Exam 25: Options and Corporate Securities

Exam 1: Introduction to Corporate Finance256 Questions

Exam 2: Financial Statements, Cash Flow, and Taxes412 Questions

Exam 3: Working With Financial Statements408 Questions

Exam 4: Long-Term Financial Planning and Corporate Growth379 Questions

Exam 5: Introduction to Valuation: the Time Value of Money280 Questions

Exam 6: Discounted Cash Flow Valuation413 Questions

Exam 7: Interest Rates and Bond Valuation393 Questions

Exam 8: Stock Valuation399 Questions

Exam 9: Net Present Value and Other Investment Criteria415 Questions

Exam 10: Making Capital Investment Decisions363 Questions

Exam 11: Project Analysis and Evaluation425 Questions

Exam 12: Lessons From Capital Market History329 Questions

Exam 13: Return, Risk, and the Security Market Line416 Questions

Exam 14: Cost of Capital377 Questions

Exam 15: Raising Capital337 Questions

Exam 16: Financial Leverage and Capital Structure Policy383 Questions

Exam 17: Dividends and Dividend Policy376 Questions

Exam 18: Short-Term Finance and Planning424 Questions

Exam 19: Cash and Liquidity Management374 Questions

Exam 20: Credit and Inventory Management384 Questions

Exam 21: International Corporate Finance369 Questions

Exam 22: Leasing269 Questions

Exam 23: Mergers and Acquisitions335 Questions

Exam 24: Enterprise Risk Management300 Questions

Exam 25: Options and Corporate Securities445 Questions

Exam 26: Behavioural Finance: Implications for Financial Management76 Questions

Select questions type

Standard deviation of the return on a stock Is a variables that is included in the Black-Scholes call option pricing formula.

Free

(True/False)

4.8/5  (34)

(34)

Correct Answer:

True

Van, Inc. stock is selling for $38 a share. The 6-month 35 call on Van, Inc. stock is selling for $5.97 while the 6-month 35 put is priced at $1.85. What is the continuously compounded risk-free rate of return?

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

B

Martin owns 15,000 shares of stock that he wants to sell sometime within the next three months. Shares of this stock are currently selling for $43.24. The stock has been increasing in price but Martin is concerned the price might start to fall. He is not yet willing to sell his shares just in case the price rises some more. To guarantee that he can receive at least $42.50 a share when he does sell, Martin could purchase _____ with a strike price of $42.50.

Free

(Multiple Choice)

4.9/5  (40)

(40)

Correct Answer:

E

You own one call option with an exercise price of $55 on Doo Little stock. The stock is currently selling for $55.20 a share but is expected to sell for either $54 or $62 a share in one year. The risk-free rate of return is 3 percent and the inflation rate is 2.5 percent. What is the current option price if the option expires one year from now?

(Multiple Choice)

4.9/5  (27)

(27)

The value of an American call option is increased when the value of the underlying asset increases.

(True/False)

4.9/5  (39)

(39)

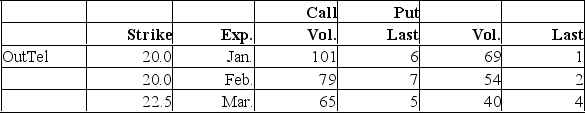

Underlying stock price: 25  You want to purchase one February call option contract on the stock. The contract with a $20 exercise price will cost you ________. (Ignore transactions costs.)

You want to purchase one February call option contract on the stock. The contract with a $20 exercise price will cost you ________. (Ignore transactions costs.)

(Multiple Choice)

4.8/5  (35)

(35)

A convertible bond has a face value of $1,000 and a conversion price of $22.50. The bond has a 6 percent coupon and pays interest semi-annually. The bond matures in six years. Similar bonds are yielding 9 percent. The current price of the stock is $23.24. What is the straight bond value?

(Multiple Choice)

4.9/5  (32)

(32)

An employee stock option gives an employee the right to _____ shares of stock in the company at a _____ price for a fixed period of time.

(Multiple Choice)

4.9/5  (42)

(42)

ESOs generally provide a guarantee that the option will be in the money prior to the expiration date.

(True/False)

4.9/5  (29)

(29)

The delta of a call option on a firm's assets is.804. This means that a $60,000 project will increase the value of equity by:

(Multiple Choice)

4.8/5  (29)

(29)

You know for certain that a common share of Mystical Inc., worth $25 today, will be worth $55 one month from now. The stock pays no dividends. Which of the following actions would maximize your return on investment (assuming no transaction costs)?

(Multiple Choice)

4.9/5  (27)

(27)

Lucie wants to have the option to buy 1,000 shares of stock at a set price any time up to a given date. Lucie should purchase:

(Multiple Choice)

4.8/5  (34)

(34)

The ______________ is the current price of common stock multiplied by the number of shares of common stock that will be received upon conversion of a convertible bond.

(Multiple Choice)

4.9/5  (30)

(30)

The common stock of New Horizon Homes is selling for $68.70 a share. U.S. Treasury bills are currently yielding 4.65 percent. What is the current value of a one-year call option on this stock if the exercise price is $67.50 and you assume the option will finish in the money?

(Multiple Choice)

4.8/5  (42)

(42)

The conversion value of a convertible bond is computed as the:

(Multiple Choice)

4.8/5  (38)

(38)

The market price of Jasper, Inc. is quite volatile and uncertainty concerning some merger activity is expected to keep the stock price volatile for the next few weeks. Given this situation, you decide to buy both a one-month put and a one-month call option on this stock with an exercise price of $42.50. You purchased the call at a quoted price of $.45 and the put at a price of $2.25. What will be your total profit or loss on this investment if the stock price is $34.50 on the day the options expire?

(Multiple Choice)

4.8/5  (29)

(29)

A $1,000 semi-annual convertible bond has a 4% coupon rate, a conversion ratio of 20, and five years to maturity. The common stock has a market price of $45. The relevant discount rate is 7%. What is the floor value of the convertible bond?

(Multiple Choice)

5.0/5  (34)

(34)

Showing 1 - 20 of 445

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)