Exam 17: Job Order Cost Systems and Overhead Allocations

Exam 1: Accounting: Information for Decision Making118 Questions

Exam 2: Basic Financial Statements142 Questions

Exam 3: The Accounting Cycle: Capturing Economic Events150 Questions

Exam 4: The Accounting Cycle: Accruals and Deferrals131 Questions

Exam 5: The Accounting Cycle: Reporting Financial Results126 Questions

Exam 6: Merchandising Activities121 Questions

Exam 7: Financial Assets206 Questions

Exam 8: Inventories and the Cost of Goods Sold147 Questions

Exam 9: Plant and Intangible Assets147 Questions

Exam 10: Liabilities197 Questions

Exam 11: Stockholders Equity: Paid-In Capital148 Questions

Exam 12: Income and Changes in Retained Earnings133 Questions

Exam 13: Statement of Cash Flows163 Questions

Exam 14: Financial Statement Analysis146 Questions

Exam 15: Global Business and Accounting82 Questions

Exam 16: Management Accounting112 Questions

Exam 17: Job Order Cost Systems and Overhead Allocations103 Questions

Exam 18: Process Costing83 Questions

Exam 19: Costing and the Value Chain70 Questions

Exam 20: Cost-Volume-Profit Analysis121 Questions

Exam 21: Incremental Analysis97 Questions

Exam 22: Responsibility Accounting and Transfer Pricing88 Questions

Exam 23: Operational Budgeting93 Questions

Exam 24: Standard Cost Systems110 Questions

Exam 25: Rewarding Business Performance69 Questions

Exam 26: Capital Budgeting99 Questions

Exam 27: the Time Value of Money: Future Amounts and Present Values49 Questions

Exam 28: Forms of Business Organization51 Questions

Select questions type

Accounting terminology

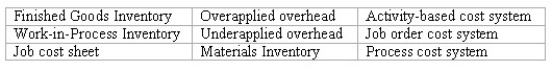

Listed below are nine technical accounting terms introduced or emphasized in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

________ (a)The balance remaining in the Manufacturing Overhead account when the overhead application rate used during the period is too low.

________ (b)The account credited as component parts are transferred into production.

________ (c)A schedule used to accumulate manufacturing costs and to determine the unit costs associated with a specific customer's order.

________ (d)The inventory account credited when the cost of goods sold is recorded.

________ (e)The type of cost accounting system most likely used by an oil refinery engaged in the continuous production of petroleum products.

________ (f)The inventory account debited when manufacturing cost accounts (such as Direct Labor or Materials Inventory)are credited.

________ (g)The type of cost accounting system likely to be used by a machine shop that manufactures items to the specifications provided by its customers.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

________ (a)The balance remaining in the Manufacturing Overhead account when the overhead application rate used during the period is too low.

________ (b)The account credited as component parts are transferred into production.

________ (c)A schedule used to accumulate manufacturing costs and to determine the unit costs associated with a specific customer's order.

________ (d)The inventory account credited when the cost of goods sold is recorded.

________ (e)The type of cost accounting system most likely used by an oil refinery engaged in the continuous production of petroleum products.

________ (f)The inventory account debited when manufacturing cost accounts (such as Direct Labor or Materials Inventory)are credited.

________ (g)The type of cost accounting system likely to be used by a machine shop that manufactures items to the specifications provided by its customers.

Free

(Essay)

4.8/5  (41)

(41)

Correct Answer:

(a)Under-applied overhead (b)Materials Inventory (c)Job cost sheet (d)Finished Goods Inventory (e)Process cost system (f)Work in Process Inventory (g)Job order cost system

Activity-based costing systems always result in more accurate measurements of unit costs.

Free

(True/False)

4.7/5  (42)

(42)

Correct Answer:

True

An overhead application rate is computed by dividing the actual overhead costs by the expected amount of units in the activity base.

