Deck 2: Current Liabilities and Payroll

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

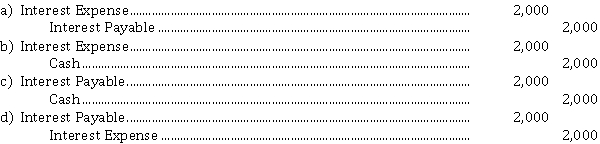

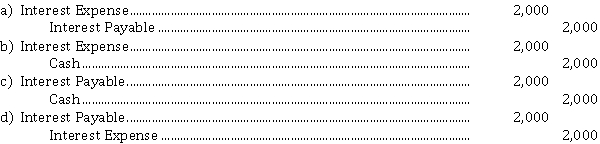

Question

Question

Question

Question

Question

Question

Question

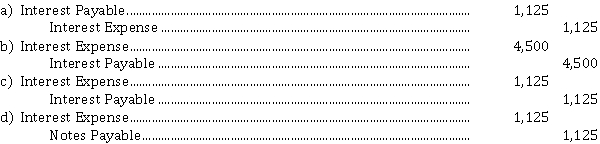

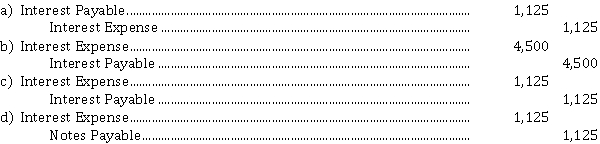

Question

Question

Question

Question

Question

Question

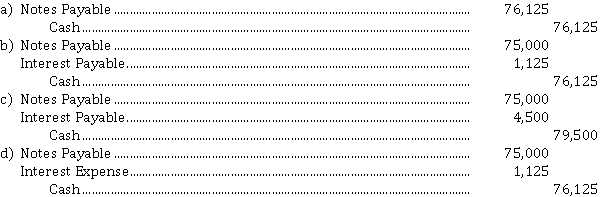

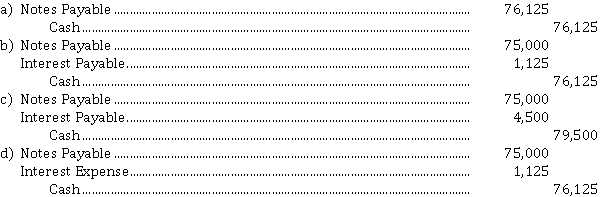

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/191

Play

Full screen (f)

Deck 2: Current Liabilities and Payroll

1

An operating line of credit is a credit that is set up by a major supplier to assist the company with their purchases online.

False

2

A bank overdraft is the same as an operating line of credit.

False

3

It is not necessary to prepare an adjusting entry to recognize the current maturity of long-term debt.

True

4

The higher the sales tax rate, the more profit a retailer can earn.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

5

Money borrowed on a line of credit is normally borrowed on a long-term basis.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

6

Liabilities with a known amount, payee, and due date are often referred to as determinable liabilities.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

7

Prime rate refers to the rate that banks charge their worst customers.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

8

A future commitment is not considered a liability unless a present obligation also exists.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

9

A note payable must be payable within one year.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

10

Bank overdrafts will require a journal entry at the end of the year to record the amount.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

11

Collateral is usually required by a bank as protection in case the company is unable to repay the bank.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

12

If a note payable is payable in a term longer than one year, it will be classified as a non-current liability.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

13

A note payable must always have an interest rate attached to it.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

14

A $ 15,000, nine-month, 8% note payable requires an interest payment of $ 900 at maturity if no interest was previously paid.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

15

Sales taxes apply to all sales.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

16

A note payable will result in more security of the debt obligation for the creditor than an account payable.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

17

At its December 31 year end, Jamison Company recorded $ 200 interest payable on a $ 10,000, three-month, 5% note payable. The company's financial statements will present notes payable of $ 10,200.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

18

Current maturities of long-term debt refer to the amount of interest on a note payable that must be paid in the current year.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

19

A liability is defined as a past obligation, arising from present events to make future payments of assets or services.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

