Exam 8: Inventories and the Cost of Goods Sold

Exam 1: Accounting: Information for Decision Making116 Questions

Exam 2: Basic Financial Statements115 Questions

Exam 3: The Accounting Cycle: Capturing Economic Events126 Questions

Exam 4: The Accounting Cycle: Accruals and Deferrals117 Questions

Exam 5: The Accounting Cycle: Reporting Financial Results111 Questions

Exam 6: Merchandising Activities122 Questions

Exam 7: Financial Assets182 Questions

Exam 8: Inventories and the Cost of Goods Sold120 Questions

Exam 9: Plant and Intangible Assets141 Questions

Exam 10: Liabilities143 Questions

Exam 11: Stockholders Equity: Paid-In Capital120 Questions

Exam 12: Income and Changes in Retained Earnings125 Questions

Exam 13: Statement of Cash Flows130 Questions

Exam 14: Financial Statement Analysis114 Questions

Exam 15: Global Business and Accounting78 Questions

Exam 16: Management Accounting: a Business Partner104 Questions

Exam 17: Job Order Cost Systems and Overhead Allocations94 Questions

Exam 18: Process Costing65 Questions

Exam 19: Costing and the Value Chain62 Questions

Exam 20: Cost-Volume-Profit Analysis88 Questions

Exam 21: Incremental Analysis70 Questions

Exam 22: Responsibility Accounting and Transfer Pricing72 Questions

Exam 23: Operational Budgeting79 Questions

Exam 24: Standard Cost Systems91 Questions

Exam 25: Rewarding Business Performance53 Questions

Exam 26: Capital Budgeting74 Questions

Exam 27: Forms of Business Organization52 Questions

Exam 28: The Time Value of Money: Future Amounts and Present Values50 Questions

Select questions type

When prices are increasing,which inventory method will produce the highest cost of goods sold?

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

B

In a periodic inventory system,recording a sale on account involves crediting which of the following accounts?

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

A

A company with a liquid inventory will have:

Free

(Multiple Choice)

4.8/5  (48)

(48)

Correct Answer:

B

Inventory flow assumptions

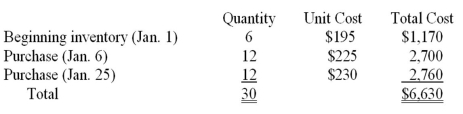

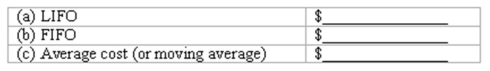

Flat TV uses a perpetual inventory system.Shown below are Flat TV's beginning inventory of a particular product and purchases during January:  On January 23 (prior to the purchase on January 25),Flat TV sold 13 units of this product.

Determine the cost of goods sold relating to the sale on January 23 under each of the following flow assumptions.(Show your computations.)

On January 23 (prior to the purchase on January 25),Flat TV sold 13 units of this product.

Determine the cost of goods sold relating to the sale on January 23 under each of the following flow assumptions.(Show your computations.)

(Essay)

4.7/5  (35)

(35)

Companies with periodic inventory systems often use techniques such as the gross profit method and the retail method to:

(Multiple Choice)

4.8/5  (43)

(43)

Overstating the ending inventory will result in understating the cost of goods sold and overstating profits.

(True/False)

4.9/5  (36)

(36)

In which of these inventory approaches is it important to determine the actual cost of a particular inventory item being sold in order to determine cost of goods sold?

(Multiple Choice)

4.8/5  (39)

(39)

If the terms of a sale are

F.O.B.shipping point,the sale should not be recorded until the goods are delivered to the buyer.

(True/False)

4.7/5  (38)

(38)

The retail inventory method requires a company to state inventory on the year-end balance sheet at its retail value.

(True/False)

4.9/5  (37)

(37)

A clothing store would logically have a higher inventory turnover rate than would a doughnut shop.

(True/False)

4.8/5  (39)

(39)

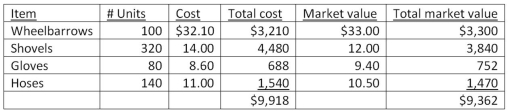

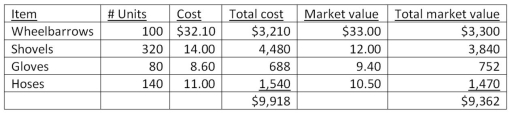

Green Leaf Company had the following information available on December 31:  Management applies the LCM rule on the basis of individual inventory items.What is the write-down required?

Management applies the LCM rule on the basis of individual inventory items.What is the write-down required?

(Multiple Choice)

4.8/5  (41)

(41)

The specific identification method is more appropriate than a cost flow assumption method:

(Multiple Choice)

4.8/5  (42)

(42)

Green Leaf Company had the following information available on December 31:  Management applies the LCM rule on the basis of the total inventory.What is the write-down required?

Management applies the LCM rule on the basis of the total inventory.What is the write-down required?

(Multiple Choice)

4.9/5  (33)

(33)

Periodic inventory systems

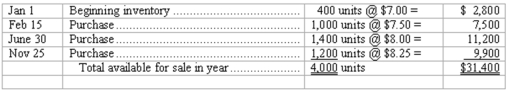

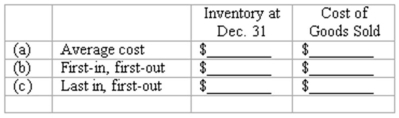

Funky Fashions uses a periodic inventory system.The beginning inventory of a particular product,and the purchases during the current year,were as follows:  At December 31,the ending inventory of this product consisted of 1,300 units.

Determine the cost of the year-end inventory and the cost of goods sold for this product under each of the following methods of inventory valuation:

At December 31,the ending inventory of this product consisted of 1,300 units.

Determine the cost of the year-end inventory and the cost of goods sold for this product under each of the following methods of inventory valuation:

(Essay)

4.8/5  (45)

(45)

The gross profit method can be used for both interim and year-end financial reporting.

(True/False)

4.9/5  (36)

(36)

The inventory turnover rate is equal to the average inventory divided by the cost of goods sold.

(True/False)

4.9/5  (39)

(39)

If all things are equal,except one company uses LIFO during inflation and the other uses FIFO,then:

(Multiple Choice)

4.8/5  (27)

(27)

Lower-of-cost-or-market

Elite Systems sells a single product.At December 31,the company's perpetual inventory records indicate 2,500 units on hand with a total cost (FIFO basis)of $155,000.The replacement cost of this product at this date is $35 per unit.

Prepare journal entries to record (a)the write-down of the inventory to the lower-of-cost-or-market value at December 31,and (b)the cash sale of 100 units on January 4 at a retail price of $50 per unit.  (a)Dec.31

(b)Jan.4

(a)Dec.31

(b)Jan.4

(Essay)

4.8/5  (36)

(36)

Showing 1 - 20 of 120

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)