Exam 2: Current Liabilities and Payroll

Exam 1: Long-Lived Assets263 Questions

Exam 2: Current Liabilities and Payroll191 Questions

Exam 3: Financial Reporting Concepts138 Questions

Exam 4: Accounting for Partnerships171 Questions

Exam 5: Introduction to Corporations210 Questions

Exam 6: Corporations: Additional Topics and IFRS42 Questions

Exam 7: Non-Current Liabilities39 Questions

Exam 8: Investments273 Questions

Exam 9: The Cash Flow Statement169 Questions

Exam 10: Financial Statement Analysis172 Questions

Exam 11: Understanding Interest, Annuities, and Bond Valuation188 Questions

Select questions type

A future commitment is not considered a liability unless a present obligation also exists.

Free

(True/False)

4.8/5  (28)

(28)

Correct Answer:

True

For small employers with perfect payroll deduction records, withholdings must be reported and remitted to the government

Free

(Multiple Choice)

4.9/5  (29)

(29)

Correct Answer:

C

Duane Herman sells Instructions

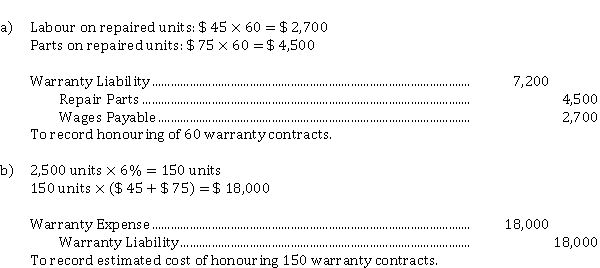

a) Prepare the journal entry to record the repairs made under warranty.

b) Prepare the journal entry to record the estimated warranty expense for the year. Determine the balance in the Warranty Liability account at the end of the year.

Free

(Essay)

4.8/5  (36)

(36)

Correct Answer:

The balance in Warranty Liability at year end is $ 10,800 ($ 18,000 - $ 7,200), which equals the expected cost of honouring the 90 remaining warranty contracts.

The balance in Warranty Liability at year end is $ 10,800 ($ 18,000 - $ 7,200), which equals the expected cost of honouring the 90 remaining warranty contracts.

Self-employed individuals pay both the employee's and the employer's share of

(Multiple Choice)

4.7/5  (40)

(40)

Match the items below by entering the appropriate code letter in the space provided.

-A form showing employment income, CPP contributions, ____

EI premiums, and income tax deducted for the year, in addition

to other voluntary deductions

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following is not considered an estimated liability?

(Multiple Choice)

4.8/5  (40)

(40)

It is not necessary to prepare an adjusting entry to recognize the current maturity of long-term debt.

(True/False)

4.9/5  (35)

(35)

Employers are required to withhold income taxes from employees each pay period. Identify the variable that is not used to determine the amount withheld.

(Multiple Choice)

4.7/5  (35)

(35)

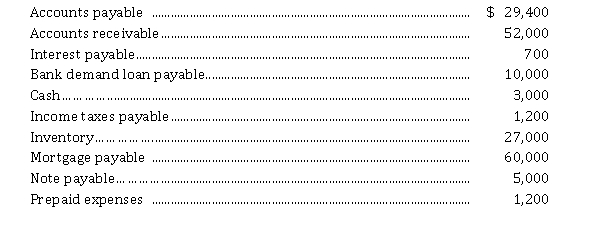

Gloria Company's December 31, 2021, trial balance includes the following accounts:  Other information:

The mortgage payable is due in annual principal installments of $ 4,000 per year.

The note payable is due in full in 18 months' time.

Industry average working capital ratio is 2.5:1

Instructions

a) Prepare the current liabilities section of Gloria's December 31, 2021, balance sheet.

b) Calculate and comment on Gloria's working capital and current ratio.

Other information:

The mortgage payable is due in annual principal installments of $ 4,000 per year.

The note payable is due in full in 18 months' time.

Industry average working capital ratio is 2.5:1

Instructions

a) Prepare the current liabilities section of Gloria's December 31, 2021, balance sheet.

b) Calculate and comment on Gloria's working capital and current ratio.

(Essay)

4.9/5  (38)

(38)

The employer's share of personal income tax is ___ the employee's share.

(Multiple Choice)

4.8/5  (31)

(31)

The accounting for warranty costs is based on the concept of matching expenses with revenues, which requires that the estimated cost of honouring warranty contracts should be recognized as an expense

(Multiple Choice)

4.9/5  (38)

(38)

Barker Company has a December 31 year end. The company received its property tax bill for 2021 on March 1, 2021. According to the bill, taxes of $ 24,000 for the year ended December 31, 2021 are due by April 30, 2021. On April 30, 2021, Barker will record which of the following entries?

(Multiple Choice)

4.8/5  (29)

(29)

At its December 31 year end, Jamison Company recorded $ 200 interest payable on a $ 10,000, three-month, 5% note payable. The company's financial statements will present notes payable of $ 10,200.

(True/False)

4.7/5  (39)

(39)

Prime rate refers to the rate that banks charge their worst customers.

(True/False)

4.9/5  (34)

(34)

An estimated liability is a liability that is known to exist but whose amount and timing are uncertain.

(True/False)

4.8/5  (28)

(28)

Muffin Company issued a five-year, interest-bearing note payable for $ 50,000 on January 1, 2021. Each January the company is required to pay $ 10,000 on the note. How will this note be reported on the December 31, 2022, balance sheet?

(Multiple Choice)

4.9/5  (37)

(37)

Kenny Company billed its customers a total of $ 2,655,500 including HST of $ 305,500 for the month of November.

Instructions

Prepare the general journal entry to record the revenue and related liabilities for the month.

(Essay)

4.9/5  (33)

(33)

Showing 1 - 20 of 191

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)