Deck 25: Options and Corporate Securities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/445

Play

Full screen (f)

Deck 25: Options and Corporate Securities

1

When the market interest rates increase, it would unambiguously decrease the value of an American put option.

True

2

The value of a put decreases as the exercise price increases.

False

3

The risk-free rate of return is a variable that determines the value of an option.

True

4

The expiration date is the only date the owner of a European option can exercise the option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

5

When the variance of the underlying asset increases, it would unambiguously decrease the value of an American put option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

6

The value of a call increases when the volatility of the price of the underlying stock increases.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

7

A put option is a wasting asset; i.e., its value declines with the passage of time, all else equal.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

8

Buying a call option gives you the right to purchase shares.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

9

A protective put entails the purchase of a put option on a stock to limit the downside risk associated with owning that stock.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

10

The seller of a put agrees to purchase shares of stock if the option is exercised.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

11

Selling a call option may give you the obligation to sell shares.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

12

The relationship between the prices of the underlying stock, a call option, a put option, and a riskless asset is referred to as a protective put.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

13

An increase in the exercise price will increase the value of a call option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

14

Selling a put option may give you the obligation to buy shares.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

15

An increase in the underlying stock price will increase the value of a call option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

16

An increase in the time to expiration will increase the value of a call option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

17

When the exercise price is increased, it would unambiguously decrease the value of an American put option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

18

The strike price is the price the owner of a call pays per share to purchase shares of stock.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

19

The primary purpose of a protective put is to limit the downside risk of asset ownership:

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

20

Buying a put option gives you the right to sell shares.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

21

Exercise price Is a variables that is included in the Black-Scholes call option pricing formula.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

22

The intrinsic value of a call is always equal to zero if the call is currently out of the money.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

23

The underlying stock price is a variable that determines the value of an option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

24

Gamma is the sensitivity of an option's value to a change in the risk-free rate.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

25

The formula C0 >= (S0 + E) if (S0 + E) >= 0 correctly describe the boundary values for an American call option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

26

According to the Black-Scholes model, when the exercise price is increased, it results in a decrease in the value of a call option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

27

The effect on an option's value of a small change in the value of the underlying asset is called the option theta.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

28

According to the Black-Scholes model, when the expiration date is extended, it results in a decrease in the value of a call option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

29

Stock price Is a variables that is included in the Black-Scholes call option pricing formula.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

30

Delta is the effect on an option's value of a small change in the value of the underlying asset is called the option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

31

The formula C0 = S0 correctly describes the boundary values for an American call option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

32

Standard deviation of the return on a stock Is a variables that is included in the Black-Scholes call option pricing formula.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

33

The sensitivity of an option's value to a change in the option's time to expiration is measured by the option theta.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

34

Put-call parity is the relationship between the prices of the underlying stock, a call option, a put option, and a riskless asset.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

35

The time to expiration is a variable that determines the value of an option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

36

The sensitivity of an option's value to a change in the risk-free rate is measured by the option rho.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

37

When the value of the underlying asset increases, it would unambiguously decrease the value of an American put option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

38

An increase in the variance of the return on the underlying asset will increase the value of a call option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

39

The formula C0 >= 0 if (S0 - E) correctly describes the boundary values for an American call option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

40

Stock beta is a variables that is included in the Black-Scholes call option pricing formula.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

