Exam 25: Transfer Pricing

Exam 1: Managerial Accounting and Cost Concepts166 Questions

Exam 2: Job-Order Costing154 Questions

Exam 3: Process Costing109 Questions

Exam 4: Cost-Volume-Profit Relationships241 Questions

Exam 5: Variable Costing and Segment Reporting: Tools for Management200 Questions

Exam 6: Activity-Based Costing: a Tool to Aid Decision Making138 Questions

Exam 7: Profit Planning106 Questions

Exam 8: Flexible Budgets and Performance Analysis295 Questions

Exam 9: Standard Costs and Variances178 Questions

Exam 10: Performance Measurement in Decentralized Organizations93 Questions

Exam 11: Differential Analysis: The Key to Decision Making153 Questions

Exam 12: Capital Budgeting Decisions144 Questions

Exam 13: Statement of Cash Flows108 Questions

Exam 14: Financial Statement Analysis211 Questions

Exam 15: Least-Squares Regression Computations22 Questions

Exam 16: Appendix B: Cost of Quality42 Questions

Exam 17: The Predetermined Overhead Rate and Capacity27 Questions

Exam 18: Further Classification of Labor Costs20 Questions

Exam 19: Fifo Method79 Questions

Exam 20: Service Department Allocations46 Questions

Exam 21: Abc Action Analysis15 Questions

Exam 22: Using a Modified Form of Activity-Based Costing to Determine Product Costs for External Reports16 Questions

Exam 23: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System105 Questions

Exam 24: Journal Entries to Record Variances52 Questions

Exam 25: Transfer Pricing21 Questions

Exam 26: Service Department Charges41 Questions

Exam 27: The Concept of Present Value12 Questions

Exam 28: Income Taxes in Capital Budgeting Decisions36 Questions

Exam 29: The Direct Method of Determining the Net Cash Provided by Operating Activities48 Questions

Exam 30: Pricing Products and Services67 Questions

Exam 31: Profitability Analysis71 Questions

Select questions type

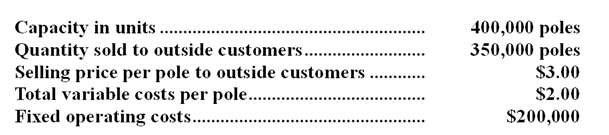

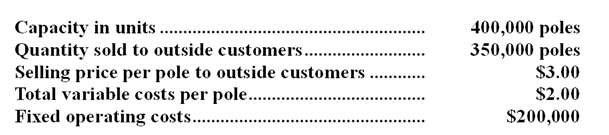

The Pole Division of Hillyard Company produces poles which can be sold to outside customers or transferred to the Flag Division of Hillyard Company. Last year the Flag Division bought 50,000 poles from Pole at $2.50 each. The following data are available for last year's activities in the Pole Division:  In order to sell 50,000 poles to the Flag Division, the Pole Division must give up sales of 30,000 poles to outside customers. That is, the Pole Division could sell 380,000 poles each year to outside customers (rather than only 350,000 poles as shown above) if it were not making sales to the Flag Division.

-According to the formula in the text,what is the lowest acceptable transfer price from the viewpoint of the selling division?

In order to sell 50,000 poles to the Flag Division, the Pole Division must give up sales of 30,000 poles to outside customers. That is, the Pole Division could sell 380,000 poles each year to outside customers (rather than only 350,000 poles as shown above) if it were not making sales to the Flag Division.

-According to the formula in the text,what is the lowest acceptable transfer price from the viewpoint of the selling division?

Free

(Multiple Choice)

4.8/5  (43)

(43)

Correct Answer:

C

When the selling division in an internal transfer has unsatisfied demand from outside customers for the product that is being transferred,then the lowest acceptable transfer price as far as the selling division is concerned is:

Free

(Multiple Choice)

4.9/5  (42)

(42)

Correct Answer:

C

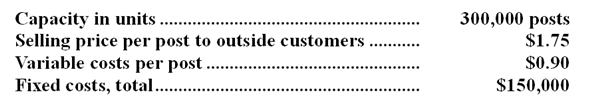

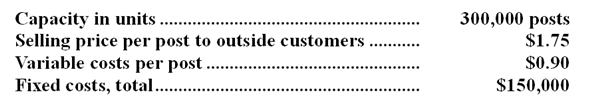

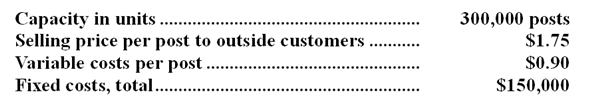

The Post Division of the M.T. Woodhead Company produces basic posts which can be sold to outside customers or sold to the Lamp Division of the M.T. Woodhead Company. Last year the Lamp Division bought all of its 25,000 posts from Post at $1.50 each. The following data are available for last year's activities of the Post Division:  The total fixed costs would be the same for all the alternatives considered below.

