Deck 6: Chinas Path of Investment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/9

Play

Full screen (f)

Deck 6: Chinas Path of Investment

1

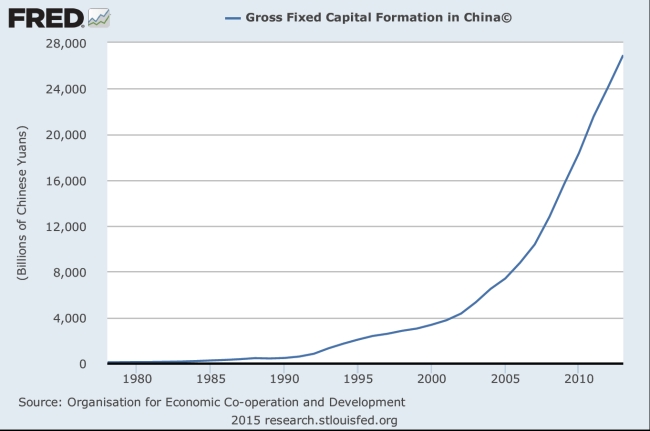

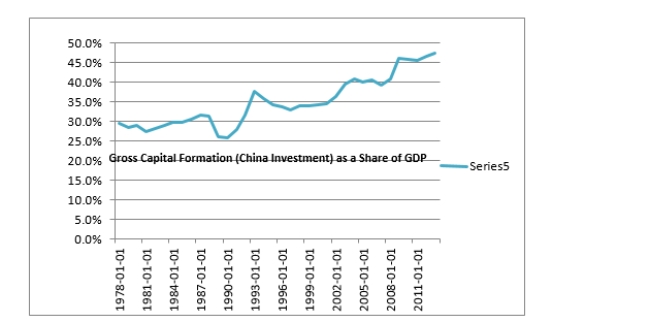

Go to FRED (the Federal Reserve Economic Database) and update Chinese investment as a share of GDP.

Source: Author estimate.

Source: Author estimate. 2

In terms of measuring the size of the government sector in China, explain why it is important to understand how GDP's components of C, I, G, and NX are being measured in a GDP accounting sense?

We measure "uses" based upon who uses the output. For example, a washing machine used by a consumer is consumption, if it is exported it is an export, if it is sold to the government it has a G use, if it is purchased by a professional launderer it is I. So when we discuss G, it is based upon how much the government uses, not produces. In China, there is still a sizeable share of SOE (government) production of goods which are used by C, I or NX.

3

In this chapter we derived: P × MPK = rental cost of capital or r

a. From the cash-flow valuation approach, assume that cash flows are growing at a rate of g. Derive the above equilibrium condition in this case.

b. Based on your answer in (a), explain in a neoclassical sense why China's investment rates are so high compared to the United States.

a. From the cash-flow valuation approach, assume that cash flows are growing at a rate of g. Derive the above equilibrium condition in this case.

b. Based on your answer in (a), explain in a neoclassical sense why China's investment rates are so high compared to the United States.

a. In this case NPV = - ΔK + CF(K)/(r-g) and the new equilibrium condition is:

MPₖ = r - g

b. Arithmetically the right hand side is smaller than in the case in the textbook and this means that the condition allows for even more investment to the point where MPK is also small. In simpler terms, high growth opportunities mean more investment.

MPₖ = r - g

b. Arithmetically the right hand side is smaller than in the case in the textbook and this means that the condition allows for even more investment to the point where MPK is also small. In simpler terms, high growth opportunities mean more investment.

4

When investment is a large fraction of GDP output, as in China, why does this present special challenges in measuring the quality of economic growth as compared to the quantity of economic growth?

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

5

Discuss the neoclassical framework as it relates to decision making on Chinese investment:

a. Provide the neoclassical framework for investment and link that to the traditional cash flow Net Present Value approach.

b. Discuss whether the approach in (a) is applicable to China. Is it more relevant for some sectors instead of others? Which sectors of the economy?

c. Why are the questions in (a) and (b) vitally important for China in the coming years?

a. Provide the neoclassical framework for investment and link that to the traditional cash flow Net Present Value approach.

b. Discuss whether the approach in (a) is applicable to China. Is it more relevant for some sectors instead of others? Which sectors of the economy?

c. Why are the questions in (a) and (b) vitally important for China in the coming years?

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

6

Explain the costs and benefits of providing public works projects (infrastructure) via the financing mechanism of the China Development Bank as compared to a taxation mechanism for public works (let's say a property tax or personal income tax) in China.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

7

In this chapter we discussed the user cost of capital and PE ratio (the home price to annual rental ratio): where user cost = (1 ? t)(r + p) + m + ? + ? ? ?e where t is the personal tax rate, r is the borrowing cost of financing a home, p is the property tax rate, m is the cost of maintenance, ? is the risk premium on property, ?e is the expected appreciation of property values and ? is the depreciation rate on residential property (all expressed in nominal percent).

a. If in the United States, home prices are expected to increase by 3 percent r = 4 percent, the tax rate is 25 percent, property tax is 1 percent, the maintenance fee is 0.5 percent, depreciation is 3.5 percent and the risk premium is 2 percent, calculate the PE Ratio.

b. If some Chinese cities have a PE of let's say 30, calculate the implicit value of ??. Provide justification for the other numbers that you used in the formula for the China case. Do you think ?? is based on rational or adaptive expectations?

c. In this chapter, Schramm suggests that the housing market price surge in China represents fundamental factors and not a bubble. Buyers may still end up losing money over the long term, however. Explain using basic supply and demand curves. If Schramm is correct, then why haven't rental rates risen as dramatically as home prices? Is Schramm wrong? Explain.

a. If in the United States, home prices are expected to increase by 3 percent r = 4 percent, the tax rate is 25 percent, property tax is 1 percent, the maintenance fee is 0.5 percent, depreciation is 3.5 percent and the risk premium is 2 percent, calculate the PE Ratio.

b. If some Chinese cities have a PE of let's say 30, calculate the implicit value of ??. Provide justification for the other numbers that you used in the formula for the China case. Do you think ?? is based on rational or adaptive expectations?

c. In this chapter, Schramm suggests that the housing market price surge in China represents fundamental factors and not a bubble. Buyers may still end up losing money over the long term, however. Explain using basic supply and demand curves. If Schramm is correct, then why haven't rental rates risen as dramatically as home prices? Is Schramm wrong? Explain.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

8

Why can the stability (that it fluctuates so little year to year) of China's investment as a share of GDP be viewed as a "blessing," a "curse," and a worrisome omen?

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

9

Explain why measuring the "cost of capital" (a difficult task anywhere in the world) is particularly difficult to measure in China.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck