Deck 20: International Finance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/175

Play

Full screen (f)

Deck 20: International Finance

1

If a currency becomes ________ valuable in world markets, then its price rises, and this increase is called a(n) ________.

A) less; appreciation

B) less; disaggregation

C) more; appreciation

D) more; aggregation

E) more; speculation

A) less; appreciation

B) less; disaggregation

C) more; appreciation

D) more; aggregation

E) more; speculation

more; appreciation

2

If the U.S. dollar ________, it becomes ________ valuable in world markets

A) appreciates; less

B) depreciates; less

C) depreciates; more

D) is indexed; less

E) is indexed; more

A) appreciates; less

B) depreciates; less

C) depreciates; more

D) is indexed; less

E) is indexed; more

depreciates; less

3

The following table shows the number of U.S. dollars required to buy one euro between February 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-Between March 1, 2016, and May 1, 2016, the U.S. dollar ________ against the euro, and the euro________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; neither appreciated nor depreciated

E) appreciated; neither appreciated nor depreciated

-Between March 1, 2016, and May 1, 2016, the U.S. dollar ________ against the euro, and the euro________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; neither appreciated nor depreciated

E) appreciated; neither appreciated nor depreciated

depreciated; appreciated

4

The following table shows the number of euros required to buy one U.S. dollar between February 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-Between March 1, 2016, and May 1, 2016, the U.S. dollar ________ against the euro, and the euro ________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; neither appreciated nor depreciated

E) appreciated; neither appreciated nor depreciated

-Between March 1, 2016, and May 1, 2016, the U.S. dollar ________ against the euro, and the euro ________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; neither appreciated nor depreciated

E) appreciated; neither appreciated nor depreciated

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

5

The following table shows the number of U.S. dollars required to buy one British pound between February 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-Between June 1, 2016, and August 1, 2016, the U.S. dollar ________ against the British pound, and the British pound ________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) appreciated; appreciated

D) depreciated; neither appreciated nor depreciated

E) neither appreciated nor depreciated; neither appreciated nor depreciated

-Between June 1, 2016, and August 1, 2016, the U.S. dollar ________ against the British pound, and the British pound ________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) appreciated; appreciated

D) depreciated; neither appreciated nor depreciated

E) neither appreciated nor depreciated; neither appreciated nor depreciated

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

6

The following table shows the number of U.S. dollars required to buy one euro between February 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-Between April 1, 2016, and June 1, 2016, the U.S. dollar ________ against the euro, and the euro________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; neither appreciated nor depreciated

E) appreciated; neither appreciated nor depreciated

-Between April 1, 2016, and June 1, 2016, the U.S. dollar ________ against the euro, and the euro________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; neither appreciated nor depreciated

E) appreciated; neither appreciated nor depreciated

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

7

The following table shows the number of various foreign currencies required to buy a U.S. dollar in April 2011 and April 2016. Use this table to answer the next questions.

-Between April 2011 and April 2016, the U.S. dollar depreciated against the

A) euro.

B) Chinese yuan.

C) Indian rupee.

D) Japanese yen.

E) British pound.

-Between April 2011 and April 2016, the U.S. dollar depreciated against the

A) euro.

B) Chinese yuan.

C) Indian rupee.

D) Japanese yen.

E) British pound.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

8

The following table shows the number of U.S. dollars required to buy one British pound between February 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-Between March 1, 2016, and April 1, 2016, the U.S. dollar ________ against the British pound, and the British pound ________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; neither appreciated nor depreciated

E) neither appreciated nor depreciated; neither appreciated nor depreciated

-Between March 1, 2016, and April 1, 2016, the U.S. dollar ________ against the British pound, and the British pound ________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; neither appreciated nor depreciated

E) neither appreciated nor depreciated; neither appreciated nor depreciated

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

9

The following table shows the number of U.S. dollars required to buy one British pound between February 1, 2016, and September 1, 2016. Use this table to answer the next questions.

- On March 1, 2016, the price of a surfboard was 1,200 U.S. dollars in La Jolla, California. Based on the exchange rates quoted in the table, a surfboard was approximately ________ British pounds.

A) 1,931

B) 1,950

C) 1,883

D) 1,805

E) 842

- On March 1, 2016, the price of a surfboard was 1,200 U.S. dollars in La Jolla, California. Based on the exchange rates quoted in the table, a surfboard was approximately ________ British pounds.

A) 1,931

B) 1,950

C) 1,883

D) 1,805

E) 842

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

10

The following table shows the number of various foreign currencies required to buy a U.S. dollar in April 2011 and April 2016. Use this table to answer the next questions.

-In April 2011, a haircut in Japan cost 2,000 yen. Using the exchange rates in the above table, that haircut cost approximately ________ U.S. dollars or ________ euros.

A) 24.04; 16.62

B) 20.08; 19.03

C) 203,080.00; 189,140.36

D) 21.15; 2,147.40

E) 9.82; 10.54

-In April 2011, a haircut in Japan cost 2,000 yen. Using the exchange rates in the above table, that haircut cost approximately ________ U.S. dollars or ________ euros.

A) 24.04; 16.62

B) 20.08; 19.03

C) 203,080.00; 189,140.36

D) 21.15; 2,147.40

E) 9.82; 10.54

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

11

The following table shows the number of U.S. dollars required to buy one euro between February 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-Between February 1, 2016, and September 1, 2016, the U.S. dollar ________ against the euro, and the euro ________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; neither appreciated nor depreciated

E) appreciated; neither appreciated nor depreciated

-Between February 1, 2016, and September 1, 2016, the U.S. dollar ________ against the euro, and the euro ________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; neither appreciated nor depreciated

E) appreciated; neither appreciated nor depreciated

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

12

The following table shows the number of euros required to buy one U.S. dollar between February 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-Between April 1, 2016, and June 1, 2016, the U.S. dollar ________ against the euro, and the euro________ against the U.S. dollar

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; neither appreciated nor depreciated

E) appreciated; neither appreciated nor depreciated

-Between April 1, 2016, and June 1, 2016, the U.S. dollar ________ against the euro, and the euro________ against the U.S. dollar

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; neither appreciated nor depreciated

E) appreciated; neither appreciated nor depreciated

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

13

If the U.S. dollar ________, it becomes ________ valuable in world markets.

A) depreciates; more

B) is indexed; less

C) appreciates; less

D) is indexed; more

E) appreciates; more

A) depreciates; more

B) is indexed; less

C) appreciates; less

D) is indexed; more

E) appreciates; more

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

14

The following table shows the number of U.S. dollars required to buy one British pound between February 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-Between February 1, 2016, and March 1, 2016, the U.S. dollar ________ against the British pound, and the British pound ________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) appreciated; appreciated

D) depreciated; neither appreciated nor depreciated

E) neither appreciated nor depreciated; neither appreciated nor depreciated

-Between February 1, 2016, and March 1, 2016, the U.S. dollar ________ against the British pound, and the British pound ________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) appreciated; appreciated

D) depreciated; neither appreciated nor depreciated

E) neither appreciated nor depreciated; neither appreciated nor depreciated

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

15

If a currency becomes ________ valuable in world markets, then its price falls, and this decrease is called a(n) ________.

A) more; approximation

B) less; depreciation

C) less; appreciation

D) more; depreciation

E) more; appreciation

A) more; approximation

B) less; depreciation

C) less; appreciation

D) more; depreciation

E) more; appreciation

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

16

The following table shows the number of U.S. dollars required to buy one British pound between February 1, 2016, and September 1, 2016. Use this table to answer the next questions.

- On February 1, 2016, the price of a skateboard at JJ’s Beach Shop was 120 U.S. dollars in La Jolla,California. On April 1, 2016, the price of a skateboard was 130 U.S. dollars. Using the exchange rates in the table, between February 1, 2016, and April 1, 2016, the price of a skateboard at JJ’s Beach Shop increased by approximately ________ in terms of U.S. dollars and ________ in terms of British pounds. (Round the percentage changes to the first decimal point.)

A) 7.7 percent; 2.3 percent

B) 7.7 percent; 12.8 percent

C) 8.3 percent; 2.3 percent

D) 8.3 percent; 8.1 percent

E) 8.3 percent; 7.7 percent

- On February 1, 2016, the price of a skateboard at JJ’s Beach Shop was 120 U.S. dollars in La Jolla,California. On April 1, 2016, the price of a skateboard was 130 U.S. dollars. Using the exchange rates in the table, between February 1, 2016, and April 1, 2016, the price of a skateboard at JJ’s Beach Shop increased by approximately ________ in terms of U.S. dollars and ________ in terms of British pounds. (Round the percentage changes to the first decimal point.)

A) 7.7 percent; 2.3 percent

B) 7.7 percent; 12.8 percent

C) 8.3 percent; 2.3 percent

D) 8.3 percent; 8.1 percent

E) 8.3 percent; 7.7 percent

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

17

The euro is an unusual currency because

A) euro coins are made of 100 percent gold.

B) it is the only other currency besides dollars that is issued solely by the United States Federal Reserve Bank.

C) euros cannot be exchanged for Mexican pesos.

D) euros are used by 19 countries in Europe.

E) a euro coin turns bright pink if it is used in an illegal transaction.

A) euro coins are made of 100 percent gold.

B) it is the only other currency besides dollars that is issued solely by the United States Federal Reserve Bank.

C) euros cannot be exchanged for Mexican pesos.

D) euros are used by 19 countries in Europe.

E) a euro coin turns bright pink if it is used in an illegal transaction.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

18

The following table shows the number of various foreign currencies required to buy a U.S. dollar in April 2011 and April 2016. Use this table to answer the next questions.

-Between April 2011 and April 2016, the price of a U.S. postage stamp increased from $0.41 to $0.46. The price of a U.S. postage stamp has increased approximately ________ in terms of Indian rupees and ________ in terms of Chinese yuan

A) 12 percent; 12 percent

B) 68 percent; 11 percent

C) 13 percent; 44 percent

D) 19 percent; 28 percent

E) 9 percent; 51 percent

-Between April 2011 and April 2016, the price of a U.S. postage stamp increased from $0.41 to $0.46. The price of a U.S. postage stamp has increased approximately ________ in terms of Indian rupees and ________ in terms of Chinese yuan

A) 12 percent; 12 percent

B) 68 percent; 11 percent

C) 13 percent; 44 percent

D) 19 percent; 28 percent

E) 9 percent; 51 percent

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

19

Currency ________ occurs when a currency increases in value relative to other currencies.

A) devaluation

B) dismissal

C) depreciation

D) appreciation

E) representation

A) devaluation

B) dismissal

C) depreciation

D) appreciation

E) representation

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

20

Currency ________ occurs when a currency decreases in value relative to other currencies.

A) apportionment

B) revaluation

C) depreciation

D) appreciation

E) representation

A) apportionment

B) revaluation

C) depreciation

D) appreciation

E) representation

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

21

If interest rates fall in the United States relative to the rest of the world, the demand for U.S. dollars will ________ because there is lesser demand for assets with ________ returns.

A) decrease; higher

B) decrease; lower

C) increase; higher

D) increase; lower

E) increase; diminishing marginal

A) decrease; higher

B) decrease; lower

C) increase; higher

D) increase; lower

E) increase; diminishing marginal

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

22

The following table shows the number of U.S. dollars required to buy one Mexican peso and the number of U.S. dollars required to buy one Japanese yen between June 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-On August 1, 2016, the price of a jar of pickles was 135 Mexican pesos at a supermarket in Juarez, Mexico. Based on the exchange rates quoted in the table, the price of the jar of pickles was approximately ________ U.S. dollars.

A) 0.18

B) 7.31

C) 7.24

D) 1,669.14

E) 1,722.38

-On August 1, 2016, the price of a jar of pickles was 135 Mexican pesos at a supermarket in Juarez, Mexico. Based on the exchange rates quoted in the table, the price of the jar of pickles was approximately ________ U.S. dollars.

A) 0.18

B) 7.31

C) 7.24

D) 1,669.14

E) 1,722.38

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

23

The following table shows the number of U.S. dollars required to buy one Mexican peso and the number of U.S. dollars required to buy one Australian dollar between June 1, 2016, and September 1, 2016:

Between June 1, 2016, and July 1, 2016, the U.S. dollar ________ against the Mexican peso, and the U.S. dollar ________ against the Australian dollar.

A) neither appreciated nor depreciated; neither appreciated nor depreciated

B) depreciated; appreciated

C) appreciated; appreciated

D) depreciated; depreciated

E) appreciated; depreciated

Between June 1, 2016, and July 1, 2016, the U.S. dollar ________ against the Mexican peso, and the U.S. dollar ________ against the Australian dollar.

A) neither appreciated nor depreciated; neither appreciated nor depreciated

B) depreciated; appreciated

C) appreciated; appreciated

D) depreciated; depreciated

E) appreciated; depreciated

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

24

The following table shows the number of British pounds required to buy one U.S. dollar and the number of euros required to buy one U.S. dollar between February 1, 2016, and September 1, 2016:

Between March 1, 2016, and April 1, 2016, the U.S. dollar ________ against the British pound, and the U.S. dollar ________ against the euro.

A) neither appreciated nor depreciated; neither appreciated nor depreciated

B) depreciated; appreciated

C) appreciated; appreciated

D) depreciated; depreciated

E) appreciated; depreciated

Between March 1, 2016, and April 1, 2016, the U.S. dollar ________ against the British pound, and the U.S. dollar ________ against the euro.

A) neither appreciated nor depreciated; neither appreciated nor depreciated

B) depreciated; appreciated

C) appreciated; appreciated

D) depreciated; depreciated

E) appreciated; depreciated

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

25

The following table shows the number of British pounds required to buy one U.S. dollar between February 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-Between June 1, 2016, and August 1, 2016, the U.S. dollar ________ against the British pound, and the British pound ________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; depreciated

E) appreciated; neither appreciated nor depreciated

-Between June 1, 2016, and August 1, 2016, the U.S. dollar ________ against the British pound, and the British pound ________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; depreciated

E) appreciated; neither appreciated nor depreciated

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

26

The following table shows the number of U.S. dollars required to buy one British pound and the number of U.S. dollars required to buy one euro between February 1, 2016, and September 1, 2016:

Between February 1, 2016, and March 1, 2016, the U.S. dollar ________ against the British pound, and the U.S. dollar ________ against the euro.

A) neither appreciated nor depreciated; neither appreciated nor depreciated

B) depreciated; appreciated

C) appreciated; appreciated

D) depreciated; depreciated

E) appreciated; depreciated

Between February 1, 2016, and March 1, 2016, the U.S. dollar ________ against the British pound, and the U.S. dollar ________ against the euro.

A) neither appreciated nor depreciated; neither appreciated nor depreciated

B) depreciated; appreciated

C) appreciated; appreciated

D) depreciated; depreciated

E) appreciated; depreciated

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

27

When demand for Canada's exports rises,

A) demand for the Canadian dollar in the foreign exchange market falls.

B) demand for the Canadian dollar in the foreign exchange market rises.

C) the Canadian dollar depreciates against all other currencies.

D) supply of the Canadian dollar in the foreign exchange market falls.

E) supply of the Canadian dollar in the foreign exchange market rises.

A) demand for the Canadian dollar in the foreign exchange market falls.

B) demand for the Canadian dollar in the foreign exchange market rises.

C) the Canadian dollar depreciates against all other currencies.

D) supply of the Canadian dollar in the foreign exchange market falls.

E) supply of the Canadian dollar in the foreign exchange market rises.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

28

According to the law of ________, the quantity of yen demanded by U.S. consumers will ________when the price of yen in terms of U.S. dollars falls.

A) demand; fall

B) demand; rise

C) international banking secrecy; neither rise nor fall

D) supply; neither rise nor fall

E) supply; fall

A) demand; fall

B) demand; rise

C) international banking secrecy; neither rise nor fall

D) supply; neither rise nor fall

E) supply; fall

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

29

If interest rates in Canada increase relative to the rest of the world, it means that 1) Canadian bondswill provide a ________ return than previously and (2) ________ for these bonds will ________.

A) higher; supply; decrease

B) higher; supply; increase

C) higher; demand; increase

D) lower; demand; decrease

E) lower; demand; increase

A) higher; supply; decrease

B) higher; supply; increase

C) higher; demand; increase

D) lower; demand; decrease

E) lower; demand; increase

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

30

The following table shows the number of U.S. dollars required to buy one Mexican peso and the number of U.S. dollars required to buy one Japanese yen between June 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-Between June 1, 2016, and July 1, 2016, the number of U.S. goods exported to Mexico likely

A) increased because U.S. goods became more expensive to consumers in Mexico.

B) decreased because U.S. goods became more expensive to consumers in Mexico.

C) increased because U.S. goods became less expensive to consumers in Mexico.

D) decreased because U.S. goods became less expensive to consumers in Mexico.

E) did not change because exchange rates do not affect trade.

-Between June 1, 2016, and July 1, 2016, the number of U.S. goods exported to Mexico likely

A) increased because U.S. goods became more expensive to consumers in Mexico.

B) decreased because U.S. goods became more expensive to consumers in Mexico.

C) increased because U.S. goods became less expensive to consumers in Mexico.

D) decreased because U.S. goods became less expensive to consumers in Mexico.

E) did not change because exchange rates do not affect trade.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

31

The following table shows the number of British pounds required to buy one U.S. dollar between February 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-Between February 1, 2016, and March 1, 2016, the U.S. dollar ________ against the British pound, and the British pound ________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; depreciated

E) appreciated; neither appreciated nor depreciated

-Between February 1, 2016, and March 1, 2016, the U.S. dollar ________ against the British pound, and the British pound ________ against the U.S. dollar.

A) depreciated; appreciated

B) appreciated; depreciated

C) neither appreciated nor depreciated; depreciated

D) depreciated; depreciated

E) appreciated; neither appreciated nor depreciated

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

32

The following table shows the number of U.S. dollars required to buy one Mexican peso and the number of U.S. dollars required to buy one Japanese yen between June 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-On August 1, 2016, Carlos paid 800,000 Japanese yen for a solid gold iPhone case in Fukushima, Japan. Because he only had Mexican pesos, he needed to exchange his pesos at a nearby bank in order to get the 800,000 yen he used to pay for the iPhone case. The bank is able to buy and sell U.S. dollars, Mexican pesos, and Japanese yen at the exchange rates shown in the table. Approximately how much did the iPhone case cost Carlos in terms of Mexican pesos?

A) 8,584

B) 11,333

C) 146,396

D) 171,118

E) 4,371,717

-On August 1, 2016, Carlos paid 800,000 Japanese yen for a solid gold iPhone case in Fukushima, Japan. Because he only had Mexican pesos, he needed to exchange his pesos at a nearby bank in order to get the 800,000 yen he used to pay for the iPhone case. The bank is able to buy and sell U.S. dollars, Mexican pesos, and Japanese yen at the exchange rates shown in the table. Approximately how much did the iPhone case cost Carlos in terms of Mexican pesos?

A) 8,584

B) 11,333

C) 146,396

D) 171,118

E) 4,371,717

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

33

The following table shows the number of U.S. dollars required to buy one Mexican peso and the number of U.S. dollars required to buy one Japanese yen between June 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-On June 1, 2016, Samantha bought a yoga mat for 250 Mexican pesos in Playa del Carmen, Mexico. Because she only had Japanese yen, she needed to exchange her Japanese yen at a nearby

Money-exchange kiosk in order to get the 250 Mexican pesos she used for the purchase. The kiosk is able to buy and sell U.S. dollars, Mexican pesos, and Japanese yen at the exchange rates shown in the table. Approximately how much did the yoga mat cost Samantha in terms of Japanese yen?