-Suppose the transfers of posts to the Lamp Division cut into sales to outside customers by 15,000 units.Further suppose that an outside supplier is willing to provide the Lamp Division with basic posts at $1.45 each.If the Lamp Division had chosen to buy all of its posts from the outside supplier instead of the Post Division,the change in net operating income for the company as a whole would have been:

The total fixed costs would be the same for all the alternatives considered below.

-Suppose the transfers of posts to the Lamp Division cut into sales to outside customers by 15,000 units.Further suppose that an outside supplier is willing to provide the Lamp Division with basic posts at $1.45 each.If the Lamp Division had chosen to buy all of its posts from the outside supplier instead of the Post Division,the change in net operating income for the company as a whole would have been:

Free

(Multiple Choice)

4.8/5  (42)

(42)

Correct Answer:

C

The Post Division of the M.T. Woodhead Company produces basic posts which can be sold to outside customers or sold to the Lamp Division of the M.T. Woodhead Company. Last year the Lamp Division bought all of its 25,000 posts from Post at $1.50 each. The following data are available for last year's activities of the Post Division:  The total fixed costs would be the same for all the alternatives considered below.

-Suppose the transfers of posts to the Lamp Division cut into sales to outside customers by 15,000 units.What is the lowest transfer price that would not reduce the profits of the Post Division?

The total fixed costs would be the same for all the alternatives considered below.

-Suppose the transfers of posts to the Lamp Division cut into sales to outside customers by 15,000 units.What is the lowest transfer price that would not reduce the profits of the Post Division?

(Multiple Choice)

4.9/5  (43)

(43)

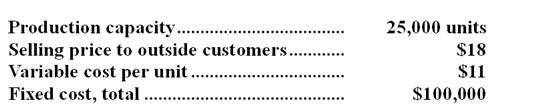

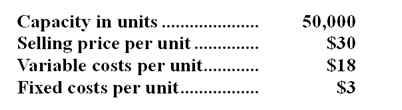

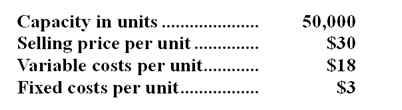

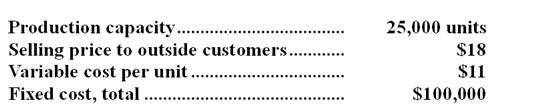

Division X makes a part with the following characteristics:  Division Y of the same company would like to purchase 10,000 units each period from Division X. Division Y now purchases the part from an outside supplier at a price of $17 each.

-Suppose Division X has ample excess capacity to handle all of Division Y's needs without any increase in fixed costs and without cutting into sales to outside customers.If Division X refuses to accept the $17 price internally and Division Y continues to buy from the outside supplier,the company as a whole will be:

Division Y of the same company would like to purchase 10,000 units each period from Division X. Division Y now purchases the part from an outside supplier at a price of $17 each.

-Suppose Division X has ample excess capacity to handle all of Division Y's needs without any increase in fixed costs and without cutting into sales to outside customers.If Division X refuses to accept the $17 price internally and Division Y continues to buy from the outside supplier,the company as a whole will be:

(Multiple Choice)

4.9/5  (36)

(36)

When an intermediate market price for a transferred item exists,it represents a lower limit on the charge that should be made on transfers between divisions.

(True/False)

4.9/5  (29)

(29)

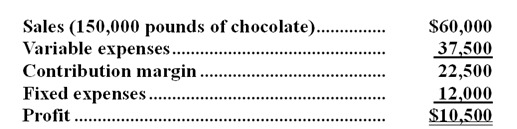

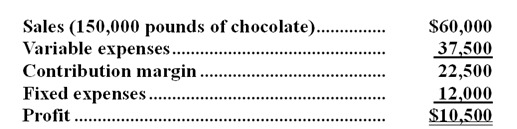

The Milk Chocolate Division of Mmmm Foods, Inc. had the following operating results last year:  Milk Chocolate expects identical operating results this year. The Milk Chocolate Division has the ability to produce and sell 200,000 pounds of chocolate annually.

-Assume that the Peanut Butter Division of Mmmm Foods wants to purchase an additional 20,000 pounds of chocolate from the Milk Chocolate Division.Milk Chocolate will be able to increase its profit by accepting any transfer price above:

Milk Chocolate expects identical operating results this year. The Milk Chocolate Division has the ability to produce and sell 200,000 pounds of chocolate annually.

