118 Questions

Exam 13: Differential Analysis: The Key to Decision Making133 Questions

Exam 14: Capital Budgeting Decisions289 Questions

Exam 15: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System111 Questions

Exam 16: Journal Entries to Record Variance56 Questions

Exam 17: The Concept of Present Value13 Questions

Exam 18: The Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

Beacham Corporation's net cash provided by operating activities was $115;its net income was $95;its capital expenditures were $65;and its cash dividends were $17.The company's free cash flow was:

(Multiple Choice)

4.7/5  (30)

(30)

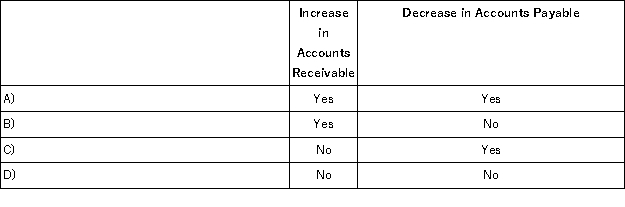

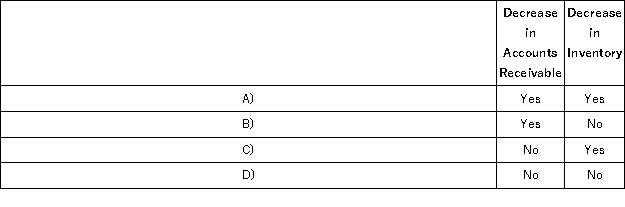

Shoshoni Corporation prepares its statement of cash flows using the indirect method.Which of the following would be added to net income in the operating activities section of the statement?

(Multiple Choice)

4.8/5  (34)

(34)

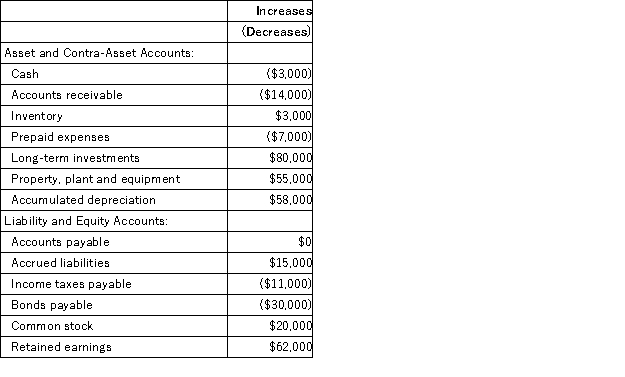

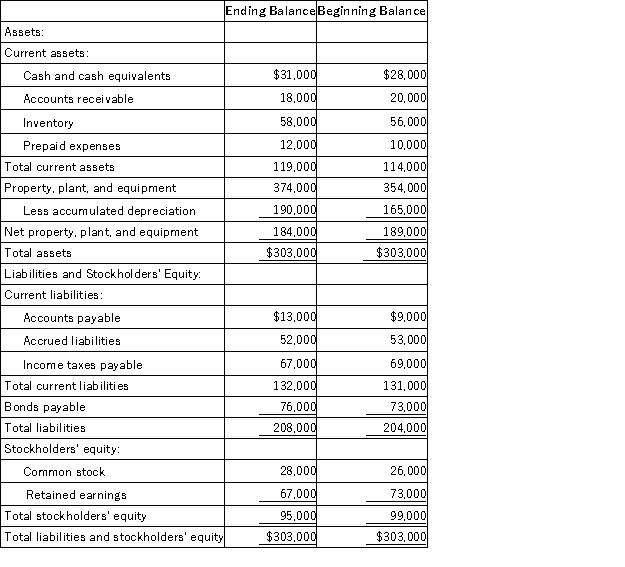

Megan Corporation's net income last year was $98,000.Changes in the company's balance sheet accounts for the year appear below:  The company paid a cash dividend of $36,000 and it did not dispose of any long-term investments or property,plant,and equipment.The company did not issue any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows. The free cash flow for the year was:

The company paid a cash dividend of $36,000 and it did not dispose of any long-term investments or property,plant,and equipment.The company did not issue any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows. The free cash flow for the year was:

(Multiple Choice)

4.8/5  (42)

(42)

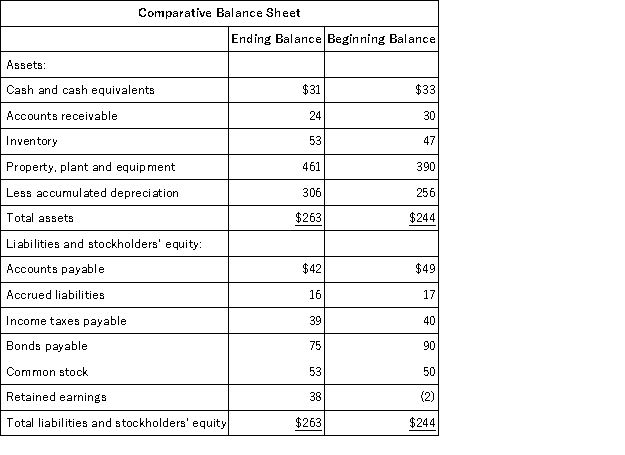

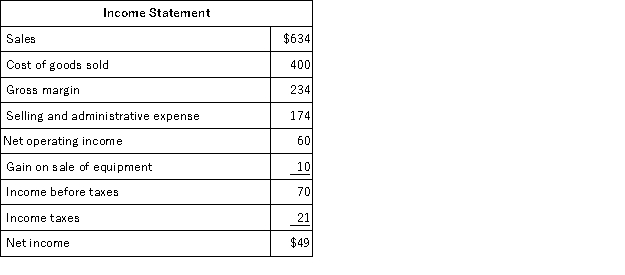

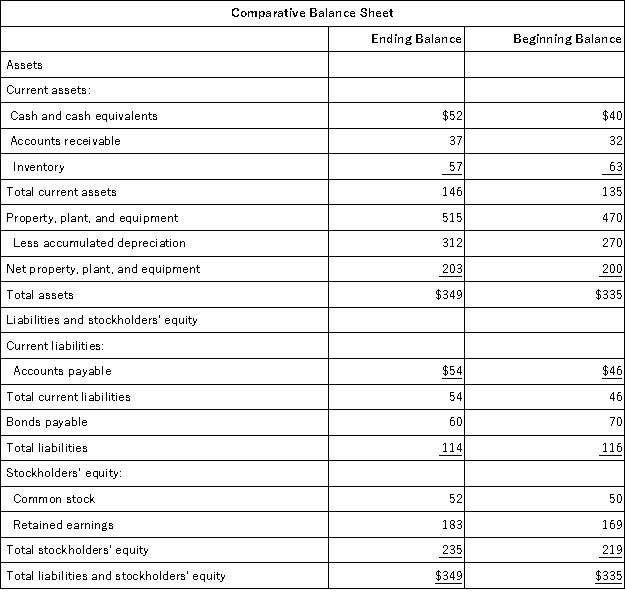

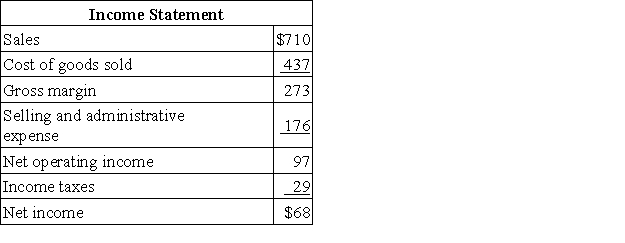

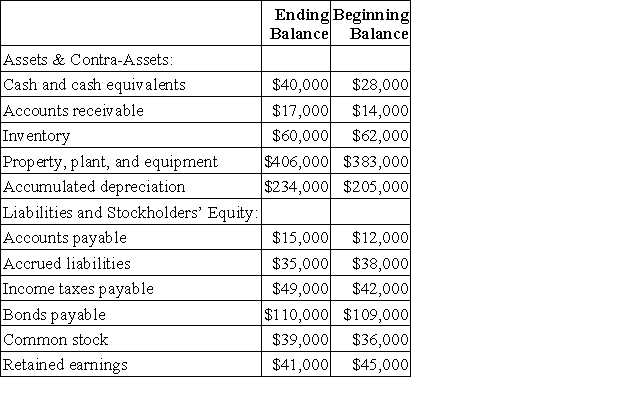

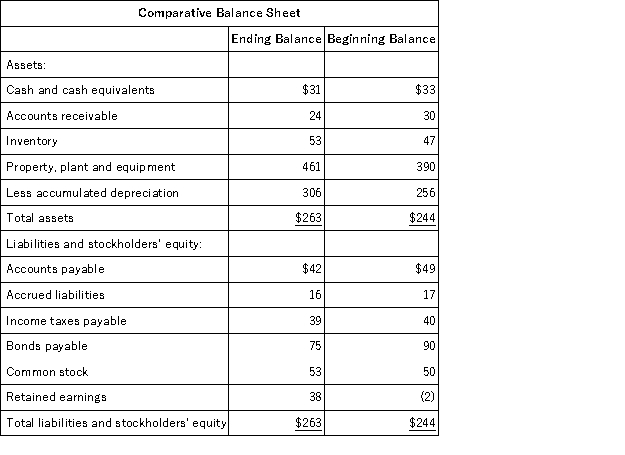

Salsedo Corporation's balance sheet and income statement appear below:

Cash dividends were $9.The company sold equipment for $15 that was originally purchased for $10 and that had accumulated depreciation of $5.It did not issue any bonds payable or repurchase any of its own common stock. The net cash provided by (used in)operating activities for the year was:

Cash dividends were $9.The company sold equipment for $15 that was originally purchased for $10 and that had accumulated depreciation of $5.It did not issue any bonds payable or repurchase any of its own common stock. The net cash provided by (used in)operating activities for the year was:

(Multiple Choice)

4.9/5  (33)

(33)

Which of the following items would not be classified as an operating activity on the statement of cash flows?

(Multiple Choice)

4.8/5  (34)

(34)

Cash equivalents on the statement of cash flows consist of any investment that can be converted into cash within one year.

(True/False)

4.7/5  (35)

(35)

Krech Corporation's comparative balance sheet appears below:  The company's net income (loss)for the year was ($3,000)and its cash dividends were $3,000.It did not sell or retire any property,plant,and equipment during the year.The company uses the indirect method to determine the net cash provided by operating activities. Which of the following is correct regarding the operating activities section of the statement of cash flows?

The company's net income (loss)for the year was ($3,000)and its cash dividends were $3,000.It did not sell or retire any property,plant,and equipment during the year.The company uses the indirect method to determine the net cash provided by operating activities. Which of the following is correct regarding the operating activities section of the statement of cash flows?

(Multiple Choice)

4.9/5  (43)

(43)

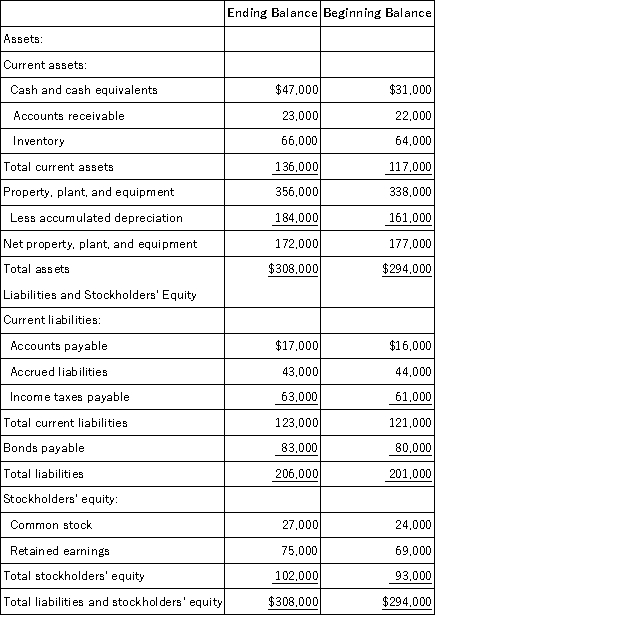

Swinger Corporation's comparative balance sheet appears below:  The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $10,000.The net cash provided by operating activities is:

