Deck 18: Monetary Policy Learning Objectives

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/169

Play

Full screen (f)

Deck 18: Monetary Policy Learning Objectives

1

The Federal Reserve actively worked to keep the federal funds rate at nearly ________ percent for several years following the Great Recession.

A) 2.5

B) 25

C) 7

D) 0

E) 5

A) 2.5

B) 25

C) 7

D) 0

E) 5

0

2

From 1982 to 2008, the economy experienced only two recessions, and they were neither lengthy nor severe. This time period is known as the

A) Great Depression.

B) Great Recession.

C) great expansion.

D) great moderation.

E) great economy.

A) Great Depression.

B) Great Recession.

C) great expansion.

D) great moderation.

E) great economy.

great moderation.

3

Central banks can use monetary policy to

A) turn prices from inflexible to flexible.

B) force private banks to lend out reserves.

C) make it easier for people and businesses to borrow.

D) print money.

E) steer the economy out of overexpansion.

A) turn prices from inflexible to flexible.

B) force private banks to lend out reserves.

C) make it easier for people and businesses to borrow.

D) print money.

E) steer the economy out of overexpansion.

make it easier for people and businesses to borrow.

4

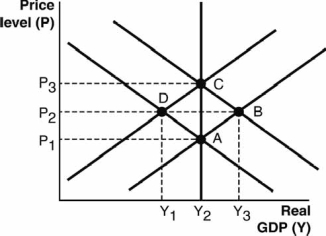

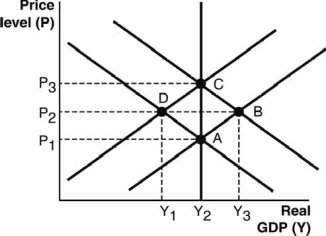

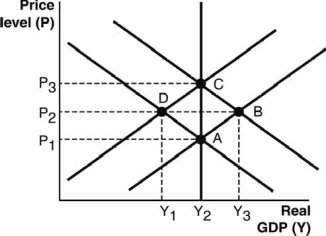

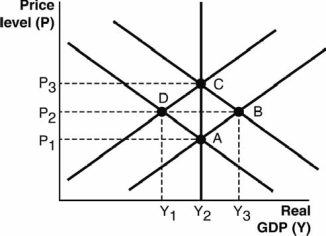

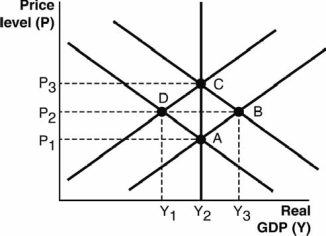

Refer to the following figure to answer the next questions.

According to the figure, expansionary monetary policy will cause an economy that is initially at full-employment output to go from equilibrium to equilibrium in the short run.

A) A; C

B) A; B

C) A; D

D) C; B

E) C; D

According to the figure, expansionary monetary policy will cause an economy that is initially at full-employment output to go from equilibrium to equilibrium in the short run.

A) A; C

B) A; B

C) A; D

D) C; B

E) C; D

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

5

Expansionary monetary policy occurs when

A) a central bank acts to decrease the money supply in an effort to stimulate the economy.

B) Congress and the president increase taxes in an effort to stimulate the economy.

C) Congress and the president decrease taxes in an effort to stimulate the economy.

D) a central bank acts to increase the money supply in an effort to stimulate the economy.

E) a central bank acts to increase government spending in an effort to stimulate the economy.

A) a central bank acts to decrease the money supply in an effort to stimulate the economy.

B) Congress and the president increase taxes in an effort to stimulate the economy.

C) Congress and the president decrease taxes in an effort to stimulate the economy.

D) a central bank acts to increase the money supply in an effort to stimulate the economy.

E) a central bank acts to increase government spending in an effort to stimulate the economy.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

6

The Federal Reserve's response to the Great Recession was an attempt to

A) increase aggregate demand.

B) decrease aggregate demand.

C) decrease the price level.

D) increase short-run aggregate supply.

E) decrease short-run aggregate supply.

A) increase aggregate demand.

B) decrease aggregate demand.

C) decrease the price level.

D) increase short-run aggregate supply.

E) decrease short-run aggregate supply.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

7

If the interest rate on a loan is higher than the expected return from an investment,

A) a rational firm will take out a loan for the investment.

B) the Federal Reserve will conduct contractionary monetary policy.

C) a rational firm will not take out a loan for the investment.

D) the Federal Reserve will conduct expansionary monetary policy.

E) the government will conduct expansionary fiscal policy.

A) a rational firm will take out a loan for the investment.

B) the Federal Reserve will conduct contractionary monetary policy.

C) a rational firm will not take out a loan for the investment.

D) the Federal Reserve will conduct expansionary monetary policy.

E) the government will conduct expansionary fiscal policy.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

8

Central banks can use monetary policy to

A) reduce interest rates.

B) decrease taxes.

C) increase government spending.

D) steer the economy out of every recession.

E) prevent recessions.

A) reduce interest rates.

B) decrease taxes.

C) increase government spending.

D) steer the economy out of every recession.

E) prevent recessions.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

9

The two types of monetary policy are

A) monetary and fiscal.

B) expansionary and contractionary.

C) countercyclical and pro-cyclical.

D) positive and negative.

E) pro and con.

A) monetary and fiscal.

B) expansionary and contractionary.

C) countercyclical and pro-cyclical.

D) positive and negative.

E) pro and con.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

10

Expansionary monetary policy makes the aggregate demand curve

A) shift to the left.

B) become flatter.

C) become steeper.

D) shift to the right.

E) remain static.

A) shift to the left.

B) become flatter.

C) become steeper.

D) shift to the right.

E) remain static.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

11

Expansionary monetary policy

A) lowers interest rates, causing aggregate demand to shift to the right.

B) lowers interest rates, causing aggregate demand to shift to the left.

C) raises interest rates, causing aggregate demand to shift to the right.

D) raises interest rates, causing aggregate demand to shift to the left.

E) lowers interest rates, causing short-run aggregate supply to shift to the right.

A) lowers interest rates, causing aggregate demand to shift to the right.

B) lowers interest rates, causing aggregate demand to shift to the left.

C) raises interest rates, causing aggregate demand to shift to the right.

D) raises interest rates, causing aggregate demand to shift to the left.