A) 0.2136

B) 1,121

C) 3,151

D) 1,411

E) 292,609

-On June 1, 2016, Samantha bought a yoga mat for 250 Mexican pesos in Playa del Carmen, Mexico. Because she only had Japanese yen, she needed to exchange her Japanese yen at a nearby

Money-exchange kiosk in order to get the 250 Mexican pesos she used for the purchase. The kiosk is able to buy and sell U.S. dollars, Mexican pesos, and Japanese yen at the exchange rates shown in the table. Approximately how much did the yoga mat cost Samantha in terms of Japanese yen?

A) 0.2136

B) 1,121

C) 3,151

D) 1,411

E) 292,609

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

34

The following table shows the number of U.S. dollars required to buy one Mexican peso and the number of U.S. dollars required to buy one Japanese yen between June 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-On July 1, 2016, Brandy paid 450 Mexican pesos for a manicure in Playa del Carmen, Mexico. Because she only had Japanese yen, she needed to exchange her Japanese yen at a nearby

Money-exchange kiosk in order to get the 450 Mexican pesos she used to pay the manicurist. The kiosk is able to buy and sell U.S. dollars, Mexican pesos, and Japanese yen at the exchange rates shown in the table. Approximately how much did the manicure cost Brandy in terms of Japanese yen?

A) 0.3386

B) 2,517

C) 2,921

D) 0.3243

E) 472,532

-On July 1, 2016, Brandy paid 450 Mexican pesos for a manicure in Playa del Carmen, Mexico. Because she only had Japanese yen, she needed to exchange her Japanese yen at a nearby

Money-exchange kiosk in order to get the 450 Mexican pesos she used to pay the manicurist. The kiosk is able to buy and sell U.S. dollars, Mexican pesos, and Japanese yen at the exchange rates shown in the table. Approximately how much did the manicure cost Brandy in terms of Japanese yen?

A) 0.3386

B) 2,517

C) 2,921

D) 0.3243

E) 472,532

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

35

When demand for Canada's exports falls,

A) Canadian producers will sell more goods to foreigners.

B) the U.S. federal government will always respond by increasing U.S. tax rates.

C) the U.S. federal government will always respond by increasing U.S. exports.

D) demand of the Canadian dollar in the foreign exchange market falls.

E) supply of the Canadian dollar in the foreign exchange market rises.

A) Canadian producers will sell more goods to foreigners.

B) the U.S. federal government will always respond by increasing U.S. tax rates.

C) the U.S. federal government will always respond by increasing U.S. exports.

D) demand of the Canadian dollar in the foreign exchange market falls.

E) supply of the Canadian dollar in the foreign exchange market rises.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

36

The claim that the quantity of euros demanded by U.S. consumers will fall when the price of euros in terms of U.S. dollars rises is best referred to as the

A) law of increasing marginal costs.

B) hot-hand fallacy.

C) law of supply.

D) exchange rate-inflation fallacy.

E) law of demand.

A) law of increasing marginal costs.

B) hot-hand fallacy.

C) law of supply.

D) exchange rate-inflation fallacy.

E) law of demand.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

37

If interest rates rise in the United States relative to the rest of the world, the demand for U.S. dollars will ________ because there is greater demand for assets with ________ returns.

A) decrease; higher

B) decrease; lower

C) increase; higher

D) increase; lower

E) increase; diminishing marginal

A) decrease; higher

B) decrease; lower

C) increase; higher

D) increase; lower

E) increase; diminishing marginal

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

38

Which statement best describes the law of demand as it relates to currency markets?

A) The law of demand only applies to goods and services, not currency.

B) When the price of a Mexican peso in terms of a U.S. dollar decreases, U.S. consumers demand fewer Mexican pesos because Mexican goods become more expensive to American consumers.

C) When the price of Japanese yen in terms of a U.S. dollar decreases, U.S. consumers demand more Japanese dollars because Japanese goods become more expensive to American consumers.

D) When the price of a Canadian dollar in terms of a U.S. dollar increases, U.S. consumers demand fewer Canadian dollars because Canadian goods become more expensive to American consumers.

E) When the price of an Australian dollar in terms of a U.S. dollar increases, U.S. consumers demand more Australian dollars because Australian goods become less expensive to American consumers.

A) The law of demand only applies to goods and services, not currency.

B) When the price of a Mexican peso in terms of a U.S. dollar decreases, U.S. consumers demand fewer Mexican pesos because Mexican goods become more expensive to American consumers.

C) When the price of Japanese yen in terms of a U.S. dollar decreases, U.S. consumers demand more Japanese dollars because Japanese goods become more expensive to American consumers.

D) When the price of a Canadian dollar in terms of a U.S. dollar increases, U.S. consumers demand fewer Canadian dollars because Canadian goods become more expensive to American consumers.

E) When the price of an Australian dollar in terms of a U.S. dollar increases, U.S. consumers demand more Australian dollars because Australian goods become less expensive to American consumers.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

39

The following table shows the number of U.S. dollars required to buy one Mexican peso and the number of U.S. dollars required to buy one Japanese yen between June 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-Between August 1, 2016, and September 1, 2016, the number of

A) Japanese goods exported to the United States likely decreased because Japanese goods became more expensive to consumers in the United States.

B) U.S. goods exported to Japan likely decreased because U.S. goods became less expensive to consumers in Japan.

C) Mexican goods exported to the United States likely increased because the Mexican peso depreciated against the U.S. dollar.

D) U.S. goods exported to Mexico likely did not change because the Mexican peso is pegged to the Japanese yen but not to the U.S. dollar.

E) Japanese goods exported to the United States likely increased because Japanese goods became less expensive to consumers in the United States.

-Between August 1, 2016, and September 1, 2016, the number of

A) Japanese goods exported to the United States likely decreased because Japanese goods became more expensive to consumers in the United States.

B) U.S. goods exported to Japan likely decreased because U.S. goods became less expensive to consumers in Japan.

C) Mexican goods exported to the United States likely increased because the Mexican peso depreciated against the U.S. dollar.

D) U.S. goods exported to Mexico likely did not change because the Mexican peso is pegged to the Japanese yen but not to the U.S. dollar.

E) Japanese goods exported to the United States likely increased because Japanese goods became less expensive to consumers in the United States.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

40

The following table shows the number of U.S. dollars required to buy one Mexican peso and the number of U.S. dollars required to buy one Japanese yen between June 1, 2016, and September 1, 2016. Use this table to answer the next questions.

-On June 1, 2016, the price of a 16-ounce can of mixed nuts was 135 Mexican pesos at a supermarket in Juarez, Mexico. Based on the exchange rates quoted in the table, the price of the 16-ounce can of mixed nuts was approximately ________ U.S. dollars.

A) 0.18

B) 7.30

C) 7.24

D) 1,669.14

E) 1,722.38

-On June 1, 2016, the price of a 16-ounce can of mixed nuts was 135 Mexican pesos at a supermarket in Juarez, Mexico. Based on the exchange rates quoted in the table, the price of the 16-ounce can of mixed nuts was approximately ________ U.S. dollars.

A) 0.18

B) 7.30

C) 7.24

D) 1,669.14

E) 1,722.38

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

41

In the foreign currency market, the supply of a foreign currency is assumed to be ________ because the central bank determines the supply of money.

A) horizontal

B) vertical

C) upward sloping

D) downward sloping

E) uncontrollable

A) horizontal

B) vertical

C) upward sloping

D) downward sloping

E) uncontrollable

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

42

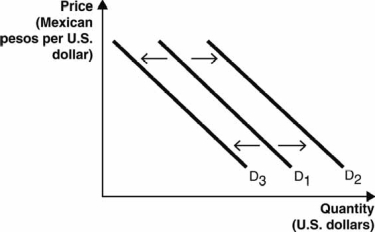

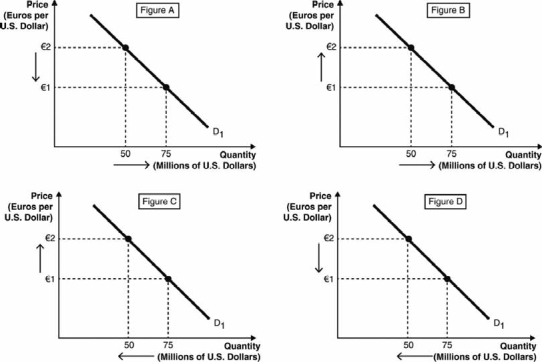

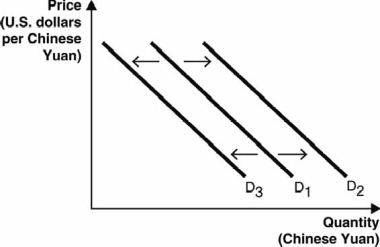

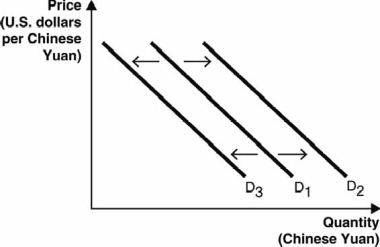

The following figure depicts the demand for U.S. dollars in the foreign currency exchange market. Use this figure to answer the next questions.

If interest rates in Mexico rise relative to interest rates in the United States, the demand curve in the figure above

A) will not shift because interest rates are not related to exchange rates.

B) will not shift because interest rates only affect the supply curve.

C) can either increase from D1 to D2 or decrease from D1 to D3, depending on the relative magnitude of the two effects.

D) will increase from D1 to D2.

E) will decrease from D1 to D3.

If interest rates in Mexico rise relative to interest rates in the United States, the demand curve in the figure above

A) will not shift because interest rates are not related to exchange rates.

B) will not shift because interest rates only affect the supply curve.

C) can either increase from D1 to D2 or decrease from D1 to D3, depending on the relative magnitude of the two effects.

D) will increase from D1 to D2.

E) will decrease from D1 to D3.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

43

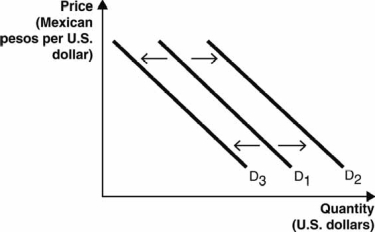

The following figure depicts the demand for U.S. dollars in the foreign currency exchange market. Use this figure to answer the next questions.

If interest rates in the United States rise relative to interest rates in Mexico and, at the same time, Mexican consumer demand for U.S. goods decreases, the demand curve in the figure above

A) will not shift because interest rates are not related to exchange rates.

B) will not shift because interest rates only affect the supply curve.

C) can either increase from D1 to D2 or decrease from D1 to D3, depending on the relative magnitude of the two effects.

D) will increase from D1 to D2.

E) will decrease from D1 to D3.

If interest rates in the United States rise relative to interest rates in Mexico and, at the same time, Mexican consumer demand for U.S. goods decreases, the demand curve in the figure above

A) will not shift because interest rates are not related to exchange rates.

B) will not shift because interest rates only affect the supply curve.

C) can either increase from D1 to D2 or decrease from D1 to D3, depending on the relative magnitude of the two effects.

D) will increase from D1 to D2.

E) will decrease from D1 to D3.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

44

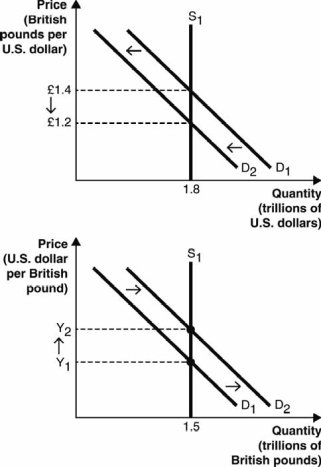

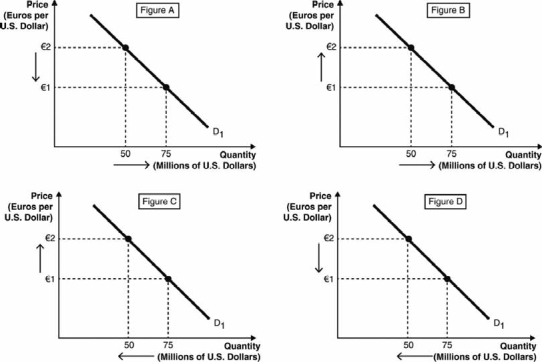

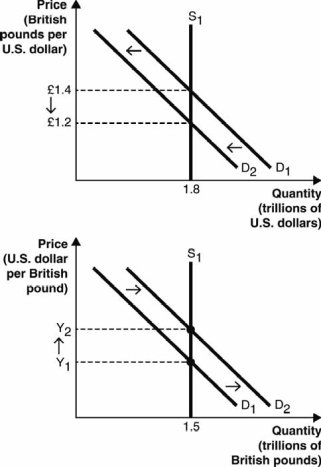

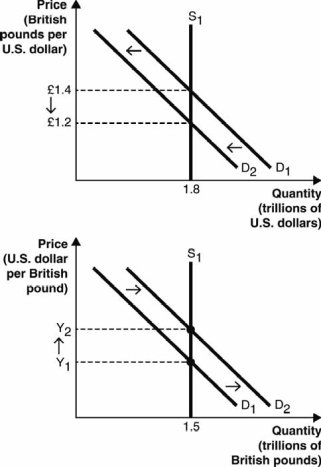

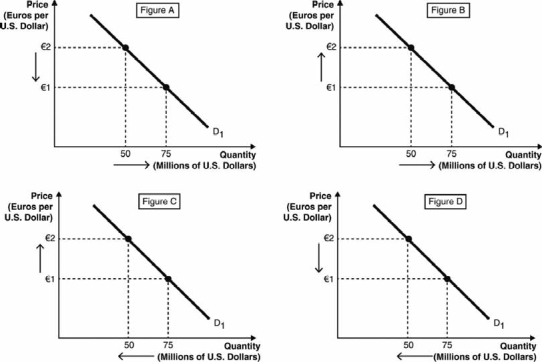

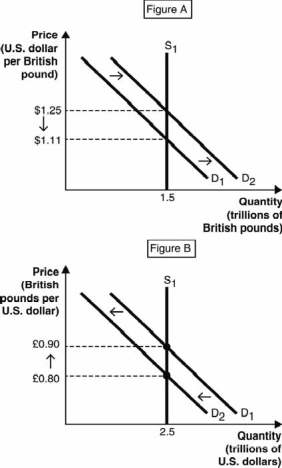

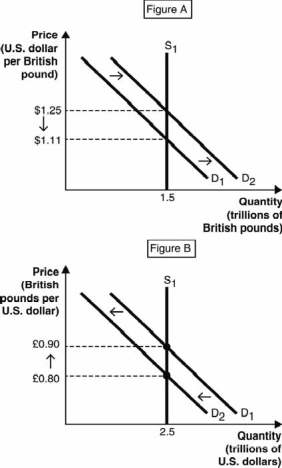

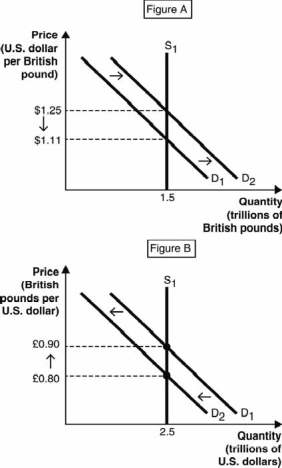

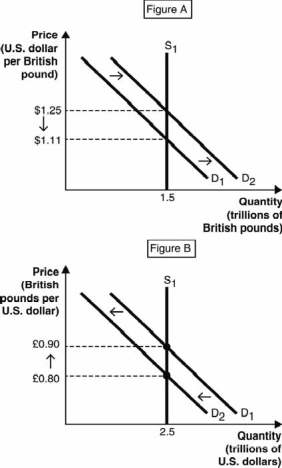

The following two figures depict the demand and supply of U.S. dollars and the demand and supply of British pounds in the foreign currency exchange market. Use these figures to answer the next questions.

Assume that the same event caused demand for U.S. dollars to decrease and demand for British pounds to increase and that both of these graphs describe that event. Approximately what is Y2 ?

A) $0.50

B) $0.71

C) $0.83

D) $1.20

E) $1.40

Assume that the same event caused demand for U.S. dollars to decrease and demand for British pounds to increase and that both of these graphs describe that event. Approximately what is Y2 ?

A) $0.50

B) $0.71

C) $0.83

D) $1.20

E) $1.40

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

45

If interest rates in Australia decrease relative to the rest of the world, it means that 1) Australian bonds will provide a ________ return than previously and (2) ________ for these bonds will________.

A) higher; supply; decrease

B) higher; supply; increase

C) higher; demand; increase

D) lower; demand; decrease

E) lower; demand; increase

A) higher; supply; decrease

B) higher; supply; increase

C) higher; demand; increase

D) lower; demand; decrease

E) lower; demand; increase

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

46

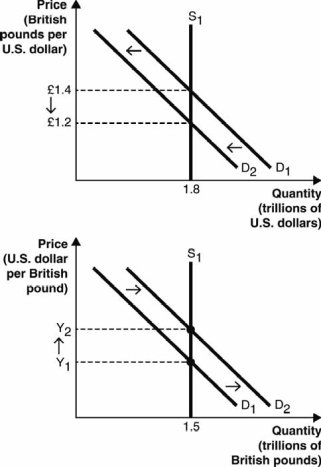

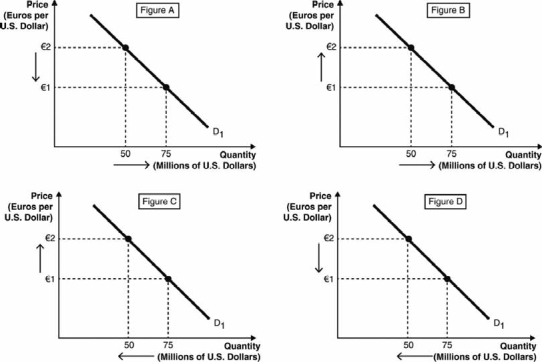

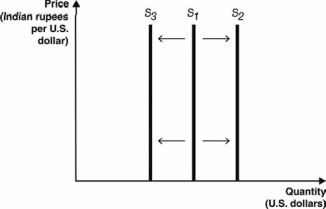

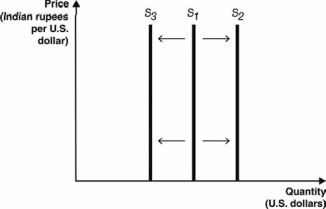

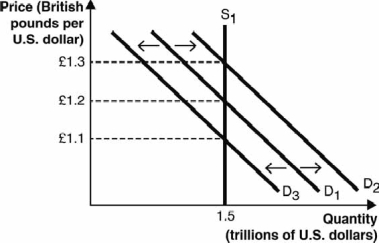

The arrows in Figures A-D represent possible movements of the exchange rate euros per U.S. dollar) and the quantity of U.S. dollars buyers are willing and able to buy. Use these figures to answer the next questions.

An appreciation of the euro against the U.S. dollar is represented by Figure ________, and a depreciation of the U.S. dollar against the euro is represented by Figure ________.