Free

(True/False)

4.7/5  (30)

(30)

Correct Answer:

False

The employee time card for John Winter indicates that he spent last week performing routine maintenance on factory machinery.Payments made to Winter for last week's work should be:

(Multiple Choice)

4.8/5  (31)

(31)

[The following information applies to the questions displayed below.]

Canfield Construction applies overhead to its projects at a rate of $65 per direct labor hour.Laborers are paid an average rate of $30 per hour.The Jefferson Apartments project was charged a total of $1,200,000 in direct materials and $450,000 in direct labor costs.

-Overhead applied to the Jefferson Apartments project amounted to:

(Multiple Choice)

4.8/5  (42)

(42)

A credit balance in the manufacturing overhead account at month end indicates that the actual overhead costs were less than the amount of overhead costs applied to jobs.

(True/False)

4.8/5  (28)

(28)

Benefits of activity-based costing include all of the following except:

(Multiple Choice)

4.9/5  (38)

(38)

A principal objective of cost accounting systems is to ensure that cost reports to management are prepared in accordance with generally accepted accounting principles.

(True/False)

4.8/5  (35)

(35)

In a job order cost system,the costs of direct materials,direct labor,and manufacturing overhead are accumulated separately for each department for a given period of time.

(True/False)

4.8/5  (40)

(40)

Allocating activity cost pools to products

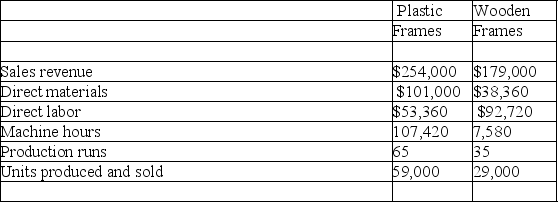

Burgandy Corporation makes plastic and wooden picture frames.The company has assigned $107,000 in monthly manufacturing overhead costs to two cost pools as follows: $67,000 to power costs,and $40,000 to production set-up costs.Additional monthly data are provided below:

Power costs are allocated to products using machine hours as an activity base.Set-up costs are allocated to products based on the number of production runs each product line requires.

(a)Allocate manufacturing overhead from the activity cost pools to each product line.

(b)Compare the total per-unit cost of manufacturing plastic frames and wooden frames.

(c)On a per-unit basis,which product line appears to be most profitable?

Power costs are allocated to products using machine hours as an activity base.Set-up costs are allocated to products based on the number of production runs each product line requires.

(a)Allocate manufacturing overhead from the activity cost pools to each product line.

(b)Compare the total per-unit cost of manufacturing plastic frames and wooden frames.

(c)On a per-unit basis,which product line appears to be most profitable?

(Essay)

4.9/5  (33)

(33)

If manufacturing overhead is materially over-applied,it is best to:

(Multiple Choice)

5.0/5  (37)

(37)

Doyle Co.uses a job order cost accounting system.At year-end the Work-in-Process Inventory controlling account showed a debit balance of $43,125.For the two jobs in process at year-end,one showed $6,000 in direct materials and $4,500 in direct labor.The job cost sheet for the second job showed $9,000 in direct materials and $6,750 in direct labor.If the company is using a predetermined overhead application rate based on direct labor cost,the rate is:

(Multiple Choice)

4.9/5  (34)

(34)

In an activity-based costing system,manufacturing overhead costs are divided into separate:

(Multiple Choice)

4.9/5  (38)

(38)

The advantage of using a predetermined overhead application rate is that:

(Multiple Choice)

4.9/5  (39)

(39)

The cost of salaries paid to employees who work in a factory maintaining the heating system is considered:

(Multiple Choice)

4.8/5  (37)

(37)

Overhead application rate

Define the term cost driver and explain the role of this item in the computation of an overhead application rate.

(Essay)

4.9/5  (30)

(30)

The document that provides information for the cost of goods manufactured is:

(Multiple Choice)

4.7/5  (33)

(33)

Showing 1 - 20 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)