41

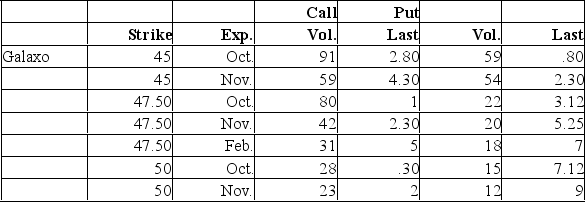

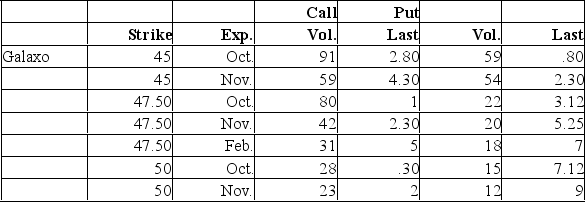

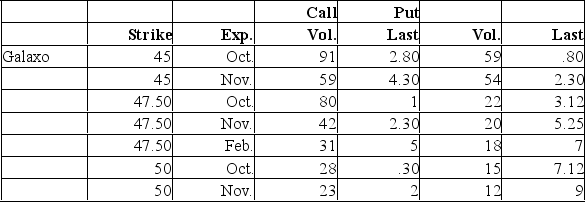

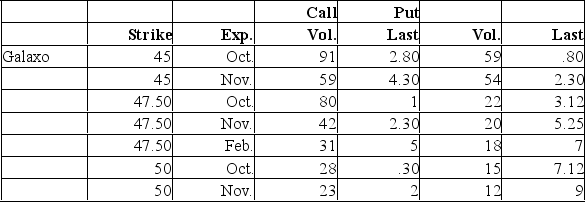

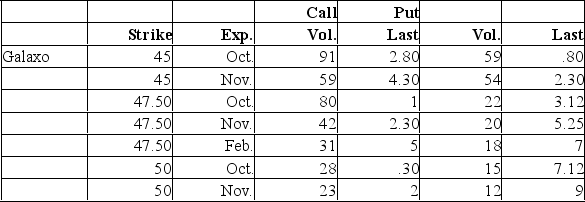

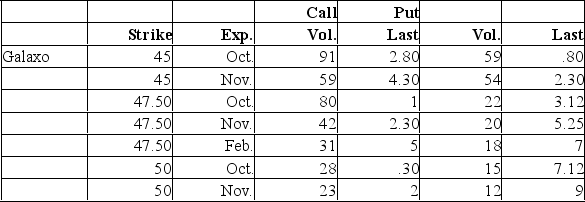

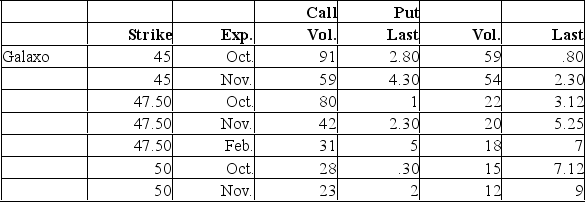

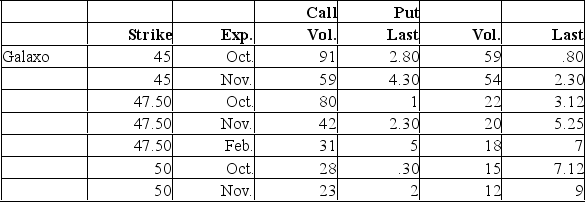

Given an underlying stock price of $45.80, the November 47 1/2 put is in the money.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

42

A decrease in the Time to expiration will increase the value of a put option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

43

A decrease in the Variance of return of the underlying asset will increase the value of a put option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

44

When the following value of the underlying asset increases, it would unambiguously increase the value of an American put option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

45

According to the Black-Scholes model, when the risk-free rate increases, it results in a decrease in the value of a call option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

46

Given an underlying stock price of $45.80, the November 50 call is in the money.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

47

A decrease in the Exercise price will increase the value of a put option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

48

Given an underlying stock price of $45.80, the October 45 put is in the money.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

49

A decrease in the current value of the underlying security will increase the value of a put option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

50

When the market interest rates increase, it would unambiguously increase the value of an American put option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

51

According to the Black-Scholes model, when the variance of the underlying asset decreases, it results in a decrease in the value of a call option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

52

C1 = 0 if (S1- E) < 0 identifies the value of a call option at expiration.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

53

An American call option, with an exercise price of $5, sells for $2; the stock price is $8 presents an arbitrage opportunity. (Assume no transaction costs and any option can be exercised immediately).

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

54

Given an underlying stock price of $45.80, the October 45 call is in the money.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

55

Given that the underlying stock price is $25, the March 22 1/2 put is in the money.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

56

When the exercise price is increased, it would unambiguously increase the value of an American put option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

57

C1 = (S1- E) if (S1- E) > 0 identifies the value of a call option at expiration.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

58

C1 = 0 if (S1- E) > 0 identifies the value of a call option at expiration.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

59

An American put option, with an exercise price of $15, sells for $7.50; the stock price is $6 presents an arbitrage opportunity. (Assume no transaction costs and any option can be exercised immediately).

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

60

C1 = (S1- E) if (S1- E) < 0 identifies the value of a call option at expiration.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

61

A decrease in the strike price will increase the value of a call option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

62

The value of a call increases when the time to expiration increases.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

63

The intrinsic value of a call is another name for the market price of a call.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

64

The value of a call increases when the stock price increases.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

65

The value of a call increases as the price of the underlying stock increases.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

66

The strike price is a variable that determines the value of an option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

67

The sensitivity of an option's value to a change in the standard deviation of the return on the underlying asset is measured by the option vega

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

68

Given that the underlying stock price is $25, then the February 20 put is in the money.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

69

The value of a put increases as the price of the underlying stock increases.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

70

The intrinsic value of a call is the value of the call if it were about to expire.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

71

The Black-Scholes Option Pricing Model as it pertains to calls is based on European options.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

72

The value of a call increases when the risk-free rate of return increases.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

73

Given that the underlying stock price is $25, then the February 20 call is in the money.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

74

The value of a call decreases as the exercise price increases.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

75

The Black-Scholes Option Pricing Model as it pertains to calls is based on the stock price, strike price, time to maturity, standard deviation of the stock, and the price of the

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

76

Given that the underlying stock price is $25, then the January 20 call is in the money.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

77

An increase in the T-bill rate will increase the value of a call option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

78

The Black-Scholes Option Pricing Model as it pertains to calls is based on the formula C = [S][N(d1)]-[E][N(d2)]/(1 + Rf)t for non-dividend paying stocks with European options.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

79

A decrease in the standard deviation of the return on the stock will increase the value of a call option.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck

80

The intrinsic value of a call is equal to the lower bound of a call's value.

Unlock Deck

Unlock for access to all 445 flashcards in this deck.

Unlock Deck

k this deck