A) A; C

B) A; A

C) B; D

D) D; B

E) A; D

An appreciation of the euro against the U.S. dollar is represented by Figure ________, and a depreciation of the U.S. dollar against the euro is represented by Figure ________.

A) A; C

B) A; A

C) B; D

D) D; B

E) A; D

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

47

The following figure depicts the supply of U.S. dollars in the foreign currency exchange market. Use this figure to answer the next questions.

The U.S. central bank has the power to increase or decrease the supply of U.S. dollars. If the U.S. central bank increases the supply of U.S. dollars, the supply curve in the above figure will ________;if the U.S. central bank decreases the supply of U.S. dollars, the supply curve in the above figure will________.

A) shift rightward; shift leftward

B) shift leftward; shift rightward

C) shift rightward; also shift rightward

D) shift leftward; also shift leftward

E) not shift; not shift

The U.S. central bank has the power to increase or decrease the supply of U.S. dollars. If the U.S. central bank increases the supply of U.S. dollars, the supply curve in the above figure will ________;if the U.S. central bank decreases the supply of U.S. dollars, the supply curve in the above figure will________.

A) shift rightward; shift leftward

B) shift leftward; shift rightward

C) shift rightward; also shift rightward

D) shift leftward; also shift leftward

E) not shift; not shift

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

48

The following two figures depict the demand and supply of U.S. dollars and the demand and supply of British pounds in the foreign currency exchange market. Use these figures to answer the next questions.

Assume that the same event caused demand for U.S. dollars to decrease and demand for British pounds to increase and that both of these graphs describe that event. Approximately what is Y1 ?

A) $0.50

B) $0.71

C) $0.83

D) $1.20

E) $1.40

Assume that the same event caused demand for U.S. dollars to decrease and demand for British pounds to increase and that both of these graphs describe that event. Approximately what is Y1 ?

A) $0.50

B) $0.71

C) $0.83

D) $1.20

E) $1.40

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

49

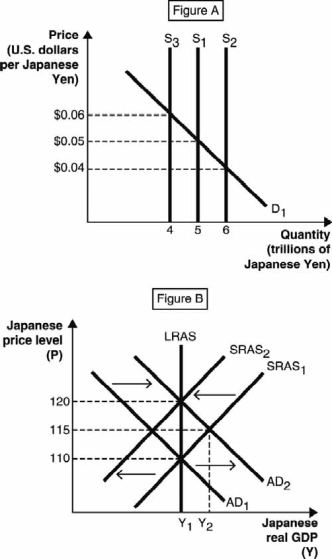

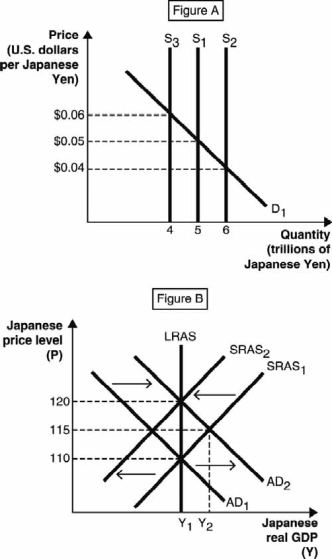

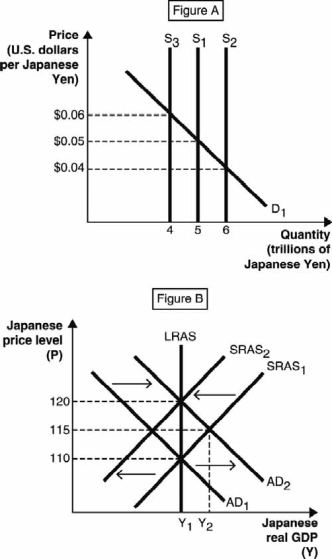

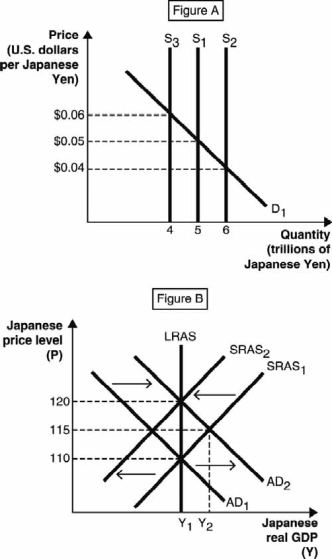

Figure A below depicts the demand and supply of Japanese yen in the foreign currency exchange market. Figure B below depicts the aggregate supply-aggregate demand model for the Japanese economy. Use these figures to answer the next questions.

Assume the Japanese economy is illustrated at the intersection of AD1 and SRAS1. If the Bank of Japan the Japanese central bank) increased the supply of yen from five trillion to six trillion, the Japanese price level would ________ in the short run and increase from 115 to 120 in the long run.

A) decrease from 120 to 110

B) not change

C) increase from 110 to 120

D) decrease from 120 to 115

E) increase from 110 to 115

Assume the Japanese economy is illustrated at the intersection of AD1 and SRAS1. If the Bank of Japan the Japanese central bank) increased the supply of yen from five trillion to six trillion, the Japanese price level would ________ in the short run and increase from 115 to 120 in the long run.

A) decrease from 120 to 110

B) not change

C) increase from 110 to 120

D) decrease from 120 to 115

E) increase from 110 to 115

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

50

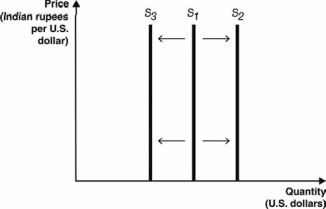

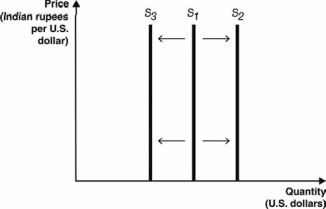

The following figure depicts the supply of U.S. dollars in the foreign currency exchange market. Use this figure to answer the next questions.

If the U.S. central bank decreases the supply of U.S. dollars, the supply curve in the above figure will________; if the Indian central bank increases the supply of rupees, the supply curve in the above figure will ________.

A) shift leftward; also shift leftward

B) shift rightward; not shift

C) not shift; shift rightward

D) shift rightward; shift leftward

E) shift leftward; not change

If the U.S. central bank decreases the supply of U.S. dollars, the supply curve in the above figure will________; if the Indian central bank increases the supply of rupees, the supply curve in the above figure will ________.

A) shift leftward; also shift leftward

B) shift rightward; not shift

C) not shift; shift rightward

D) shift rightward; shift leftward

E) shift leftward; not change

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

51

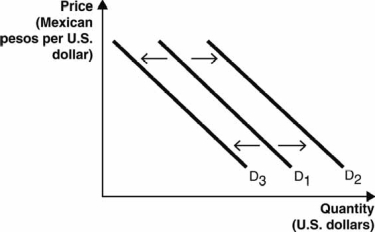

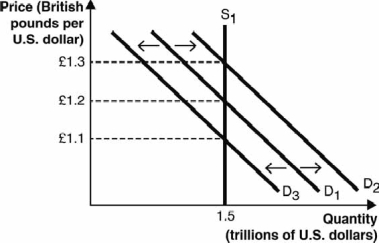

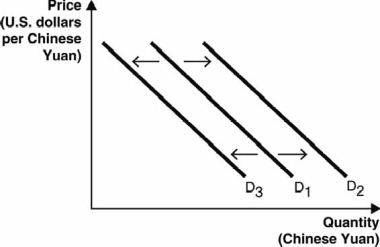

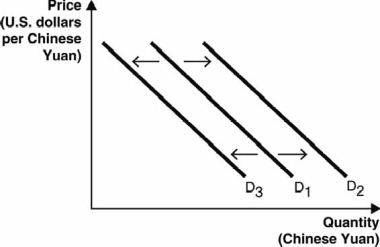

The figure below depicts the supply of U.S. dollars in the foreign currency exchange market.  A shift from D1 to D3 in the above figure could have been caused by an)

A shift from D1 to D3 in the above figure could have been caused by an)

A) decrease in the exchange rate from £1.2/$1 to £1.1/$1.

B) increase in the exchange rate from £1.1/$1 to £1.2/$1.

C) increase in demand for U.S. assets relative to British assets.

D) increase in U.S. interest rates relative to British interest rates.

E) decrease in British consumers' demand for U.S. goods.

A shift from D1 to D3 in the above figure could have been caused by an)

A shift from D1 to D3 in the above figure could have been caused by an)A) decrease in the exchange rate from £1.2/$1 to £1.1/$1.

B) increase in the exchange rate from £1.1/$1 to £1.2/$1.

C) increase in demand for U.S. assets relative to British assets.

D) increase in U.S. interest rates relative to British interest rates.

E) decrease in British consumers' demand for U.S. goods.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

52

The arrows in Figures A-D represent possible movements of the exchange rate euros per U.S. dollar) and the quantity of U.S. dollars buyers are willing and able to buy. Use these figures to answer the next questions.

A depreciation of the euro against the U.S. dollar is represented by Figure ________, and a depreciation of the U.S. dollar against the euro is represented by Figure ________.

A) A; C

B) C; A

C) B; D

D) D; B

E) A; D

A depreciation of the euro against the U.S. dollar is represented by Figure ________, and a depreciation of the U.S. dollar against the euro is represented by Figure ________.

A) A; C

B) C; A

C) B; D

D) D; B

E) A; D

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

53

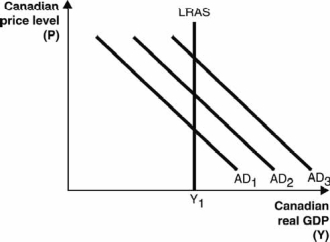

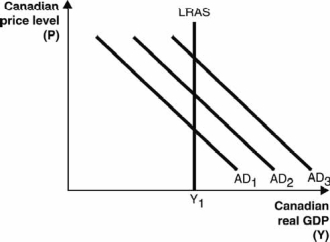

The figure below depicts the three possible aggregate demand curves.  If the Bank of Canada the Canadian central bank)________ Canadian dollar(s), the Canadian dollar will depreciate and the aggregate demand curve will shift from AD2 to ________.