E) lowers interest rates, causing short-run aggregate supply to shift to the right.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

12

________ policy is when a central bank acts to increase the money supply in an effort to stimulate the economy.

A) Expansionary monetary

B) Expansionary fiscal

C) Contractionary monetary

D) Contractionary fiscal

E) Countercyclical monetary

A) Expansionary monetary

B) Expansionary fiscal

C) Contractionary monetary

D) Contractionary fiscal

E) Countercyclical monetary

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

13

Refer to the following figure to answer the next questions.

According to the figure, if the economy started at full-employment output, expansionary monetary policy would cause real gross domestic product (GDP) to ________ in the short run.

A) increase from Y1 to Y2

B) increase from Y1 to Y3

C) decrease from Y2 to Y1

D) decrease from Y3 to Y2

E) increase from Y2 to Y3

According to the figure, if the economy started at full-employment output, expansionary monetary policy would cause real gross domestic product (GDP) to ________ in the short run.

A) increase from Y1 to Y2

B) increase from Y1 to Y3

C) decrease from Y2 to Y1

D) decrease from Y3 to Y2

E) increase from Y2 to Y3

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

14

In the short run, some prices are inflexible. Most often, the prices that are inflexible are

A) output prices.

B) energy prices.

C) food prices.

D) product prices.

E) wages for workers.

A) output prices.

B) energy prices.

C) food prices.

D) product prices.

E) wages for workers.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

15

Expansionary monetary policy ________ interest rates, which ________ the ________.

A) raises; increases; aggregate demand

B) raises; decreases; aggregate demand

C) lowers; decreases; demand for loanable funds

D) lowers; increases; quantity demanded for loanable funds

E) raises; increases; quantity demanded for loanable funds

A) raises; increases; aggregate demand

B) raises; decreases; aggregate demand

C) lowers; decreases; demand for loanable funds

D) lowers; increases; quantity demanded for loanable funds

E) raises; increases; quantity demanded for loanable funds

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

16

When the Fed buys bonds from financial institutions, new money moves directly

A) out of the loanable funds market.

B) into the hands of consumers.

C) into the loanable funds market.

D) out of the hands of consumers.

E) into short-run aggregate supply.

A) out of the loanable funds market.

B) into the hands of consumers.

C) into the loanable funds market.

D) out of the hands of consumers.

E) into short-run aggregate supply.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following best describes how expansionary monetary policy affects the aggregate demand curve in the aggregate demand-aggregate supply model?

A) Expansionary monetary policy directly pulls money out of the loanable funds market. This lowers the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the right.

B) Expansionary monetary policy directly puts money into the loanable funds market. This lowers the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the right.

C) Expansionary monetary policy directly puts money into the loanable funds market. This raises the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the right.

D) Expansionary monetary policy directly puts money into the loanable funds market. This lowers the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the left.

E) Expansionary monetary policy directly pulls money out of the loanable funds market. This raises the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the left.

A) Expansionary monetary policy directly pulls money out of the loanable funds market. This lowers the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the right.

B) Expansionary monetary policy directly puts money into the loanable funds market. This lowers the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the right.

C) Expansionary monetary policy directly puts money into the loanable funds market. This raises the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the right.

D) Expansionary monetary policy directly puts money into the loanable funds market. This lowers the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the left.

E) Expansionary monetary policy directly pulls money out of the loanable funds market. This raises the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the left.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

18

The Federal Reserve generally uses ________ to implement monetary policy.

A) reserve requirements

B) open market operations

C) fiscal policy

D) discount policies

E) government spending and taxes

A) reserve requirements

B) open market operations

C) fiscal policy

D) discount policies

E) government spending and taxes

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

19

In the short run, expansionary monetary policy ________ real gross domestic product (GDP),

________ unemployment, and ________ the price level.

A) raises; lowers; raises

B) raises; raises; raises

C) lowers; lowers; raises

D) lowers; lowers; lowers

E) raises; lowers; lowers

________ unemployment, and ________ the price level.

A) raises; lowers; raises

B) raises; raises; raises

C) lowers; lowers; raises

D) lowers; lowers; lowers

E) raises; lowers; lowers

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

20

Holding all else constant, in the short run, an increase in the money supply can cause an)

A) increase in unemployment.

B) lower rate of inflation.

C) decrease in the price level.

D) decrease in real gross domestic product GDP).

E) increase in real gross domestic product GDP).

A) increase in unemployment.

B) lower rate of inflation.

C) decrease in the price level.

D) decrease in real gross domestic product GDP).

E) increase in real gross domestic product GDP).

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following best describes how contractionary monetary policy affects the aggregate demand curve in the aggregate demand-aggregate supply model?

A) Contractionary monetary policy directly pulls money out of the loanable funds market. This lowers the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the right.

B) Contractionary monetary policy directly puts money into the loanable funds market. This lowers the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the right.

C) Contractionary monetary policy directly puts money into the loanable funds market. This raises the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the right.

D) Contractionary monetary policy directly puts money into the loanable funds market. This lowers the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the left.

E) Contractionary monetary policy directly pulls money out of the loanable funds market. This raises the interest rate, which provides a lesser incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the left.

A) Contractionary monetary policy directly pulls money out of the loanable funds market. This lowers the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the right.

B) Contractionary monetary policy directly puts money into the loanable funds market. This lowers the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the right.

C) Contractionary monetary policy directly puts money into the loanable funds market. This raises the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the right.

D) Contractionary monetary policy directly puts money into the loanable funds market. This lowers the interest rate, which provides a larger incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the left.

E) Contractionary monetary policy directly pulls money out of the loanable funds market. This raises the interest rate, which provides a lesser incentive for firms to invest. Investment is a component of aggregate demand, so this shifts aggregate demand to the left.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

22

Injecting new money into the economy eventually causes

A) a recession.

B) deflation.

C) stagflation.

D) unemployment.

E) inflation.

A) a recession.

B) deflation.

C) stagflation.

D) unemployment.

E) inflation.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

23

________ would be hurt by unexpected inflation.

A) Someone who borrowed money at a fixed interest rate

B) A firm who hired a worker on a two-year wage contract

C) A worker who signed a two-year wage contract

D) A worker whose wage increases with inflation

E) A firm that purchased inputs with a two-year contract

A) Someone who borrowed money at a fixed interest rate

B) A firm who hired a worker on a two-year wage contract

C) A worker who signed a two-year wage contract

D) A worker whose wage increases with inflation

E) A firm that purchased inputs with a two-year contract

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

24

Changes in the quantity of money lead to real changes in the economy. If this is the case, why would the central bank ever stop increasing the money supply?