20

It is possible to have a prepaid property tax and a property tax expense recorded at the same time.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

21

The employer incurs a payroll cost equal to the amount withheld from the employees' wages for personal income taxes.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

22

As long as it is likely the company will have to settle the obligation, and the company can reasonably estimate the amount, the liability is recognized.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

23

After the warranty liability has been established, future costs will be recorded with a debit to Warranty Expense.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

24

An estimated liability is a liability that is known to exist but whose amount and timing are uncertain.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

25

Canada Pension Plan (CPP) or Quebec Pension Plan (QPP) contributions, employment insurance (EI), and personal income taxes are mandatory payroll deductions.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

26

CPP is an example of a voluntary payroll deduction.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

27

Under ASPE, a contingent liability is defined as a liability that is contingent on the occurrence or non-occurrence of some future event.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

28

ASPE considers a liability to be a contingent liability as long as its ultimate existence depends on the outcome of a future event, even if the event is likely to occur.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

29

Canadian Tire Money represents a liability to Canadian Tire.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

30

The higher the pay or earnings, the higher the amount of income taxes withheld.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

31

Contingencies are events with certain outcomes.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

32

With a customer loyalty program, the cost of the program is usually shown as a sales discount and reported as a contra sales account.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

33

Payroll deductions may be mandatory or voluntary.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

34

Under IFRS, a provision is a liability of certain timing and amounts.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

35

IFRS is generally regarded as having a higher threshold for recognizing liabilities.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

36

During the month, a company sells goods for a total of $ 113,480, which includes HST of $ 13,480; therefore, the company should recognize $ 100,000 in Sales Revenues and $ 13,480 in Sales Tax Payable.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

37

Gross pay, or earnings, is the total compensation earned by an employee.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

38

When a company issues a gift card, the company will record the gift card in revenue in the period in which it is sold.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

39

There are two types of payroll costs to a company: employee costs and employer costs.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

40

Warranty liabilities are estimated based on actual warranty costs incurred to date.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

41

Employer payroll costs would include an amount deducted from the individual for income taxes.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

42

Under ASPE, current liabilities are the first category reported in the liability section of the balance sheet.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

43

CPP and EI and income tax deductions are remitted to the CRA, usually on a quarterly basis.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

44

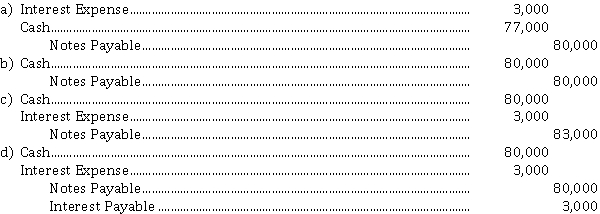

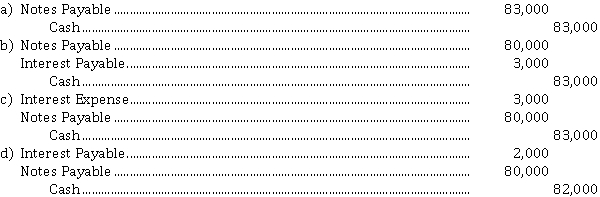

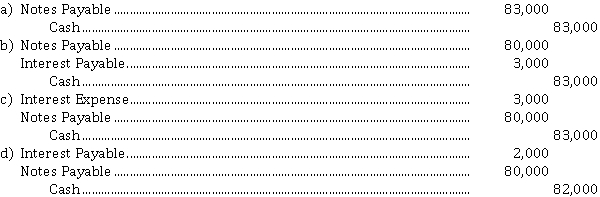

Bell Provincial Bank agrees to lend Griswold Brick Company $ 80,000 on January 1. Griswold Brick Company signs an $ 80,000, 9-month, 5% note. The entry made by Griswold Brick Company on January 1 to record the proceeds and issue of the note is

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

45

A note payable is in the form of

A) a contingency that is reasonably likely to occur.

B) a written promissory note.

C) an oral agreement.

D) a standing agreement.

A) a contingency that is reasonably likely to occur.

