Exam 8: Simple Interest Applications

Exam 1: Review of Arithmetic116 Questions

Exam 2: Review of Basic Algebra232 Questions

Exam 3: Ratio,proportion,and Percent188 Questions

Exam 4: Linear Systems75 Questions

Exam 5: Cost-Volume-Profit Analysis and Break-Even39 Questions

Exam 6: Trade Discounts, cash Discounts, markup, and Markdown143 Questions

Exam 7: Simple Interest114 Questions

Exam 8: Simple Interest Applications75 Questions

Exam 9: Compound Interestfuture Value and Present Value147 Questions

Exam 10: Compound Interestfurther Topics64 Questions

Exam 11: Ordinary Simple Annuities89 Questions

Exam 12: Ordinary General Annuities89 Questions

Exam 13: Annuities Due, deferred Annuities, and Perpetuities157 Questions

Exam 14: Amortization of Loans,including Residential Mortgages71 Questions

Exam 15: Bond Valuation and Sinking Funds97 Questions

Exam 16: Investment Decision Applications67 Questions

Select questions type

A promissory note has a face value of $6000 and it has a date of issue of June 1 this year.The term is for 6 months.The rate of interest is 8.00%.What is the maturity value of the note?

(Multiple Choice)

4.8/5  (39)

(39)

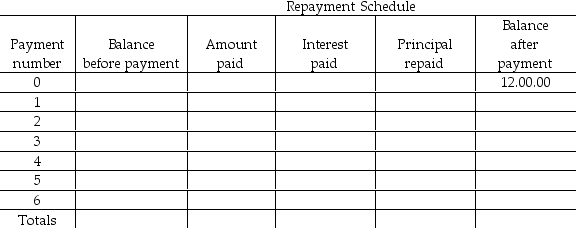

You borrowed the amount indicated in the Balance after payment column of the following schedule from your friendly credit union.You agreed to repay the loan in monthly payments equal to  of the original loan,including interest due and principal.Interest is charged at a rate of 12.2% per annum computed on the monthly balance.

of the original loan,including interest due and principal.Interest is charged at a rate of 12.2% per annum computed on the monthly balance.

Required: Complete the repayment schedule (this includes totalling of the Payment,Interest paid and Principal repaid columns to check the accuracy of your work).

a)What is the loan balance after the third payment?

b)What is the total amount needed to repay the loan?

Required: Complete the repayment schedule (this includes totalling of the Payment,Interest paid and Principal repaid columns to check the accuracy of your work).

a)What is the loan balance after the third payment?

b)What is the total amount needed to repay the loan?

(Essay)

4.9/5  (33)

(33)

PC Financial approved a $75 000 line of credit on a demand basis to Little Blessings day care to finance equipment.Interest at the rate of prime plus 1% is charged to the account at the bank on the 15th of each month.The initial advance was $45 000 on July 15,when the prime rate stood at 3%.There were further advances of $8000 on August 20 and $10 000 on September 10.Payments of $15 000 each were applied against the principal on October 1 and November 1.What was the total interest accumulated on the loan for the period July 15 to November 15?

(Essay)

4.8/5  (33)

(33)

Marty took a $5000 loan from a financial institute at a rate of 6%,which should be repaid in two equal installments of $2575.25 made every 4 months.How much more interest would have been paid,had Marty paid it in a single installment after 8 months?

(Multiple Choice)

4.8/5  (34)

(34)

You bought a $100 000 91-day T-bill for $99 453.67 61 days before maturity.What discount rate was used?

(Multiple Choice)

4.9/5  (43)

(43)

Find the maturity value of a $473 note issued on October 4 at 8.5% for 190 days.

(Essay)

4.9/5  (40)

(40)

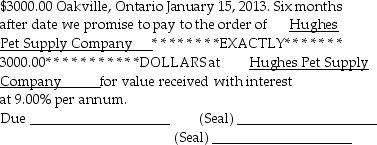

For the following promissory note,determine the amount of interest due at maturity.

(Essay)

4.8/5  (31)

(31)

Average rate of return or yield on a 6-month Government of Canada treasury bills sold on June 18,2013 was 1.04% (http://www.bankofcanada.ca/rates/interest-rates/t-bill-yields/).At this yield,what price was paid for a T-bill with a face value of $50 000?

(Multiple Choice)

4.9/5  (37)

(37)

Find the maturity date and the maturity value of a $1415.00,5.25%,220-day note dated February 25,2012.

(Essay)

4.7/5  (29)

(29)

Calculate the legal due date of a $10 000,120-day note with interest at 4.56% dated March 31,2012.

(Multiple Choice)

4.8/5  (36)

(36)

Lee is planning to buy furniture worth $7000 from Leons.He can buy on his MasterCard and pay it within 7 days following the grace period of 21 days.His second option is to buy on the personal (unsecured)line of credit and pay it back after 6 months.His third option is to use secured line of credit and pay it back in 9 months.MasterCard charges an interest rate of 19.9%.Unsecured line of credit charges a rate of prime (3%)plus 3% and secured line of credit charges a rate of prime plus 0.5%.What is his best option?

(Multiple Choice)

4.8/5  (43)

(43)

Amertech borrowed $32 000.00 from Balzac Credit Union on May 17 at 12%.The interest rate was changed to 14.11% effective July 1 and to 13.27% effective October 1.The loan was repaid by payments of $17 000.000 on July 15 and the balance,including the accumulated interest,on November 20.How much did the loan cost?

(Essay)

4.9/5  (23)

(23)

You bought $150 000 in 364-day T-bills.The T-bills were discounted at a rate of 4.432%.If you paid $148 811.24 for the T-bills,how many days before maturity did you buy it?

(Multiple Choice)

5.0/5  (31)

(31)

On July 12,2013 a 140-day note promissory note for $9 175 with interest at 5.75% was issued.Find the proceeds of the note on September 30,2013 if money is worth 7%.

(Essay)

4.9/5  (41)

(41)

Raymond borrowed $3900.00 from Airdrie Regional Savings.The line of credit agreement provided for repayment of the loan in four equal monthly payments plus interest at 9.56% per annum calculated on the unpaid balance.Determine the total interest cost.

(Essay)

4.8/5  (36)

(36)

Showing 61 - 75 of 75

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)