Exam 19: A Macroeconomic Theory of the Open Economy

Exam 1: Ten Principles of Economics438 Questions

Exam 2: Thinking Like an Economist620 Questions

Exam 3: Interdependence and the Gains From Trade527 Questions

Exam 4: The Market Forces of Supply and Demand700 Questions

Exam 5: Elasticity and Its Application598 Questions

Exam 6: Supply, Demand, and Government Policies648 Questions

Exam 7: Consumers, Producers, and the Efficiency of Markets547 Questions

Exam 8: Application: the Costs of Taxation514 Questions

Exam 9: Application: International Trade496 Questions

Exam 10: Measuring a Nations Income522 Questions

Exam 11: Measuring the Cost of Living545 Questions

Exam 12: Production and Growth507 Questions

Exam 13: Saving, Investment, and the Financial System567 Questions

Exam 14: The Basic Tools of Finance513 Questions

Exam 15: Unemployment699 Questions

Exam 16: The Monetary System517 Questions

Exam 17: Money Growth and Inflation487 Questions

Exam 18: Open-Economy Macroeconomics: Basic Concepts522 Questions

Exam 19: A Macroeconomic Theory of the Open Economy484 Questions

Exam 20: Aggregate Demand and Aggregate Supply563 Questions

Exam 21: The Influence of Monetary and Fiscal Policy on Aggregate Demand511 Questions

Exam 22: The Short-Run Trade-Off Between Inflation and Unemployment516 Questions

Exam 23: Six Debates Over Macroeconomic Policy372 Questions

Select questions type

If after a country experiences capital flight, people become more confident about the safety of its assets, then in that country

(Multiple Choice)

4.8/5  (34)

(34)

In the open-economy macroeconomic model which of the following falls if there is an increase in the budget deficit?

(Multiple Choice)

4.8/5  (43)

(43)

Because depreciation of the real exchange rate of the dollar increases U.S. net exports, the demand curve for dollars in the foreign-currency exchange market is downward sloping.

(True/False)

4.9/5  (38)

(38)

Which of the following is most likely to result if foreigners decide to withdraw the funds that they have loaned to the United States?

(Multiple Choice)

4.7/5  (32)

(32)

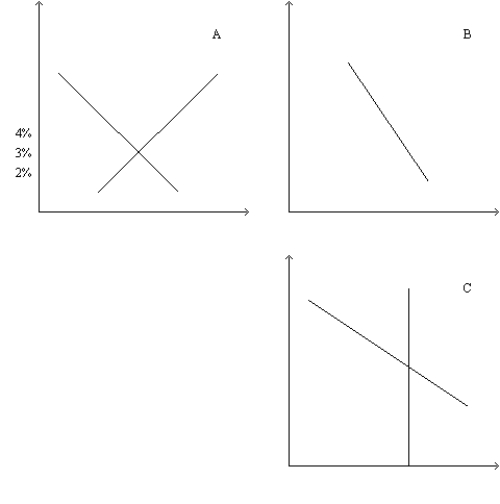

Figure 32-4

Refer to this diagram of the open-economy macroeconomic model to answer the questions below.

-Refer to Figure 32-4. Suppose that the government goes from a budget surplus to a budget deficit. The effects of the change could be illustrated by

-Refer to Figure 32-4. Suppose that the government goes from a budget surplus to a budget deficit. The effects of the change could be illustrated by

(Multiple Choice)

4.7/5  (25)

(25)

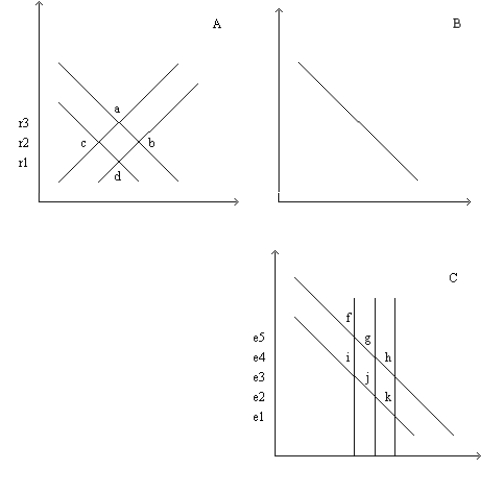

Figure 32-6

Refer to this diagram of the open-economy macroeconomic model to answer the questions below.

-Refer to Figure 32-6. If equilibrium were at point j and the government imposed import quotas the equilibrium moves to

-Refer to Figure 32-6. If equilibrium were at point j and the government imposed import quotas the equilibrium moves to

(Multiple Choice)

4.8/5  (31)

(31)

A German company wants to buy dollars to purchase U.S. bonds. In the open-economy macroeconomic model of the U.S., this transaction would be accounted for in

(Multiple Choice)

4.8/5  (34)

(34)

If a country removed an import quota on cotton, then overall that country's

(Multiple Choice)

4.8/5  (40)

(40)

If the risk of buying U.S. assets rises because it is discovered that lending institutions had not carefully evaluated borrowers prior to lending them funds, then

(Multiple Choice)

4.8/5  (38)

(38)

If the people thought that many banks in a certain country were at or near the point of bankruptcy, then that country's real exchange rate

(Multiple Choice)

4.8/5  (37)

(37)

In the open-economy macroeconomic model, at the equilibrium real interest rate, the amount that people including government) want to save equals desired quantities of domestic investment and net capital outflow.

(True/False)

4.9/5  (33)

(33)

In the open-economy macroeconomic model, if the supply of loanable funds shifts right, then

(Multiple Choice)

4.8/5  (36)

(36)

A country recently had 500 billion euros of national saving and 200 billion euros of domestic investment. What was its net capital outflow? What was its quantity of loanable funds demanded?

(Essay)

4.8/5  (42)

(42)

If a country makes political reforms so that people now believe this country's assets are less risky, what happens to its interest rate, its exchange rate, and its net exports?

(Essay)

4.9/5  (36)

(36)

A country produces two goods, soda and chips. It currently exports soda and imports chips. If it were to impose a tariff on chips,

(Multiple Choice)

4.7/5  (33)

(33)

In the open-economy macroeconomic model, if the supply of loanable funds shifts right, then

(Multiple Choice)

4.8/5  (37)

(37)

Refer to Shoe Quota. At a given exchange rate what does a quota do to desired net exports? As a result of this change which curve in the open-economy model shifts and which direction does it shift?

(Essay)

4.8/5  (35)

(35)

According to the open-economy macroeconomic model, if the United States moved from a government budget deficit to a government budget surplus, U.S. real interest rates would increase and the real exchange rate of the U.S. dollar would appreciate.

(True/False)

4.8/5  (37)

(37)

Other things the same, an increase in the U.S. interest rate causes the quantity of loanable funds supplied to

(Multiple Choice)

4.7/5  (38)

(38)

Showing 21 - 40 of 484

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)