A) Although there is a short-run incentive to increase the money supply, these effects wear off in the long run as prices adjust and then drive up the value of money.

B) The government has rules in place on the maximum amount the money supply can be increased in a given fiscal year.

C) Although there is a short-run incentive to increase the money supply, these effects wear off in the long run as prices adjust and then drive down the value of money.

D) Increasing the money supply is not a politically popular action and may lead to leaders of the central bank not getting reelected.

E) The short-run benefits are outweighed by the short-run costs of increases in the money supply.

A) Although there is a short-run incentive to increase the money supply, these effects wear off in the long run as prices adjust and then drive up the value of money.

B) The government has rules in place on the maximum amount the money supply can be increased in a given fiscal year.

C) Although there is a short-run incentive to increase the money supply, these effects wear off in the long run as prices adjust and then drive down the value of money.

D) Increasing the money supply is not a politically popular action and may lead to leaders of the central bank not getting reelected.

E) The short-run benefits are outweighed by the short-run costs of increases in the money supply.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

25

According to the Fisher equation, if a bank extends a loan for 3 percent and the inflation rate ends up

being 5 percent, the ________ interest rate is ________ percent.

A) nominal; 2

B) real; 2

C) nominal; -2

D) real;-2

E) nominal; 8

being 5 percent, the ________ interest rate is ________ percent.

A) nominal; 2

B) real; 2

C) nominal; -2

D) real;-2

E) nominal; 8

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

26

Contractionary monetary policy ________ interest rates, causing ________ to shift to the ________.

A) lowers; aggregate demand; right

B) lowers; aggregate demand; left

C) raises; aggregate demand; right

D) raises; aggregate demand; left

E) lowers; short-run aggregate supply; right

A) lowers; aggregate demand; right

B) lowers; aggregate demand; left

C) raises; aggregate demand; right

D) raises; aggregate demand; left

E) lowers; short-run aggregate supply; right

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

27

When the Fed sells bonds to financial institutions, new money moves directly

A) out of the loanable funds market.

B) into the hands of consumers.

C) into the loanable funds market.

D) out of the hands of consumers.

E) into short-run aggregate supply.

A) out of the loanable funds market.

B) into the hands of consumers.

C) into the loanable funds market.

D) out of the hands of consumers.

E) into short-run aggregate supply.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

28

What did the Federal Reserve do in response to the Great Recession?

A) It conducted open market purchases to drive up interest rates.

B) It conducted open market selling to drive up interest rates.

C) It conducted open market purchases to drive down interest rates.

D) It conducted open market selling to drive down interest rates.

E) It decreased the reserve requirements to drive up interest rates.

A) It conducted open market purchases to drive up interest rates.

B) It conducted open market selling to drive up interest rates.

C) It conducted open market purchases to drive down interest rates.

D) It conducted open market selling to drive down interest rates.

E) It decreased the reserve requirements to drive up interest rates.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

29

If the interest rate on a loan is lower than the expected return from an investment,

A) a rational firm will take out a loan for the investment.

B) the Federal Reserve will conduct contractionary monetary policy.

C) a rational firm will not take out a loan for the investment.

D) the Federal Reserve will conduct expansionary monetary policy.

E) the government will conduct expansionary fiscal policy.

A) a rational firm will take out a loan for the investment.

B) the Federal Reserve will conduct contractionary monetary policy.

C) a rational firm will not take out a loan for the investment.

D) the Federal Reserve will conduct expansionary monetary policy.

E) the government will conduct expansionary fiscal policy.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

30

According to the Fisher equation, if a bank extends a loan for 3 percent and the inflation rate ends up

being 2 percent, the ________ interest rate is ________ percent.

A) nominal; 1

B) real; 1

C) nominal; -1

D) real; -1

E) nominal; 5

being 2 percent, the ________ interest rate is ________ percent.

A) nominal; 1

B) real; 1

C) nominal; -1

D) real; -1

E) nominal; 5

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

31

________ would be hurt by unexpected inflation.

A) Someone who lent money out at a fixed interest rate

B) A firm that hired a worker on a two-year wage contract

C) Someone who borrowed money at a fixed interest rate

D) A worker whose wage increases with inflation

E) A firm that purchased inputs with a two-year contract

A) Someone who lent money out at a fixed interest rate

B) A firm that hired a worker on a two-year wage contract

C) Someone who borrowed money at a fixed interest rate

D) A worker whose wage increases with inflation

E) A firm that purchased inputs with a two-year contract

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

32

________ policy is when a central bank acts to decrease the money supply in an effort to control an economy that is expanding too quickly.

A) Expansionary monetary

B) Expansionary fiscal

C) Contractionary monetary

D) Contractionary fiscal

E) Countercyclical monetary

A) Expansionary monetary

B) Expansionary fiscal

C) Contractionary monetary

D) Contractionary fiscal

E) Countercyclical monetary

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

33

Expansionary monetary policy can have immediate real short-run effects; initially, no prices have adjusted. But as prices adjust in the long run, the real impact of monetary policy

A) is multiplied.

B) is negative.

C) is cut in half.

D) dissipates completely.

E) is unknown.

A) is multiplied.

B) is negative.

C) is cut in half.

D) dissipates completely.

E) is unknown.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

34

________ would be helped by unexpected inflation.

A) Someone who lent money out at a fixed interest rate

B) Someone who signed a two-year contract at a fixed wage

C) Someone who borrowed money at a fixed interest rate

D) A worker whose wage increases with expected inflation

E) Elderly individuals on a fixed income

A) Someone who lent money out at a fixed interest rate

B) Someone who signed a two-year contract at a fixed wage

C) Someone who borrowed money at a fixed interest rate

D) A worker whose wage increases with expected inflation

E) Elderly individuals on a fixed income

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

35

Contractionary monetary policy ________ interest rates, by ________ the ________.

A) raises; decreasing; supply of loanable funds

B) raises; increasing; demand for loanable funds

C) lowers; decreasing; short-run aggregate supply

D) lowers; increasing; aggregate demand

E) raises; increasing; long-run aggregate supply

A) raises; decreasing; supply of loanable funds

B) raises; increasing; demand for loanable funds

C) lowers; decreasing; short-run aggregate supply

D) lowers; increasing; aggregate demand

E) raises; increasing; long-run aggregate supply

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

36

Contractionary monetary policy makes the aggregate demand curve

A) shift to the left.