B) a written promissory note.

C) an oral agreement.

D) a standing agreement.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

46

Employers are required by law to remit the mandatory payroll deductions to Canada Revenue Agency on at least a monthly basis.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

47

A determinable liability is one that

A) has uncertainty with the timing of the due date.

B) has uncertainty about the amount which is owed.

C) has a known payee.

D) has an amount which is due within one year.

A) has uncertainty with the timing of the due date.

B) has uncertainty about the amount which is owed.

C) has a known payee.

D) has an amount which is due within one year.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

48

A current liability is a debt that can reasonably be expected to be paid

A) within one year.

B) between 6 months and 18 months.

C) out of currently recognized revenues.

D) out of cash currently on hand.

A) within one year.

B) between 6 months and 18 months.

C) out of currently recognized revenues.

D) out of cash currently on hand.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

49

Current liabilities are usually listed in order of liquidity.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

50

An operating line of credit

A) is a non-current liability.

B) is required by all companies.

C) helps companies manage temporary cash shortages.

D) is usually required by the bank in case a company is unable to repay a loan.

A) is a non-current liability.

B) is required by all companies.

C) helps companies manage temporary cash shortages.

D) is usually required by the bank in case a company is unable to repay a loan.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

51

With an interest-bearing note, the amount of assets received upon issue of the note is generally

A) equal to the note's face value.

B) greater than the note's face value.

C) less than the note's face value.

D) equal to the note's maturity value plus interest.

A) equal to the note's face value.

B) greater than the note's face value.

C) less than the note's face value.

D) equal to the note's maturity value plus interest.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

52

Most companies pay current liabilities

A) out of current assets.

B) by issuing interest-bearing notes payable.

C) by issuing common shares.

D) by creating non-current liabilities.

A) out of current assets.

B) by issuing interest-bearing notes payable.

C) by issuing common shares.

D) by creating non-current liabilities.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

53

The entry to record the proceeds upon issuing an interest-bearing note is

A) Interest Expense Cash

Notes Payable

B) Cash Notes Payable

C) Notes Payable Cash

D) Cash Notes Payable

Interest Payable

A) Interest Expense Cash

Notes Payable

B) Cash Notes Payable

C) Notes Payable Cash

D) Cash Notes Payable

Interest Payable

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

54

Workplace Health, Safety, and Compensation is a cost to both the employee and the employer.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

55

Determinable liabilities involve no uncertainty about all of the following except

A) the existence of the liability.

B) the amount of the liability.

C) the eventual payment of the liability.

D) all of the above involve no uncertainty with respect to the determinable liability.

A) the existence of the liability.

B) the amount of the liability.

C) the eventual payment of the liability.

D) all of the above involve no uncertainty with respect to the determinable liability.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

56

Each employer is required to pay an employee for sick days.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

57

All of the following are definitely determinable liabilities except

A) current maturities of long-term debt.

B) operating lines of credit.

C) a future commitment to purchase an asset.

D) accounts payable.

A) current maturities of long-term debt.

B) operating lines of credit.

C) a future commitment to purchase an asset.

D) accounts payable.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

58

Gross pay is the amount of net pay less any deductions.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

59

Operating line of credit borrowings usually

A) are credited to a note payable account.

B) are reported as a non-current liability.

C) are debited to the cash account and result in a current liability.

D) are required by all companies.

A) are credited to a note payable account.

B) are reported as a non-current liability.

C) are debited to the cash account and result in a current liability.

D) are required by all companies.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

60

Employer payroll costs will include both the gross wages of employees plus the employer costs of benefits.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

61

Sales taxes collected by a retailer are expenses

A) of the retailer.

B) of the customers.

C) of the government.

D) that are not recognized by the retailer until they are submitted to the government.

A) of the retailer.

B) of the customers.

C) of the government.

D) that are not recognized by the retailer until they are submitted to the government.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

62

When an interest-bearing note matures, the balance in the Notes Payable account is

A) less than the total amount repaid by the borrower.

B) the difference between the maturity value of the note and the face value of the note.

