Exam 3: The Financial System and the Level of Interest Rates

Exam 1: The Financial Manager and the Firm85 Questions

Exam 2: The Financial System and the Level of Interest Rates76 Questions

Exam 3: The Financial System and the Level of Interest Rates94 Questions

Exam 4: Analyzing Financial Statements113 Questions

Exam 5: The Time Value of Money130 Questions

Exam 6: Discounted Cash Flows and Valuation112 Questions

Exam 7: Risk and Return85 Questions

Exam 8: Bond Valuation and the Structure of Interest Rates81 Questions

Exam 9: Stock Valuation99 Questions

Exam 10: The Fundamentals of Capital Budgeting91 Questions

Exam 11: Cash Flows and Capital Budgeting90 Questions

Exam 12: Evaluating Project Economics94 Questions

Exam 13: The Cost of Capital87 Questions

Exam 14: Working Capital Management82 Questions

Exam 15: How Firms Raise Capital82 Questions

Exam 16: Capital Structure Policy91 Questions

Exam 17: Dividends, Stock Repurchases, and Payout Policy83 Questions

Exam 18: Business Formation, Growth, and Valuation85 Questions

Exam 19: Financial Planning and Managing Growth93 Questions

Exam 20: Options and Corporate Finance111 Questions

Exam 21: International Financial Management84 Questions

Select questions type

Which of the following is NOT true about treasury stock?

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

C

The going concern assumption states that a business will be shutting down its operation in the near future.

Free

(True/False)

4.9/5  (39)

(39)

Correct Answer:

False

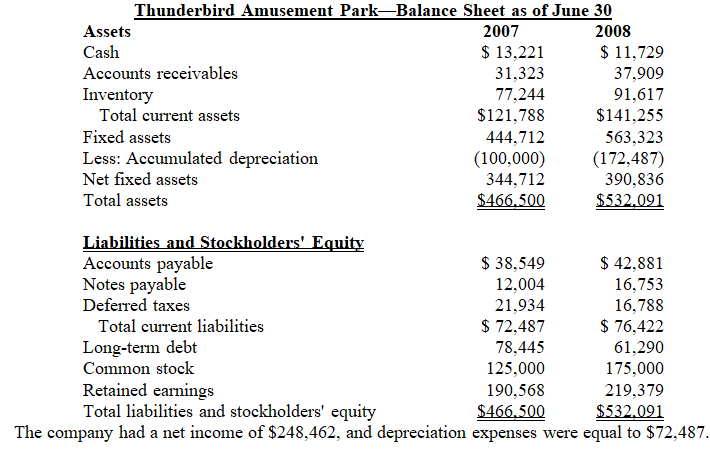

What is the firm's cash flow from financing activities?

Free

(Multiple Choice)

4.9/5  (32)

(32)

Correct Answer:

D

Cash flows from operations are the net cash flows that support a firm's principal business activities.

(True/False)

4.8/5  (33)

(33)

Simplex Healthcare had net income of $5,411,623 after paying taxes at 34 percent. The firm had revenues of $20,433,770.Its interest expense for the year was $1,122,376, while depreciation expense was $2,079,112. What was the firm's operating expenses excluding depreciation? Round your intermediate calculations and final answer to the nearest dollar.

(Multiple Choice)

4.9/5  (33)

(33)

Which of the following best represents cash flows to investors?

(Multiple Choice)

4.9/5  (37)

(37)

The cost principle calls for the recognition of all accounting transactions at their current market value.

(Essay)

4.8/5  (36)

(36)

Which of the following is the best example of how a market-value balance sheet item differs from the firm's book-value balance sheet item?

(Multiple Choice)

4.9/5  (44)

(44)

Tre-Bien Bakeries generated net income of $233,412 this year. At year end, the company had accounts receivables of $47,199, inventory of $63,781, and cash of $21,461. It also had accounts payables of $51,369, short-term notes payables of $11,417, and accrued taxes of $6,145. The net working capital of the firm is

(Multiple Choice)

4.7/5  (43)

(43)

Which of the following statements is NOT a limitation associated with market valuation of balance sheet accounts?

(Multiple Choice)

4.7/5  (35)

(35)

During rising prices, a company using the FIFO method will sell its newest, highest-cost inventory first.

(True/False)

4.9/5  (32)

(32)

In a balance sheet, assets are listed in order of their liquidity.

(True/False)

4.8/5  (43)

(43)

Galan Associates prepared its financial statement for 2008 based on the information given here. The company had cash worth $1,234, inventory worth $13,480, and accounts receivables worth $7,789. The company's net fixed assets are $42,331, and other assets are $1,822. It had accounts payables of $9,558, notes payables of $2,756, common stock of $22,000, and retained earnings of $14,008. How much long-term debt does the firm have?

(Multiple Choice)

4.9/5  (35)

(35)

The realization principle assumes that the parties to a transaction are economically rational and are free to act independently of each other.

(True/False)

4.8/5  (37)

(37)

According to the realization principle, revenue from a sale of a firm's products are recognized:

(Multiple Choice)

4.9/5  (37)

(37)

-Triumph Trading Company provided the following information to its auditors. For the year ended March 31, 2008, the company had revenues of $1,122,878, operating expenses (excluding depreciation and leasing expenses) of $612,663, depreciation expenses of $231,415, leasing expenses of $126,193, and interest expenses of $87,125. If the company's average tax rate was 34 percent, what is its net income after taxes? Round your final answer to the nearest dollar.

-Triumph Trading Company provided the following information to its auditors. For the year ended March 31, 2008, the company had revenues of $1,122,878, operating expenses (excluding depreciation and leasing expenses) of $612,663, depreciation expenses of $231,415, leasing expenses of $126,193, and interest expenses of $87,125. If the company's average tax rate was 34 percent, what is its net income after taxes? Round your final answer to the nearest dollar.

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following presents a summary of the changes in a firm's balance sheet from the beginning of an accounting period to the end of an accounting period?

(Multiple Choice)

4.8/5  (31)

(31)

Trekkers Footwear bought a piece of machinery on January 1, 2006 at a cost of $2.3 million, and the machinery is being depreciated annually at an amount of $230,000 for 10 years. Its market value on December 31, 2008 is $1.75 million. The firm's accountant is preparing its financial statement for the fiscal year end on December 31, 2008. The net value of the asset that should be reported on the balance sheet is:

(Multiple Choice)

4.7/5  (34)

(34)

When prices are falling, the value of inventory using the LIFO method rather than FIFO gives:

(Multiple Choice)

4.8/5  (40)

(40)

Showing 1 - 20 of 94

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)