B) become flatter.

C) become steeper.

D) shift to the right.

E) remain static.

A) shift to the left.

B) become flatter.

C) become steeper.

D) shift to the right.

E) remain static.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

37

As the prices of goods and services decrease, the value of money

A) stays the same.

B) increases.

C) decreases.

D) increases initially and then decreases.

E) decreases initially and then increases.

A) stays the same.

B) increases.

C) decreases.

D) increases initially and then decreases.

E) decreases initially and then increases.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

38

Holding all else constant, in the short run, a decrease in the money supply can cause an)

A) decrease in unemployment.

B) high rate of inflation.

C) increase in the price level.

D) decrease in real gross domestic product GDP).

E) increase in real gross domestic product GDP).

A) decrease in unemployment.

B) high rate of inflation.

C) increase in the price level.

D) decrease in real gross domestic product GDP).

E) increase in real gross domestic product GDP).

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

39

As the prices of goods and services increase, the value of money

A) stays the same.

B) increases.

C) decreases.

D) increases initially and then decreases.

E) decreases initially and then increases.

A) stays the same.

B) increases.

C) decreases.

D) increases initially and then decreases.

E) decreases initially and then increases.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

40

Contractionary monetary policy occurs when

A) a central bank acts to decrease the money supply in an effort to control an economy that is expanding too quickly.

B) Congress and the president increase taxes in an effort to control an economy that is expanding too quickly.

C) Congress and the president decrease taxes in an effort to stimulate the economy.

D) a central bank acts to increase the money supply in an effort to stimulate the economy.

E) a central bank acts to increase government spending in an effort to stimulate the economy.

A) a central bank acts to decrease the money supply in an effort to control an economy that is expanding too quickly.

B) Congress and the president increase taxes in an effort to control an economy that is expanding too quickly.

C) Congress and the president decrease taxes in an effort to stimulate the economy.

D) a central bank acts to increase the money supply in an effort to stimulate the economy.

E) a central bank acts to increase government spending in an effort to stimulate the economy.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

41

Printing more paper money doesn't affect the economy's long-run productivity or its ability to produce; these outcomes are determined by

A) resources only.

B) technology only.

C) institutions only.

D) resources, technology, and institutions.

E) resources and technology only.

A) resources only.

B) technology only.

C) institutions only.

D) resources, technology, and institutions.

E) resources and technology only.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following explains why the money supply is not completely controlled by the Federal Reserve?

A) The actions of private individuals and banks can increase or decrease the money supply via the money multiplier.

B) The president can issue an executive order that can increase or decrease the money supply.

C) The Treasury has say over when the Federal Reserve can increase or decrease the money supply.

D) The actions of banks, which determine reserve requirements, can increase or decrease the money supply via the spending multiplier.

E) Congress has authority to veto any monetary policy enacted by the Federal Reserve.

A) The actions of private individuals and banks can increase or decrease the money supply via the money multiplier.

B) The president can issue an executive order that can increase or decrease the money supply.

C) The Treasury has say over when the Federal Reserve can increase or decrease the money supply.

D) The actions of banks, which determine reserve requirements, can increase or decrease the money supply via the spending multiplier.

E) Congress has authority to veto any monetary policy enacted by the Federal Reserve.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

43

Expectations

A) have no effect on monetary policy.

B) have no effect on consumers' spending habits.

C) play a role in fiscal policy but not in monetary policy.

D) can dampen the effects of monetary policy.

E) are easily studied in economics.

A) have no effect on monetary policy.

B) have no effect on consumers' spending habits.

C) play a role in fiscal policy but not in monetary policy.

D) can dampen the effects of monetary policy.

E) are easily studied in economics.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

44

The idea that the money supply does not affect real economic variables is called

A) adaptive expectations theory.

B) monetary neutrality.

C) the Phillips curve.

D) contractionary monetary policy.

E) expansionary monetary policy.

A) adaptive expectations theory.

B) monetary neutrality.

C) the Phillips curve.

D) contractionary monetary policy.

E) expansionary monetary policy.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements regarding the relationship between input prices and output prices is true?

A) Input prices adjust slower than output prices.

B) Output prices adjust slower than input prices.

C) Input prices and output prices adjust at the same rate.

D) Input prices adjust before output prices.

E) Input prices and output prices adjust at random times.

A) Input prices adjust slower than output prices.

B) Output prices adjust slower than input prices.

C) Input prices and output prices adjust at the same rate.

D) Input prices adjust before output prices.

E) Input prices and output prices adjust at random times.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

46

According to the theory of monetary neutrality, in the long run,

A) monetary policy is always more effective than fiscal policy.

B) fiscal policy is always more effective than monetary policy.

C) expansionary monetary policy is more effective than contractionary monetary policy.

D) contractionary monetary policy is more effective than expansionary monetary policy.

E) there is a lack of real economic effects from monetary policy.

A) monetary policy is always more effective than fiscal policy.

B) fiscal policy is always more effective than monetary policy.

C) expansionary monetary policy is more effective than contractionary monetary policy.

D) contractionary monetary policy is more effective than expansionary monetary policy.

E) there is a lack of real economic effects from monetary policy.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

47

During a financial crisis hit hard by bank failures, the money supply

A) decreases because people start putting money into savings accounts.

B) increases because people start putting money into savings accounts.

C) increases because people start withdrawing their money from banks.

D) decreases because people start withdrawing their money from banks.

E) increases because people spend more instead of saving more.

A) decreases because people start putting money into savings accounts.

B) increases because people start putting money into savings accounts.

C) increases because people start withdrawing their money from banks.

D) decreases because people start withdrawing their money from banks.

E) increases because people spend more instead of saving more.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

48

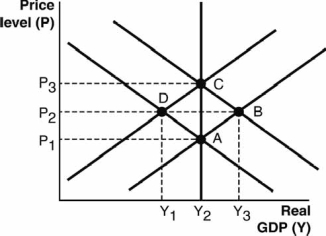

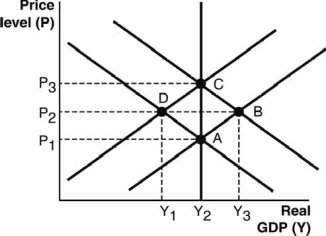

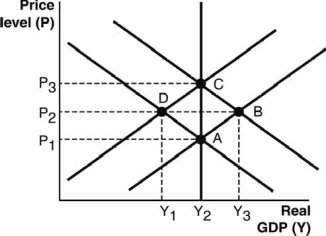

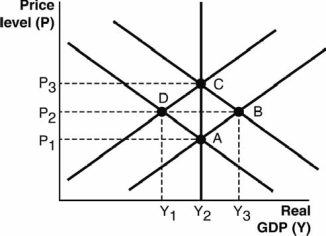

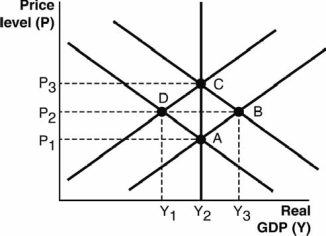

Refer to the following figure to answer the next questions.

According to the figure, contractionary monetary policy starting at full-employment equilibrium will go from point ________ to point ________ in the short run and then to point ________ in the long

run.

A) A; D; A

B) C; B; A

C) A; D; C

D) C; D; C

E) C; D; A

According to the figure, contractionary monetary policy starting at full-employment equilibrium will go from point ________ to point ________ in the short run and then to point ________ in the long

run.

A) A; D; A

B) C; B; A

C) A; D; C

D) C; D; C

E) C; D; A

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following explains why resource prices are often the slowest prices to adjust?

A) Resource prices are not affected by inflation.

B) Resource prices are often set by lengthy contracts.

C) Resource prices are often set by governments.

D) Resource prices are not reported in the consumer price index CPI).

E) Resource prices are all tied to inflation.

A) Resource prices are not affected by inflation.

B) Resource prices are often set by lengthy contracts.

C) Resource prices are often set by governments.

D) Resource prices are not reported in the consumer price index CPI).

E) Resource prices are all tied to inflation.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

50

Refer to the following figure to answer the next questions.

According to the figure, contractionary monetary policy will cause an economy that is initially at full-employment output to go from equilibrium ________ to equilibrium ________ in the short run.

A) A; C

B) A; B

C) A; D

D) C; B

E) C; D

According to the figure, contractionary monetary policy will cause an economy that is initially at full-employment output to go from equilibrium ________ to equilibrium ________ in the short run.

A) A; C

B) A; B

C) A; D

D) C; B

E) C; D

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following best explains how the money supply changed during the early part of the Great Depression?

A) In the early part of the Great Depression, the money supply increased due to uncertainty and unemployment.

B) In the early part of the Great Depression, the money supply decreased due to individuals withdrawing funds and holding more currency.

C) In the early part of the Great Depression, the money supply increased due to individuals withdrawing funds and holding more currency.

D) In the early part of the Great Depression, the money supply increased due to huge bond-buying programs by the Federal Reserve.

E) In the early part of the Great Depression, the money supply decreased due to huge bond-buying programs by the Federal Reserve.

A) In the early part of the Great Depression, the money supply increased due to uncertainty and unemployment.

B) In the early part of the Great Depression, the money supply decreased due to individuals withdrawing funds and holding more currency.

C) In the early part of the Great Depression, the money supply increased due to individuals withdrawing funds and holding more currency.

D) In the early part of the Great Depression, the money supply increased due to huge bond-buying programs by the Federal Reserve.

E) In the early part of the Great Depression, the money supply decreased due to huge bond-buying programs by the Federal Reserve.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

52

By shifting aggregate demand, monetary policy can affect ________ and ________.

A) real gross domestic product GDP); unemployment

B) real gross domestic product GDP); interest rates

C) interest rates; unemployment

D) money supply; real gross domestic product GDP)

E) money supply; unemployment

A) real gross domestic product GDP); unemployment

B) real gross domestic product GDP); interest rates

C) interest rates; unemployment

D) money supply; real gross domestic product GDP)

E) money supply; unemployment

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

53

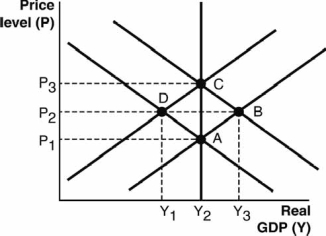

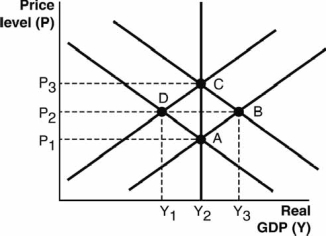

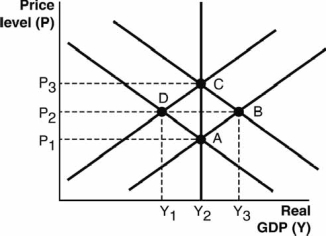

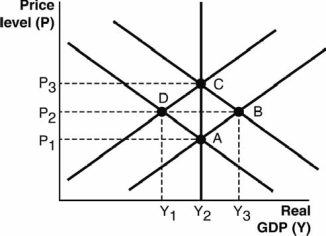

Refer to the following figure to answer the next questions.

According to the figure, expansionary monetary policy starting at full-employment equilibrium will go from point ________ to point ________ in the short run and then to point ________ in the long run.

A) A; B; A

B) A; D; A

C) A; D; C

D) A; B; C

E) C; B; A

According to the figure, expansionary monetary policy starting at full-employment equilibrium will go from point ________ to point ________ in the short run and then to point ________ in the long run.

A) A; B; A

B) A; D; A

C) A; D; C

D) A; B; C

E) C; B; A

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following explains expansionary monetary policy in the long run?

A) Expansionary monetary policy shifts aggregate demand to the left, moving the economy from long-run equilibrium to a short-run equilibrium with a lower price level and a lower level of real gross domestic product GDP). In the long run, as resource prices fall, the short-run aggregate supply curve shifts to the right, bringing the economy back to a long-run equilibrium where no real changes to GDP have occurred.

B) Expansionary monetary policy shifts aggregate demand to the right, moving the economy from long-run equilibrium to a short-run equilibrium with a higher price level and a higher level of real gross domestic product GDP). In the long run, as resource prices rise, the aggregate demand curve shifts back to the left, causing the economy to expand.

C) Expansionary monetary policy shifts aggregate demand to the right, moving the economy from long-run equilibrium to a short-run equilibrium with a higher price level and a higher level of real gross domestic product GDP). In the long run, as resource prices rise, the short-run aggregate supply curve shifts to the left, bringing the economy back to a long-run equilibrium where no real changes to GDP have occurred.