C) equal to the total amount repaid by the borrower.

D) greater than the total amount repaid by the borrower.

A) less than the total amount repaid by the borrower.

B) the difference between the maturity value of the note and the face value of the note.

C) equal to the total amount repaid by the borrower.

D) greater than the total amount repaid by the borrower.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

63

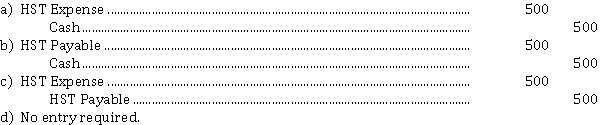

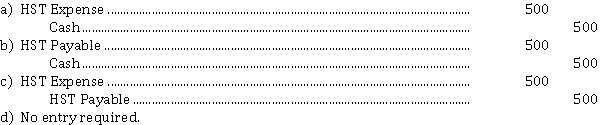

Jim's Pharmacy has collected $ 500 in HST during March. If sales taxes must be remitted to the Canada Revenue Agency monthly, what entry will Jim's Pharmacy make to show the March remittance?

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

64

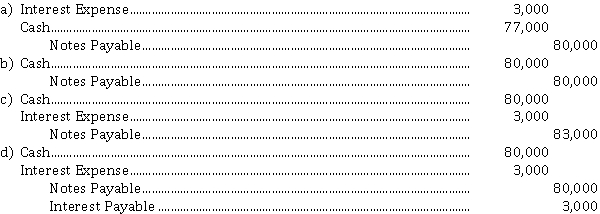

Cloudy Day Bank agrees to lend Sleep Dog Company $ 80,000 on January 1. Sleep Dog Company signs an $ 80,000, 9-month, 5% note. What entry will Sleep Dog Company make to pay off the note and interest at maturity assuming that interest has been accrued to September 30?

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

65

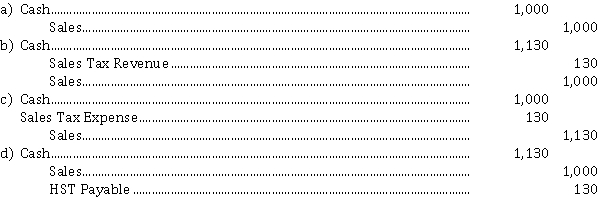

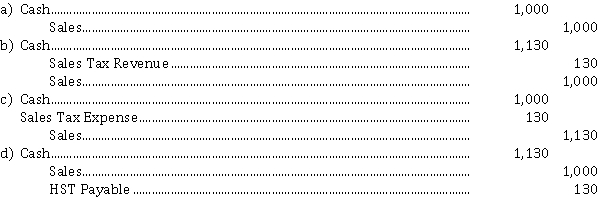

A cash register tape shows cash sales of $ 1,000 and HST of $ 130. The journal entry to record this information is

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

66

The current portion of long-term debt should

A) be paid immediately.

B) be reclassified as a current liability.

C) be classified as a non-current liability.

D) not be separated from the non-current portion of debt.

A) be paid immediately.

B) be reclassified as a current liability.

C) be classified as a non-current liability.

D) not be separated from the non-current portion of debt.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

67

As interest is recorded on an interest-bearing note, the Interest Expense account is

A) increased; the Notes Payable account is increased.

B) increased; the Notes Payable account is decreased.

C) increased; the Interest Payable account is increased.

D) decreased; the Interest Payable account is increased.

A) increased; the Notes Payable account is increased.

B) increased; the Notes Payable account is decreased.

C) increased; the Interest Payable account is increased.

D) decreased; the Interest Payable account is increased.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

68

When HST is remitted to the Canada Revenue Agency, ___ is credited and ___ is debited.

A) Cash; HST Payable

B) Cash; Sales

C) HST Expense; Cash

D) HST Payable; Cash

A) Cash; HST Payable

B) Cash; Sales

C) HST Expense; Cash

D) HST Payable; Cash

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

69

HST (harmonized sales tax) collected by a retailer is recorded by

A) crediting HST Recoverable.

B) debiting HST Expense.

C) crediting HST Payable.