If the Bank of Canada the Canadian central bank)________ Canadian dollar(s), the Canadian dollar will depreciate and the aggregate demand curve will shift from AD2 to ________.

A) devalues the; AD1

B) prints more; AD1

C) decreases the supply of; AD3

D) increases the supply of; AD3

E) prints less; AD3

If the Bank of Canada the Canadian central bank)________ Canadian dollar(s), the Canadian dollar will depreciate and the aggregate demand curve will shift from AD2 to ________.

If the Bank of Canada the Canadian central bank)________ Canadian dollar(s), the Canadian dollar will depreciate and the aggregate demand curve will shift from AD2 to ________.A) devalues the; AD1

B) prints more; AD1

C) decreases the supply of; AD3

D) increases the supply of; AD3

E) prints less; AD3

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

54

A national government or central bank can ________ its currency in foreign currency exchange markets by printing more of it

A) reflate

B) recombine

C) demonetize

D) monetize

E) devalue

A) reflate

B) recombine

C) demonetize

D) monetize

E) devalue

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

55

The following two figures depict the demand and supply of U.S. dollars and the demand and supply of British pounds in the foreign currency exchange market. Use these figures to answer the next questions.

An increase in U.S. consumer demand for British goods is consistent with

A) both Figures A and B.

B) neither Figure A nor Figure B.

C) Figure A but not Figure B.

D) Figure B but not Figure A.

E) the supply curve being upward sloping in both Figures A and B.

An increase in U.S. consumer demand for British goods is consistent with

A) both Figures A and B.

B) neither Figure A nor Figure B.

C) Figure A but not Figure B.

D) Figure B but not Figure A.

E) the supply curve being upward sloping in both Figures A and B.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

56

The following two figures depict the demand and supply of U.S. dollars and the demand and supply of British pounds in the foreign currency exchange market. Use these figures to answer the next questions.

An appreciation of the ________ is shown in ________.

A) U.S. dollar; Figure A but not Figure B

B) U.S. dollar; Figure B but not Figure A

C) U.S. dollar; both Figures A and B

D) British pound; neither Figure A nor Figure B

E) British pound; both Figures A and B

An appreciation of the ________ is shown in ________.

A) U.S. dollar; Figure A but not Figure B

B) U.S. dollar; Figure B but not Figure A

C) U.S. dollar; both Figures A and B

D) British pound; neither Figure A nor Figure B

E) British pound; both Figures A and B

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

57

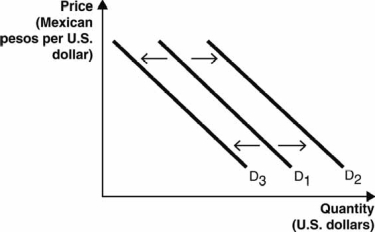

The following figure depicts the demand for Chinese yuan in the foreign currency exchange market. Use this figure to answer the next questions.

If the interest rates in China rise relative to interest rates in the United States, the demand curve in the figure above

A) will not shift because interest rates are not related to exchange rates.

B) will not shift because interest rates only affect the supply curve.

C) can either increase from D1 to D2 or decrease from D1 to D3.

D) will increase from D1 to D2.

E) will decrease from D1 to D3.

If the interest rates in China rise relative to interest rates in the United States, the demand curve in the figure above

A) will not shift because interest rates are not related to exchange rates.

B) will not shift because interest rates only affect the supply curve.

C) can either increase from D1 to D2 or decrease from D1 to D3.

D) will increase from D1 to D2.

E) will decrease from D1 to D3.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

58

The following figure depicts the demand for Chinese yuan in the foreign currency exchange market. Use this figure to answer the next questions.

If the interest rates in China fall relative to interest rates in the United States and, at the same time, U.S. consumer demand for Chinese goods decreases, the demand curve in the figure above

A) will not shift because interest rates are not related to exchange rates.

B) will not shift because interest rates only affect the supply curve.

C) can either increase from D1 to D2 or decrease from D1 to D3.

D) will increase from D1 to D2.

E) will decrease from D1 to D3.

If the interest rates in China fall relative to interest rates in the United States and, at the same time, U.S. consumer demand for Chinese goods decreases, the demand curve in the figure above

A) will not shift because interest rates are not related to exchange rates.

B) will not shift because interest rates only affect the supply curve.

C) can either increase from D1 to D2 or decrease from D1 to D3.

D) will increase from D1 to D2.

E) will decrease from D1 to D3.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

59

Figure A below depicts the demand and supply of Japanese yen in the foreign currency exchange market. Figure B below depicts the aggregate supply-aggregate demand model for the Japanese economy. Use these figures to answer the next questions.

Which of the following is the most accurate description of the phenomenon shown in Figure B?

A) The Japanese central bank increased the money supply S1 to S2, which caused the price level to fall from 115 to 110, which then caused the short-run aggregate supply to decrease from SRAS1 to SRAS2.

B) The Japanese central bank increased the money supply S1 to S2, which caused aggregate demand to increase from AD1 to AD2, which then caused the short-run aggregate supply to decrease from SRAS1 to SRAS2.

C) The Japanese central bank decreased the money supply S1 to S3, which caused aggregate demand to decrease from AD2 to AD1, which then caused the short-run aggregate supply to decrease from SRAS1 to SRAS2.

D) The Japanese central bank increased the money supply S1 to S2, which caused real gross domestic product GDP) to fall from Y2 to Y1, which caused the short-run aggregate supply to decrease from SRAS1 to SRAS2, which then caused aggregate demand to increase from AD1 to AD2.

E) Aggregate demand increased from AD1 to AD2, which forced the Japanese central bank to increase the money supply S1 to S2, which then caused the short-run aggregate supply to decrease from SRAS1 to SRAS2.

Which of the following is the most accurate description of the phenomenon shown in Figure B?

A) The Japanese central bank increased the money supply S1 to S2, which caused the price level to fall from 115 to 110, which then caused the short-run aggregate supply to decrease from SRAS1 to SRAS2.

B) The Japanese central bank increased the money supply S1 to S2, which caused aggregate demand to increase from AD1 to AD2, which then caused the short-run aggregate supply to decrease from SRAS1 to SRAS2.

C) The Japanese central bank decreased the money supply S1 to S3, which caused aggregate demand to decrease from AD2 to AD1, which then caused the short-run aggregate supply to decrease from SRAS1 to SRAS2.

D) The Japanese central bank increased the money supply S1 to S2, which caused real gross domestic product GDP) to fall from Y2 to Y1, which caused the short-run aggregate supply to decrease from SRAS1 to SRAS2, which then caused aggregate demand to increase from AD1 to AD2.

E) Aggregate demand increased from AD1 to AD2, which forced the Japanese central bank to increase the money supply S1 to S2, which then caused the short-run aggregate supply to decrease from SRAS1 to SRAS2.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

60

________ occurs when a national government or central bank intentionally adjusts its money supply to affect the exchange rate of its currency.