D) Expansionary monetary policy shifts aggregate demand to the right, moving the economy from long-run equilibrium to a short-run equilibrium with a higher price level and a higher level of real gross domestic product GDP). In the long run, as resource prices fall, the short-run aggregate supply curve shifts to the right as well, causing the economy to expand.

E) Expansionary monetary policy shifts aggregate demand to the left, moving the economy from long-run equilibrium to a short-run equilibrium with a lower price level and a lower level of real gross domestic product GDP). In the long run, as resource prices rise, the short-run aggregate supply curve shifts to the left, causing the economy to contract.

A) Expansionary monetary policy shifts aggregate demand to the left, moving the economy from long-run equilibrium to a short-run equilibrium with a lower price level and a lower level of real gross domestic product GDP). In the long run, as resource prices fall, the short-run aggregate supply curve shifts to the right, bringing the economy back to a long-run equilibrium where no real changes to GDP have occurred.

B) Expansionary monetary policy shifts aggregate demand to the right, moving the economy from long-run equilibrium to a short-run equilibrium with a higher price level and a higher level of real gross domestic product GDP). In the long run, as resource prices rise, the aggregate demand curve shifts back to the left, causing the economy to expand.

C) Expansionary monetary policy shifts aggregate demand to the right, moving the economy from long-run equilibrium to a short-run equilibrium with a higher price level and a higher level of real gross domestic product GDP). In the long run, as resource prices rise, the short-run aggregate supply curve shifts to the left, bringing the economy back to a long-run equilibrium where no real changes to GDP have occurred.

D) Expansionary monetary policy shifts aggregate demand to the right, moving the economy from long-run equilibrium to a short-run equilibrium with a higher price level and a higher level of real gross domestic product GDP). In the long run, as resource prices fall, the short-run aggregate supply curve shifts to the right as well, causing the economy to expand.

E) Expansionary monetary policy shifts aggregate demand to the left, moving the economy from long-run equilibrium to a short-run equilibrium with a lower price level and a lower level of real gross domestic product GDP). In the long run, as resource prices rise, the short-run aggregate supply curve shifts to the left, causing the economy to contract.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

55

In the short run, contractionary monetary policy ________ real gross domestic product (GDP),

________ unemployment, and ________ the price level.

A) raises; lowers; raises

B) raises; raises; raises

C) lowers; lowers; raises

D) lowers; raises; lowers

E) raises; lowers; lowers

________ unemployment, and ________ the price level.

A) raises; lowers; raises

B) raises; raises; raises

C) lowers; lowers; raises

D) lowers; raises; lowers

E) raises; lowers; lowers

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

56

What will economists today likely state should have been done to limit the severity of the Great Depression?

A) The Fed should have done more to decrease the money supply at the onset.

B) The Fed should have done more to decrease the inflation at the onset.

C) The Fed should have reacted more quickly to decrease the money supply.

D) The Fed should have waited longer before trying to raise the money supply.

E) The Fed should have done more to offset the decline in the money supply at the onset.

A) The Fed should have done more to decrease the money supply at the onset.

B) The Fed should have done more to decrease the inflation at the onset.

C) The Fed should have reacted more quickly to decrease the money supply.

D) The Fed should have waited longer before trying to raise the money supply.

E) The Fed should have done more to offset the decline in the money supply at the onset.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

57

An active monetary policy that attempts to smooth out the business cycle would involve conducting ________ monetary policy during recessions and ________ monetary policy during expansions.

A) contractionary; contractionary

B) expansionary; expansionary

C) contractionary; expansionary

D) expansionary; contractionary

E) countercyclical; expansionary

A) contractionary; contractionary

B) expansionary; expansionary

C) contractionary; expansionary

D) expansionary; contractionary

E) countercyclical; expansionary

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

58

Economists who discount the short-run expansionary effects of monetary policy focus on the problems of

A) inflation.

B) government intervention.

C) fiscal policy.

D) unemployment.

E) disinflation.

A) inflation.

B) government intervention.

C) fiscal policy.

D) unemployment.

E) disinflation.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

59

Refer to the following figure to answer the next questions.

According to the figure, if the economy started at full-employment output, contractionary monetary policy would cause real gross domestic product (GDP) to ________ in the short run.

A) increase from Y1 to Y2

B) increase from Y1 to Y3

C) decrease from Y2 to Y1

D) decrease from Y3 to Y2

E) increase from Y2 to Y3

According to the figure, if the economy started at full-employment output, contractionary monetary policy would cause real gross domestic product (GDP) to ________ in the short run.

A) increase from Y1 to Y2

B) increase from Y1 to Y3

C) decrease from Y2 to Y1

D) decrease from Y3 to Y2

E) increase from Y2 to Y3

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

60

Monetary neutrality is

A) when a central bank acts to increase the money supply.

B) when a central bank acts to decrease the money supply.

C) the short-run inverse relationship between inflation and unemployment rates.

D) the combination of high unemployment and high inflation.

E) the idea that the money supply does not affect real economic variables.

A) when a central bank acts to increase the money supply.

B) when a central bank acts to decrease the money supply.

C) the short-run inverse relationship between inflation and unemployment rates.

D) the combination of high unemployment and high inflation.

E) the idea that the money supply does not affect real economic variables.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

61

________ indicates a short-run inverse relationship between inflation and unemployment rates.

A) Stagflation

B) Adaptive expectations theory

C) The Phillips curve

D) Monetary neutrality

E) Rational expectations theory

A) Stagflation

B) Adaptive expectations theory

C) The Phillips curve

D) Monetary neutrality

E) Rational expectations theory

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

62

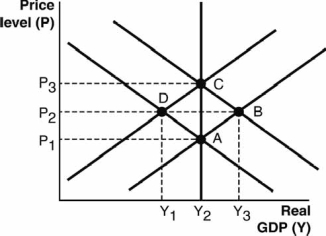

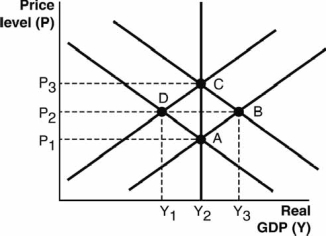

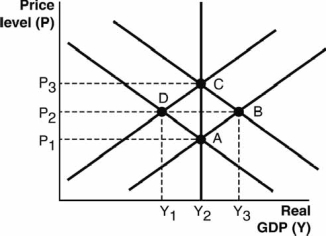

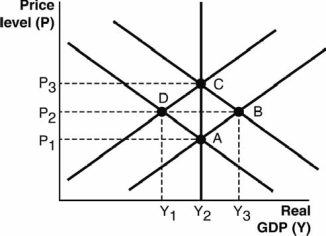

Refer to the following figure to answer the next questions.

