Exam 6: Simple Interest

Exam 1: Review and Applications of Basic Mathematics385 Questions

Exam 2: A: Review and Applications of Algebra223 Questions

Exam 2: B: Review and Applications of Algebra242 Questions

Exam 3: Ratios and Proportions298 Questions

Exam 4: Mathematics of Merchandising295 Questions

Exam 5: Cost-Volume-Profit Analysis137 Questions

Exam 6: Simple Interest302 Questions

Exam 7: Applications of Simple Interest168 Questions

Exam 8: Compound Interest: Future Value and Present Value325 Questions

Exam 9: Compound Interest: Further Topics and Applications397 Questions

Exam 10: Annuities: Future Value and Present Value257 Questions

Exam 11: Annuities: Periodic Payment, Number of Payments, and Interest Rate253 Questions

Exam 12: Annuities: Special Situations186 Questions

Exam 13: Loan Amortization; Mortgages188 Questions

Select questions type

The first two of the following three payments were not made as scheduled. $1,200 was due seven months ago, $900 was due two months ago, and $1,500 is due in one month. The three payments are to be replaced by a single equivalent payment due three months from now. What should the payment be if money is worth 9.9%? Use three months from now as the focal date.

(Short Answer)

4.9/5  (34)

(34)

On June 26, 2013, $1000 was borrowed at an interest rate of 10.75%. On what date was the loan repaid if the amount of accrued interest was $63.91?

(Short Answer)

4.8/5  (43)

(43)

Karen borrowed $2,000 at 10¼% on July 13. On what date would the amount owed first exceed $2,100?

(Short Answer)

4.8/5  (32)

(32)

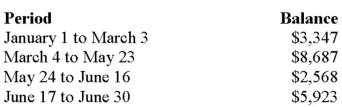

The cash balance in Amalia's account with her stockbroker earns interest on the daily balance at an annual rate of 4%. Accrued interest is credited to her account every six months-on June 30 and December 31. As a result of the purchase and sale of securities from time to time, the account's balance changed as follows:  Investment date Amount invested Interest rate M

What interest was credited to Amalia's account on June 30? The brokerage firm includes interest for both January 1 and June 30 in the June 30 payment. Assume that February had 28 days.

Investment date Amount invested Interest rate M

What interest was credited to Amalia's account on June 30? The brokerage firm includes interest for both January 1 and June 30 in the June 30 payment. Assume that February had 28 days.

(Short Answer)

4.7/5  (39)

(39)

What interest rate must money earn for a payment of $1,389 on August 20 to be equivalent to a payment of $1,348 on the previous March 29?

(Short Answer)

4.8/5  (38)

(38)

If money if worth $650 now and $675 in 3 months, determine the rate of return that an investor would be indifferent between the two options.

(Multiple Choice)

4.8/5  (39)

(39)

How many months would it take for $3,500 to grow to $4,000 at 15%?

(Multiple Choice)

4.9/5  (48)

(48)

A $3,000 payment is scheduled for 6 months from now. If money is worth 6.75%, calculate the payment's equivalent values at two-month intervals beginning today and ending one year from now.

(Essay)

4.9/5  (31)

(31)

On what day will the amount of interest earned reach $5,000 if $250,000 was invested at an interest rate of 11% on June 23?

(Multiple Choice)

4.8/5  (43)

(43)

Payments of $7,000 120 days ago and $3,000 90 days ago are to be replaced by $4,500 60 days from now and a final payment 240 days from now. If interest is 5.95% annually, determine the value of the final payment.

(Multiple Choice)

4.9/5  (33)

(33)

If $3,702.40 earned $212.45 interest from September 17, 2014 to March 11, 2015, what rate of interest was earned?

(Short Answer)

4.9/5  (33)

(33)

If the interest rate money can earn is revised upward, is today's economic value of a stream of future payments higher or lower? Explain.

(Essay)

4.8/5  (40)

(40)

Michaela is supposed to pay $15,000 to Mahmoud, but due to financial constraints, has to be delayed by on quarter. Determine the future amount if the rate of interest is 11.45%

(Multiple Choice)

4.8/5  (41)

(41)

Mike borrowed $6,000 on August 15 at a rate of 9.3% annually. Two payments of $2,000 were made on September 1 and November 1 to reduce the loan. What amount should be paid on December 15 to pay off the loan?

(Multiple Choice)

4.9/5  (39)

(39)

What amount paid on September 24 is equivalent to $1,000 paid on the following December 1 if money can earn 3%?

(Short Answer)

4.8/5  (41)

(41)

How much money would have to be deposited on March 11 into an account earning a simple interest rate of 9.5% if the goal is to have the deposit grow to $12,000 by November 1?

(Multiple Choice)

4.7/5  (40)

(40)

What will be the maturity value after seven months of $2950 earning interest at the rate of 4.5%?

(Short Answer)

4.9/5  (38)

(38)

How can you determine which of three payments has the largest economic value?

(Essay)

4.9/5  (37)

(37)

Two debt payments of $2,000 each are due now and nine months from now. If money is worth 8%, what single payment six months from now is required to settle the debt?

(Multiple Choice)

4.8/5  (41)

(41)

Showing 281 - 300 of 302

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)