A) Dollarization

B) A complete breakdown of the fractional reserve banking system

C) Demonetization

D) Exchange rate manipulation

E) A currency war

A) Dollarization

B) A complete breakdown of the fractional reserve banking system

C) Demonetization

D) Exchange rate manipulation

E) A currency war

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

61

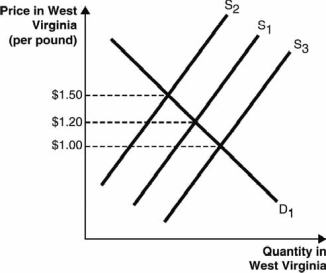

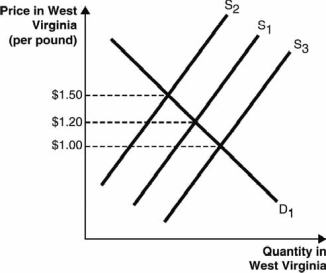

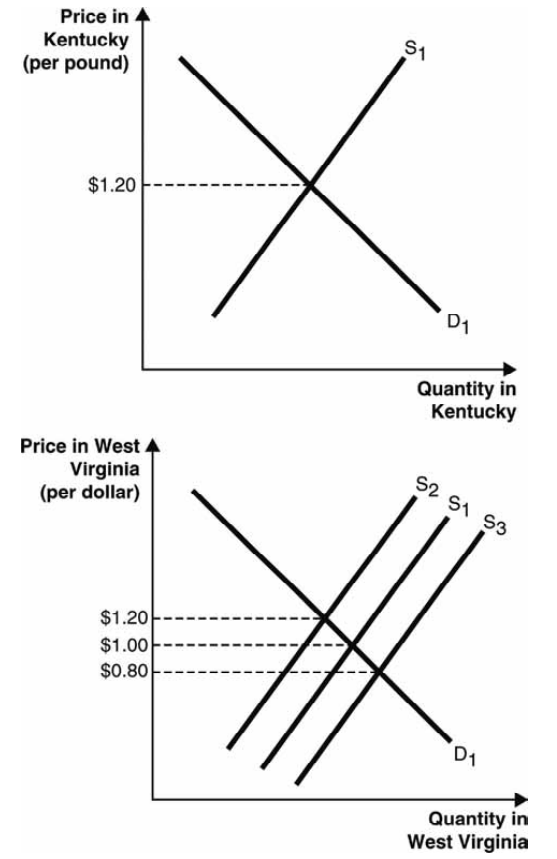

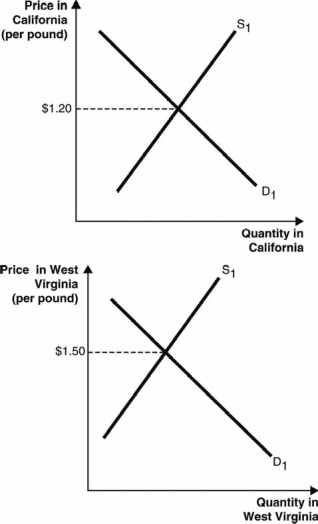

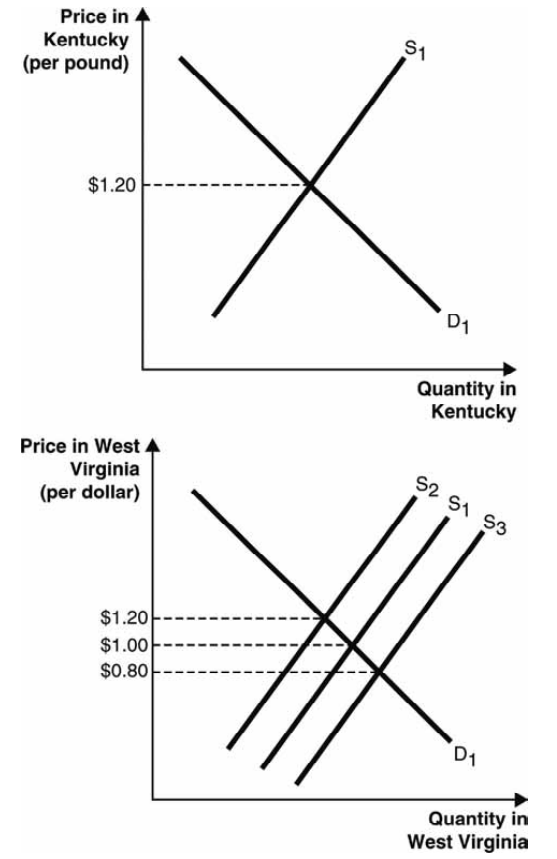

The following graph depicts the market for potatoes in West Virginia. Assume there are similar markets for potatoes in all other U.S. states and that the potatoes sold in all states are identical. Further, assume potato sellers incur zero costs to transport potatoes between any U.S. states and that there are no other barriers to trade. Use this graph to answer the next question.

Suppose the equilibrium price of a pound of potatoes in all U.S. states is initially $1.20. Which scenario could cause a shift in West Virginia from S1 to S2 as shown in the graph?

A) Potato farmers in other states produce unusually large crops of potatoes, causing the price in those states to fall to $1.00.

B) Potato farmers in other states produce unusually small crops of potatoes, causing the price in those states to rise to $1.50.

C) Demand for potatoes increases in West Virginia, causing the price there to rise to $1.50.

D) Demand for potatoes falls in other states, causing the price in those states to fall to $1.00.

E) Demand for potatoes falls in West Virginia, causing the price there to fall to $1.00.

Suppose the equilibrium price of a pound of potatoes in all U.S. states is initially $1.20. Which scenario could cause a shift in West Virginia from S1 to S2 as shown in the graph?

A) Potato farmers in other states produce unusually large crops of potatoes, causing the price in those states to fall to $1.00.

B) Potato farmers in other states produce unusually small crops of potatoes, causing the price in those states to rise to $1.50.

C) Demand for potatoes increases in West Virginia, causing the price there to rise to $1.50.

D) Demand for potatoes falls in other states, causing the price in those states to fall to $1.00.

E) Demand for potatoes falls in West Virginia, causing the price there to fall to $1.00.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

62

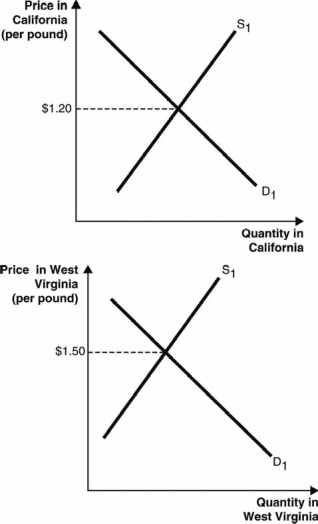

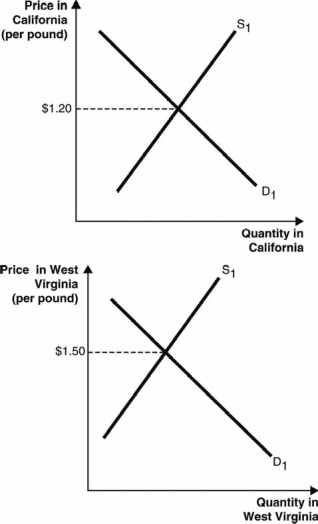

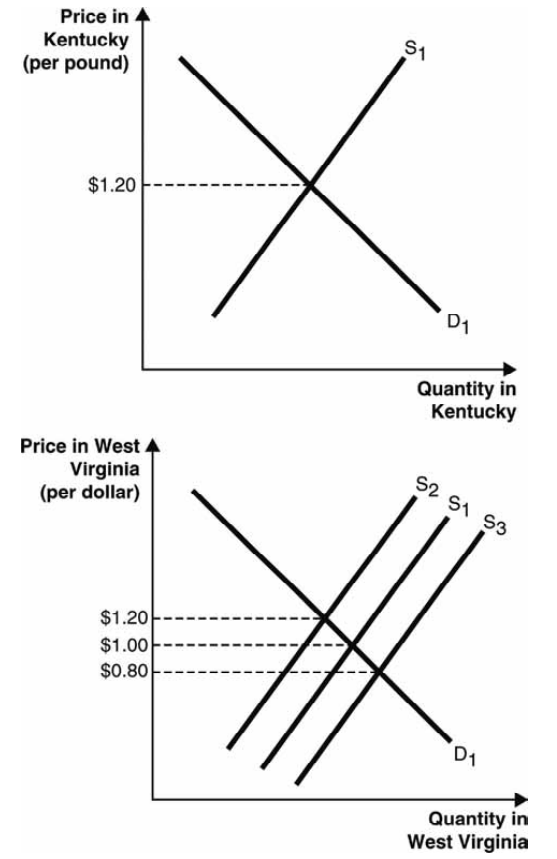

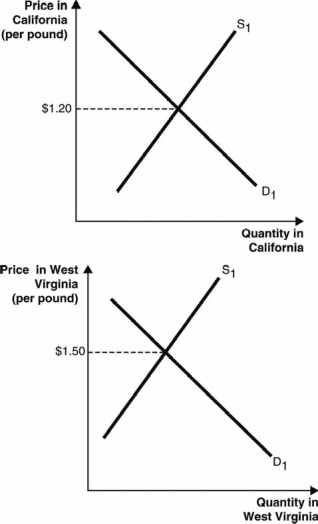

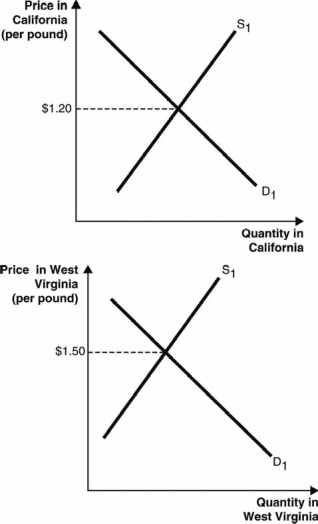

The following two graphs depict the equilibrium price of a pound of grapes in California and West Virginia, respectively. Assume the type and quality of the grapes being sold in the two states are identical. Further, assume grape sellers incur zero costs to transport grapes between the two states and there are no other barriers to trade. Use these graphs to answer the next questions.

Which of the following pairs of prices is consistent with the law of one price?

A) California price: $0.50; West Virginia price: $0.80

B) California price: $0.80; West Virginia price: $0.80

C) California price: $1.20; West Virginia price: $1.20

D) California price: $1.35; West Virginia price: $1.35

E) California price: $1.50; West Virginia price: $1.50

Which of the following pairs of prices is consistent with the law of one price?

A) California price: $0.50; West Virginia price: $0.80

B) California price: $0.80; West Virginia price: $0.80

C) California price: $1.20; West Virginia price: $1.20

D) California price: $1.35; West Virginia price: $1.35

E) California price: $1.50; West Virginia price: $1.50

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

63

If the Central Reserve Bank of Peru the Peruvian central bank) were to take steps to devalue the sol the Peruvian currency) in foreign currency markets, the Peruvian aggregate demand curve would________ in the short run, and the Peruvian short-run aggregate supply curve would ________ in the long run.

A) not change; not change

B) not change; shift leftward

C) shift rightward; not change

D) shift rightward; shift leftward

E) shift leftward; shift rightward

A) not change; not change

B) not change; shift leftward

C) shift rightward; not change

D) shift rightward; shift leftward

E) shift leftward; shift rightward

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

64

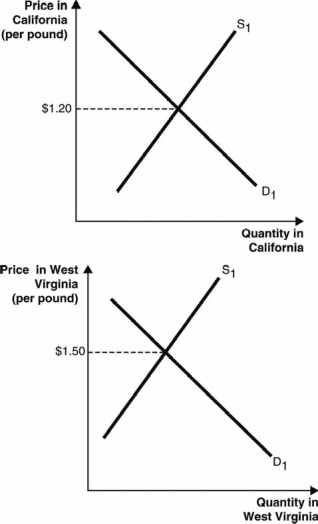

The following two graphs depict the equilibrium price of a pound of flax seed in Kentucky and West Virginia, respectively. Assume the type and quality of the flax seed being sold in the two states are identical. Further, assume flax seed sellers incur zero costs to transport flax seed between the two states and that there are no other barriers to trade. Use these graphs to answer the next questions.