According to the figure, if an expansionary monetary policy is fully expected, that policy will cause an economy initially in full-employment equilibrium to move from point

A) A to B.

B) A to B and back to A.

C) A to B to C.

D) A to C and back to A.

E) A to C.

According to the figure, if an expansionary monetary policy is fully expected, that policy will cause an economy initially in full-employment equilibrium to move from point

A) A to B.

B) A to B and back to A.

C) A to B to C.

D) A to C and back to A.

E) A to C.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

63

The Phillips curve

A) holds that people's expectations of future inflation are based on their most recent experiences.

B) is the combination of high unemployment rates and high inflation.

C) holds that people form expectations on the basis of all available information.

D) involves the strategic use of monetary policy to counteract macroeconomic expansions and contractions.

E) indicates a short-run inverse relationship between inflation and unemployment rates.

A) holds that people's expectations of future inflation are based on their most recent experiences.

B) is the combination of high unemployment rates and high inflation.

C) holds that people form expectations on the basis of all available information.

D) involves the strategic use of monetary policy to counteract macroeconomic expansions and contractions.

E) indicates a short-run inverse relationship between inflation and unemployment rates.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

64

When both long-run and short-run aggregate supply shift leftward,

A) monetary policy is more likely to restore the economy to its prerecession conditions.

B) inflation is not a concern.

C) the natural rate of unemployment decreases.

D) monetary policy can have no effect on the economy, even in the short run.

E) monetary policy is much less likely to restore the economy to its prerecession conditions.

A) monetary policy is more likely to restore the economy to its prerecession conditions.

B) inflation is not a concern.

C) the natural rate of unemployment decreases.

D) monetary policy can have no effect on the economy, even in the short run.

E) monetary policy is much less likely to restore the economy to its prerecession conditions.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

65

To avoid the negative effects of unexpected inflation, workers have an incentive to

A) lock in their current wages for years.

B) stay unemployed during years of inflation.

C) never negotiate wage contracts.

D) change jobs regularly.

E) expect a certain level of inflation and to negotiate their contracts accordingly.

A) lock in their current wages for years.

B) stay unemployed during years of inflation.

C) never negotiate wage contracts.

D) change jobs regularly.

E) expect a certain level of inflation and to negotiate their contracts accordingly.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

66

The widespread problems in financial markets during the Great Recession negatively affected key institutions in the macroeconomy. In addition, the financial regulations that were put in place restricted banks’ ability to lend at levels equal to those in effect prior to 2008. This resulted in a shift

________ of the ________ curve.

A) leftward; aggregate demand

B) leftward; long-run aggregate supply

C) rightward; long-run aggregate supply

D) rightward; aggregate demand

E) rightward; short-run aggregate supply

________ of the ________ curve.

A) leftward; aggregate demand

B) leftward; long-run aggregate supply

C) rightward; long-run aggregate supply

D) rightward; aggregate demand

E) rightward; short-run aggregate supply

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements best describes monetary policy during the Great Recession?

A) During the wake of the Great Recession, there were significant expansionary monetary policy interventions.

B) During the wake of the Great Recession, there were significant contractionary monetary policy interventions.

C) During the wake of the Great Recession, there was a lack of monetary policy interventions.

D) Monetary policy during the Great Recession was completely unexpected.

E) Monetary policy during the Great Recession had no impact in the short run.

A) During the wake of the Great Recession, there were significant expansionary monetary policy interventions.

B) During the wake of the Great Recession, there were significant contractionary monetary policy interventions.

C) During the wake of the Great Recession, there was a lack of monetary policy interventions.

D) Monetary policy during the Great Recession was completely unexpected.

E) Monetary policy during the Great Recession had no impact in the short run.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following explains contractionary monetary policy in the long run?

A) Contractionary monetary policy shifts aggregate demand to the left, moving the economy from long-run equilibrium to a short-run equilibrium with a lower price level and a lower level of real gross domestic product GDP). In the long run, as resource prices fall, the short-run aggregate supply curve shifts to the right, bringing the economy back to a long-run equilibrium, where no real changes to GDP have occurred.

B) Contractionary monetary policy shifts aggregate demand to the right, moving the economy from long-run equilibrium to a short-run equilibrium with a higher price level and a higher level of real gross domestic product GDP). In the long run, as resource prices rise, the aggregate demand curve shifts back to the left, bringing the economy back to a long-run equilibrium, where no real changes to GDP have occurred.

C) Contractionary monetary policy shifts aggregate demand to the right, moving the economy from long-run equilibrium to a short-run equilibrium with a higher price level and a higher level of real gross domestic product GDP). In the long run, as resource prices rise, the short-run aggregate supply curve shifts to the left, bringing the economy back to a long-run equilibrium, where no real changes to GDP have occurred.

D) Contractionary monetary policy shifts aggregate demand to the right, moving the economy from long-run equilibrium to a short-run equilibrium with a higher price level and a higher level of real gross domestic product GDP). In the long run, as resource prices fall, the short-run aggregate supply curve shifts to the right as well, causing the economy to expand.

E) Contractionary monetary policy shifts aggregate demand to the left, moving the economy from long-run equilibrium to a short-run equilibrium with a lower price level and a lower level of real gross domestic product GDP). In the long run, as resource prices rise, the short-run aggregate supply curve shifts to the left, causing the economy to contract.

A) Contractionary monetary policy shifts aggregate demand to the left, moving the economy from long-run equilibrium to a short-run equilibrium with a lower price level and a lower level of real gross domestic product GDP). In the long run, as resource prices fall, the short-run aggregate supply curve shifts to the right, bringing the economy back to a long-run equilibrium, where no real changes to GDP have occurred.

B) Contractionary monetary policy shifts aggregate demand to the right, moving the economy from long-run equilibrium to a short-run equilibrium with a higher price level and a higher level of real gross domestic product GDP). In the long run, as resource prices rise, the aggregate demand curve shifts back to the left, bringing the economy back to a long-run equilibrium, where no real changes to GDP have occurred.

C) Contractionary monetary policy shifts aggregate demand to the right, moving the economy from long-run equilibrium to a short-run equilibrium with a higher price level and a higher level of real gross domestic product GDP). In the long run, as resource prices rise, the short-run aggregate supply curve shifts to the left, bringing the economy back to a long-run equilibrium, where no real changes to GDP have occurred.