The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $10,000.The net cash provided by operating activities is:

(Multiple Choice)

4.7/5  (37)

(37)

Partin Corporation's cash and cash equivalents consist of cash and marketable securities.Last year the company's cash account increased by $31,000 and its marketable securities account decreased by $22,000.Cash provided by operating activities was $108,000.Net cash used in financing activities was $70,000.Based on this information,the net cash flow from investing activities on the statement of cash flows was:

(Multiple Choice)

4.9/5  (42)

(42)

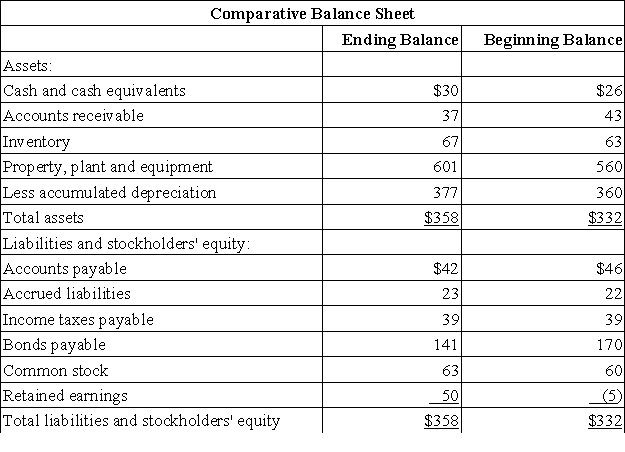

Tani Corporation's most recent balance sheet appears below:  The company's net income for the year was $18 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $4.The net cash provided by (used in)investing activities for the year was:

The company's net income for the year was $18 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $4.The net cash provided by (used in)investing activities for the year was:

(Multiple Choice)

4.8/5  (47)

(47)

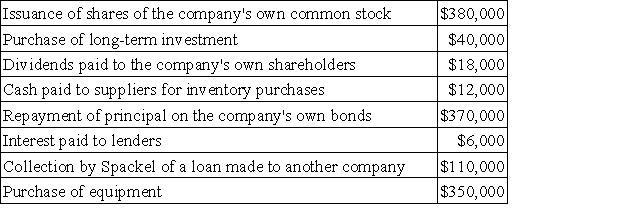

Beltram Corporation's balance sheet and income statement appear below:

The company did not dispose of any property,plant,and equipment,issue any bonds payable,or repurchase any of its own common stock during the year.The company declared and paid a cash dividend of $13.

Required:

Prepare a statement of cash flows in good form using the indirect method.

The company did not dispose of any property,plant,and equipment,issue any bonds payable,or repurchase any of its own common stock during the year.The company declared and paid a cash dividend of $13.

Required:

Prepare a statement of cash flows in good form using the indirect method.

(Essay)

4.8/5  (36)

(36)

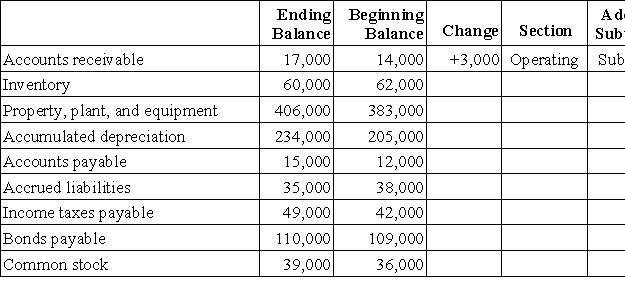

The ending and beginning balances of Farmer Corporation's balance sheet accounts for the most recent year are listed below:  The company's net income (loss)for the year was $0 and its cash dividends were $4,000.It did not dispose of any property,plant,and equipment,retire any bonds payable,or repurchase any of its own common stock during the year.

