Exam 5: Time Value of Money

Exam 1: An Overview of Financial Management65 Questions

Exam 2: Financial Markets and Institutions33 Questions

Exam 3: Financial Statements,cash Flow,and Taxes138 Questions

Exam 4: Analysis of Financial Statements133 Questions

Exam 5: Time Value of Money164 Questions

Exam 6: Interest Rates82 Questions

Exam 7: Bonds and Their Valuation91 Questions

Exam 8: Risk and Rates of Return147 Questions

Exam 9: Stocks and Their Valuation89 Questions

Exam 10: The Cost of Capital94 Questions

Exam 11: The Basics of Capital Budgeting107 Questions

Exam 12: Cash Flow Estimation and Risk Analysis75 Questions

Exam 13: Capital Structure and Leverage88 Questions

Exam 15: Working Capital Management124 Questions

Exam 16: Financial Planning and Forecasting39 Questions

Exam 17: Multinational Financial Management50 Questions

Exam 18: Interest Rates and Compounding8 Questions

Exam 19: Zero Coupon Bonds and Taxation18 Questions

Exam 20: Taxes, Bankruptcy Act, and Financial Management4 Questions

Exam 21: Capital Budgeting and Risk Analysis5 Questions

Exam 22: Financial Analysis and Capital Structure Decision Making3 Questions

Exam 23: Comparing Two Mutually Exclusive Projects: NPV and Equivalent Annual Annuity Analysis2 Questions

Exam 24: Financial Leverage and Operating Leverage23 Questions

Select questions type

Which of the following statements regarding a 15-year (180-month)$125,000,fixed-rate mortgage is CORRECT? (Ignore taxes and transactions costs. )

(Multiple Choice)

4.9/5  (30)

(30)

The greater the number of compounding periods within a year,then (1)the greater the future value of a lump sum investment at Time 0 and (2)the greater the present value of a given lump sum to be received at some future date.

(True/False)

4.9/5  (33)

(33)

You are negotiating to make a 7-year loan of $37,500 to Breck Inc.To repay you,Breck will pay $2,500 at the end of Year 1,$5,000 at the end of Year 2,and $7,500 at the end of Year 3,plus a fixed but currently unspecified cash flow,X,at the end of each year from Year 4 through Year 7.Breck is essentially riskless,so you are confident the payments will be made.You regard 8% as an appropriate rate of return on a low risk but illiquid 7-year loan.What cash flow must the investment provide at the end of each of the final 4 years,that is,what is X?

(Multiple Choice)

5.0/5  (36)

(36)

Which of the following statements is CORRECT,assuming positive interest rates and holding other things constant?

(Multiple Choice)

4.7/5  (41)

(41)

Which of the following statements regarding a 30-year monthly payment amortized mortgage with a nominal interest rate of 10% is CORRECT?

(Multiple Choice)

5.0/5  (35)

(35)

Your father's employer was just acquired,and he was given a severance payment of $442,500,which he invested at a 7.5% annual rate.He now plans to retire,and he wants to withdraw $35,000 at the end of each year,starting at the end of this year.How many years will it take to exhaust his funds,i.e. ,run the account down to zero?

(Multiple Choice)

4.8/5  (33)

(33)

You deposit $500 today in a savings account that pays 6% interest,compounded annually.How much will your account be worth at the end of 20 years?

(Multiple Choice)

5.0/5  (40)

(40)

When a loan is amortized,a relatively low percentage of the payment goes to reduce the outstanding principal in the early years,and the principal repayment's percentage increases in the loan's later years.

(True/False)

4.9/5  (39)

(39)

Suppose you are buying your first condo for $300,000,and you will make a $15,000 down payment.You have arranged to finance the remainder with a 30-year,monthly payment,amortized mortgage at a 6.5% nominal interest rate,with the first payment due in one month.What will your monthly payments be?

(Multiple Choice)

5.0/5  (34)

(34)

Steve and Ed are cousins who were both born on the same day,and both turned 25 today.Their grandfather began putting $2,300 per year into a trust fund for Steve on his 20th birthday,and he just made a 6th payment into the fund.The grandfather (or his estate's trustee)will make 40 more $2,300 payments until a 46th and final payment is made on Steve's 65th birthday.The grandfather set things up this way because he wants Steve to work,not be a "trust fund baby," but he also wants to ensure that Steve is provided for in his old age.

Until now,the grandfather has been disappointed with Ed,hence has not given him anything.However,they recently reconciled,and the grandfather decided to make an equivalent provision for Ed.He will make the first payment to a trust for Ed today,and he has instructed his trustee to make 40 additional equal annual payments until Ed turns 65,when the 41st and final payment will be made.If both trusts earn an annual return of 8%,how much must the grandfather put into Ed's trust today and each subsequent year to enable him to have the same retirement nest egg as Steve after the last payment is made on their 65th birthday?

(Multiple Choice)

4.9/5  (41)

(41)

Suppose you have $2,350 and plan to purchase a 5-year certificate of deposit (CD)that pays 3.5% interest,compounded annually.How much will you have when the CD matures?

(Multiple Choice)

4.7/5  (40)

(40)

The payment made each period on an amortized loan is constant,and it consists of some interest and some principal.The closer we are to the end of the loan's life,the greater the percentage of the payment that will be a repayment of principal.

(True/False)

4.9/5  (40)

(40)

Last year Dania Corporation's sales were $525 million.If sales grow at 9.5% per year,how large (in millions)will they be 8 years later?

(Multiple Choice)

4.8/5  (41)

(41)

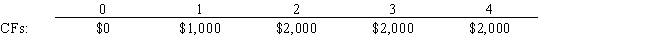

You sold a car and accepted a note with the following cash flow stream as your payment.What was the effective price you received for the car assuming an interest rate of 7.0%?

(Multiple Choice)

4.8/5  (36)

(36)

If we are given a periodic interest rate,say a monthly rate,we can find the nominal annual rate by multiplying the periodic rate by the number of periods per year.

(True/False)

4.8/5  (42)

(42)

Starting to invest early for retirement increases the benefits of compound interest.

(True/False)

4.9/5  (40)

(40)

Suppose an Exxon Corporation bond will pay $4,500 ten years from now.If the going interest rate on safe 10-year bonds is 5.60%,how much is the bond worth today?

(Multiple Choice)

4.7/5  (40)

(40)

Sue now has $280.How much would she have after 8 years if she leaves it invested at 8.5% with annual compounding?

(Multiple Choice)

4.9/5  (37)

(37)

Showing 61 - 80 of 164

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)