D) debiting HST Payable.

A) crediting HST Recoverable.

B) debiting HST Expense.

C) crediting HST Payable.

D) debiting HST Payable.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

70

Tony Tools Company has a December 31 year end. The company received its property tax bill for 2021 on March 1, 2021. According to the bill, taxes of $ 24,000 for the year ended December 31, 2021 are due by April 30, 2021. On March 1, Tony will record property tax expense of

A) $ 4,000.

B) $ 8,000.

C) $ 12,000.

D) $ 24,000.

A) $ 4,000.

B) $ 8,000.

C) $ 12,000.

D) $ 24,000.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

71

Cutes National Bank agrees to lend Sunny Screen Company $ 80,000 on January 1. Sunny Screen Company signs an $ 80,000, 9-month, 5% note. What is the adjusting entry required if Sunny Screen Company prepares financial statements on June 30?

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

72

Interest expense on an interest-bearing note is

A) always equal to zero.

B) accrued over the life of the note.

C) only recorded at the time the note is issued.

D) only recorded at maturity when the note is paid.

A) always equal to zero.

B) accrued over the life of the note.

C) only recorded at the time the note is issued.

D) only recorded at maturity when the note is paid.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

73

On October 1, Frank's Accounting Service borrows $ 75,000 from National Bank on a $ 75,000, 3-month, 6% note. What entry must Frank's Accounting make on December 31 before financial statements are prepared?

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

74

A retailer that collects sales taxes is acting as an agent for the

A) wholesaler.

B) customer.

C) taxing authority.

D) chamber of commerce.

A) wholesaler.

B) customer.

C) taxing authority.

D) chamber of commerce.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

75

Sales taxes collected by a retailer are reported as

A) a contingent loss.

B) revenues.

C) expenses.

D) current liabilities.

A) a contingent loss.

B) revenues.

C) expenses.

D) current liabilities.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

76

The entry to record the payment of an interest-bearing note at maturity after all interest expense has been recognized is

A) Notes Payable Interest Payable

Cash

B) Notes Payable Interest Expense

Cash

C) Notes Payable Cash

D) Notes Payable Cash

Interest Payable

A) Notes Payable Interest Payable

Cash

B) Notes Payable Interest Expense

Cash

C) Notes Payable Cash

D) Notes Payable Cash

Interest Payable

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

77

On October 1, Asus Computers borrows $ 75,000 from Small Town Bank on a $ 75,000, 3-month, 6% note. Assuming interest was accrued at December 31, the entry by Asus Computers to record payment of the note and accrued interest on January 1 is

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

78

Barker Company has a December 31 year end. The company received its property tax bill for 2021 on March 1, 2021. According to the bill, taxes of $ 24,000 for the year ended December 31, 2021 are due by April 30, 2021. On April 30, 2021, Barker will record which of the following entries?

A) Dr. Cash; Cr. Property Tax Payable

B) Dr. Property Tax Payable; Dr. Prepaid Property Tax; Cr. Cash

C) Dr. Property Tax Expense; Cr. Property Tax Payable

D) Dr. Property Tax Expense; Cr. Cash

A) Dr. Cash; Cr. Property Tax Payable

B) Dr. Property Tax Payable; Dr. Prepaid Property Tax; Cr. Cash

C) Dr. Property Tax Expense; Cr. Property Tax Payable

D) Dr. Property Tax Expense; Cr. Cash

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

79

The amount of sales tax (GST and PST, or HST) collected by a retail store when making sales is

A) a miscellaneous revenue for the store.

B) a current liability.

C) not recorded because it is a tax paid by the customer.

D) will increase the profit of the company.

A) a miscellaneous revenue for the store.

B) a current liability.

C) not recorded because it is a tax paid by the customer.

D) will increase the profit of the company.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck

80

Property taxes are generally based on

A) income before tax.

B) property values.

C) gross sales.

D) gross wages.

A) income before tax.

B) property values.

C) gross sales.

D) gross wages.

Unlock Deck

Unlock for access to all 191 flashcards in this deck.

Unlock Deck

k this deck