D) Contractionary monetary policy shifts aggregate demand to the right, moving the economy from long-run equilibrium to a short-run equilibrium with a higher price level and a higher level of real gross domestic product GDP). In the long run, as resource prices fall, the short-run aggregate supply curve shifts to the right as well, causing the economy to expand.

E) Contractionary monetary policy shifts aggregate demand to the left, moving the economy from long-run equilibrium to a short-run equilibrium with a lower price level and a lower level of real gross domestic product GDP). In the long run, as resource prices rise, the short-run aggregate supply curve shifts to the left, causing the economy to contract.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

69

Refer to the following figure to answer the next questions.

According to the figure, if an expansionary monetary policy is fully expected, that policy will cause an economy initially in full-employment equilibrium to see its price level

A) increase from P1 to P3.

B) increase from P1 to P2.

C) initially increase from P1 to P2 and over time increase to P3.

D) decrease from P3 to P2.

E) decrease from P3 to P1.

According to the figure, if an expansionary monetary policy is fully expected, that policy will cause an economy initially in full-employment equilibrium to see its price level

A) increase from P1 to P3.

B) increase from P1 to P2.

C) initially increase from P1 to P2 and over time increase to P3.

D) decrease from P3 to P2.

E) decrease from P3 to P1.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

70

One explanation as to why monetary policy did not have the intended effects on the economy during the Great Recession is that

A) part of the recession was caused by a rightward shift in aggregate supply.

B) monetary policy is ineffective in the short run.

C) the monetary policy conducted during the Great Recession was mostly unexpected.

D) part of the recession was caused by a leftward shift in aggregate supply.

E) focus was on fiscal policy during the Great Recession.

A) part of the recession was caused by a rightward shift in aggregate supply.

B) monetary policy is ineffective in the short run.

C) the monetary policy conducted during the Great Recession was mostly unexpected.

D) part of the recession was caused by a leftward shift in aggregate supply.

E) focus was on fiscal policy during the Great Recession.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

71

The traditional short-run Phillips curve is

A) upward sloping.

B) downward sloping.

C) horizontal.

D) vertical.

E) U-shaped.

A) upward sloping.

B) downward sloping.

C) horizontal.

D) vertical.

E) U-shaped.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

72

Monetary policy has real effects only when

A) all prices are flexible.

B) inflation is expected.

C) some prices are sticky.

D) the economy is at full-employment output.

E) conducted by Congress.

A) all prices are flexible.

B) inflation is expected.

C) some prices are sticky.

D) the economy is at full-employment output.

E) conducted by Congress.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

73

Unexpected inflation harms workers and other resource suppliers who have ________ prices in the________ run.

A) flexible; short

B) fixed; short

C) fixed; long

D) flexible; short.

E) flexible; medium

A) flexible; short

B) fixed; short

C) fixed; long

D) flexible; short.

E) flexible; medium

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

74

When inflation is expected, the real effect on the economy is

A) amplified.

B) positive.

C) negative.

D) limited.

E) delayed.

A) amplified.

B) positive.

C) negative.

D) limited.

E) delayed.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

75

A cost-of-living adjustment clause

A) is required in all government employee contracts.

B) forces an employer to increase wages at the same rate of inflation.

C) states that no raise can be less than the rate of inflation.

D) is not allowed for private employees.

E) forces an employer to increase wages at a rate higher than inflation.

A) is required in all government employee contracts.

B) forces an employer to increase wages at the same rate of inflation.

C) states that no raise can be less than the rate of inflation.

D) is not allowed for private employees.

E) forces an employer to increase wages at a rate higher than inflation.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

76

When supply shifts cause a downturn in the economy,

A) monetary policy is more likely to restore the economy to its prerecession conditions.

B) inflation is not a concern.

C) the natural rate of unemployment decreases.

D) monetary policy can have no effect on the economy, even in the short run.

E) monetary policy is much less likely to restore the economy to its prerecession conditions.

A) monetary policy is more likely to restore the economy to its prerecession conditions.

B) inflation is not a concern.

C) the natural rate of unemployment decreases.

D) monetary policy can have no effect on the economy, even in the short run.

E) monetary policy is much less likely to restore the economy to its prerecession conditions.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

77

The traditional short-run Phillips curve has ________ on the x axis and ________ on the y axis.

A) unemployment; inflation

B) inflation; unemployment

C) real gross domestic product GDP); price level

D) price level; real gross domestic product GDP)

E) real gross domestic product GDP); inflation

A) unemployment; inflation

B) inflation; unemployment

C) real gross domestic product GDP); price level

D) price level; real gross domestic product GDP)

E) real gross domestic product GDP); inflation

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

78

If inflation is expected,

A) the effects of monetary policy will be amplified.

B) prices become sticky.

C) the effects of monetary policy will be delayed.

D) prices are not sticky.

E) the effects of fiscal policy will be amplified.

A) the effects of monetary policy will be amplified.

B) prices become sticky.

C) the effects of monetary policy will be delayed.

D) prices are not sticky.

E) the effects of fiscal policy will be amplified.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

79

When an employer is forced to increase wages at the same rate of inflation, the

A) worker is receiving a cost-of-living adjustment.

B) economy is experiencing stagflation.

C) economy is experiencing hyperinflation.

D) economy is experiencing disinflation.

E) effects of expansionary monetary policy are amplified.

A) worker is receiving a cost-of-living adjustment.

B) economy is experiencing stagflation.

C) economy is experiencing hyperinflation.

D) economy is experiencing disinflation.

E) effects of expansionary monetary policy are amplified.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

80

Refer to the following figure to answer the next questions.

According to the figure, if an expansionary monetary policy is fully expected, that policy will cause an economy initially in full-employment equilibrium to see real gross domestic product GDP)

A) increase from Y2 to Y3.

B) first increase from Y2 to Y3 but then decrease back to Y2.

C) stay at Y2.

D) decrease from Y2 to Y1.

E) increase from Y1 to Y2.

According to the figure, if an expansionary monetary policy is fully expected, that policy will cause an economy initially in full-employment equilibrium to see real gross domestic product GDP)

A) increase from Y2 to Y3.

B) first increase from Y2 to Y3 but then decrease back to Y2.

C) stay at Y2.

D) decrease from Y2 to Y1.

E) increase from Y1 to Y2.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck