Exam 7: Analyzing Common Stocks

Exam 1: The Investment Environment83 Questions

Exam 2: Securities Markets and Transactions114 Questions

Exam 3: Investment Information and Securities Transactions134 Questions

Exam 4: Return and Risk133 Questions

Exam 5: Modern Portfolio Concepts111 Questions

Exam 6: Common Stocks137 Questions

Exam 7: Analyzing Common Stocks131 Questions

Exam 8: Stock Valuation124 Questions

Exam 9: Market Efficiency and Behavioral Finance122 Questions

Exam 10: Fixed-Income Securities129 Questions

Exam 11: Bond Valuation125 Questions

Exam 12: Mutual Funds and Exchange-Traded Funds121 Questions

Exam 13: Managing Your Own Portfolio123 Questions

Exam 14: Options: Puts and Calls132 Questions

Exam 15: Futures Markets and Securities112 Questions

Select questions type

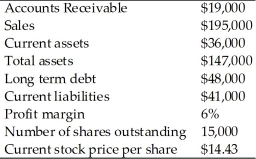

The following information is available for the Oil Creek Corporation.  (a)What is the current ratio?

(b)What is the net working capital?

(c)What is the net income?

(d)What is the return on equity?

(e)What is the total asset turnover?

(f)What is the debt-equity ratio?

(g)What is the accounts receivable turnover?

(h)What is the earnings per share (EPS)?

(i)What is the price to earnings (P/E)ratio?

(a)What is the current ratio?

(b)What is the net working capital?

(c)What is the net income?

(d)What is the return on equity?

(e)What is the total asset turnover?

(f)What is the debt-equity ratio?

(g)What is the accounts receivable turnover?

(h)What is the earnings per share (EPS)?

(i)What is the price to earnings (P/E)ratio?

(Essay)

4.9/5  (34)

(34)

The Allied Computer Co.has sales of $300 million, a net profit margin of 9%, and 10 million shares of common stock outstanding.It has no preferred stock outstanding.If Allied stock trades at $50 per share, it has a price/earnings ratio of 20.9.

(True/False)

4.9/5  (36)

(36)

Ratio analysis is the study of the relationships between various financial statement accounts.

(True/False)

5.0/5  (30)

(30)

List and explain the various stages of the growth cycle of an industry.Also discuss the merit of investing in the industry during each of the various stages.

(Essay)

4.8/5  (33)

(33)

Developing a general economic outlook assists in the identification of industries and firms that might be good investment opportunities.

(True/False)

4.8/5  (30)

(30)

Which of the following are measures of liquidity?

I.net working capital

II.accounts receivable turnover

III.current ratio

IV.times interest earned

(Multiple Choice)

4.8/5  (43)

(43)

A high PEG ratio implies a high growth rate in earnings relative to the stock's price.

(True/False)

4.8/5  (43)

(43)

Changes in stock prices tend to lag changes in level of economic activity by several months.

(True/False)

4.9/5  (39)

(39)

Most firms tend to be more profitable and have higher stock values when the economy is strong.

(True/False)

4.9/5  (37)

(37)

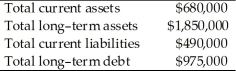

On December 31, the Gold Standard Company reported the following information on its financial statements.  According to this information, the company's current ratio is approximately

According to this information, the company's current ratio is approximately

(Multiple Choice)

4.9/5  (25)

(25)

Briefly describe and discuss industry analysis and the motivation behind it.

(Essay)

4.8/5  (35)

(35)

Calculating the times interest earned ratio using EBITDA is more conservative than using EBIT because it takes the cost of replacing fixed assets into consideration.

(True/False)

4.9/5  (42)

(42)

Fundamental analysis can only be profitable if some securities are at least temporarily mispriced.

(True/False)

4.8/5  (32)

(32)

Briefly describe fundamental analysis and the basic assumption behind it.

(Essay)

4.8/5  (40)

(40)

Positive cash flow from investing activities is typical of firms experiencing healthy growth.

(True/False)

4.8/5  (35)

(35)

If a firm has an equity multiplier of 3, this means that the firm has $3 in equity for every $1 in long-term debt.

(True/False)

4.9/5  (41)

(41)

The consumer electronics industry would be most significantly affected by

(Multiple Choice)

5.0/5  (40)

(40)

In seeking potential stock investments, most analysts look for companies that have PEG ratios that are equal to or less than one.

(True/False)

4.8/5  (32)

(32)

ROE = (net profit margin)(total asset turnover)(equity multiplier).What is the advantage of using this expanded version of the ROE formula versus using the simplified version which is net income divided by total equity?

(Essay)

4.9/5  (28)

(28)

Showing 61 - 80 of 131

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)