Suppose the price of a pound of flax seed is currently $1.20 in both Kentucky and West Virginia. Further, suppose there is a decrease in demand for flax seed in Kentucky but not in West Virginia. Before flax seed sellers are able to adjust the relative quantity of flax seed supplied in the two states, the decrease in demand causes the equilibrium price of a pound of flax seed in Kentucky to change by $0.20. The law of one price suggests that the price of a pound of flax seed be ________ in West Virginia after sellers adjust the relative quantity of flax seed supplied in the two states.

A) $1.00

B) between $1.20 and $1.00

C) between $1.00 and $0.80

D) less than $0.80

E) higher than $1.20

Suppose the price of a pound of flax seed is currently $1.20 in both Kentucky and West Virginia. Further, suppose there is a decrease in demand for flax seed in Kentucky but not in West Virginia. Before flax seed sellers are able to adjust the relative quantity of flax seed supplied in the two states, the decrease in demand causes the equilibrium price of a pound of flax seed in Kentucky to change by $0.20. The law of one price suggests that the price of a pound of flax seed be ________ in West Virginia after sellers adjust the relative quantity of flax seed supplied in the two states.

A) $1.00

B) between $1.20 and $1.00

C) between $1.00 and $0.80

D) less than $0.80

E) higher than $1.20

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

65

Suppose market forces outside of the control of the Chinese government are causing the price of Chinese yuan in terms of Japanese yen to rise. In order to maintain the current value of the yuan, the Chinese government must

A) file a pegging application with one of the three international currency-management agencies.

B) ban Chinese firms from hiring Japanese workers.

C) use tax incentives to encourage Chinese firms to hire more Japanese workers.

D) get official approval from the World Trade Organization.

E) buy yen with newly created yuan.

A) file a pegging application with one of the three international currency-management agencies.

B) ban Chinese firms from hiring Japanese workers.

C) use tax incentives to encourage Chinese firms to hire more Japanese workers.

D) get official approval from the World Trade Organization.

E) buy yen with newly created yuan.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

66

According to the theory of purchasing power parity, why should identical goods have the same price in different locations?

A) To prevent price gouging, international law mandates that identical goods must be sold for the same currency-adjusted price across all locations.

B) If the goods were two different prices, it would cause an increase in supply of the good at the low-price location and a decrease in supply of the good at the high-price location, which would cause the prices in each location to converge to the same price.

C) If the goods were two different prices, it would cause an increase in supply of the good at the high-price location and a decrease in supply of the good at the low-price location, which would cause the prices in each location to converge to the same price.

D) If the goods were two different prices, it would cause a decrease in demand of the good at the low-price location and an increase in demand of the good at the high-price location, which would cause the prices in each location to converge to the same price.

E) If the goods were two different prices, it would cause an increase in demand of the good solely at the low-price location until that good reached the same price as the good in the high-price location.

A) To prevent price gouging, international law mandates that identical goods must be sold for the same currency-adjusted price across all locations.

B) If the goods were two different prices, it would cause an increase in supply of the good at the low-price location and a decrease in supply of the good at the high-price location, which would cause the prices in each location to converge to the same price.

C) If the goods were two different prices, it would cause an increase in supply of the good at the high-price location and a decrease in supply of the good at the low-price location, which would cause the prices in each location to converge to the same price.

D) If the goods were two different prices, it would cause a decrease in demand of the good at the low-price location and an increase in demand of the good at the high-price location, which would cause the prices in each location to converge to the same price.

E) If the goods were two different prices, it would cause an increase in demand of the good solely at the low-price location until that good reached the same price as the good in the high-price location.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

67

If the Bank of Japan the Japanese central bank) were to take steps to devalue the yen in foreign currency markets, ________, which would cause Japanese real gross domestic product GDP) to increase in the short run.

A) aggregate demand for Japanese goods and services would increase

B) aggregate demand for Japanese goods and services would decrease

C) Japanese interest rates would rise

D) aggregate supply of Japanese goods and services would decrease

E) one U.S. dollar would subsequently buy many fewer yen

A) aggregate demand for Japanese goods and services would increase

B) aggregate demand for Japanese goods and services would decrease

C) Japanese interest rates would rise

D) aggregate supply of Japanese goods and services would decrease

E) one U.S. dollar would subsequently buy many fewer yen

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

68

In order to maintain a pegged exchange rate in China,

A) the Chinese government must prevent Chinese citizens from trading goods or services with other countries.

B) the Chinese government must prevent Chinese citizens from purchasing assets denominated in foreign currencies.

C) the Chinese government must adjust the supply of the yuan in world markets.

D) at least one foreign country must also maintain a pegged exchange rate.

E) no other country with which China shares a geographical border can maintain a pegged exchange rate.

A) the Chinese government must prevent Chinese citizens from trading goods or services with other countries.

B) the Chinese government must prevent Chinese citizens from purchasing assets denominated in foreign currencies.

C) the Chinese government must adjust the supply of the yuan in world markets.

D) at least one foreign country must also maintain a pegged exchange rate.

E) no other country with which China shares a geographical border can maintain a pegged exchange rate.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

69

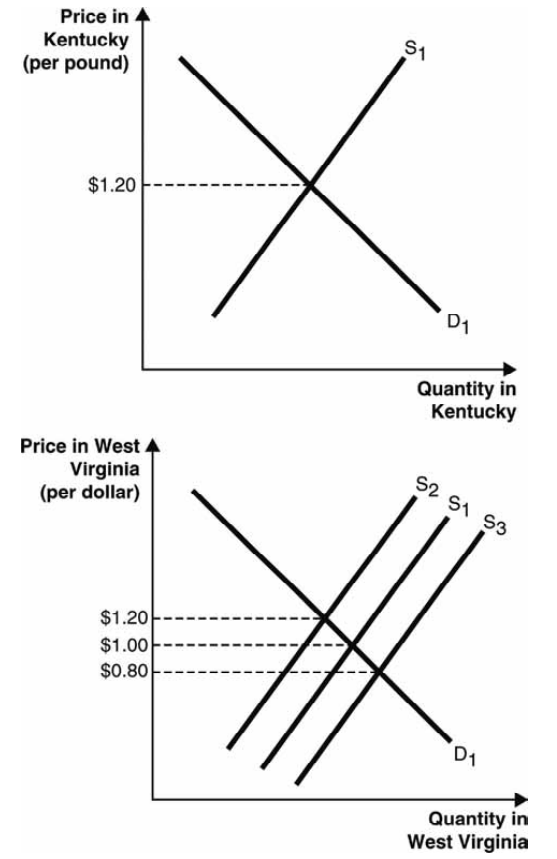

The following two graphs depict the equilibrium price of a pound of grapes in California and West Virginia, respectively. Assume the type and quality of the grapes being sold in the two states are identical. Further, assume grape sellers incur zero costs to transport grapes between the two states and there are no other barriers to trade. Use these graphs to answer the next questions.

According to the law of one price, the supply curve in the California grape market will shift to the ________, and the supply curve in the West Virginia grape market will ________.

A) right; also shift to the right

B) left; shift to the right

C) right; shift to the left

D) left; also shift to the left

E) left; not shift

According to the law of one price, the supply curve in the California grape market will shift to the ________, and the supply curve in the West Virginia grape market will ________.

A) right; also shift to the right

B) left; shift to the right

C) right; shift to the left

D) left; also shift to the left

E) left; not shift

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

70

The national government or central bank of country X might take steps to purposefully depreciate its currency because

A) country X wants its currency to command more respect from international news reporters.

B) consumers in country X would be able to purchase more goods from producers in country Y.

C) producers in country X would be able to sell more goods to consumers in country Y.

D) a depreciated currency would benefit both consumers and producers in country X.

E) an appreciated currency would harm both consumers and producers in country Y.

A) country X wants its currency to command more respect from international news reporters.

B) consumers in country X would be able to purchase more goods from producers in country Y.

C) producers in country X would be able to sell more goods to consumers in country Y.

D) a depreciated currency would benefit both consumers and producers in country X.

E) an appreciated currency would harm both consumers and producers in country Y.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

71

Pegged exchange rates can also be referred to as ________ exchange rates.

A) variable

B) fixed

C) flexible

D) specialized

E) nominal

A) variable

B) fixed

C) flexible

D) specialized

E) nominal

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

72

According to the law of ________, after accounting for transportation costs and trade barriers, identical goods in different locations must sell for the same price.

A) supply

B) demand

C) one price

D) currency equivocation

E) diminishing marginal product

A) supply

B) demand

C) one price

D) currency equivocation

E) diminishing marginal product

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

73

Floating exchange rates can also be referred to as ________ exchange rates.

A) flexible

B) real

C) fixed

D) pegged

E) specialized

A) flexible

B) real

C) fixed

D) pegged

E) specialized

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

74

If the theory of purchasing power parity holds, then how much does an Egyptian tapestry cost in the United States if the same tapestry sells for 15,000 Egyptian pounds in Egypt and the exchange rate is $0.14 per Egyptian pound?

A) $12,000

B) $2,100

C) $107,143

D) $15,000

E) $3,148

A) $12,000

B) $2,100

C) $107,143

D) $15,000

E) $3,148

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

75

In the short run, ________ would increase domestic aggregate demand in the context of the aggregate supply-aggregate demand model.

A) an increase in the value of the domestic currency against all foreign currencies

B) a depreciation of the domestic currency against all foreign currencies

C) an appreciation of the domestic currency against all foreign currencies

D) a depreciation of all foreign currencies against the domestic currency

E) either an increase or decrease in domestic government spending

A) an increase in the value of the domestic currency against all foreign currencies

B) a depreciation of the domestic currency against all foreign currencies

C) an appreciation of the domestic currency against all foreign currencies

D) a depreciation of all foreign currencies against the domestic currency

E) either an increase or decrease in domestic government spending

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

76