Required:

Compute the change in each balance sheet account in the below table.Indicate whether the change in each balance will be recorded in the operating,investing,or financing activities section of the statement of cash flows.For items recorded in the operating activities section,also indicate whether the change will be added to or subtracted from net income.For all other items,indicate whether the change will be added as a cash inflow or subtracted as a cash outflow.The first entry has been filled in as an example.

The company's net income (loss)for the year was $0 and its cash dividends were $4,000.It did not dispose of any property,plant,and equipment,retire any bonds payable,or repurchase any of its own common stock during the year.

Required:

Compute the change in each balance sheet account in the below table.Indicate whether the change in each balance will be recorded in the operating,investing,or financing activities section of the statement of cash flows.For items recorded in the operating activities section,also indicate whether the change will be added to or subtracted from net income.For all other items,indicate whether the change will be added as a cash inflow or subtracted as a cash outflow.The first entry has been filled in as an example.

(Essay)

4.8/5  (41)

(41)

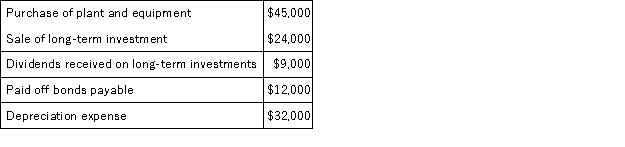

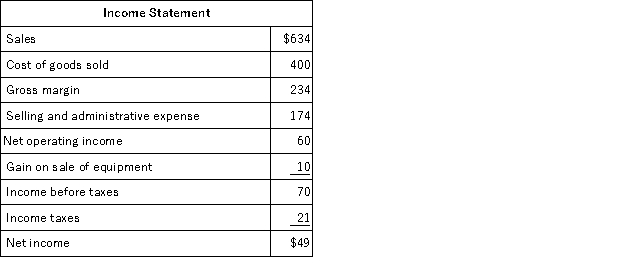

The following events occurred last year at Dorder Corporation:  Based on the above information,the cash provided (used)by investing activities for the year on the statement of cash flows would net to:

Based on the above information,the cash provided (used)by investing activities for the year on the statement of cash flows would net to:

(Multiple Choice)

4.9/5  (29)

(29)

The direct method of preparing the statement of cash flows will show the same increase or decrease in cash as the indirect method.

(True/False)

4.8/5  (40)

(40)

Dukas Corporation's net cash provided by operating activities was $218,000;its net income was $203,000;its capital expenditures were $146,000;and its cash dividends were $49,000.

Required:

Determine the company's free cash flow.

(Essay)

4.8/5  (31)

(31)

When computing the net cash provided by operating activities under the indirect method on the statement of cash flows,an increase in prepaid expenses would be added to net income.

(True/False)

4.9/5  (40)

(40)

Salsedo Corporation's balance sheet and income statement appear below:

Cash dividends were $9.The company sold equipment for $15 that was originally purchased for $10 and that had accumulated depreciation of $5.It did not issue any bonds payable or repurchase any of its own common stock. The net cash provided by (used in)financing activities for the year was:

Cash dividends were $9.The company sold equipment for $15 that was originally purchased for $10 and that had accumulated depreciation of $5.It did not issue any bonds payable or repurchase any of its own common stock. The net cash provided by (used in)financing activities for the year was:

(Multiple Choice)

4.9/5  (34)

(34)

Spackel Corporation recorded the following events last year:  On the statement of cash flows,some of these events are classified as operating activities,some are classified as investing activities,and some are classified as financing activities. Based solely on the information above,the net cash provided by (used in)investing activities on the statement of cash flows would be:

On the statement of cash flows,some of these events are classified as operating activities,some are classified as investing activities,and some are classified as financing activities. Based solely on the information above,the net cash provided by (used in)investing activities on the statement of cash flows would be:

(Multiple Choice)

4.9/5  (37)

(37)

Adah Corporation prepares its statement of cash flows using the indirect method.Which of the following would be subtracted from net income in the operating activities section of the statement?

(Multiple Choice)

4.9/5  (33)

(33)

In a statement of cash flows,issuing bonds payable affects the:

(Multiple Choice)

4.9/5  (34)

(34)

Showing 101 - 120 of 133

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)