-Assume that the Peanut Butter Division of Mmmm Foods wants to purchase an additional 20,000 pounds of chocolate from the Milk Chocolate Division.Milk Chocolate will be able to increase its profit by accepting any transfer price above:

(Multiple Choice)

4.9/5  (42)

(42)

Division P of Turbo Corporation has the capacity for making 75,000 wheel sets per year and regularly sells 60,000 each year on the outside market.The regular sales price is $100 per wheel set,and the variable production cost per unit is $65.Division Q of Turbo Corporation currently buys 30,000 wheel sets (of the kind made by Division P)yearly from an outside supplier at a price of $90 per wheel set.If Division Q were to buy the 30,000 wheel sets it needs annually from Division P at $87 per wheel set,the change in annual net operating income for the company as a whole,compared to what it is currently,would be:

(Multiple Choice)

4.8/5  (35)

(35)

When a division is operating at full capacity,the transfer price to other divisions should include opportunity costs.

(True/False)

4.8/5  (38)

(38)

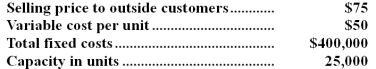

Division A produces a part with the following characteristics:  Division B, another division in the company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $28 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.

-Suppose Division A is currently operating at capacity and can sell all of the units it produces on the outside market for its usual selling price.From the point of view of Division A,any sales to Division B should be priced no lower than:

Division B, another division in the company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $28 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.

-Suppose Division A is currently operating at capacity and can sell all of the units it produces on the outside market for its usual selling price.From the point of view of Division A,any sales to Division B should be priced no lower than:

(Multiple Choice)

4.9/5  (36)

(36)

Division A produces a part with the following characteristics:  Division B, another division in the company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $28 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.

-Suppose that Division A has ample idle capacity to handle all of Division B's needs without any increase in fixed costs and without cutting into its sales to outside customers.From the point of view of Division A,any sales to Division B should be priced no lower than:

Division B, another division in the company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $28 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.

-Suppose that Division A has ample idle capacity to handle all of Division B's needs without any increase in fixed costs and without cutting into its sales to outside customers.From the point of view of Division A,any sales to Division B should be priced no lower than:

(Multiple Choice)

4.8/5  (28)

(28)

Leontif Corporation has a Parts Division that does work for other Divisions in the company as well as for outside customers.The company's Equipment Division has asked the Parts Division to provide it with 2,000 special parts each year.The special parts would require $17.00 per unit in variable production costs.

The Equipment Division has a bid from an outside supplier for the special parts at $28.00 per unit.In order to have time and space to produce the special part,the Parts Division would have to cut back production of another part-the J789 that it presently is producing.The J789 sells for $34.00 per unit,and requires $22.00 per unit in variable production costs.Packaging and shipping costs of the J789 are $4.00 per unit.Packaging and shipping costs for the new special part would be only $0.50 per unit.The Parts Division is now producing and selling 10,000 units of the J789 each year.Production and sales of the J789 would drop by 10% if the new special part is produced for the Equipment Division.

Required:

a.What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 2,000 special parts per year from the Parts Division to the Equipment Division?

b.Is it in the best interests of Leontif Corporation for this transfer to take place? Explain.

(Note: Due limitations in fonts and word processing software,> and < signs must be used in this solution rather than "greater than or equal to" and "less than or equal to" signs. )

(Essay)

4.8/5  (37)

(37)

Division X has asked Division K of the same company to supply it with 5,000 units of part L433 this year to use in one of its products.Division X has received a bid from an outside supplier for the parts at a price of $26.00 per unit.Division K has the capacity to produce 30,000 units of part L433 per year.Division K expects to sell 26,000 units of part L433 to outside customers this year at a price of $30.00 per unit.To fill the order from Division X,Division K would have to cut back its sales to outside customers.Division K produces part L433 at a variable cost of $21.00 per unit.The cost of packing and shipping the parts for outside customers is $2.00 per unit.These packing and shipping costs would not have to be incurred on sales of the parts to Division X.

Required:

a.What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 5,000 parts this year from Division X to Division K?

b.Is it in the best interests of the overall company for this transfer to take place? Explain.

(Note: Due limitations in fonts and word processing software,> and < signs must be used in this solution rather than "greater than or equal to" and "less than or equal to" signs. )

(Essay)

4.8/5  (36)

(36)

A transfer price is the price charged when one segment of a company provides goods or services to another segment of the company.

(True/False)

4.9/5  (32)

(32)

The Milk Chocolate Division of Mmmm Foods, Inc. had the following operating results last year:  Milk Chocolate expects identical operating results this year. The Milk Chocolate Division has the ability to produce and sell 200,000 pounds of chocolate annually.

-Assume that the Milk Chocolate Division is currently operating at its capacity of 200,000 pounds of chocolate.Also assume again that the Peanut Butter Division wants to purchase an additional 20,000 pounds of chocolate from Milk Chocolate.Under these conditions,what amount per pound of chocolate would Milk Chocolate have to charge Peanut Butter in order to maintain its current profit?

Milk Chocolate expects identical operating results this year. The Milk Chocolate Division has the ability to produce and sell 200,000 pounds of chocolate annually.

-Assume that the Milk Chocolate Division is currently operating at its capacity of 200,000 pounds of chocolate.Also assume again that the Peanut Butter Division wants to purchase an additional 20,000 pounds of chocolate from Milk Chocolate.Under these conditions,what amount per pound of chocolate would Milk Chocolate have to charge Peanut Butter in order to maintain its current profit?

(Multiple Choice)

4.8/5  (28)

(28)

The Post Division of the M.T. Woodhead Company produces basic posts which can be sold to outside customers or sold to the Lamp Division of the M.T. Woodhead Company. Last year the Lamp Division bought all of its 25,000 posts from Post at $1.50 each. The following data are available for last year's activities of the Post Division:  The total fixed costs would be the same for all the alternatives considered below.

-Suppose there is ample capacity so that transfers of the posts to the Lamp Division do not cut into sales to outside customers.What is the lowest transfer price that would not reduce the profits of the Post Division?

The total fixed costs would be the same for all the alternatives considered below.

-Suppose there is ample capacity so that transfers of the posts to the Lamp Division do not cut into sales to outside customers.What is the lowest transfer price that would not reduce the profits of the Post Division?

(Multiple Choice)

4.7/5  (45)

(45)

Division X makes a part with the following characteristics:  Division Y of the same company would like to purchase 10,000 units each period from Division X. Division Y now purchases the part from an outside supplier at a price of $17 each.

-Suppose that Division X is operating at capacity and can sell all of its output to outside customers.If Division X sells the parts to Division Y at $17 per unit,the company as a whole will be:

Division Y of the same company would like to purchase 10,000 units each period from Division X. Division Y now purchases the part from an outside supplier at a price of $17 each.

-Suppose that Division X is operating at capacity and can sell all of its output to outside customers.If Division X sells the parts to Division Y at $17 per unit,the company as a whole will be:

(Multiple Choice)

4.9/5  (23)

(23)

Division X makes a part that it sells to customers outside of the company.Data concerning this part appear below:  Division Y of the same company would like to use the part manufactured by Division X in one of its products.Division Y currently purchases a similar part made by an outside company for $70 per unit and would substitute the part made by Division X.Division Y requires 5,000 units of the part each period.Division X can already sell all of the units it can produce on the outside market.What should be the lowest acceptable transfer price from the perspective of Division X?

Division Y of the same company would like to use the part manufactured by Division X in one of its products.Division Y currently purchases a similar part made by an outside company for $70 per unit and would substitute the part made by Division X.Division Y requires 5,000 units of the part each period.Division X can already sell all of the units it can produce on the outside market.What should be the lowest acceptable transfer price from the perspective of Division X?

(Multiple Choice)

4.9/5  (37)

(37)

Part WY4 costs the Eastern Division of Tyble Corporation $26 to make-direct materials are $10,direct labor is $4,variable manufacturing overhead is $9,and fixed manufacturing overhead is $3.Eastern Division sells Part WY4 to other companies for $30.The Western Division of Tyble Corporation can use Part WY4 in one of its products.The Eastern Division has enough idle capacity to produce all of the units of Part WY4 that the Western Division would require.What is the lowest transfer price at which the Eastern Division should be willing to sell Part WY4 to the Central Division?

(Multiple Choice)

4.8/5  (37)

(37)

The Pole Division of Hillyard Company produces poles which can be sold to outside customers or transferred to the Flag Division of Hillyard Company. Last year the Flag Division bought 50,000 poles from Pole at $2.50 each. The following data are available for last year's activities in the Pole Division:  In order to sell 50,000 poles to the Flag Division, the Pole Division must give up sales of 30,000 poles to outside customers. That is, the Pole Division could sell 380,000 poles each year to outside customers (rather than only 350,000 poles as shown above) if it were not making sales to the Flag Division.

-Suppose that last year an outside supplier would have been willing to provide the Flag Division with the basic poles at $2.10 each.If Flag had chosen to buy all of its poles from the outside supplier instead of the Pole Division,the change in net operating income for the company as a whole would have been:

In order to sell 50,000 poles to the Flag Division, the Pole Division must give up sales of 30,000 poles to outside customers. That is, the Pole Division could sell 380,000 poles each year to outside customers (rather than only 350,000 poles as shown above) if it were not making sales to the Flag Division.

-Suppose that last year an outside supplier would have been willing to provide the Flag Division with the basic poles at $2.10 each.If Flag had chosen to buy all of its poles from the outside supplier instead of the Pole Division,the change in net operating income for the company as a whole would have been:

(Multiple Choice)

4.7/5  (36)

(36)

Showing 1 - 20 of 21

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)