Exam 2: Understanding the Accounting Cycle

Exam 1: An Introduction to Accounting139 Questions

Exam 2: Understanding the Accounting Cycle143 Questions

Exam 3: Accounting for Merchandising Businesses143 Questions

Exam 4: Internal Controls,accounting for Cash,and Ethics127 Questions

Exam 5: Accounting for Receivables and Inventory Cost Flow161 Questions

Exam 6: Accounting for Long-Term Operational Assets141 Questions

Exam 7: Accounting for Liabilities139 Questions

Exam 8: Proprietorships, partnerships, and Corporations123 Questions

Select questions type

On November 1,2012,Kelly Rowan received $2,100 in advance for services that she will perform over the next six months.Related to this transaction,list any amounts and the related accounts that will be shown on the following 2012 financial statements after adjustments.

a)Balance Sheet

b)Income Statement

c)Statement of Cash Flows

(Essay)

4.8/5  (34)

(34)

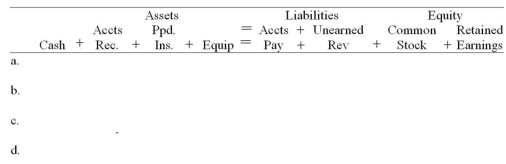

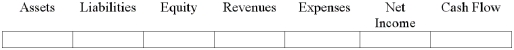

Using the form below,record each of the following 2012 transactions for Craig Corporation:

a)Nov.1.Received cash from clients for services to be performed over the next six months,$6,000.

b)Nov.1.Paid $600 for a 12-month insurance policy.

c)Dec.31.Recorded expiration of two months of the insurance.

d)Dec.31.Earned $2,000 of the amount received from clients in November.

(Essay)

4.9/5  (38)

(38)

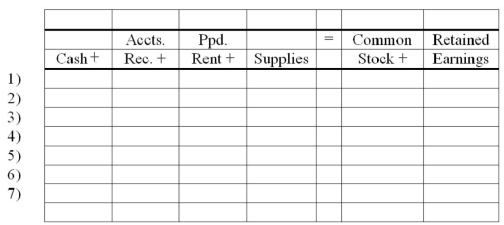

Anderson Book Company shows the following transactions for the accounting period ending December 31,2012:

1)Sold books to customers for $34,000 on account

2)Collected $28,000 from customers

3)Issued common stock for $8,000 cash

4)Prepaid four months rent for $4,400 on October 1,2012

5)Purchase supplies for $10,500 cash

6)Physical count shows $3,250 of supplies left over on December 31,2012

7)Recorded adjustment for prepaid rent used up

Show how the above transactions and yearend adjustments affect the financial statement accounts on the accounting equation.After entering all the transactions and adjustments,enter column totals.

(Essay)

4.7/5  (40)

(40)

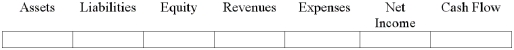

Hico Co.received a $5,000 cash advance for services to be provided to a customer in the future.

(Short Answer)

4.8/5  (31)

(31)

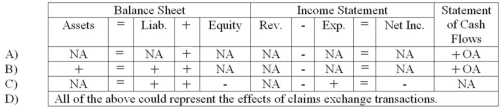

Which of the following could describe the effects of a claims exchange transaction on a company's financial statements?

(Multiple Choice)

4.9/5  (25)

(25)

Which of the following is an example of a claims exchange transaction?

(Multiple Choice)

4.8/5  (46)

(46)

Liu Co.prepaid its fire insurance for three years.The amount of cash paid for the insurance was $21,000.

(Short Answer)

4.7/5  (35)

(35)

Two of the steps in the accounting cycle are adjusting the accounts and closing the accounts.

(True/False)

4.8/5  (30)

(30)

The term "accrual" describes an earnings event that is recognized before cash is paid or received.

(True/False)

4.9/5  (39)

(39)

What was Nez's cash flow from operating activities for 2012?

(Multiple Choice)

4.8/5  (36)

(36)

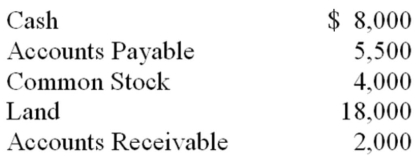

The following accounts and balances were drawn from the records of Schultz Company:  Based on this information,the amount of retained earnings was:

Based on this information,the amount of retained earnings was:

(Multiple Choice)

4.9/5  (30)

(30)

Harrison and Sons is a law firm.On September 1,2012,Harrison contracted to provide 12 months of legal services to a client.On that date,Harrison collected a $36,000 retainer and began providing services.How much revenue would Harrison report from that client for the year ending December 31,2012?

(Multiple Choice)

4.8/5  (32)

(32)

Total assets on the December 31,2012 balance sheet amounted to

(Multiple Choice)

4.8/5  (43)

(43)

Give an example of a transaction that decreases a liability and increases equity.

(Essay)

4.9/5  (30)

(30)

The amount of net income shown on the December 31,2012 income statement would amount to:

(Multiple Choice)

4.9/5  (40)

(40)

After closing,the only accounts with non-zero balances are assets,liabilities,and equity.

(True/False)

4.8/5  (41)

(41)

Which of the following lists represents the correct sequence of stages in an accounting cycle?

(Multiple Choice)

4.8/5  (29)

(29)

Showing 41 - 60 of 143

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)